Bahrain Insurance Telematics Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Deployment Mode, Organization Size, Technology, and Region

Bahrain Insurance Telematics Market was valued at USD 0.63 billion in 2023. Bahrain Insurance Telematics Market size is estimated to grow at a CAGR of 4.8% over the forecast period.

Format : PDF | Report ID : SMR_580

Bahrain Insurance Telematics Market Definition:

Insurance telematics is used to track the driving behavior of individuals and involves collecting, estimating, and sending a various number of data points. For the most part, it goes about as a little GPS-based gadget set inside a vehicle, which tracks areas and screens various boundaries, like speed, distance, and area. Moreover, by checking drivers’ execution in the driver's seat, insurers can carry out usage-based insurance (UBI) programs and accordingly design premium prices for auto insurance policyholders.

The Bahrain Insurance Telematics Market report gives a comprehensive assessment of the market for the forecast period. The report involves different sections as well as an investigation of the patterns and factors that are assuming a significant part on the lookout. These elements; the market elements include the drivers, limitations, opportunities, and difficulties through which the effect of these variables in the market is illustrated. The drivers and restrictions are inborn variables though valuable opportunities and difficulties are inessential elements of the market. The Bahrain Insurance Telematics Market study gives a point of view toward the advancement of the market regarding income all through the forecast period.

Bahrain Insurance Telematics Market Dynamics:

The rise in the need for telematics devices in the insurance and automotive sector drives the market growth across Bahrain. This is ascribed to the way that telematics devices help in working on premium estimating, improving client impression of an organization, and fortifying long-term connections through nearer correspondence. Also, the growing need for administrative consistency in the car business and the surge in adoption of Internet of Things (IoT) innovation among protection telematics providers are central points that strikingly contribute to the growth of the Bahrain market.

To get more Insights: Request Free Sample Report

However, concerns related to information security and assurance and the absence of awareness of insurance telematics are some of the elements that limit the insurance telematics market growth. Running against the norm, creating economies offer critical opportunities for insurance telematics organizations to extend and develop their contributions, particularly among arising economy like Bahrain.

Furthermore, Bahrain is on the verge of developing their automotive sectors with a lack of financial resources has prompted the need for cost-productive arrangements that are supposed to offer remunerative opportunities for extension of the market. Also, rapid development in the automotive industry is giving new opportunities to telematics providers to further develop client encounters, improve coordinated effort with accomplices, and information adaptation, which is expected to open new avenues for the market in the coming years.

Besides, the composition of automotive insurance, such as collision, liability, and third-party insurance in both developed and emerging economies is generating the demand for telematics. The development of the insurance telematics market is additionally upheld by elements, for example, low insurance premiums, vehicle tracking in the case of theft, and customized and value-added services in insurance plans to serve client intrigues all the more successfully. Additionally, the rise of IoT and distributed computing has introduced numerous amazing opportunities for the growth of the market.

Bahrain Insurance Telematics Market Segment Analysis:

Based on Organization Size, the market is bifurcated into Large Organizations and Small and Medium Organizations. The large organization dominates the segment over the forecast year, it will keep on keeping up with its strength. With the rising adoption of a versatile telematics system, it has emphatically influenced the automotive protection telematics sector. However, small and medium organizations will observe huge development. The elements, for example, client maintenance, and cost-effective services of claims, are contributing to the growth of the segment.

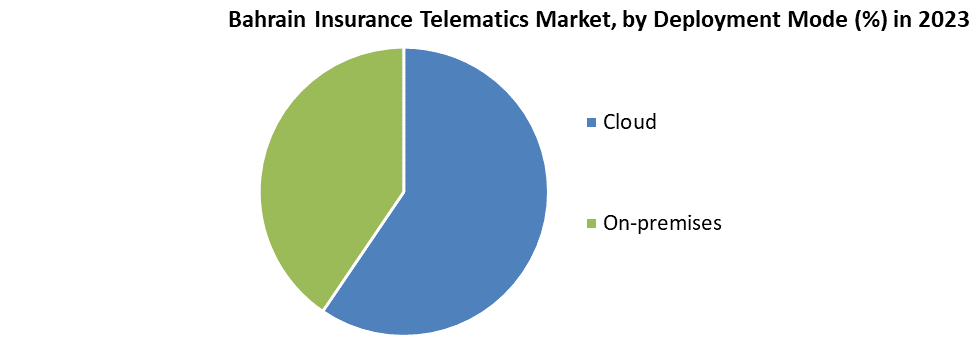

Based on Deployment Mode, the market is bifurcated into Cloud and On-premises. The on-premises deployment segment is anticipated to witness huge growth in the Bahrain insurance market during the forecast period. Since telematics is an indispensable part of the auto insurance sector, on-premise arrangement conveys ongoing data and bits of knowledge. The absolute number of associated vehicles across Bahrain is expected to build, the on-premise deployment will get the job done within the network boundaries, such as software upgrades.

Bahrain Insurance Telematics Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in Bahrain, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Bahrain Insurance Telematics market to the stakeholders in the industry. The report provides trends that are most dominant in the Bahrain Insurance Telematics market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Bahrain Insurance Telematics Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Bahrain Insurance Telematics market report is to help understand which market segments, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Bahrain Insurance Telematics market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Bahrain Insurance Telematics market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Bahrain Insurance Telematics market. The report also analyses if the Bahrain Insurance Telematics market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Bahrain Insurance Telematics market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Bahrain Insurance Telematics market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Bahrain Insurance Telematics market is aided by legal factors.

Bahrain Insurance Telematics Market Scope:

|

Bahrain Insurance Telematics Market Scope |

|

|

Market Size in 2023 |

USD 0.63 Bn. |

|

Market Size in 2030 |

USD 0.88 Bn. |

|

CAGR (2024-2030) |

4.8% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Organization Size

|

|

By Deployment Mode

|

|

|

|

By Technology

|

Bahrain Insurance Telematics MARKET KEY PLAYERS:

- Agero Inc., Medford, Massachusetts, United States

- IMS, David Johnston Research & Technology Park,

- Masternaut Limited, France

- Meta System S.p.A., Reggio Emilia RE, Italy

- MiX Telematics, Midrand, South Africa

- Octo Group S.p.A, Rome, Italy

- Sierra Wireless, Richmond, Canada

- TomTom International BV., Amsterdam, Netherlands

Frequently Asked Questions

The market size of the Bahrain Insurance Telematics Market by 2030 is expected to reach USD 0.88 Billion.

The forecast period for the Bahrain Insurance Telematics Market is 2024-2030

The market size of the Bahrain Insurance Telematics Market in 2023 was valued at USD 0.63 Billion.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Bahrain Insurance Telematics Market Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Bahrain Insurance Telematics Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Bahrain Insurance Telematics Market: Dynamics

4.1. Bahrain Insurance Telematics Market Trends

4.2. Bahrain Insurance Telematics Market Drivers

4.3. Bahrain Insurance Telematics Market Restraints

4.4. Bahrain Insurance Telematics Market Opportunities

4.5. Bahrain Insurance Telematics Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Bahrain Insurance Telematics Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. Bahrain Insurance Telematics Market Size and Forecast, by Organization Size (2024-2030)

5.1.1. Large Organization

5.1.2. Small and Medium Organizations

5.2. Bahrain Insurance Telematics Market Size and Forecast, by Deployment Mode (2024-2030)

5.2.1. Cloud

5.2.2. On-premises

5.3. Bahrain Insurance Telematics Market Size and Forecast, by Technology (2024-2030)

5.3.1. OBD-II

5.3.2. Smartphone

5.3.3. Hybrid

5.3.4. Black-box

6. Company Profile: Key Players

6.1. Agero Inc., Medford, Massachusetts, United States

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. IMS, David Johnston Research & Technology Park,

6.3. Masternaut Limited, France

6.4. Meta System S.p.A., Reggio Emilia RE, Italy

6.5. MiX Telematics, Midrand, South Africa

6.6. Octo Group S.p.A, Rome, Italy

6.7. Sierra Wireless, Richmond, Canada

6.8. TomTom International BV., Amsterdam, Netherlands

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook