Mexico Digital Payment Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

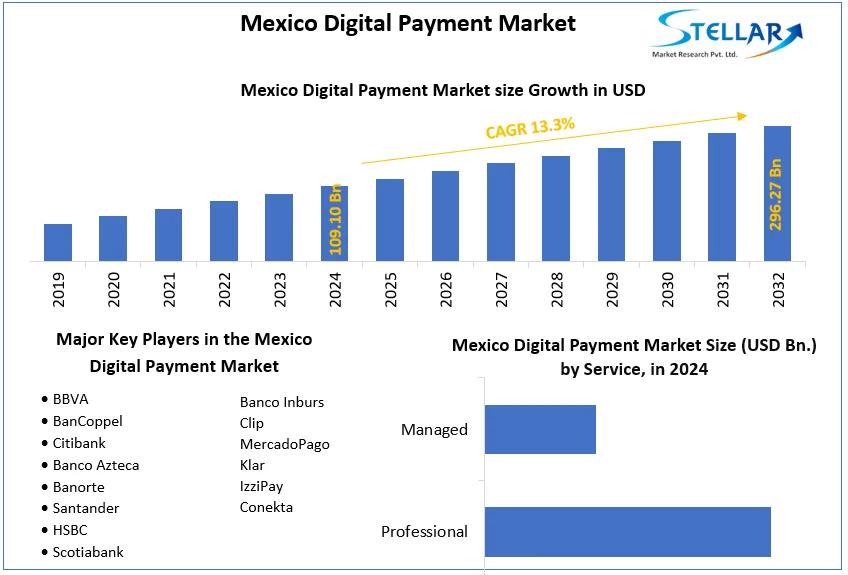

The Mexico Digital Payment Market size was valued at USD 109.10 Bn. in 2024 and the total Mexico Digital Payment revenue is expected to grow at a CAGR of 13.3% from 2025 to 2032, reaching nearly USD 296.27 Bn.

Format : PDF | Report ID : SMR_1576

Mexico Digital Payment Overview

The Mexico Digital Payment industry has grown significantly thanks to remote work surges, supply chain disruptions, and cybersecurity threats. Also, interest rate hikes, regulatory complexity, and business digitization contribute. The innovations in payment methods, standardization, and mobile payment acceleration are prominent. Collaborations among tech giants, banks, fintechs, and payment providers drive efficiency and relationships, marking the Mexico Digital Payment industry's transformation with faster, safer transactions.

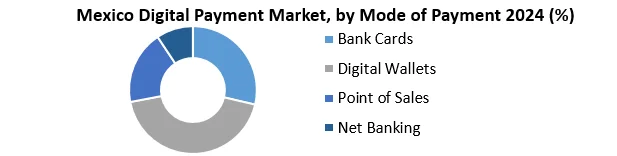

- Bank cards (credit & and debit) hold a dominant 55-60% share, boosted by government initiatives and rewards programs.

- Digital wallets are rapidly growing, capturing 15-20%, driven by smartphone penetration and contactless payments.

- Point of sale (POS), a traditional method, maintains 10-15%, with contactless terminals and QR payments gaining traction.

- Net banking, a secure option for larger transactions, holds a 5-10% share.

The comprehensive report serves as a detailed analysis of the Mexico Digital Payment Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the Digital Payment Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Rapid Growth of Mobile Payments Impact on The Mexico Digital Payment Market.

The trend actively drives fintech innovation, fostering competition, and reducing costs for consumers. In Mexico, mobile payments offer convenience and cover financial services, and boost security, promoting economic inclusion and e-commerce. The benefits, and concerns such as privacy, cybersecurity, job displacement, and predatory practices persist. Mobile transactions swiftly reach the unbanked, fostering economic inclusion. Security measures, including biometric authentication, actively reduce fraud risks. Businesses use consumer data to personalize marketing, propelling e-commerce and the Mexico Digital Payment market.

The Mexico Digital Payment industry continues as not everyone has access to smartphones or reliable internet, excluding them from the digital payment economy, worsening inequalities. Privacy concerns arise due to extensive data collection in mobile payments, posing risks of misuse by companies or governments. Cybersecurity threats, job displacement, and potential predatory practices highlight challenges requiring awareness and protective measures for both businesses and consumers.

Mexico Digital Payment Market Segment Analysis

Based on Mode of Payment, the Bank Cards segment held the largest market share of about 60% in the Mexico Digital Payment Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 13.6% during the forecast period. It stands out as the dominant segment within the Mexico Digital Payment Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

In Mexico Digital Payment market bank cards, particularly debit cards, actively contribute to financial inclusion by providing access to financial services for individuals lacking traditional banking access. Debit cards actively offer a secure and convenient alternative to cash, with added speed and hygiene benefits through contactless payments. Government initiatives, like Mexico's CoDi, actively promote a cashless society for transparency. Consumer rewards, such as cashback, actively encourage spending, thereby stimulating economic activity. Additionally, bank card transactions actively supply valuable data for financial institutions to actively improve product and service offerings.

Exorbitant fees, commonly linked to credit cards, jeopardize financial stability, imposing high-interest rates and annual fees on users. Poorly managed, credit cards encourage overspending and financial irresponsibility. The Mexico digital payment market divide actively excludes specific demographics from card benefits, reinforcing inequalities. Despite security measures, bank cards confront risks like fraud and scams, endangering cardholders. The production and disposal of plastic cards, coupled with reliance on traditional banking systems, actively contribute to a significant carbon footprint.

|

Mexico Digital Payment Market Scope |

|

|

Market Size in 2024 |

USD 109.10 Billion |

|

Market Size in 2032 |

USD 296.27 Billion |

|

CAGR (2025-2032) |

13.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Service

|

|

By Solution

|

|

|

By Mode of Payment

|

|

|

By Organization Size

|

|

|

By Deployment Mode

|

|

|

By Industry

|

|

Leading Key Players in the Mexico Digital Payment Market

Frequently Asked Questions

Data Privacy and Security Concerns and Infrastructure and Accessibility Gaps are expected to be the major restraining factors for the Mexico Digital Payment market growth.

The Mexico Digital Payment Market size was valued at USD 109.10 Billion in 2024 and the total Mexico Digital Payment revenue is expected to grow at a CAGR of 13.3% from 2025 to 2032, reaching nearly USD 296.27 Billion By 2032.

1. Mexico Digital Payment Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Mexico Digital Payment Market Consumer Adoption and Behaviour

2.1 Consumer Preferences

2.2 Factors Influencing Adoption

2.3 Challenges in Consumer Adoption

3. Mexico Digital Payment Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Value Chain Analysis

3.5 Regulatory Landscape

3.6 Analysis of Government Schemes and Initiatives for the Mexico Digital Payment Industry

3.7 The Pandemic and Redefining of The Mexico Digital Payment Industry Landscape

4. Mexico Digital Payment Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Mexico Digital Payment Market Size and Forecast, by Service (2024-2032)

4.1.1 Professional

4.1.2 Managed

4.2 Mexico Digital Payment Market Size and Forecast, Solution (2024-2032)

4.2.1 Payment Gateway

4.2.2 Payment Processing

4.2.3 Payment Security & Fraud Management

4.3 Mexico Digital Payment Market Size and Forecast, by Mode of Payment (2024-2032)

4.3.1 Bank Cards

4.3.2 Digital Wallets

4.3.3 Point of Sales

4.3.4 Net Banking

4.4 Mexico Digital Payment Market Size and Forecast, by Organization Size (2024-2032)

4.4.1 SMEs

4.4.2 Large Enterprises

4.5 Mexico Digital Payment Market Size and Forecast, by Deployment Mode (2024-2032)

4.5.1 Cloud

4.5.2 On-premises

4.6 Mexico Digital Payment Market Size and Forecast, by Industry (2024-2032)

4.6.1 BFSI

4.6.2 Healthcare

4.6.3 IT & Telecom

4.6.4 Retail & E-commerce

4.6.5 Transportation

5. Mexico Digital Payment Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Mexico Digital Payment Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 BBVA

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 BanCoppel

6.3 Citibank

6.4 Banco Azteca

6.5 Banorte

6.6 Santander

6.7 HSBC

6.8 Scotiabank

6.9 Banco Inburs

6.10 Clip

6.11 MercadoPago

6.12 Klar

6.13 IzziPay

6.14 Conekta

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Mexico Digital Payment Market: Research Methodology