MEA Online Gambling Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Type, Device and Region.

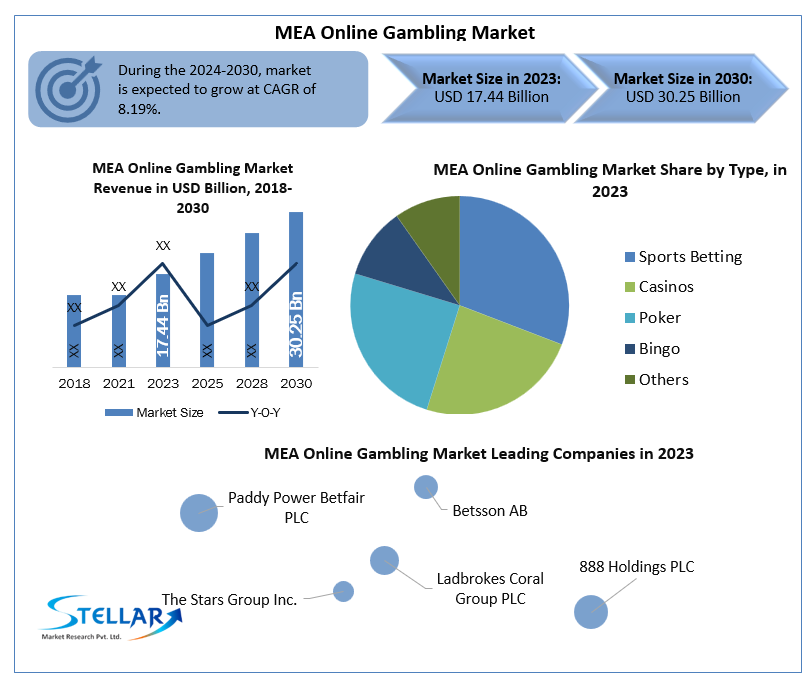

MEA Online Gambling Market was valued nearly US$ 17.44 Bn. in 2023 and market size is estimated to grow at a CAGR of 8.19% & is expected to reach at US$ 30.25 Bn. by 2030.

Format : PDF | Report ID : SMR_245

MEA Online Gambling Market Overview:

The market is majorly driven by rising internet penetration and increasing use of mobile phones by users to play online games from their homes & public places. Factors including simple access to internet gambling, legality & societal acceptance, corporate sponsorships, and celebrity endorsements are also driving market expansion. Market growth is expected to be aided by the increasing availability of low-cost mobile applications around the world.

The internet has evolved into a global communication platform that allows businesses to sell their goods and services in the digital marketplace. According to trends, service consumption in the global virtual market has climbed by 28.0 percent each year over the last decade. The popularity of the internet has led in a significant increase in the number of online casinos. Furthermore, rising consumer awareness of new technologies and rising disposable income are likely to drive market expansion.

To get more Insights: Request Free Sample Report

Casinos, sports betting, & online gambling are all prohibited in most parts of the Middle East. Despite the fact that Muslims are prohibited from gambling, Middle Eastern gamblers make for a sizable share of worldwide gaming profits. Intriguingly, gambling seems to have a long history in Islamic culture, as ancient civilizations like the Assyrians maintained a thriving gambling sector during their golden period. Big shows & gambling events were put on by bookmakers & auctioneers, which drew large crowds. During this time, the region's current bookkeeping and bookmaking businesses arose and developed. The ancient Egyptian civilization had a thriving gaming culture. Many Muslim-majority countries have decided to limit casino games to foreigners or non-Muslim guests, requiring players to show their passports at the door. Many people with dual citizenship in the Middle East, on the other hand, enjoy access to casinos. Furthermore, the performance of these casinos is frequently hampered by high tax rates & unrealistic regulatory restrictions. In Egypt, for example, the approximately 14 casinos of Kairo produce gross gaming revenues (GGR) of over US $ 200 Mn a year - of which the casinos must pay a gaming tax of 50% (GGR) on a daily basis.

Despite the fact that the expansion of the casino business is subject to strict Islamic restrictions, most Middle Eastern regions allow visitors to view international websites. Because less stringent restrictions apply when foreign online gambling operators are engaged. As a result, Middle Eastern software companies are increasingly licensing their games to international casinos with a strong online presence that allow Middle Eastern players. Citizens of Lebanon, Israel, Egypt, and the United Arab Emirates, in particular, are now offered internet casinos that are specifically tailored to their countries.

Sports betting has just lately gained popularity in the Arab world. Soccer, camel races, formula racing, & horse races are among the most popular sporting activities, with soccer being the most popular - owing to the fact that some of Asia's greatest national soccer leagues and clubs are based in Arab countries and regions. Locals are excited about both local and international athletic events, and they wager on their favorite teams using well-known worldwide online betting sites. However, because translations into Arabic and regional languages are sometimes unavailable, these platforms only suit the wagering needs of the Arab people to a limited extent.

As a betting supplier, it is critical to thoroughly understand the needs of this industry and to tailor the betting experience to the domestic market. The legal framework for each country can be found here, along with other information.

Africa

The African gambling sector is constantly expanding and, according to stellar analysts, has the potential to transform the continent's economy in the long run. Many prominent iGaming companies regard Africa as a lucrative market to enter. South Africa, Nigeria, & Kenya, for example, provide a plethora of investment options due to their economic dynamics and excitement for online sports betting. Nigeria, Kenya, and South Africa were expected to have a combined GDP of $ 40 Bn in 2018.

Currently, sports betting in Africa focuses primarily on soccer & horse racing. Horse racing has a long history in North Africa, dating back to the 15th century. For more than 70 years, Africans have supposedly been betting on soccer. The majority of African gamers have accounts with foreign online betting platforms like Betway, which operate on a global scale. South Africa has the largest gambling market on the continent. According to Stellar report study estimates, more than half of South African people wager on sports on a regular basis. According to our analyst estimates, gross gaming revenue will exceed $ 2.3 Bn by 2023.

Nigeria has by far the greatest population & gross domestic output in Africa, and it also has the largest gaming market (measured by GGR) in Sub-Saharan Africa, with a share of 7% of the continent. The gambling embargo that Nigeria had been subjected to was abolished in 2004, allowing investment in the business to resume. According to a 2018 study report survey, roughly 30% of Nigerians aged 18 to 40 wager on sports on a daily basis, resulting in a market of over 65 Mn players spending an average of USD 15 per day on sports bets.

The steady rise of the African sports betting market may be ascribed to the continent's population's enormous passion for sport, with football being the most popular sport on the continent. Cricket, rugby, and marathon racing are some of the other sports that Africans are passionate about. African kids are also great admirers of European football leagues & other FIFA events. The main European leagues, like the EPL, La Liga, Serie A, and Bundesliga, are where most players put their wagers, with the EPL being the most popular on the continent. Other European competitions, like as the UEFA Champions League and the UEFA Europa League, are also extremely popular. The African sports betting industries potential is based on the continent's youthful population. Over 200 million Africans, according to statistics, are between the ages of 18 and 24. This generation has no qualms about using their smartphone to place sports bets. Furthermore, the high unemployment rate is an additional motivation to gamble for a living online. Betting companies in the African region must thus have an online or mobile first strategy with an offer tailored to the tastes of the local population.

MEA Online Gambling Market Segment Overview:

Online poker has gotten a lot of attention, especially among college students. Due to the widespread popularity of online card games, the market is likely to grow at a high rate. Many sites accept deposits from major credit cards, online wallets, and even virtual currencies like Bitcoin, which has contributed to online poker's success over the years. The segment is further fueled by the large number of games available to players.

In 2023, the desktop segment dominated the market. When compared to mobile phones and other devices, PCs have a larger screen size, allowing gamblers to enjoy the game's aesthetics and fine features. On desktops, performance characteristics like screen clarity, sound volume, and storage capacity can also be tweaked for a better gaming experience. These reasons have aided in the expansion of the desktop market.

Smart watches bring a Whole New Level of iGaming to the Table.

Betting using a smart watch is suddenly a very real possibility. People have been utilizing their cellphones & tablets to connect to internet casinos in recent years. Smart watches are poised to replace smartphones as a more convenient & accessible option. Stellar study report expect that the smart watch sector will be valued about $33 Bn globally by 2023, & gambling will be a part of this massive trend. Wearable technology has always been popular, and it will continue to be in the coming years as more gaming software developers create new games that can be readily linked into a variety of gadgets. Whether in an online or physical casino, the purpose of the operator is to always provide the customers what they want. The major motivation is to provide the best gaming pleasure, in addition to delivering excellent customer service, fine food, rewards programmes, and incentives. The current tendency is to combine the best of interactive online gaming systems and technologies with the old-fashioned allure of a live-based casino.

New Table Games are being introduced.

Some games, such as blackjack & poker, necessitate a certain level of knowledge in order to be played correctly and increase the chances of winning. Unfortunately, not everyone possesses this ability, so they seek out games that are both tough and simple to master. As a result, casino owners continue to introduce new table games to the floor in order to determine which ones are the most popular. Furthermore, as visitors get more familiar with online and social games, they are lured to similar games on the casino floor, which is why interactive gaming systems have become increasingly popular in brick-and-mortar casinos.

The objective of the report is to present a comprehensive analysis of the MEA Online Gambling Market to the stakeholders in the industry. The report provides trends that are most dominant in the MEA Online Gambling Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the MEA Online Gambling Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the MEA Online Gambling Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the MEA Online Gambling Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the MEA Online Gambling Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the MEA Online Gambling Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the MEA Online Gambling Market is aided by legal factors.

MEA Online Gambling Market Scope:

|

MEA Online Gambling Market |

|

|

Market Size in 2023 |

USD 17.44 Bn. |

|

Market Size in 2030 |

USD 30.25 Bn. |

|

CAGR (2024-2030) |

8.19% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Device

|

|

|

Country Scope |

South Africa GCC Egypt Nigeria Rest of the Middle East and Africa |

Major Players operating in the MEA Online Gambling Market are:

- William Hill PLC

- Bet365 Group Ltd.

- Paddy Power Betfair PLC

- Betsson AB

- Ladbrokes Coral Group PLC

- The Stars Group Inc.

- 888 Holdings PLC

- Sky Betting and Gaming

- Kindred Group PLC

- GVC Holdings PLC

Frequently Asked Questions

Mobile segment is the dominating end use segment in the market.

William Hill PLC, Bet365 Group Ltd., Paddy Power Betfair PLC, Betsson AB Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC.

The major factors for the growth of the MEA & Africa Online Gambling market includes high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1.Research Process

2.2.MEA & Africa Online Gambling Market: Target Audience

2.3.MEA & Africa Online Gambling Market: Primary Research (As per Client Requirement)

2.4.MEA & Africa Online Gambling Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2023-2030(In %)

4.1.1.1. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.2. Market Dynamics

4.2.1.Market Drivers

4.2.2.Market Restraints

4.2.3.Market Opportunities

4.2.4.Market Challenges

4.2.5.PESTLE Analysis

4.2.6.PORTERS Five Force Analysis

4.2.7.Value Chain Analysis

4.3. Middle East and Africa Online Gambling Market Segmentation Analysis, 2023-2030 (Value US$ BN)

4.3.1.1.Middle East and Africa Market Share Analysis, By Type, 2023-2030 (Value US$ BN)

4.3.1.1.1.Sports Betting

4.3.1.1.2.Casinos

4.3.1.1.3.Poker

4.3.1.1.4.Bingo

4.3.1.1.5.Others

4.3.1.2. Middle East and Africa Market Share Analysis, By Device, 2023-2030 (Value US$ BN)

4.3.1.2.1.Desktop

4.3.1.2.2.Mobile

4.3.1.2.3.Others

4.3.1.3. Middle East and Africa Market Share Analysis, By Country, 2023-2030 (Value US$ BN)

4.3.1.3.1.South Africa

4.3.1.3.2.GCC

4.3.1.3.3.Egypt

4.3.1.3.4.Nigeria

4.3.1.3.5.Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.Middle East and Africa Competition Matrix

5.2.Key Players Benchmarking

5.2.1.Key Players Benchmarking By Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Bulk Online Gambling

5.3.1.M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1.William Hill PLC.

6.1.1.1.Company Overview

6.1.1.2.Source Portfolio

6.1.1.3.Financial Overview

6.1.1.4.Business Strategy

6.1.1.5.Key Developments

6.1.2.Bet365 Group Ltd.

6.1.3.Paddy Power Betfair PLC

6.1.4.Betsson AB

6.1.5.Ladbrokes Coral Group PLC

6.1.6.The Stars Group Inc.

6.1.7.888 Holdings PLC

6.1.8.Sky Betting and Gaming

6.1.9.Kindred Group PLC

6.1.10.GVC Holdings PLC.

6.2. Key Findings

6.3. Recommendations.