Machine Control System Market Analysis: Global Outlook, Technology Trends, and Forecast (2026-2032)

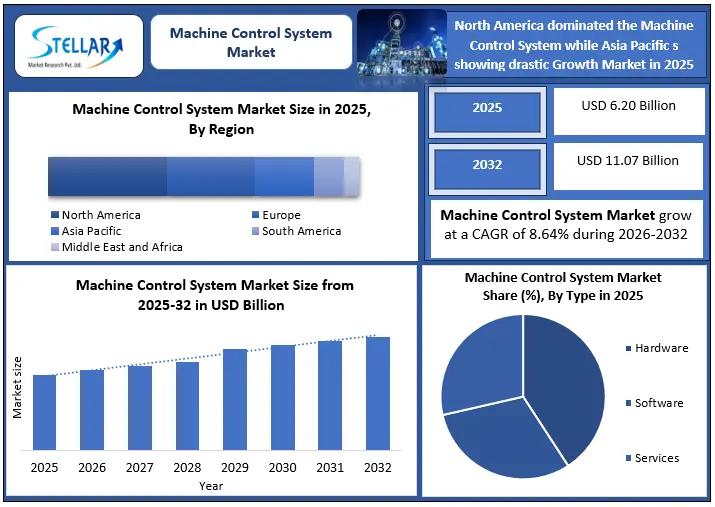

Global Machine Control System Market was valued US$ 6.20 Bn. In 2025 and is expected to reach a value of US$ 11.07 Bn. By 2032, with a CAGR of 8.64 % during the forecast period.

Format : PDF | Report ID : SMR_307

Machine Control System Market Overview:

The Global Machine Control System Market was valued at USD 6.20 Billion in 2025 and is projected to reach USD 11.07 Billion by 2032, expanding at a robust CAGR of 8.64% during the forecast period. This growth is structural rather than cyclical, driven by labor shortages, rising project complexity, sustainability mandates, and the need for precision-driven productivity across construction, mining, and agriculture industries

Machine control systems have evolved from optional productivity tools into core operational infrastructure, enabling real-time positioning, automated grading, reduced rework, and measurable cost savings. With rework accounting for over 50% of construction inefficiencies globally, adoption is increasingly tied to ROI certainty rather than technology preference.

The market is further reinforced by the transition from 2D and 3D guidance toward semi-autonomous and autonomous machine operations, positioning machine control systems at the center of digital construction and smart infrastructure development.

To get more Insights: Request Free Sample Report

Key Highlights in the Machine Control System Market

- Productivity Gains: Machine control systems deliver 30–50 percent (2024) productivity improvement in grading and earthmoving applications.

- Material Savings: Precision grading reduces material usage by 10–20 percent (2024) per project.

- Adoption Penetration: Over 98 percent of European construction firms use machine control in some capacity, though fewer than 10 percent deploy it across most projects.

- Technology Mix: GNSS-based solutions accounted for over 58 percent of installed systems in 2024.

Industry Adoption driving the Machine Control System Market:

Labor shortages are a primary growth driver. In 2025, more than 650,000 manufacturing and construction roles remained unfilled in the United States. Nearly one-quarter of the workforce in heavy industries is over 55 years of age, accelerating reliance on automation.

Productivity improvement is another key factor. Automation technologies have contributed close to 9.87 percent of GDP growth in advanced economies over the past two decades. Machine control systems reduce rework, which accounts for over 50 percent of global construction inefficiencies.

Sustainability pressure is rising. The built environment contributes nearly 45 percent of global carbon emissions. Machine control systems reduce emissions by minimizing idle time, fuel usage, and material waste.

Machine Control System Market Restraints:

High upfront costs limit adoption among small and mid-sized contractors. Hardware, software licenses, and integration costs raise total ownership expenses. Interoperability issues with legacy equipment further increase deployment complexity.

Training requirements and resistance to workflow changes also slow adoption. Lack of standardization across platforms remains a structural challenge.

Opportunities in the Machine Control System Market

Retrofit solutions offer significant growth potential. Cost-effective sensor upgrades enable existing fleets to adopt digital construction capabilities without full replacement. Emerging markets present long-term opportunities due to low penetration and expanding infrastructure investment.

Machine Control System Cost Breakdown Analysis 2025

|

Cost Equipment |

Description |

Share of Total Cost (%) |

|

Hardware |

GNSS receivers, sensors, onboard controllers, displays |

45–55 |

|

Software |

Machine control software, licenses, updates |

15–20 |

|

Integration & Installation |

System setup, calibration, interoperability |

10–15 |

|

Training & Support |

Operator training, technical support |

5–10 |

|

Maintenance & Upgrades |

Firmware updates, sensor recalibration |

5–10 |

Machine Control System Market Segment Analysis:

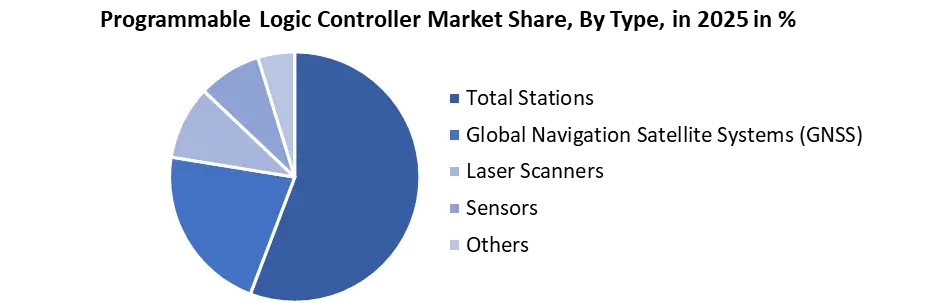

By Type: Hardware accounts for the largest revenue share of the Machine Control System Market owning more than 40 % demand. GNSS receivers, total stations, laser scanners, and onboard sensors form the core hardware stack. GNSS-based systems dominate due to scalability and suitability for large sites.

Total stations and laser scanners retain importance in urban environments and high-precision applications. Retrofit demand is rising as contractors upgrade existing fleets instead of purchasing new equipment.

By Equipment: Excavators and Graders: xcavators and motor graders represent the highest machine control penetration globally representing 60% of the market. These equipment types are central to earthmoving and grading, where precision directly impacts material consumption and schedules.

Machine control enables millimetres-level accuracy, reducing rework caused by design deviations. Excavators benefit from depth and slope control, improving safety and reducing operator fatigue. OEM integration is accelerating adoption in these categories.

Machine Control System Market Regional Analysis:

Asia Pacific leads growth by 43% due to large-scale infrastructure projects in China, India, and Southeast Asia. Government-backed transport and urban development programs support adoption. Europe remains technologically mature, led by Germany and Scandinavia. Automation mandates and sustainability regulations drive steady penetration. North America shows strong demand through rental and leasing models. Adoption is highest in road construction and mining operations. South America and the Middle East show gradual uptake, driven by mining activity and energy infrastructure development.

Machine Control System Market Competitive Landscape

The Machine Control System Market is moderately consolidated, with the top five players accounting for approximately 55–60 percent of global revenue. Competition is concentrated among technology specialists and equipment OEMs with deep integration capabilities.

Trimble, Topcon, and Leica Geosystems collectively control over 45 percent of the construction-focused machine control segment, driven by strong penetration in grading, earthmoving, and infrastructure projects. These players benefit from long-standing OEM relationships and large installed bases across North America and Europe.

On the industrial automation and software side, Siemens, ABB, and Rockwell Automation account for an 25–30 percent share of advanced control software deployments, particularly in hybrid construction–industrial applications and fleet-level control platforms.

Equipment OEMs such as Caterpillar, Komatsu, and John Deere represent over 50 percent of new machine control installations globally, as factory-fitted and OEM-certified systems increasingly replace aftermarket retrofits. OEM-integrated solutions reduce installation time by up to 40 percent and improve system reliability.

Competitive differentiation is shifting toward software intelligence, cloud connectivity, and interoperability. Vendors offering modular, retrofit-friendly platforms are capturing higher adoption among mixed-equipment fleets, while software and subscription revenues are growing at 1.3–1.5 times the rate of hardware sales.

Recent Developments in Machine Control System Industry

- At CES 2026, Caterpillar announced an expanded partnership with Nvidia to integrate artificial intelligence and autonomy into its construction equipment lineup.

- Gravis Robotics secured USD 23 million in funding in late 2025 to scale its AI autonomy kits for heavy machinery.

- AMETEK and FARO said that they have entered into a definitive agreement which states that AMETEK will acquire all outstanding shares of FARO Technologies common stock for $44 per share in cash, which as of May 5, 2025 represents an approximate 40% premium to FARO’s closing price.

Global Machine Control System Market Scope

|

Global Machine Control System Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 6.20 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

8.64% |

Market Size in 2032: |

USD 11.07 Billion |

|

Machine Control System Market Segment Analysis |

By Type |

Hardware Total Stations Global Navigation Satellite Systems (GNSS) Laser Scanners Sensors Others Software Services |

|

|

By Controller Type |

Computer Numerical Control (CNC) Programmable Logic Controller (PLC) Programmable Automation Controller (PAC) Personal Computer (PC) Motion Controllers Others |

||

|

By Equipment |

Computer Numerical Control (CNC) Programmable Logic Controller (PLC) Programmable Automation Controller (PAC) Personal Computer (PC) Motion Controllers Others |

||

|

By End-use Industry |

Building & Construction Agriculture & Forestry Mining & Excavation Oil & Gas Energy & Petrochemicals Marine & Shipbuilding Aerospace Infrastructure Development Others |

||

Machine Control System Market Key Players

- Trimble Inc.

- Topcon Corporation

- Hexagon AB

- MOBA Mobile Automation AG

- Hemisphere GNSS Inc.

- Spectra Precision

- Caterpillar Inc.

- Komatsu Ltd.

- John Deere

- Volvo CE

- Liebherr

- Hitachi Construction Machinery

- Kobelco Construction Machinery

- Case Construction Equipment

- JCB

- XCMG

- SANY

- Belden Inc.

- Teletrac Navman

- Raven Industries

- Wirtgen Group

- Bomag

- Omron Corporation

Frequently Asked Questions

The US will lead the Machine Control System Market in North America in the future.

Major competitors of the market are Trimble, Topcon, and Komatsu.

APAC is going to grow with the highest CAGR

The estimated market size in the Machine Control System Market for year 2032 is US$ 11.07 Bn.

1. Machine Control System Market: Research Methodology

1.1. Research Data

1.1.1. Secondary And Primary Research

1.1.2. Primary Data

1.1.3. Secondary Data

1.2. Market Size Estimation

1.2.1. Top-Down Approach

1.2.2. Bottom-Up Approach

2. Machine Control System Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Machine Control System Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Headquarter

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Machine Control System Market: Dynamics

4.1. Trends

4.2. Drivers

4.3. Restraints

4.4. Opportunities

4.5. Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technology Analysis

4.8.1. Iot

4.8.2. Machine Learning

4.8.3. Artificial Intelligence

4.8.4. Technological Roadmap (Forecast Period 2025 – 2032)

4.9. Value Chain Analysis

4.10. Ecosystem Mapping

4.11. Pricing Analysis

4.12. Regulatory Landscape by Region

4.12.1. North America

4.12.2. Europe

4.12.3. Asia Pacific

4.12.4. Middle East and Africa

4.12.5. South America

5. Global Machine Control System Market: Global Market Size and Forecast (Value in USD Million) (2024-2032)

5.1. Global Machine Control System Market Size and Forecast, By Type (2024-2032)

5.1.1. Total Stations

5.1.2. Global Navigation Satellite Systems (GNSS)

5.1.3. Laser Scanners

5.1.4. Sensors

5.2. Global Machine Control System Market Size and Forecast, By Equipment (2024-2032)

5.2.1. Excavators

5.2.2. Loaders

5.2.3. Graders

5.2.4. Dozers

5.2.5. Scrapers

5.2.6. Paving Systems

5.3. Global Machine Control System Market Size and Forecast, By Vertical (2024-2032)

5.3.1. Infrastructure

5.3.2. Commercial

5.3.3. Residential

5.3.4. Industrial

5.4. Global Machine Control System Market Size and Forecast, By Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Machine Control System Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

6.1. North America Machine Control System Market Size and Forecast, By Type (2024-2032)

6.1.1. Total Stations

6.1.2. Global Navigation Satellite Systems (GNSS)

6.1.3. Laser Scanners

6.1.4. Sensors

6.2. North America Machine Control System Market Size and Forecast, By Equipment (2024-2032)

6.2.1. Excavators

6.2.2. Loaders

6.2.3. Graders

6.2.4. Dozers

6.2.5. Scrapers

6.2.6. Paving Systems

6.3. North America Machine Control System Market Size and Forecast, By Vertical (2024-2032)

6.3.1. Infrastructure

6.3.2. Commercial

6.3.3. Residential

6.3.4. Industrial

6.4. North America Machine Control System Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Machine Control System Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

7.1. Europe Machine Control System Market Size and Forecast, By Type (2024-2032)

7.2. Europe Machine Control System Market Size and Forecast, By Equipment (2024-2032)

7.3. Europe Machine Control System Market Size and Forecast, By Vertical (2024-2032)

7.4. Europe Machine Control System Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Machine Control System Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

8.1. Asia Pacific Machine Control System Market Size and Forecast, By Type (2024-2032)

8.2. Asia Pacific Machine Control System Market Size and Forecast, By Equipment (2024-2032)

8.3. Asia Pacific Machine Control System Market Size and Forecast, By Vertical (2024-2032)

8.4. Asia Pacific Machine Control System Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Machine Control System Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

9.1. Middle East and Africa Machine Control System Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Machine Control System Market Size and Forecast, By Equipment (2024-2032)

9.3. Middle East and Africa Machine Control System Market Size and Forecast, By Vertical (2024-2032)

9.4. Middle East and Africa Machine Control System Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Machine Control System Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

10.1. South America Machine Control System Market Size and Forecast, By Type (2024-2032)

10.2. South America Machine Control System Market Size and Forecast, By Equipment (2024-2032)

10.3. South America Machine Control System Market Size and Forecast, By Vertical (2024-2032)

10.4. South America Machine Control System Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Trimble

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Topcon

11.3. MOBA Mobile Automation

11.4. Hemisphere GNSS

11.5. James Fisher Prolec

11.6. Eos Positioning Systems

11.7. Komatsu

11.8. Hexagon (Leica Geosystems)

11.9. Caterpillar

11.10. Volvo Construction Equipment

11.11. Mitsui Co.

11.12. Schneider Electric

11.13. Liebherr Group

11.14. JCB

11.15. Kobelco Construction Machinery

11.16. RIB Software AG

11.17. Hitachi Construction Machinery

11.18. Belden Inc.

11.19. Hyundai Construction Equipment

12. Key Findings

13. Industry Recommendations