Gonorrhea Diagnostic Market: Industry Analysis and Forecast (2025-2032)

The Gonorrhea Diagnostic Market Size Was Valued At USD 11.56 Bn. In 2024 And The Total Global Gonorrhea Diagnostic Revenue Is Expected To Grow At A CAGR Of 6.5% From 2025 To 2032, Reaching Nearly USD 19.14 Bn. By 2032.

Format : PDF | Report ID : SMR_1800

Gonorrhea Diagnostic Market Overview

Gonorrhea diagnostic is the process of testing for the presence of the bacteria Neisseria gonorrhoeae, which causes the sexually transmitted infection gonorrhea. It is done through various methods such as urine tests, swab tests, and blood tests. The SMR report provides a detailed examination of key market dynamics, trends, and drivers influencing the demand for diagnostic solutions. It includes a thorough segmentation analysis, categorizing diagnostic tests by type and end-user settings such as hospitals, clinics, and ambulatory surgical centers. Also, the report offers a comprehensive regional analysis, highlighting market trends and dynamics across key regions globally.

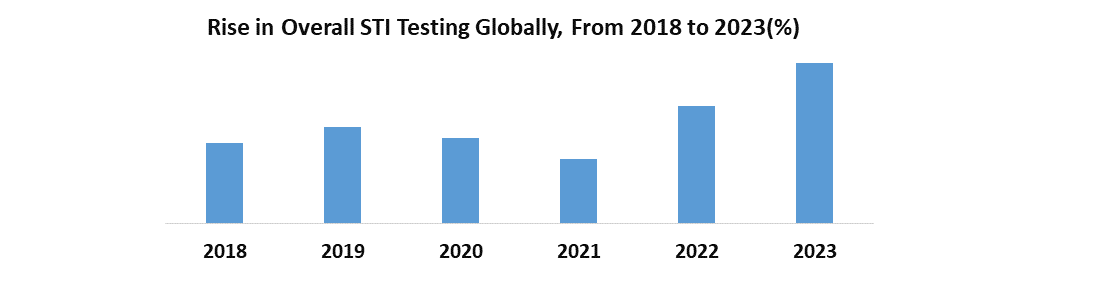

Increasing gonorrhea prevalence globally drives demand for diagnostic tests. Technological advancements in molecular diagnostics and rapid point-of-care tests, enhance diagnostic accuracy and efficiency, driving market growth. Government initiatives promoting STI awareness and screening contribute to increased demand. Also, the threat of antimicrobial resistance focuses on the need for tests capable of identifying antibiotic-resistant strains. Investing in research and development for innovative diagnostic technologies offers significant opportunities by enhancing sensitivity.

These opportunities are increasing in emerging markets such as North America, Asia Pacific, and South America, with high gonorrhea prevalence rates, which presents growth prospects. Strategic partnerships with healthcare organizations, research institutions, and government agencies facilitate market penetration and growth. The development of collaborative efforts to address the growing demand for gonorrhea diagnostics. These strategies are essential for capitalizing on market opportunities, driving innovation, and ensuring broader accessibility to advanced diagnostic solutions.

According to WHO, Every day, over 1 million cases of sexually transmitted infections (STIs) are contracted globally, with the majority showing no symptoms. Annually, approximately 374 million new infections arise, comprising four treatable STIs including chlamydia, gonorrhea, syphilis, and trichomoniasis. STIs directly affect sexual and reproductive health, leading to issues such as stigmatization, infertility, cancer, and pregnancy complications, and elevate HIV risk. The emergence of drug resistance poses a significant challenge to mitigating the global burden of STIs.

To get more Insights: Request Free Sample Report

Gonorrhea Diagnostic Market Dynamics

Growing Awareness and Screening Programs

Public health initiatives and awareness campaigns aimed at promoting regular screening for STIs, including gonorrhea, contribute to the growth of the diagnostic market. Increased awareness among individuals about the importance of early detection and treatment further increases the demand for diagnostic tests. Also, targeted screening programs by government and healthcare organizations for high-risk populations create specific demand for gonorrhea testing within these groups, further driving market growth in the diagnostic sector. These factors collectively contribute to the growth and evolution of the Gonorrhea Diagnostic market.

The Key Highlights in the Gonorrhea Diagnostic Market Report:

- In Canada, Chlamydia trachomatis (chlamydia) and Neisseria gonorrhoeae (gonorrhea) stand as the most prevalent sexually transmitted bacterial infection (STI), with reported cases consistently increasing since 2000. In 2023, individuals aged 15–29 years bore the highest burden, with chlamydia rates ranging from XX to XX% and gonorrhea rates from XX% to XX% within the demographic. However, due to underreporting and asymptomatic cases, the true prevalence among the age group is expected to be as high as XX% to XX%.

- Untreated chlamydia in females leads to various complications, including cervicitis XX%, pelvic inflammatory disease (10% to 16%), infertility (up to XX %), chronic pelvic pain (3% to 8%), and ectopic pregnancy (up to 2%). Equally, untreated gonorrhea is expected to result in pelvic inflammatory disease rates surpassing those of chlamydia. In males, chlamydia causes epididymitis (up to XX %), occasionally leading to infertility. Additional complications for both sexes include urethritis, pharyngitis, proctitis, reactive arthritis (lasting >6 months), and disseminated gonococcal infection, which rarely leads to severe conditions like sepsis or meningitis. These complications underscore the critical importance of effective diagnostics for Neisseria gonorrhoeae, as timely detection and treatment mitigate the risk of these serious health outcomes.

- The SMR report has analyzed prevalence trends of gonorrhea and chlamydia and guides the demand for diagnostic tests, especially with increasing reported cases indicating a heightened need for screening solutions. Understanding demographic patterns in sexually transmitted infections (STI) prevalence aids in effectively targeting screening efforts, and informing market strategies for developing age-specific diagnostic products. Evaluating the impact of national guidelines on screening practices informs market players about the evolving landscape of STI diagnostics, potentially driving shifts in demand for specific tests. Insights into opportunistic screening locations enable diagnostic companies to tailor marketing efforts and distribution channels, facilitating effective outreach to healthcare providers and maximizing market penetration in the Gonorrhea Diagnostic. These data points are crucial for market positioning, informing strategic decision-making, and addressing evolving healthcare needs effectively.

Antibiotic Resistance

The rise of antibiotic-resistant strains of Neisseria gonorrhoeae complicates treatment and necessitates the development of more sensitive diagnostic tests to guide appropriate therapy. Antimicrobial resistance (AMR) poses a significant global health and development challenge, directly contributing to an estimated 1.27 million deaths worldwide in 2019 and playing a role in 4.95 million deaths. Misuse and overuse of antimicrobials across human, animal, and plant sectors are the primary drivers behind the emergence of drug-resistant pathogens. AMR affects countries of all income levels and is exacerbated by poverty and inequality, with low- and middle-income countries bearing the greatest burden. It jeopardizes the progress of modern medicine by making infections more difficult to treat and increasing the risks associated with medical procedures such as surgery, cesarean sections, and cancer chemotherapy.

As antimicrobial resistance complicates treatment for gonorrhea infections, the demand for accurate and reliable diagnostic tools becomes even more critical. Increased awareness of AMR encourages healthcare providers to prioritize early and accurate diagnosis of gonorrhea, driving market demand for advanced diagnostic solutions. Also, the economic burden imposed by AMR underscores the importance of efficient diagnostic testing to guide appropriate treatment decisions and mitigate healthcare costs associated with antimicrobial resistance. Thus, addressing AMR directly influences the growth and development of the Gonorrhea Diagnostic Market by highlighting the urgent need for innovative diagnostic technologies and solutions.

Gonorrhea Diagnostic Market Segment Analysis

By Application, The Ambulatory Surgical Centers (ASCs) segment held the largest market share in the Global Gonorrhea Diagnostic Market in 2024. According to SMR analysis, the segment is further expected to grow at a CAGR of XX% during the forecast period. Ambulatory Surgical Centers (ASCs) play a crucial role in shaping the Gonorrhea Diagnostic market, driven by several key factors such as ASCs offer enhanced convenience and efficiency compared to traditional hospital settings, enticing more individuals to undergo gonorrhea testing. It increases convenience and promotes higher testing rates, thereby stimulating market growth. Also, many ASCs specialize in specific procedures, including sexual health services like gonorrhea testing.

The specialized focus ensures that patients receive tailored and comprehensive diagnostic services, further driving market growth. Additionally, ASCs frequently provide more cost-effective diagnostic options than hospitals, widening access to gonorrhea testing for a broader population. The affordability factor significantly increases market demand and growth by eliminating financial barriers to testing. The prevalence of ASCs in the Gonorrhea Diagnostic market signifies improved accessibility, specialized care, and cost-effective solutions, all of which contribute significantly to market growth and progress.

Gonorrhea Diagnostic Market Regional Insights

North America leads the Gonorrhea Diagnostic market because of the heightened STD awareness, facilitated by extensive healthcare infrastructure. The region benefits from the widespread availability of FDA-approved, advanced diagnostic tools, ensuring precise and prompt gonorrhea diagnoses. With a well-established healthcare system boasting numerous clinics and laboratories specializing in STD testing, North America provides accessible and comprehensive diagnostic services.

In 2024, the United States reported a total of 648,056 cases of gonorrhea, making it the second most common nationally notifiable sexually transmitted infection. After a historic low in 2009, reported gonorrhea rates increased until 2021 but decreased by XX% from 2021 to 2022. The decline was observed across genders, age groups, and most racial/ethnic groups, with 41 states experiencing decreases. Significantly, women saw the most significant decrease XX%, particularly among those aged 20 to 24 years 18.1% and diagnosed in non-STD clinic settings XX%. Since 2013, reported gonorrhea rates have been higher among men, likely due to cases identified in both men who have sex with men (MSM) and men who have sex with women only (MSW).

Enhanced data from the STD Surveillance Network (SSuN) suggests that nearly 40% of gonorrhea cases in 2024 occurred among MSM, with variation across participating jurisdictions. These data points are crucial for estimating the Gonorrhea Diagnostic market growth as they provide insights into the prevalence and distribution of gonorrhea cases, demographic trends, and high-risk populations. The SMR report provides all the data for Understanding changes in reported rates helps forecast the demand for diagnostic tests and identifies areas where targeted screening and diagnostic efforts are necessary. Also, insights into the proportion of cases among MSM highlight the importance of developing tailored diagnostic solutions to effectively address the needs of specific populations at higher risk of gonorrhea infection.

Gonorrhea Diagnostic Market Competitive Landscape

New diagnostic tests offering faster results and non-invasive procedures attract more healthcare providers and patients, increasing market reach. Technological advancements, such as rapid point-of-care tests, are expected to disrupt the market dynamics, compelling established players to adapt. Price competition from new entrants drives affordability and accessibility, benefiting patients. Additionally, products targeting specific needs, like home testing kits or tests for resource-limited settings, address unmet needs and expand the market size. For example, a rapid point-of-care gonorrhea test with a 30-minute turnaround time increases testing rates, while a non-invasive urine-based test can increase patient compliance and testing rates.

- In October 2022, Bayer and the Bill & Melinda Gates Foundation initiated joint funding for pre-clinical research into innovative non-hormonal contraception methods. This partnership aims to broaden access to contraceptive options, addressing the unmet needs of women globally.

- September 2022 witnessed the launch of Abbott's European Amplatzer™ Talisman™ PFO Occlusion System. This system targets individuals who have suffered a stroke and are at risk of recurrent incidents due to Patent Foramen Ovale (PFO), a congenital heart condition characterized by an unclosed hole.

- August 2022 marked the completion of Danaher Corporation's acquisition of Aldevron. Operating as an independent entity under Danaher's Life Sciences segment, Aldevron maintains its brand identity and operational autonomy.

|

|

Gonorrhea Diagnostic Market Scope |

|

Market Size in 2024 |

USD 11.56 Bn. |

|

Market Size in 2032 |

USD 19.14 Bn. |

|

CAGR (2025-2032) |

6.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Type Chromatography Diagnostic Imaging Differential Light Scattering Flow Cytometry Gel Microdroplets Immunoassay Molecular Diagnostics Monoclonal Antibodies Test |

|

By Application Hospitals Ambulatory Surgical Centers Diagnostic Centers Clinics Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Gonorrhea Diagnostic Market

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific Inc.

- Hologic, Inc.

- BD (Becton, Dickinson and Company)

- Cepheid Inc. (Danaher Corporation)

- bioMérieux SA

- QIAGEN N.V.

- DiaSorin S.p.A.

- Meridian Bioscience, Inc.

- Gen-Probe Incorporated (Hologic, Inc.)

- Sekisui Diagnostics LLC

- F. Hoffmann-La Roche AG

- Cepheid, Inc.

- Siemens Healthineers

- Luminex Corporation

- Bio-Rad Laboratories, Inc.

- Mycoplasma Diagnostics, Inc.

- GenMark Diagnostics, Inc.

- Nanosphere Inc. (Luminex Corporation)

Frequently Asked Questions

Challenges in the gonorrhea diagnostic market include the asymptomatic nature of many gonorrhea infections, leading to underreporting and delayed diagnosis. Additionally, the emergence of drug-resistant strains poses a significant threat to effective diagnosis and treatment.

Common diagnostic methods for gonorrhea include molecular diagnostics (such as Polymerase Chain Reaction or PCR), culture-based methods, and immunoassays (such as enzyme-linked immunosorbent assay or ELISA). Rapid point-of-care tests are also becoming more prevalent.

The Market size was valued at USD 11.56 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of % from 2025 to 2032, reaching nearly USD 19.14 Billion.

The segments covered in the market report are by Type and Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Gonorrhea Diagnostic Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Gonorrhea Diagnostic Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. New Launches and Innovations

4. Gonorrhea Diagnostic Market: Dynamics

4.1. Gonorrhea Diagnostic Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Gonorrhea Diagnostic Market Drivers

4.3. Gonorrhea Diagnostic Market Restraints

4.4. Gonorrhea Diagnostic Market Opportunities

4.5. Gonorrhea Diagnostic Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Gonorrhea Diagnostic Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

5.1.1. Chromatography

5.1.2. Diagnostic Imaging

5.1.3. Differential Light Scattering

5.1.4. Flow Cytometry

5.1.5. Gel Microdroplets

5.1.6. Immunoassay

5.1.7. Molecular Diagnostics

5.1.8. Monoclonal Antibodies Test

5.2. Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

5.2.1. Hospitals

5.2.2. Ambulatory Surgical Centers

5.2.3. Diagnostic Centers

5.2.4. Clinics

5.2.5. Others

5.3. Gonorrhea Diagnostic Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Gonorrhea Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

6.1.1. Chromatography

6.1.2. Diagnostic Imaging

6.1.3. Differential Light Scattering

6.1.4. Flow Cytometry

6.1.5. Gel Microdroplets

6.1.6. Immunoassay

6.1.7. Molecular Diagnostics

6.1.8. Monoclonal Antibodies Test

6.2. North America Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

6.2.1. Hospitals

6.2.2. Ambulatory Surgical Centers

6.2.3. Diagnostic Centers

6.2.4. Clinics

6.2.5. Others

6.3. North America Gonorrhea Diagnostic Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Gonorrhea Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

7.2. Europe Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

7.3. Europe Gonorrhea Diagnostic Market Size and Forecast, by Country (2024-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Gonorrhea Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

8.3. Asia Pacific Gonorrhea Diagnostic Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Gonorrhea Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

9.3. Middle East and Africa Gonorrhea Diagnostic Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Gonorrhea Diagnostic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Gonorrhea Diagnostic Market Size and Forecast, by Type (2024-2032)

10.2. South America Gonorrhea Diagnostic Market Size and Forecast, by Application (2024-2032)

10.3. South America Gonorrhea Diagnostic Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Abbott Laboratories

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Roche Diagnostics

11.3. Thermo Fisher Scientific Inc.

11.4. Hologic, Inc.

11.5. BD (Becton, Dickinson and Company)

11.6. Cepheid Inc. (Danaher Corporation)

11.7. bioMérieux SA

11.8. QIAGEN N.V.

11.9. DiaSorin S.p.A.

11.10. Meridian Bioscience, Inc.

11.11. Gen-Probe Incorporated (Hologic, Inc.)

11.12. Sekisui Diagnostics LLC

11.13. F. Hoffmann-La Roche AG

11.14. Cepheid, Inc.

11.15. Siemens Healthineers

11.16. Luminex Corporation

11.17. Bio-Rad Laboratories, Inc.

11.18. Mycoplasma Diagnostics, Inc.

11.19. GenMark Diagnostics, Inc.

11.20. Nanosphere Inc. (Luminex Corporation)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook