Natural Tocopherols Market: Size, Share, Trends, By Product Type, By Source, By Application, Dynamics, Key Players, and Forecast 2025-2032

The Natural Tocopherols Market was estimated at USD 682.15 million in 2024 and is expected to grow at a CAGR of 14.58% from 2025 to 2032, reaching nearly USD 2,020 million by 2032.

Format : PDF | Report ID : SMR_2620

Natural Tocopherols Market Overview:

Natural tocopherols are fat-soluble, plant-derived compounds with antioxidant properties, representing the natural form of vitamin E. The Natural Tocopherols Market is driven by the increasing demand for natural antioxidants in the food, pharmaceuticals, and cosmetic industries. Tocopherols, commonly known as vitamin E, are widely used as a preservative in food products and dietary supplements due to their ability to prevent oxidation and extend shelf life. The food and beverage industry is a significant contributor to the demand for natural tocopherols due to its serving as an effective preservative by preventing lipid oxidation in processed foods. The global trend favoring natural and organic products, food manufacturers are replacing synthetic antioxidants like BHA and BHT with natural tocopherols to comply with regulatory guidelines and consumer preferences.

Also, regulatory support for natural ingredients over synthetic chemicals has increased the natural tocopherols market growth. Due to increased consumer awareness about health benefits of tocopherols and their role in preventing chronic diseases such as cancer and heart diseases. Around 60% of foods purchased by Americans contain technical food additives, including preservatives or antioxidants, sweeteners, and coloring agents. Due to these factors, the natural tocopherols market shows significant growth during the forecast period.

To get more Insights: Request Free Sample Report

Natural Tocopherols Market Dynamics

Continuous Research and Development in the Field of Natural Tocopherol Extraction to Fuel the Natural Tocopherols Market Growth

The extraction of natural tocopherols plays a crucial role in driving market growth due to advancements in extraction techniques that improve sustainability and cost-effectiveness. Natural tocopherols are primarily derived from vegetable oils such as soybean, sunflower, and rapeseed. One of the key factors fueling the Natural Tocopherols Market is the increasing focus on eco-friendly and sustainable extraction methods. Natural Tocopherols mmanufacturers are investing in bio-based extraction technologies that minimize chemical use and reduce waste. Also, advancements in enzyme-assisted extraction and membrane separation techniques have improved tocopherol yield and purity, making them more competitive with synthetic alternatives. As regulatory bodies continue to execute restrictions on synthetic antioxidants, the demand for naturally sourced tocopherols is expected to grow during the forecast period.

High-Production Costs and Availability of Synthetic Alternatives to restraint Natural Tocopherols Market growth

The extraction process from vegetable oils is complex and requires advanced processing technology. Due to this, natural tocopherols are more expensive and Synthetic vitamin E is readily available and often cheaper than natural tocopherols. Fluctuations in the prices of such raw materials impact production costs, hampering the growth of the Natural Tocopherols industry. The raw material availability and pricing volatility presents serious limitations due to seasonal agricultural output; climate change, geopolitical tensions, and global trade policies impact production of natural tocopherols, leading to uncertainty in pricing and availability for manufacturers. Also, limited awareness about natural tocopherols in some regions, particularly in developing Natural Tocopherols Market.

The Growing Demand for Natural Ingredients in the Cosmetics and Personal Care Industry presents opportunity for the Natural Tocopherols Market growth

The antioxidant and anti-aging properties of natural tocopherols are needed in skincare and haircare formulations. The demand for clean-label and chemical-free beauty products continues to grow, and natural tocopherols are expected to see increased adoption by cosmetic brands. Another major opportunity is the expansion of the nutraceutical and functional food sectors. With rising awareness of lifestyle-related diseases and a growing preference for preventive healthcare, consumers are turning to dietary supplements and fortified foods. Also, regulatory support and clean-label movement in developed markets are encouraging food and cosmetic manufacturers to replace synthetic additives with natural tocopherols. These factors offer a wide range of growth opportunities for companies in the natural tocopherols market.

Natural Tocopherols Market Segment Analysis

Based on product type, the Natural Tocopherols Market is segmented into alpha-tocopherol, Beta-Tocopherol, gamma-tocopherol, and Delta-Tocopherol. Alpha-tocopherol is the most biologically active form of vitamin E, and it is widely used in dietary supplements and cosmetics due to its antioxidant properties. Dietary vitamin E is obtained mainly from plant sources, including sunflower seeds, olive oil, and almonds, which contain high amounts of alpha-tocopherol. It is also used in the prevention and treatment of heart disease, cancer, and Alzheimer’s disease. Also, gamma and delta—tocopherols are highly effective as food preservatives due to their superior antioxidant capacity, making them more suitable for the food and beverages industry.

Based on the source, the Natural Tocopherol Market is segmented into Soybean oil, Sunflower oil, Rapeseed oil, and others. The Soybean Oil segment dominated the market in 2024 and is expected to h old the largest market share over the forecast period (2025-2032). The natural tocopherols are mainly extracted from vegetable oils, with soybean oil being most widely used due to its availability and cost-effectiveness. Soybean oil is rich in gamma and delta tocopherols, making it an ideal choice for food-related applications and also preferred by the food and beverage industry as a preservative. Globally, soybean is one of the most cultivated oilseeds, and countries like the US, Brazil, Argentina, and China are major producers. From an economic perspective, soybean oil offers a high tocopherol yield per unit cost, making it a commercially feasible choice for small and large-scale manufacturers. Also, Sunflower oil, which contains a higher proportion of alpha-tocopherol, is preferred in supplements and skincare products.

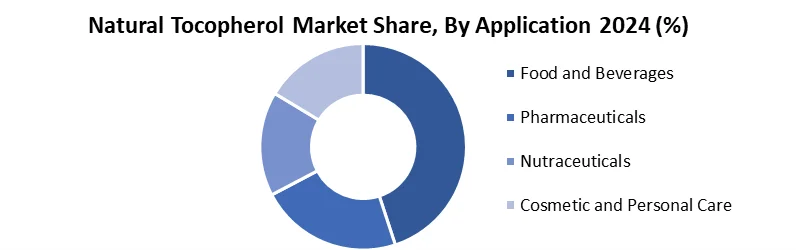

Based on the application, the Natural Tocopherol Market is segmented into Food and beverages, Pharmaceuticals, Nutraceuticals, Cosmetics and personal care, and animal feed. The Food and Beverages Segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Natural tocopherols, a form of vitamin E, act as antioxidants that prevent oxidative rancidity in oil, fats, and lipid-containing food products and extend the shelf life of food products, making them a valuable additive for food manufacturers. The primary role in this sector is to extend shelf life, maintain flavour stability, and preserve nutritional quality. Also, in pharmaceuticals, tocopherols are used as antioxidants and have potential applications in wound healing and other applications.

Natural Tocopherols Market Regional Analysis

North America is the dominant region in the Natural Tocopherols market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032).

North America holds a significant share of the natural tocopherols market due to high consumer awareness, strong demand for natural and clean-label products, and a well-established dietary supplement industry. In the United States, there is wide use of natural tocopherols used in food preservation, functional foods, and cosmetics. Regulation bodies like the FDA and USFDA encourage the use of natural additives over synthetic additives. Also, the region's advanced oilseed processing sector ensures a steady supply of raw materials like soybean oil, further supporting the natural tocopherols market. Europe is another major player in the natural tocopherols market due to the high demand for natural ingredients in food cosmetics and nutraceuticals.

Natural Tocopherols Market Competitive Landscape

The natural tocopherols market is competitive, with a mix of multinational corporations and regional producers actively shaping market trends. Companies compete based on factors like product purity, source sustainability, pricing, innovation, and application-specific customization. BASF SE is one of the leading suppliers of natural tocopherols globally. The company's strong research and development capabilities and global manufacturing network increase the range of tocopherol products, especially for the food, feed, and cosmetic sectors. DSM-Firmenich is another major player focusing on nutrition and health solutions

|

Natural Tocopherols Market Scope |

|

|

Market Size in 2024 |

USD 682.15 Mn |

|

Market Size in 2032 |

USD 2,020 Mn |

|

CAGR (2025-2032) |

14.58% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Alpha-tocopherol Beta-tocopherol Gamma-tocopherol Delta-tocopherol |

|

By Source Soybean oil Sunflower oil Rapeseed oil Others |

|

|

By Application Food and Beverages Pharmaceuticals Nutraceuticals Cosmetics and Personal Care |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Natural Tocopherols Market

North America

- Cargill, Inc. (USA)

- Archer Daniels Midland Company (USA)

- Kemin Industries (USA)

- DuPont (USA)

- The Dow Chemical Company (USA)

Europe

- DSM Nutritional Products (Netherlands)

- BASF SE (Germany)

- Wacker Chemie AG (Germany)

- Evonik Industries AG (Germany)

- Nutralliance (France)

Asia-Pacific

- Nouryon (China)

- Vitae Naturals (China)

- COFCO Biochemical (China)

- Jiangsu Tiansheng Pharmaceutical Co., Ltd. (China)

- Shandong Shengli Biotechnology Co., Ltd. (China)

Middle East and Africa

- Solvay SA (South Africa)

- Lubrizol Corporation (South Africa)

- Austrianova (Middle East)

- Algaecytes Ltd. (UAE)

- BioScience (South Africa)

South America

- Marubeni Corporation (Brazil)

- SABINSA Corporation (Brazil)

- Diana Food (Brazil)

- Vitamins & Supplements Company (Brazil)

Frequently Asked Questions

Continuing Research and Development in the Field of Natural Tocopherol Extraction to Fuel The Market Growth.

Cargill.Inc, Archer Daniels Midland, BASF, DOW chemical, and DuPont are the key competitors in the Natural Tocopherols Market

The Growing Demand for Natural Ingredients in the Cosmetics and Personal Care Industry is an opportunity for the Natural Tocopherols Market.

The Natural Tocopherols Market is studied from 2025 to 2032.

1. Natural Tocopherols Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Natural Tocopherols Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Natural Tocopherols Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Natural Tocopherols Market: Dynamics

3.1. Natural Tocopherols Market Trends by Region

3.1.1. North America Natural Tocopherols Market Trends

3.1.2. Europe Natural Tocopherols Market Trends

3.1.3. Asia Pacific Natural Tocopherols Market Trends

3.1.4. Middle East & Africa Natural Tocopherols Market rends

3.1.5. South America Natural Tocopherols Market Marke Trends

3.2. Natural Tocopherols Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Natural Tocopherols Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

4.1. Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

4.1.1. Alpha-tocopherol

4.1.2. Beta-tocopherol

4.1.3. Gamma-tocopherol

4.1.4. Delta-tocopherol

4.2. Natural Tocopherols Market Size and Forecast, By Source (2025-2032)

4.2.1. Soybean Oil

4.2.2. Sunflower Oil

4.2.3. Rapeseed Oil

4.2.4. Others

4.3. Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

4.3.1. Food and Beverages

4.3.2. Pharmaceuticals

4.3.3. Nutraceuticals

4.3.4. Cosmetics and Personal Care

4.4. Natural Tocopherols Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Natural Tocopherols Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

5.1. North America Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

5.1.1. Alpha-tocopherol

5.1.2. Beta-tocopherol

5.1.3. Gamma-tocopherol

5.1.4. Delta-tocopherol

5.2. North America Natural Tocopherols Market Size and Forecast, By Source (2025-2032)

5.2.1. Soybean Oil

5.2.2. Sunflower Oil

5.2.3. Rapeseed Oil

5.2.4. Others

5.3. North America Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

5.3.1. Food and Beverages

5.3.2. Pharmaceuticals

5.3.3. Nutraceuticals

5.3.4. Cosmetics and Personal Care

5.4. North America Natural Tocopherols Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

5.4.1.1.1. Alpha-tocopherol

5.4.1.1.2. Beta-tocopherol

5.4.1.1.3. Gamma-tocopherol

5.4.1.1.4. Delta-tocopherol

5.4.1.2. United States United States Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

5.4.1.2.1. Soybean Oil

5.4.1.2.2. Sunflower Oil

5.4.1.2.3. Rapeseed Oil

5.4.1.2.4. Others

5.4.1.3. United States Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

5.4.1.3.1. Food and Beverages

5.4.1.3.2. Pharmaceuticals

5.4.1.3.3. Nutraceuticals

5.4.1.3.4. Cosmetics and Personal Care

5.4.2. Canada

5.4.2.1. Canada Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

5.4.2.1.1. Alpha-tocopherol

5.4.2.1.2. Beta-tocopherol

5.4.2.1.3. Gamma-tocopherol

5.4.2.1.4. Delta-tocopherol

5.4.2.2. Canada Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

5.4.2.2.1. Soybean Oil

5.4.2.2.2. Sunflower Oil

5.4.2.2.3. Rapeseed Oil

5.4.2.2.4. Others

5.4.2.3. Canada Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

5.4.2.3.1. Food and Beverages

5.4.2.3.2. Pharmaceuticals

5.4.2.3.3. Nutraceuticals

5.4.2.3.4. Cosmetics and Personal Care

5.4.3. Mexico

5.4.3.1. Mexico Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

5.4.3.1.1. Alpha-tocopherol

5.4.3.1.2. Beta-tocopherol

5.4.3.1.3. Gamma-tocopherol

5.4.3.1.4. Delta-tocopherol

5.4.3.2. Mexico Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

5.4.3.2.1. Soybean Oil

5.4.3.2.2. Sunflower Oil

5.4.3.2.3. Rapeseed Oil

5.4.3.2.4. Others

5.4.3.3. Mexico Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

5.4.3.3.1. Food and Beverages

5.4.3.3.2. Pharmaceuticals

5.4.3.3.3. Nutraceuticals

5.4.3.3.4. Cosmetics and Personal Care

6. Europe Natural Tocopherols Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

6.1. Europe Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.2. Europe Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.3. Europe Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4. Europe Natural Tocopherols Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.1.2. United Kingdom Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.1.3. United Kingdom Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.2. France

6.4.2.1. France Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.2.2. France Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.2.3. France Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.3.2. Germany Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.3.3. Germany Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.4.2. Italy Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.4.3. Italy Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.5.2. Spain Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.5.3. Spain Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.6.2. Sweden Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.6.3. Sweden Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.7.2. Austria Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.7.3. Austria Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

6.4.8.2. Rest of Europe Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

6.4.8.3. Rest of Europe Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7. Asia Pacific Natural Tocopherols Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

7.1. Asia Pacific Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.2. Asia Pacific Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.3. Asia Pacific Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4. Asia Pacific Natural Tocopherols Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.1.2. China Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.1.3. China Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.2.2. S Korea Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.2.3. S Korea Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.3.2. Japan Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.3.3. Japan Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.4. India

7.4.4.1. India Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.4.2. India Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.4.3. India Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.5.2. Australia Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.5.3. Australia Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.6. ASEAN

7.4.6.1. ASEAN Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.6.2. ASEAN Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.6.3. ASEAN Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

7.4.7. Rest of Asia Pacific

7.4.7.1. Rest of Asia Pacific Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

7.4.7.2. Rest of Asia Pacific Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

7.4.7.3. Rest of Asia Pacific Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

8. Middle East and Africa Natural Tocopherols Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032)

8.1. Middle East and Africa Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

8.2. Middle East and Africa Natural Tocopherols Market Size and Forecast, By Sources Model (2025-2032)

8.3. Middle East and Africa Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

8.4. Middle East and Africa Natural Tocopherols Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

8.4.1.2. South Africa Natural Tocopherols Market Size and Forecast, By Sources Model (2025-2032)

8.4.1.3. South Africa Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

8.4.2.2. GCC Natural Tocopherols Market Size and Forecast, By Sources Model (2025-2032)

8.4.2.3. GCC Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

8.4.3.2. Nigeria Natural Tocopherols Market Size and Forecast, By Sources Model (2025-2032)

8.4.3.3. Nigeria Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

8.4.4.2. Rest of ME&A Natural Tocopherols Market Size and Forecast, By Sources Model (2025-2032)

8.4.4.3. Rest of ME&A Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

9. South America Natural Tocopherols Market Size and Forecast by Segmentation (by Value USD Mn.) (2025-2032)

9.1. South America Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

9.2. South America Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

9.3. South America Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

9.4. South America Natural Tocopherols Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

9.4.1.2. Brazil Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

9.4.1.3. Brazil Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Natural Tocopherols Market Size and Forecast, By Product Type 2025-2032)

9.4.2.2. Argentina Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

9.4.2.3. Argentina Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Natural Tocopherols Market Size and Forecast, By Product Type (2025-2032)

9.4.3.2. Rest Of South America Natural Tocopherols Market Size and Forecast, By Sources (2025-2032)

9.4.3.3. Rest Of South America Natural Tocopherols Market Size and Forecast, By Application (2025-2032)

10. Company Profile: Key Players

10.1 Cargill, Inc. (USA)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 Archer Daniels Midland Company (USA)

10.3 Kemin Industries (USA)

10.4 DuPont (USA)

10.5 The Dow Chemical Company (USA)

10.6 DSM Nutritional Products (Netherlands)

10.7 BASF SE (Germany)

10.8 Wacker Chemie AG (Germany)

10.9 Evonik Industries AG (Germany)

10.10 Nutralliance (France)

10.11 Nouryon (China)

10.12 Vitae Naturals (China)

10.13 COFCO Biochemical (China)

10.14 Jiangsu Tiansheng Pharmaceutical Co., Ltd. (China)

10.15 Shandong Shengli Biotechnology Co., Ltd. (China)

10.16 Solvay SA (South Africa)

10.17 Lubrizol Corporation (South Africa)

10.18 Austrianova (Middle East)

10.19 Algaecytes Ltd. (UAE)

10.20 BioScience (South Africa)

10.21 Marubeni Corporation (Brazil)

10.22 SABINSA Corporation (Brazil)

10.23 Diana Food (Brazil)

10.24 Vitamins & Supplements Company (Brazil)

11. Key Findings & Analyst Recommendations

12. Natural Tocopherols Markets: Research Methodology