Private Tutoring Market Size and Forecast 2026-2032 Market Share, Competitive Analysis, Shits in Consumer Preferences, Global Market Outlook

Private Tutoring Market was valued at USD 151.3 Billion in 2025, and the total revenue is expected to grow at a CAGR of 8.4 % from 2026 to 2032, reaching USD 266.1 Billion by 2032. This robust expansion is fueled by the intensification of the "Shadow Education" phenomenon, where supplementary instruction is no longer an luxury but a competitive necessity for academic survival.

Format : PDF | Report ID : SMR_971

The demand is particularly concentrated in the K-12 segment, driven by high-stakes testing and the global STEM-based curriculum surge. In some countries, over 70% of students now pay for private tutoring in addition to their regular schooling to maintain a competitive edge. The integration of AI-driven personalization and B2B tutoring models is allowing providers to scale volumetric delivery while maintaining the individualized focus that parents and institutional stakeholders now demand.

Key Market Insights:

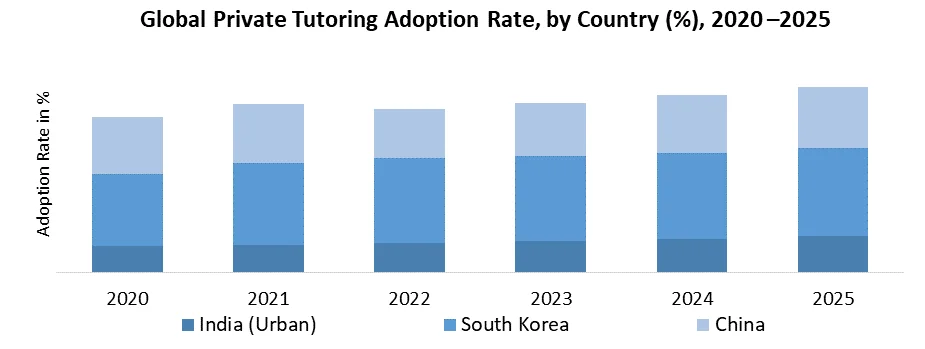

- Adoption Milestone: In major hubs like South Korea and Hong Kong, the adoption rate for secondary students has officially surpassed the 70%–80% threshold as of 2025.

- STEM Revenue: STEM-related subjects account for 47.2% of the 2025 market valuation.

- Efficiency Gain: AI-integrated platforms are reporting a 20% increase in student score improvements due to the "individualized focus" mentioned above.

Top Market Trend: Hyper-Personalized Hybrid Model

The most dominant trend in 2025 is the Hyper-Personalized Hybrid Model, where AI acts as a 24/7 "co-pilot" alongside human experts. Instead of weekly sessions, students interact daily with AI diagnostic tools for instant feedback. According to MMR Over 54% of tutoring firms have launched AI platforms to automate grading and "doubt-solving," enabling tutors to focus on high-impact mentoring.

- Gamified Retention: 59% of platforms now use immersive, level-based learning to combat virtual fatigue, boosting participation by nearly 60%.

- Data-Driven Mastery: 61% of tutors utilize analytics dashboards tracking "micro-behaviors" to auto-adjust curricula.

- Microlearning Expansion: In the U.S. and Europe, students are opting for 5–10 minute modular bursts, aligning with mobile-first habits and on-demand test preparation.

2025 Trend Impact Analysis

|

Trend Component |

2025 Statistical Impact |

Core Benefit |

|

AI Integration |

32.1% (AI-bot segment) |

24/7 "on-demand" academic support. |

|

Hybrid Enrollment |

35% Increase |

Combines digital flexibility with human trust. |

|

STEM Specialization |

74% Surge in demand |

Focuses on high-ROI subjects like coding and physics. |

.webp)

To get more Insights: Request Free Sample Report

Private Tutoring Market Dynamics:

Escalating Academic Competition & Global STEM Focus to drive the Private Tutoring Market

The market is primarily driven by escalating global competition for admission into elite universities, which enforce rigorous entrance and English proficiency standards. This "exam-centric" culture has led 57% of students in China and 55% of those in India to seek supplemental instruction. a strategic global shift toward STEM proficiency has transformed private tutoring into a critical asset, as parents prioritize science and math to secure top academic rankings and meet the strict requirements of international colleges.

Rising Financial Burden and Socio-Economic Disparities:

The primary restraint on market expansion is the significant financial burden on households, which creates a substantial barrier for lower-income families. According to 2025 government surveys, private tutoring became the third-largest contributor to household expenses in India, with urban families spending an average of ?9,950 annually per student for higher secondary coaching. Globally, the premium nature of personalized 1:1 instruction often excludes approximately 42% of low-income households, while unregulated fee structures and rising inflation are forcing even middle-class families to compromise on service quality. This widening "educational divide" not only limits the Total Addressable Market (TAM) but also prompts increased government scrutiny and regulatory interventions aimed at capping tuition fees to ensure equitable access, also in some societies, social competition pushes even low-income families to invest in private tutoring.

Rapid Proliferation of AI-Driven Microlearning:

The integration of Artificial Intelligence (AI) and microlearning modules presents a significant growth opportunity to enhance scalability while reducing operational overhead. In 2025, the AI in education market witnessed a double-digit growth, enabling platforms to offer 24/7 automated "doubt-solving" and adaptive study paths that adjust in real-time to student performance. Furthermore, the shift toward B2B tutoring models where platforms partner directly with schools and corporations is opening new revenue streams, allowing providers to reduce their dependence on seasonal exam cycles and achieve a 15% reduction in delivery costs through tech-enabled, high-engagement content like gamified flashcards and 5-minute modular lessons.

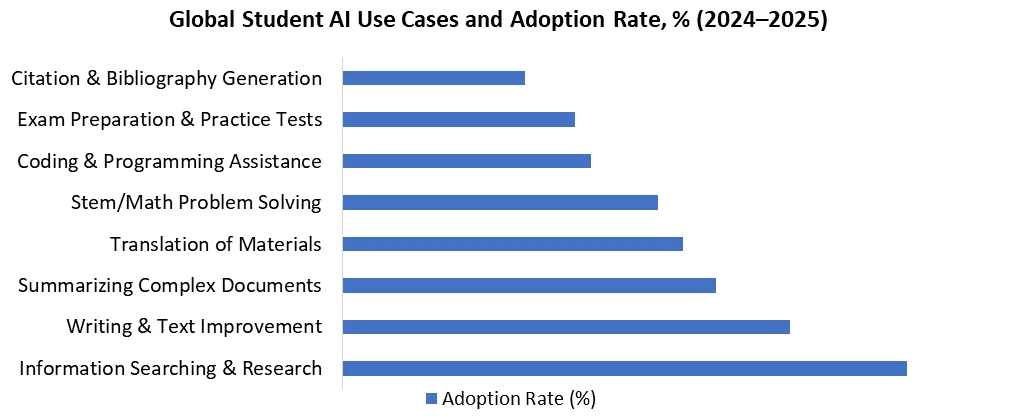

Leading Use Cases for Artificial Intelligence (AI) Tools in Schoolwork Among Higher Education Students Worldwide 2024-2025

Private Tutoring Market: Segment Analysis

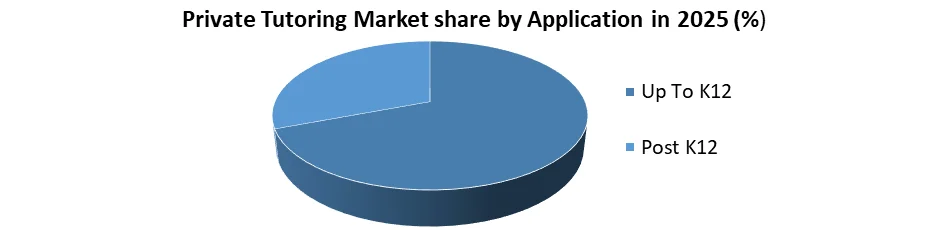

By Application: In 2025, the market was primarily segmented by application into Up To K12 and Post K12, with the Up To K12 segment maintaining a dominant 71% market share. This dominance was fueled by intense parental pressure for foundational academic success and high-stakes high school graduation exams, particularly in STEM subjects. the Post K12 (University & Professional) segment is the fastest-growing area, expanding at a 14.6% CAGR as college students seek specialized entrance exam prep (SAT, GRE, NEET) and working professionals increasingly adopt upskilling modules in coding and digital literacy to remain competitive in an AI-driven global job market.

Regional Analysis:

In 2025, the global market is led by the Asia Pacific Private Tutorial Market, which commanded the largest revenue share due to "exam-centric" cultures in China, India, and South Korea, where high-stakes entrance exams drive mass adoption. In North America, growth was fueled by a surge in STEM-focused supplemental education and the rapid integration of AI-driven platforms that provide on-demand support for K-12 students. Europe followed closely, with the UK and Germany witnessing a shift toward curriculum-aligned blended learning, while emerging markets in Latin America and the Middle East are experiencing the highest growth rates as digital infrastructure expands and a growing middle class seeks competitive academic advantages for their children.

Competitive Landscape: Structural Fragmentation and Value Chain Archetypes

In 2025, the Competitive Landscape of the private tutoring market was undergoing a significant transformation, shifting from traditional B2C models to AI-driven, B2B, and skilling-focused strategies. The market remained fragmented but is dominated by several key players who are pivoting to address new regulatory and technological realities.

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations. The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

Major Player Strategic Initiatives:

|

Key Company |

Core Strategy in 2025 |

Strategic Action / Example |

|

Chegg, Inc. |

B2B Skilling Pivot |

Shifted to "Chegg Skilling" to capture the USD 40B workforce AI training market. |

|

TAL Education |

AI-Integrated Enrichment |

Reported USD 861M revenue by pivoting to non-academic AI solutions. |

|

Pearson Plc |

AI Study Agents |

Embedded generative AI across K-12 platforms, driving 17% growth in virtual learning. |

|

Varsity Tutors |

Institutional B2B |

Partnered with Digital Ready to provide on-demand academic support for school districts. |

|

BYJU’S |

Debt Restructuring |

Transitioned from expansion to a focus on asset liquidation and debt management. |

Private Tutoring Market Scope

|

Private Tutoring Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 151.3 Bn |

|

Forecast Period 2026 to 2032 CAGR: |

8.4 % |

Market Size in 2032: |

USD 266.1 Bn |

|

Private Tutoring Market Segments Covered: |

By Subject |

Academic Based STEM and Language Subjects Social Sciences Professional Courses Others Non-Academic Based Life Skills Coaching Hobbies, Interests, and Arts Technology and Digital Skills Professional Development Others |

|

|

By Type |

Online Offline Hybrid |

||

|

By Duration |

Short-term Courses Long-term Courses |

||

|

By Course Type |

Curriculum-Based Learning Test Preparation Others |

||

|

By Mode of Delivery |

One-on-One Tutoring Group Tutoring |

||

|

By Application |

Up To K12 Post K12 |

||

Private Tutoring Market, by region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, and Rest of APAC)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

Private Tutoring industry key Players

- Chegg, Inc. (USA)

- Varsity Tutors (Nerdy Inc., USA)

- The Princeton Review (USA)

- Sylvan Learning (USA)

- Kumon Institute of Education (Japan/Global)

- Kaplan, Inc. (USA)

- Mathnasium (USA)

- Huntington Learning Center (USA)

- Pearson Plc (UK/Global)

- Tutor.com (USA)

- Wyzant (USA)

- Revolution Prep (USA)

- TAL Education Group (China)

- New Oriental Education & Technology (China)

- BYJU’S (Think and Learn Pvt. Ltd., India)

- Vedantu (India)

- Unacademy (India)

- Gaotu Techedu (China)

- Yuanfudao (China)

- Zuoyebang (China)

- Daekyo Co., Ltd. (South Korea)

- Ambow Education (China)

- GoStudent (Austria/Europe)

- Preply (USA)

- iTalki (China)

- Paper (Canada - B2B/Institutional)

- Skooli (Canada/USA)

- TutorMe (USA)

Frequently Asked Questions

In 2025, the Asia-Pacific region dominated the Private Tutoring market. This dominance is driven by intense academic competition in China and India.

The Private Tutoring market was valued at USD 151.3 Billion in 2025 and is expected to grow at 8.4 % CAGR, reaching USD 266.1 Billion by 2032.

The report covers Subject, Type, Duration, Course Type, Mode of Delivery, Application and Region.

The biggest challenges for the private tutoring market include high service costs, quality inconsistency, and rising social inequality in educational access.

1. Private Tutoring Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Private Tutoring Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Portfolio

2.2.4. Market Share (%)

2.2.5. Revenue, (2025)

2.2.6. Profit Margin (%)

2.2.7. Tutor networks

2.2.8. Content & Curriculum quality

2.2.9. Technological Innovations

2.2.10. Partnerships & institutional ties

2.2.11. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Private Tutoring Market: Dynamics

3.1. Private Tutoring Market Trends

3.2. Private Tutoring Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Private Tutoring Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

4.1. Private Tutoring Market Size and Forecast, By Subject (2025-2032)

4.1.1. Academic Based

4.1.1.1. STEM and Language Subjects

4.1.1.2. Social Sciences

4.1.1.3. Professional Courses

4.1.1.4. Others

4.1.2. Non-Academic Based

4.1.2.1. Life Skills Coaching

4.1.2.2. Hobbies, Interests, and Arts

4.1.2.3. Technology and Digital Skills

4.1.2.4. Professional Development

4.1.2.5. Others

4.2. Private Tutoring Market Size and Forecast, By Type (2025-2032)

4.2.1. Online

4.2.2. Offline

4.2.3. Hybrid

4.3. Private Tutoring Market Size and Forecast, By Duration (2025-2032)

4.3.1. Short-term Courses

4.3.2. Long-term Courses

4.4. Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

4.4.1. Curriculum-Based Learning

4.4.2. Test Preparation

4.4.3. Others

4.5. Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

4.5.1. One-on-One Tutoring

4.5.2. Group Tutoring

4.6. Private Tutoring Market Size and Forecast, By Application (2025-2032)

4.6.1. Up To K12

4.6.2. Post K12

4.7. Private Tutoring Market Size and Forecast, By Region (2025-2032)

4.7.1. North America

4.7.2. Europe

4.7.3. Asia Pacific

4.7.4. Middle East and Africa

4.7.5. South America

5. North America Private Tutoring Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

5.1. North America Private Tutoring Market Size and Forecast, By Subject (2025-2032)

5.2. North America Private Tutoring Market Size and Forecast, By Type (2025-2032)

5.3. North America Private Tutoring Market Size and Forecast, By Duration (2025-2032)

5.4. North America Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

5.5. North America Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

5.6. North America Private Tutoring Market Size and Forecast, By Application (2025-2032)

5.7. North America Private Tutoring Market Size and Forecast, by Country (2025-2032)

5.7.1. United States

5.7.2. Canada

5.7.3. Mexico

6. Europe Private Tutoring Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

6.1. Europe Private Tutoring Market Size and Forecast, By Subject (2025-2032)

6.2. Europe Private Tutoring Market Size and Forecast, By Type (2025-2032)

6.3. Europe Private Tutoring Market Size and Forecast, By Duration (2025-2032)

6.4. Europe Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

6.5. Europe Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

6.6. Europe Private Tutoring Market Size and Forecast, By Application (2025-2032)

6.7. Europe Private Tutoring Market Size and Forecast, by Country (2025-2032)

6.7.1. United Kingdom

6.7.1.1. United Kingdom Private Tutoring Market Size and Forecast, By Subject (2025-2032)

6.7.1.2. United Kingdom Private Tutoring Market Size and Forecast, By Type (2025-2032)

6.7.1.3. United Kingdom Private Tutoring Market Size and Forecast, By Duration (2025-2032)

6.7.1.4. United Kingdom Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

6.7.1.5. United Kingdom Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

6.7.1.6. United Kingdom Private Tutoring Market Size and Forecast, By Application (2025-2032)

6.7.2. France

6.7.3. Germany

6.7.4. Italy

6.7.5. Spain

6.7.6. Sweden

6.7.7. Russia

6.7.8. Rest of Europe

7. Asia Pacific Private Tutoring Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Asia Pacific Private Tutoring Market Size and Forecast, By Subject (2025-2032)

7.2. Asia Pacific Private Tutoring Market Size and Forecast, By Type (2025-2032)

7.3. Asia Pacific Private Tutoring Market Size and Forecast, By Duration (2025-2032)

7.4. Asia Pacific Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

7.5. Asia Pacific Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

7.6. Asia Pacific Private Tutoring Market Size and Forecast, By Application (2025-2032)

7.7. Asia Pacific Private Tutoring Market Size and Forecast, by Country (2025-2032)

7.7.1. China

7.7.2. S Korea

7.7.3. Japan

7.7.4. India

7.7.5. Australia

7.7.6. Indonesia

7.7.7. Malaysia

7.7.8. Philippines

7.7.9. Thailand

7.7.10. Vietnam

7.7.11. Rest of Asia Pacific

8. Middle East and Africa Private Tutoring Market Size and Forecast (by Value in USD Billion) (2025-2032)

8.1. Middle East and Africa Private Tutoring Market Size and Forecast, By Subject (2025-2032)

8.2. Middle East and Africa Private Tutoring Market Size and Forecast, By Type (2025-2032)

8.3. Middle East and Africa Private Tutoring Market Size and Forecast, By Duration (2025-2032)

8.4. Middle East and Africa Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

8.5. Middle East and Africa Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

8.6. Middle East and Africa Private Tutoring Market Size and Forecast, By Application (2025-2032)

8.7. Middle East and Africa Private Tutoring Market Size and Forecast, by Country (2025-2032)

8.7.1. South Africa

8.7.2. GCC

8.7.3. Egypt

8.7.4. Nigeria

8.7.5. Rest of ME&A

9. South America Private Tutoring Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. South America Private Tutoring Market Size and Forecast, By Subject (2025-2032)

9.2. South America Private Tutoring Market Size and Forecast, By Type (2025-2032)

9.3. South America Private Tutoring Market Size and Forecast, By Duration (2025-2032)

9.4. South America Private Tutoring Market Size and Forecast, By Course Type (2025-2032)

9.5. South America Private Tutoring Market Size and Forecast, By Mode of Delivery (2025-2032)

9.6. South America Private Tutoring Market Size and Forecast, By Application (2025-2032)

9.7. South America Private Tutoring Market Size and Forecast, by Country (2025-2032)

9.7.1. Brazil

9.7.2. Argentina

9.7.3. Colombia

9.7.4. Chile

9.7.5. Rest Of South America

10. Company Profile: Key Players

10.1. Clayton Homes (Berkshire Hathaway)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.1.7. BYD Auto

10.2. Chegg, Inc. (USA)

10.3. Varsity Tutors (Nerdy Inc., USA)

10.4. The Princeton Review (USA)

10.5. Sylvan Learning (USA)

10.6. Kumon Institute of Education (Japan/Global)

10.7. Kaplan, Inc. (USA)

10.8. Mathnasium (USA)

10.9. Huntington Learning Center (USA)

10.10. Pearson Plc (UK/Global)

10.11. Tutor.com (USA)

10.12. Wyzant (USA)

10.13. Revolution Prep (USA)

10.14. TAL Education Group (China)

10.15. New Oriental Education & Technology (China)

10.16. BYJU’S (Think and Learn Pvt. Ltd., India)

10.17. Vedantu (India)

10.18. Unacademy (India)

10.19. Gaotu Techedu (China)

10.20. Yuanfudao (China)

10.21. Zuoyebang (China)

10.22. Daekyo Co., Ltd. (South Korea)

10.23. Ambow Education (China)

10.24. GoStudent (Austria/Europe)

10.25. Preply (USA)

10.26. iTalki (China)

10.27. Paper (Canada - B2B/Institutional)

10.28. Skooli (Canada/USA)

10.29. TutorMe (USA)

10.30. Others

11. Key Findings

12. Analyst Recommendations

13. Private Tutoring Market: Research Methodology