Germany Generic Drugs Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

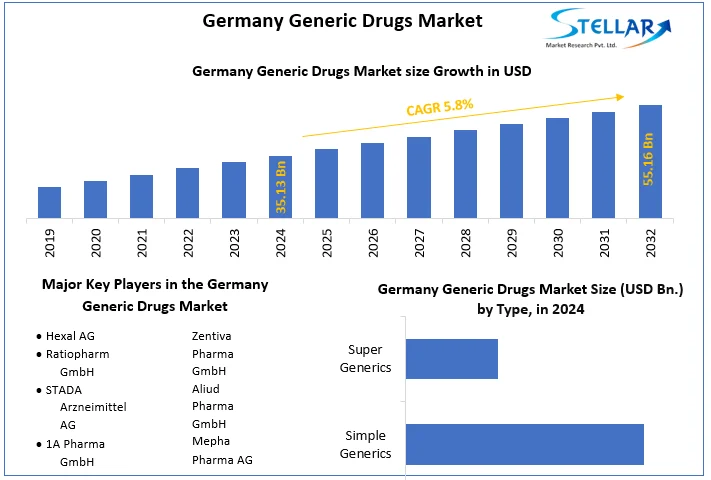

The Germany Generic Drugs Market size was valued at USD 35.13 Bn. in 2024 and the total Germany Generic Drugs Market revenue is expected to grow at a CAGR of 5.8 % from 2025 to 2032, reaching nearly USD 55.16 Bn. by 2032.

Format : PDF | Report ID : SMR_1791

Germany Generic Drugs Market Overview

A generic drug is a medication created to be the same as an already marketed brand-name drug in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. These similarities help to demonstrate bioequivalence, which means that a generic medicine works in the same way and provides the same clinical benefit as the brand-name medicine.

The report has covered primary and secondary research that has been collected through interviews with industry stakeholders, annual reports government agencies, etc. In-depth analysis of competitors and recent market trends to offer investors valuable insights. The generic drugs market encompasses an advanced category of super generic drugs designed to offer additional benefits beyond traditional generics, such as enhanced efficacy, safety, or delivery mechanisms. The segments have been steadily growing, driven by factors including patent expirations of blockbuster drugs, rising demand for cost-effective therapies, and regulatory initiatives promoting generic competition and innovation.

Key drivers include the expiration of patents for branded drugs, regulatory support for generic competition, and technological advancements enabling the development of novel formulations. Major players in the market include both established pharmaceutical companies and specialized generics manufacturers, who invest in research as well as in development to create innovative products. Super Generics are available across various therapeutic areas, targeting high unmet medical needs or significant market potential.

To get more Insights: Request Free Sample Report

Germany Generic Drugs Market Dynamics

A Look into the Growth of the German Generics Drugs Market

The rising prevalence of chronic diseases and increasing awareness of maintaining health have been influencing factors in the German Generics Drugs Market. More than one out of three adults have a long-standing (chronic) illness or health problem, and an increasing proportion of chronically ill people suffer from multi-morbidity, having two or more chronic conditions as a result it has propelled the demand for the Generic drugs in Germany.

- Germany spends USD 8011 per capita on health, more than the OECD average of USD 4986.

Germany constitutes the major German pharmaceutical market and the fourth largest globally. Driven by trends such as demographic change, a rise in chronic diseases, and an increasing emphasis on prevention and self-medication has accelerated the market growth.

- SMEs constitute the backbone of the economic sector, with more than 90 percent of drug manufacturers having less than 500 employees. Overall, the German pharmaceutical industry has a workforce of around 140,000 people.

Surged rules and regulations for the generics drug in Germany have played a vital role in the production of generics in the country. It has opened opportunities to many manufacturers to grow their business in the industry. In February 2023, the government proposed additional legal changes to prevent supply shortages and to incentivize the development and supply of certain critical medicines. The German government anticipates faster approvals for clinical trials, faster access to innovative medicines, more digitalization, greater supply security, a more investment-friendly environment, and a reduction of bureaucracy. The German government is implementing several reforms in a new Pharma Strategy aimed at enhancing the business environment for the pharmaceutical sector in Germany. A new law affecting drug prices and reimbursement policies is estimated to be passed in Germany.

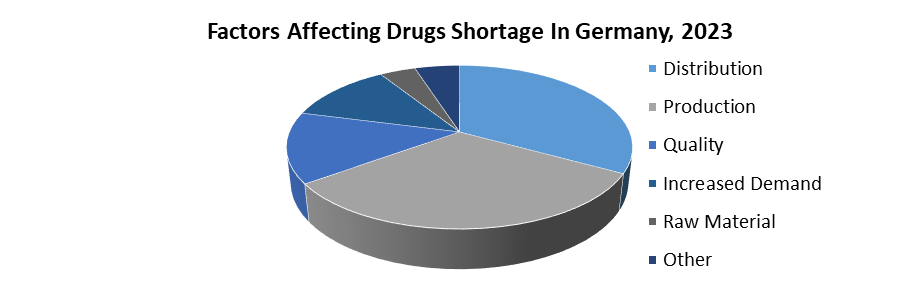

Supply Shortages and Pricing Pressures Challenges Facing the German Generics Drugs Market

The increasing shortages of supply have impacted the market growth in Germany. Drug supply shortages have become an increasingly pressing issue in Germany in recent years, and the pharmaceutical industry has been experiencing a strong relationship between the shortages and the continual downward price pressure on generics. Supply chain disruptions and increased demand are driving the shortfall in Germany.

- Pharmacies have been shutting down at an alarming rate in recent years in Germany, with more than 120 stores closing in the first three months of the year alone, according to data from the Federal Association of German Pharmacists (ABDA).

A sizeable erosion in branded generics sales share has affected German pharma companies' profitability, as sharply lower average prices are expected to outweigh potential benefits from lower marketing costs as a result it has hindered the market growth.

Germany Generic Drugs Market Segment Analysis

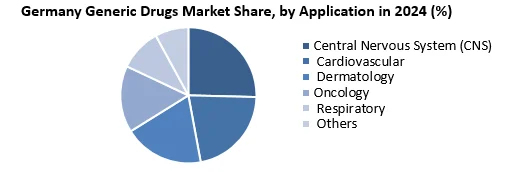

Based on Application, the Central Nervous System Segment held the majority of the share and is expected to rise with an increasing CAGR through 2032. The increase in the demand for generic drugs to cure central nervous system disease owing to cheaper prices with the same result as branded medicine has propelled the market growth. Brand-name medications are typically 30%–60% more expensive than their generic counterparts as a result it has boosted the demand in the market.

An increased use of cheaper generic prescription drugs as alternatives to more expensive branded products is encouraged by health authorities globally. Additionally, generic drugs approved by national regulatory authorities must be bioequivalent to the brand-name version. FDA-approved generic medicines work in the same way and provide the same clinical benefits and risks as their brand-name counterparts. A generic medicine is required to be the same as a brand-name medicine in dosage, safety, effectiveness, strength, stability, and quality, as well as in the way it is taken. Generic medicines also have the same risks and benefits as their brand-name counterparts.

|

|

Germany Generic Drugs Market Scope |

|

Market Size in 2024 |

USD 35.13 Bn. |

|

Market Size in 2032 |

USD 55.16 Bn. |

|

CAGR (2025-2032) |

5.8 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By End User

|

Germany Generic Drugs Market Key Players

- Hexal AG

- Ratiopharm GmbH

- STADA Arzneimittel AG

- 1A Pharma GmbH

- Zentiva Pharma GmbH

- Aliud Pharma GmbH

- Mepha Pharma AG

Frequently Asked Questions

High manufacturing costs are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 35.13 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 5.8 % from 2025 to 2032, reaching nearly USD 55.16 Billion.

The segments covered in the market report are By Type, Application, Route of Administration and End User.

1. Germany Generic Drugs Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany Generic Drugs Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Germany Generic Drugs Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Germany Generic Drugs Market: Dynamics

4.1. Germany Generic Drugs Market Trends

4.2. Germany Generic Drugs Market Drivers

4.3. Germany Generic Drugs Market Restraints

4.4. Germany Generic Drugs Market Opportunities

4.5. Germany Generic Drugs Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Germany Generic Drugs Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Germany Generic Drugs Market Size and Forecast, by Type (2024-2032)

5.1.1. Simple Generics

5.1.2. Super Generics

5.2. Germany Generic Drugs Market Size and Forecast, by Application (2024-2032)

5.2.1. Central Nervous System (CNS)

5.2.2. Cardiovascular

5.2.3. Dermatology

5.2.4. Oncology

5.2.5. Respiratory

5.2.6. Others

5.3. Germany Generic Drugs Market Size and Forecast, by Route of Administration (2024-2032)

5.3.1. Oral

5.3.2. Topical

5.3.3. Parenteral

5.3.4. Others

5.4. Germany Generic Drugs Market Size and Forecast, by End User (2024-2032)

5.4.1. Hospitals

5.4.2. Homecare

5.4.3. Specialty Clinics

5.4.4. Others

6. Company Profile: Key Players

6.1. Hexal AG

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Ratiopharm GmbH

6.3. STADA Arzneimittel AG

6.4. 1A Pharma GmbH

6.5. Zentiva Pharma GmbH

6.6. Aliud Pharma GmbH

6.7. Mepha Pharma AG

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook