Poland Generic Drugs Market: Industry Analysis and Forecast (2024-2030)

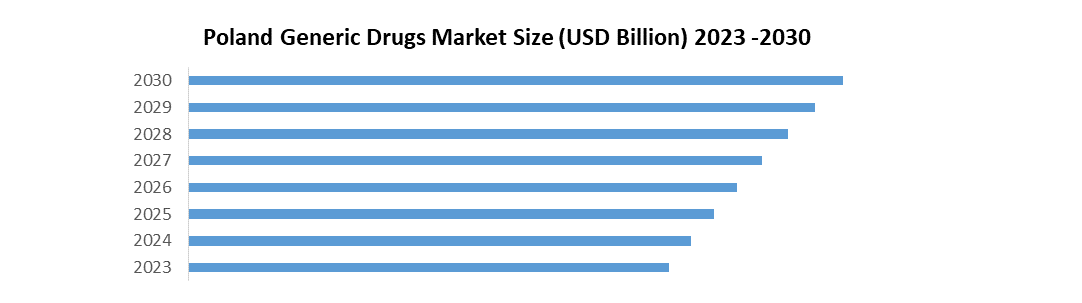

The Poland Generic Drugs Market size was valued at USD 22.14 Bn. in 2023 and the total Poland Generic Drugs Market size is expected to grow at a CAGR of 4.5 % from 2024 to 2030, reaching nearly USD 30.13 Bn. by 2030.

Format : PDF | Report ID : SMR_1795

Poland Generic Drugs Market Overview

Generic drugs contain the same active ingredients, in the very same strength, as brand-name drugs. When a medicine is first developed, the pharmaceutical company that discovers and markets it receives a patent on its new drug. The patent usually lasts for 20 years, to give the originating company a chance to recoup its research investment. After the patent expires, a generic version of the drug become available.

The comprehensive analysis of the Poland Generic Drugs aims to equip readers with both quantitative and qualitative insights, facilitating the development of effective business and growth strategies. The report includes an analysis of companies that have been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified, it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The Bargaining Power of Buyers & Suppliers and the Threat of New Entrants, Rivalry, and Substitutes have also been analyzed and rated between LOW-HIGH to provide a holistic view of market favorability. One of the core components of the customer landscape is price sensitivity, an analysis of, which is expected to help market leaders refine marketing strategies to gain a competitive advantage. The segments have been steadily growing, driven by factors including patent expirations of blockbuster drugs, rising demand for cost-effective therapies, and regulatory initiatives promoting generic competition and innovation. The report serves as a valuable resource for industry stakeholders, allowing them to navigate the complexities of the Poland generic drugs market with strategic foresight.

- Poland has supported the domestic pharma industry to address the rising production cost of medicines, including generics, to compete with Asia and avoid potential manufacturers.

- Poland is very enthusiastic about the direction of the proposed amendments to the European pharmaceutical legislation, especially in terms of regulations related to the availability of medicinal products.

To get more Insights: Request Free Sample Report

Poland Generic Drugs Market Dynamics

Regulatory Shifts and Economic Viability Propel Growth in Poland's Generic Drugs Market

The Increase in the rules and regulations of Poland regarding generic drugs has propelled the market growth. For instance, Poland has pricing regulation of generic medicines, included in the reimbursement system. Setting the reference pricing (RP) at the price of the cheapest generic medicine in combination with the low level of medicine prices in Poland has been expected to keep down the profitability of generic medicines.

The rising cost of branded medicine, increase in healthcare expenditure, and propel demand for generic drugs have driven the market growth in Poland. In Addition, manufacturers are rapidly investing in the development of enhanced generic drugs in Poland which has fuelled the market growth. The factors that influenced the growth of the market is the economic viability of the Polish generic medicines market derives from the fact that it is a high-volume market as a result of the positive attitude of physicians towards generic medicines and the high level of patient co-payments.

Challenges Facing Poland's Generic Drugs Market

The generic drugs industry has been severely affected by drug shortages, especially due to national price caps. Several cheap drugs have disappeared from the market because it have become economically unviable to produce, directly impacting patients in need and resulting in hindering the market growth. Surged in limited access to healthcare infrastructure and services in Poland poses a significant obstacle to pharmaceutical industry growth that has created barriers to the market growth of generic drugs. Insufficient healthcare facilities, lack of trained personnel, and inadequate distribution of generic drugs have hindered the reach of pharmaceutical products to the intended population. Economic disparities in Poland contribute to financial constraints on both the government and the population.

- The inflation rate in Poland was 14. 4% in 2023. Although the increase in the price of medicines was below inflation, the cost of non-prescription medicines grew by 8.6%, prescriptions reimbursed by 3.3% and prescriptions not reimbursed by 8.4%

Poland Generic Drugs Market Segment Analysis

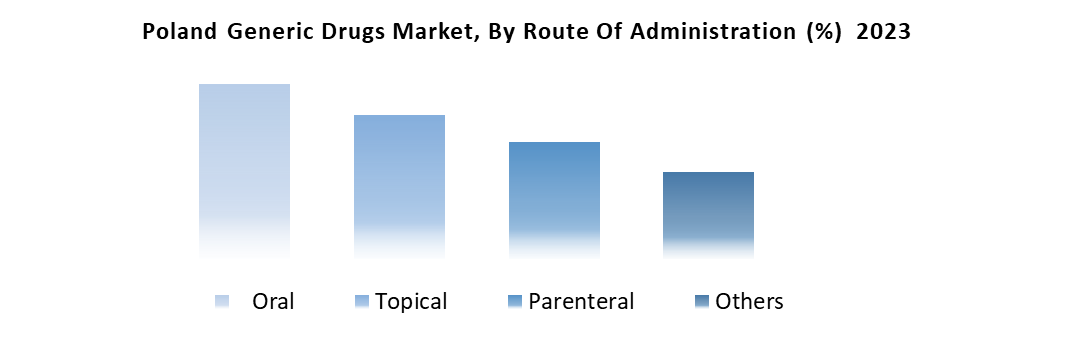

Based on the route of Administration, the Oral segment is expected to held a significant share of the market with rising CAGR through the forecast period. The oral route is one of the safest and least expensive ways to intake generics as it is administered orally as liquids, capsules, tablets, or chewable tablets. Adoption of Oral Administration has increased owing to its convenient use as it is easier to intake and less painful compared to the injection. Some orally administered drugs irritate the digestive tract. For example, aspirin and most other nonsteroidal anti-inflammatory drugs (NSAIDs) harm the lining of the stomach and small intestine to potentially cause or aggravate preexisting ulcers.

Different pharmaceutical technologies and drug delivery systems including nanocarriers, micelles, cyclodextrins, and lipid-based carriers have been explored to enhance oral drug absorption. Around 60% of established small-molecule drug products available commercially are administered via the oral route. Current estimates indicate that oral formulations represent about 90% of the global market share of all pharmaceutical formulations intended for human use.

Based on the End User, the Hospital segment dominates the market with an increasing CAGR through the forecast period. Hospital use of generic drugs increases adoption by community pharmacies. The increasing adoption rate of hospitals for Generic medicine owing to cheaper as compared to branded medicine with the same formulations has propelled the market growth of generics in Poland. Generic medications are readily available and reasonably priced options that increase the likelihood that patients adhere to the treatment recommended by their doctors regarding the many people who need to take medication.

Poland Generic Drugs Market Scope

|

|

Poland Generic Drugs Market |

|

Market Size in 2023 |

USD 22.14 Bn. |

|

Market Size in 2030 |

USD 30.13 Bn. |

|

CAGR (2024-2030) |

4.5 % |

|

Historic Data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By End User

|

Poland Generic Drugs Market Key Players

- Polfa Tarchomin

- Aflofarm

- Adamed Pharma S.A.

Frequently Asked Questions

Drug Shortages are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 22.14 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.5 % from 2024 to 2030, reaching nearly USD 49.20 Billion.

The segments covered in the market report are By Type, Application, Route of Administration and End User.

1. Poland Generic Drugs Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Poland Generic Drugs Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Poland Generic Drugs Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Poland Generic Drugs Market: Dynamics

4.1. Poland Generic Drugs Market Trends

4.2. Poland Generic Drugs Market Drivers

4.3. Poland Generic Drugs Market Restraints

4.4. Poland Generic Drugs Market Opportunities

4.5. Poland Generic Drugs Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Poland Generic Drugs Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Poland Generic Drugs Market Size and Forecast, by Type (2023-2030)

5.1.1. Simple Generics

5.1.2. Super Generics

5.2. Poland Generic Drugs Market Size and Forecast, by Application (2023-2030)

5.2.1. Central Nervous System (CNS)

5.2.2. Cardiovascular

5.2.3. Dermatology

5.2.4. Oncology

5.2.5. Respiratory

5.2.6. Others

5.3. Poland Generic Drugs Market Size and Forecast, by Route of Administration (2023-2030)

5.3.1. Oral

5.3.2. Topical

5.3.3. Parenteral

5.3.4. Others

5.4. Poland Generic Drugs Market Size and Forecast, by End User (2023-2030)

5.4.1. Hospitals

5.4.2. Homecare

5.4.3. Specialty Clinics

5.4.4. Others

6. Company Profile: Key Players

6.1. Polfa Tarchomin

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Aflofarm

6.3. Adamed Pharma S.A.

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook