Chad Smart Cattle Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Type, Application, Packaging, and Region

Chad Smart Cattle Market was valued at USD 1.19 billion in 2023 and is expected to reach a value of USD 1.88 billion in 2030. Chad Smart Cattle Market's size is estimated to grow at a CAGR of 6.75% over the forecast period.

Format : PDF | Report ID : SMR_600

Chad Smart Cattle Market Definition:

Smart Cattle Farming or Smart dairy farming aims to achieve more productive, efficient, and sustainable farm operations based on the effective use of digital technologies. It includes real-time sensors that collect data from cows with the help of wearable smart collars, machine learning data analysis, and cloud-based data centers to support the farmer in managing the quality of dairy products. IoT has created many opportunities for the agriculture industry, which has led to the development of the internet of cattle, known as 'Smart Cattle' wherein cattle is attached with sensors that accumulate data and analyze whether the cattle is sick, lost, or trapped, and decreased.

Chad Smart Cattle Market Dynamics:

Increasing Demand for dairy products across the Chad:

A growing population and changing diets are driving up the demand for the food. A 2020 report found that nearly 690 million people, or 8.9% of the global population, lack the consumption of cattle products as per their requirements, and it will increase by 60 million in more than five years. Chad is the country that is considered the 8thlargest producer of cattle products. In 2020, the production of milk by Chad was 395,945 thousand tonnes, or have the growing at an average annual rate of 2.15%, thus by using the smart cattle farming will increase their products more effectively and efficiently as per the requirement of the population after the pandemic, choosing the quality of cattle products for the consumption.

To get more Insights: Request Free Sample Report

Chad with Rich Natural Resources:

Chad presents an opportunity for targeted engagement in the key sectors. Despite numerous challenges, the success of several foreign investors in Chad illustrates the business opportunities. Chad is Africa's 5th largest country by geographical area, which allows the smart cattle farming because it requires proper spacing for the effective monitoring of animals, the country also witnessed a rapidly growing GDP, Population, and Per capita income in 2020, according to the World Bank which reflects the growth of the smart cattle market by having proper investment by the country and also the availability of population means the fulfillment of required farmers for the cattle farming. The country is also enriched with the World's 10th largest population of goats, sheep, and cattle.

Opportunities for the country based on a niche market:

Chad's ongoing development presents opportunities for medium and large-scale projects in livestock, agri-business, and others. There are opportunities in niche markets like Shea, butter, cheese, and as well as opportunities to develop value-added products and other processed cattle products. This provides opportunities to many companies associated with smart cattle farming to invest and locate this country as their base for farming. The smart cattle enable sensors to detect if cattle are working efficiently or not. This helps the farmers by saving animals from any injury.

Challenges for the country towards smart cattle market:

The biggest challenge to companies operating in Chad is the dependence on the prices, low consumer purchasing power, difficult business and investment climate, and under-developed capital market. Government spending and consumer purchasing power are highly dependent on global commodity prices. Chad's economy remains heavily reliant on agriculture and oil production and is highly vulnerable to external factors, such as food and oil prices and drought. Chad's business and investment climate is challenging. The private sector is hindered by poor transport infrastructure, lack of skilled labor, minimal and unreliable electricity supply, limited telecommunication infrastructure, government bureaucracy, corruption, and high tax burdens on private enterprises. Chad's capital market is underdeveloped, less than 10% of personal and small business transactions pass through formal banking systems. Private sector financing is limited, and low GDP growth restrains government investment and private sector spending.

Chad Smart Cattle Market Segment Analysis:

By Deployment, Cloud is the major segment which holds more than 50% in this market share in 2023. The cloud is estimating growth because it has the facilities it is utilized to collect, analyze, and store agriculture data. The Cloud-connected wireless sensors capture data from the field, and machine learning algorithms analyze that real-time information, giving farmers a better understanding of cattle. The cloud-based program helps thousands of small, family farms in Chad and has become a thriving business for cattle farmers. The farm, located in the small towns of Chad with less than 1000 cows, helps to produce thousands of liters of milk, which is transported to thousands of states with the proper quality as per the requirement of consumers.

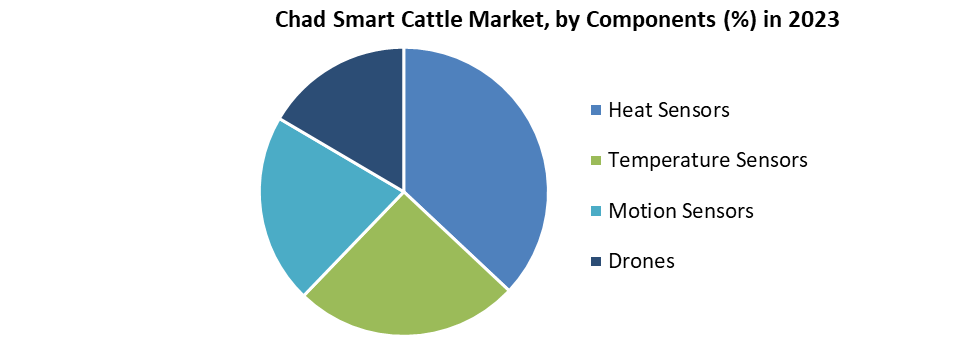

By Components, The most dominating segment is drones and sensors, it almost captures the same market share of the smart cattle market in 2023. The growth is attributed to the most useful tasks that drones could handle in cattle farming is the remote monitoring and analysis of animal's motions. Drones travel at a certain altitude and visually check the animal's conditions. It helps in saving time and labor that would normally be involved in manual checking. Drones and sensors monitoring the farms can collect data related to cattle that helps in the analysis of animals for the production of cattle products according to the proper quality. It can also embed multiple sensors in the drone which check and identify sick animals so that farmers can separate them from the herd to avoid contamination.'

Base Stations are the segment that also holds the market share after sensors and drones because they provide services like analyzing big data analytics and data management, in these, farmers can create their reports with insights and patterns on climate, fields, and animal behavior. Such data derived from different farms could go to help scientists and improve farming facilities.

Chad Smart Cattle Market Key Players Insights:

According to the BBC news, Chad is helping Angola's state by giving them cattle, Chad needs some cash for the advancement of various sectors, and Angola needs cattle, more than 1000 cows arrived by ships in Angola's capital, Luanda, in total would receive in total 75000 cattle over 10 years from 2010-2020. Angola needs it because it would help the Southern African state rebuild its cattle population in drought-affected areas, this will allow increasing the market demand for the smart cattle industry of this country.

As per the reports of OIE (Organisation for Animal Health), livestock farming country par excellence, with about 94 million head of cattle and it accounts for an increase their exports of cattle products by 30% and it is considered as the main source of foreign exchange after the oil industry. The smart cattle market is getting the opportunity to witness growth because of major factors like Chad is one of the largest exporters of cattle and also has a labor force in which 80% of them are associated with the agriculture industry. These are the factors that are contributing to the growth of Chad as well as the smart cattle market.

Competitive Landscape-

Connecterra is the engineering sensor hardware and cloud-based machine learning platform to predict the real-time behavior of dairy farm animals and save the farmer's direct cost by $250 per year. Trimble, Inc. is on a mission to help livestock producers by increasing productivity and predicting, preventing, and precisely managing diseases in the herd. They will build up the largest database of clinical, health, performance, and genetic data for cattle.

AgJunction is developing the world's most advanced technology for dairy farms today, technology that's a transformation for animals, farmers, and the production of food. Using computer vision and AI to identify health, reproduction, and environmental changes early on, it translates visual information into actionable data.

The market is characterized by the existence of many well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in Chad, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Chad Smart Cattle Market to the stakeholders in the industry. The report provides trends that are most dominant in the Chad Smart Cattle Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Chad Smart Cattle Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Chad Smart Cattle Market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Chad Smart Cattle Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Chad Smart Cattle Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Chad Smart Cattle Market. The report also analyses if the Chad Smart Cattle Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Chad Smart Cattle Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Chad Smart Cattle Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Chad Smart Cattle Market is aided by legal factors.

Chad Smart Cattle Market Scope:

|

Chad Smart Cattle Market |

|

|

Market Size in 2023 |

USD 1.19 Bn. |

|

Market Size in 2030 |

USD 1.88 Bn. |

|

CAGR (2024-2030) |

6.75% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Deployment

|

|

By Components

|

|

Chad Smart Cattle Market Key Players:

- BT Group (England)

- Topcon Positioning System (US)

- AgJunction Inc. (Canada)

- Trimble Inc. (California)

- AGCO Corporation (Georgia)

- AG Leader Technology (US)

- Afimilk Limited (Israel)

- InnovaSea Systems (US)

- Abaco Systems, Inc. (US)

- GEA Group (Germany)

- Connecterra (Netherlands)

- Others

Frequently Asked Questions

The market size of the Chad Smart Cattle Market by 2030 is expected to reach USD 1.88 billion.

The forecast period for the Chad Smart Cattle Market is 2024-2030

The market size of the Chad Smart Cattle Market in 2023 was valued at USD 1.19 billion.

The CAGR of the Chad Smart Cattle Market over the forecasted period is 6.75%.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Chad Smart Cattle Market Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024-2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Chad Smart Cattle Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Chad Smart Cattle Market: Dynamics

4.1. Chad Smart Cattle Market Trends

4.2. Chad Smart Cattle Market Drivers

4.3. Chad Smart Cattle Market Restraints

4.4. Chad Smart Cattle Market Opportunities

4.5. Chad Smart Cattle Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Real-Time Sensors

4.8.2. Wearable Smart Collars

4.8.3. Machine Learning Data Analysis

4.8.4. Cloud-Based Data Centers

4.8.5. Technological Roadmap

4.9. Regulatory Landscape

5. Chad Smart Cattle Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. Chad Smart Cattle Market Size and Forecast, by Deployment (2024-2020)

5.1.1. Cloud

5.1.2. On-premises

5.2. Chad Smart Cattle Market Size and Forecast, by Components (2024-2030)

5.2.1. Heat Sensors

5.2.2. Temperature Sensors

5.2.3. Motion Sensors

5.2.4. Drones

5.2.5. Base Stations

5.2.6. Others

6. Company Profile: Key Players

6.1. BT Group (England)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Topcon Positioning System (US)

6.3. AgJunction Inc. (Canada)

6.4. Trimble Inc. (California)

6.5. AGCO Corporation (Georgia)

6.6. AG Leader Technology (US)

6.7. Afimilk Limited (Israel)

6.8. InnovaSea Systems (US)

6.9. Abaco Systems, Inc. (US)

6.10. GEA Group (Germany)

6.11. Connecterra (Netherlands)

6.12. Others

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook