Indonesia Esports Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The Indonesia Esports Market size was valued at USD 11.75 Mn. in 2024 and the total Indonesia Esports revenue is expected to grow at a CAGR of 5.87% from 2025 to 2032, reaching nearly USD 18.54 Mn. in 2032.

Format : PDF | Report ID : SMR_1702

Indonesia Esports Market Overview

The comprehensive report serves as a detailed analysis of the Indonesia Esports Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that Mold its trajectory. Delving deep into the present landscape, the report dissects the Indonesia Esports Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

- Indonesia boasts a high gaming population, with 79% identifying as gamers, especially favouring mobile titles.

- Audience engagement is strong, with 96% familiar with esports and over half closely following the scene.

- Additionally, daily play is common, with sessions lasting 30-60 minutes on average, and mobile game downloads surged by 26%.

Esports, or electronic sports, has emerged as a vibrant domain of competitive video gaming, where professional players or teams engage in multiplayer games. These contests organized into leagues, tournaments, and events, captivate audiences both online and offline, shaping Esports into a global industry of substantial economic importance. The Indonesia Esports market dissected into six primary segments. Sponsorship & Advertising entails revenue sourced from sponsorship deals and event advertising. Merchandise & Ticketing denote earnings primarily from tournament tickets and associated merchandise sales. Additionally, Streaming, Media Rights, and Publisher Fees include revenues linked to broadcasting Esports events across various channels. Lastly, Esports Betting involves wagering on outcomes of Esport events.

The report also includes insights on revenues, ad expenditures, user demographics, average revenue per user, and penetration rates, with sales channels covering both online and offline platforms. Key players in this domain include prominent companies or teams such as FaZe, Cloud9, or TSM. For detailed data, users access additional information through the info button adjacent to the respective data boxes.

To get more Insights: Request Free Sample Report

Growing Popularity and Viewership Drives the Indonesia Esports Market

In Indonesia's Esports Market mobile games dominate particularly Battle Royale titles such as PUBG Mobile and Free Fire, along with MOBA games like Mobile Legends. These genres are highly favoured among both esports viewers and gamers and reflecting the nation's strong affinity for competitive gaming.

In the Esports market, engagement is remarkably high with 96% of Indonesians familiar with the term "esports," and over half closely following the scene. This passionate audience actively spends on attending events, purchasing merchandise, and investing in in-game content, underscoring the strong dedication and involvement within the esports community. The Market shows promising monetization potential, with robust revenue growth in media rights. Additionally, sponsorships and advertising are experiencing upward trends, albeit at a slower pace. This indicates a fertile landscape for revenue generation within the industry, enticing investors and stakeholders to capitalize on the burgeoning opportunities presented by Indonesia's dynamic esports market.

In the Indonesia Esports Market, challenges persist alongside the enthusiasm. Local game development trails the popularity of imported titles and posing a difficulty to the industry's growth. Additionally, a significant portion of gaming revenue exits the country and highlighting the need for strategies to retain earnings domestically. Addressing these challenges is crucial for fostering a sustainable and thriving ecosystem within Indonesia's burgeoning esports industry.

Indonesia Esports Market Segment Analysis

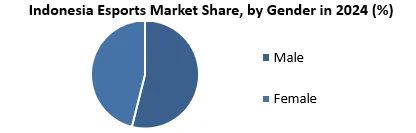

Based on Gender, the Male segment held the largest market share of about 60% in the Indonesia Esports Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 5.90 % during the forecast period. Indonesia's Esports Market shines with rapid tech progress and widespread smart device use, making it the dominant segment, run by connectivity and integration trends.

4In the Indonesia Esports industry males likely dominate and echoing global patterns where male audiences typically predominate. This demographic trend underscores the significant presence and influence of male participants within Indonesia's booming esports market, aligning with broader international patterns observed across the gaming industry. In the Indonesia Esports domain, there's a pronounced emphasis on mobile gaming, mirroring broader market trends. Genres like Battle Royale and MOBA, popular among esports enthusiasts and particularly favoured on mobile platforms, reflecting the nation's strong inclination towards competitive gaming on handheld devices.

In Indonesia's esports landscape, a substantial male demographic is actively engaged in following the scene, indicating robust audience involvement. This active participation underscores the fervent interest and dedication among male viewers within the Indonesian esports community and shaping the industry's vibrant and dynamic ecosystem. In the Indonesia Esports realm, male gamers are presumed to play a pivotal role in in-game expenditures, investing in items, cosmetics or battle passes to elevate their gaming experience. This pattern reflects their active participation and financial contribution to the esports ecosystem driving further growth and innovation.

Additionally, In Indonesia's Esports market, male gamers are pivotal in driving in-game spending, particularly on items, cosmetics, and battle passes to enrich their gaming experience. The potential for monetization through sponsorship and advertising targeting this demographic is significant and estimated to increase. Also, challenges persist, particularly in the dominance of recognized titles, potentially overshadowing local game development. While data specifically on male gamers is limited, alternative approaches such as monitoring industry reports and exploring mobile gaming demographics could offer valuable insights. Stay updated on evolving trends for a comprehensive understanding of the Indonesian Esports Market.

|

Indonesia Esports Market Scope |

|

|

Market Size in 2024 |

USD 11.75 Million |

|

Market Size in 2032 |

USD 18.54 Million |

|

CAGR (2025-2032) |

5.87% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Gender

|

|

By Type

|

|

|

By Revenue Model

|

|

Leading Key Players in the Indonesia Esports Market

- EVOS Esports

- RRQ (Rex Regum Qeon)

- Bigetron Esports

- ONIC Esports

- NXT Esports

- Moonton Technology (Mobile Legends: Bang Bang)

- Garena (Free Fire, Arena of Valor)

- Krafton (PUBG Mobile)

- Riot Games (Valorant, League of Legends: Wild Rift)

Frequently Asked Questions

Infrastructure limitations, particularly in internet connectivity and gaming infrastructure, pose a significant restraint for the growth of the Indonesia Esports market.

The Indonesia Esports Market size was valued at USD 11.75 Million in 2024 and the total Indonesia Esports revenue is expected to grow at a CAGR of 5.87% from 2025 to 2032, reaching nearly USD 18.54 Million By 2032.

1. Indonesia Esports Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Indonesia Esports Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Indonesia Esports Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Indonesia Esports Market: Dynamics

4.1. Indonesia Esports Market Trends

4.2. Indonesia Esports Market Drivers

4.3. Indonesia Esports Market Restraints

4.4. Indonesia Esports Market Opportunities

4.5. Indonesia Esports Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Indonesia Esports Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Indonesia Esports Market Size and Forecast, by Gender (2024-2032)

5.1.1. Male

5.1.2. Female

5.2. Indonesia Esports Market Size and Forecast, by Type (2024-2032)

5.2.1. Hardcore Gamers

5.2.2. Casual Gamers

5.2.3. Traditional Sports Fans

5.2.4. Mobile-First Viewers

5.2.5. Non-Gaming Audience

5.3. Indonesia Esports Market Size and Forecast, by Revenue Model (2024-2032)

5.3.1. Sponsorship & advertising

5.3.2. Esports betting & fantasy site

5.3.3. Prize pool

5.3.4. Amateur & micro tournament

5.3.5. Merchandising

5.3.6. Ticket sale

6. Company Profile: Key Players

6.1. EVOS Esports

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. RRQ (Rex Regum Qeon)

6.3. Bigetron Esports

6.4. ONIC Esports

6.5. NXT Esports

6.6. Moonton Technology (Mobile Legends: Bang Bang)

6.7. Garena (Free Fire, Arena of Valor)

6.8. Krafton (PUBG Mobile)

6.9. Riot Games (Valorant, League of Legends: Wild Rift)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook