Middle East and Africa duty-free retail Market: Industry Analysis and Forecast (2024-2030)

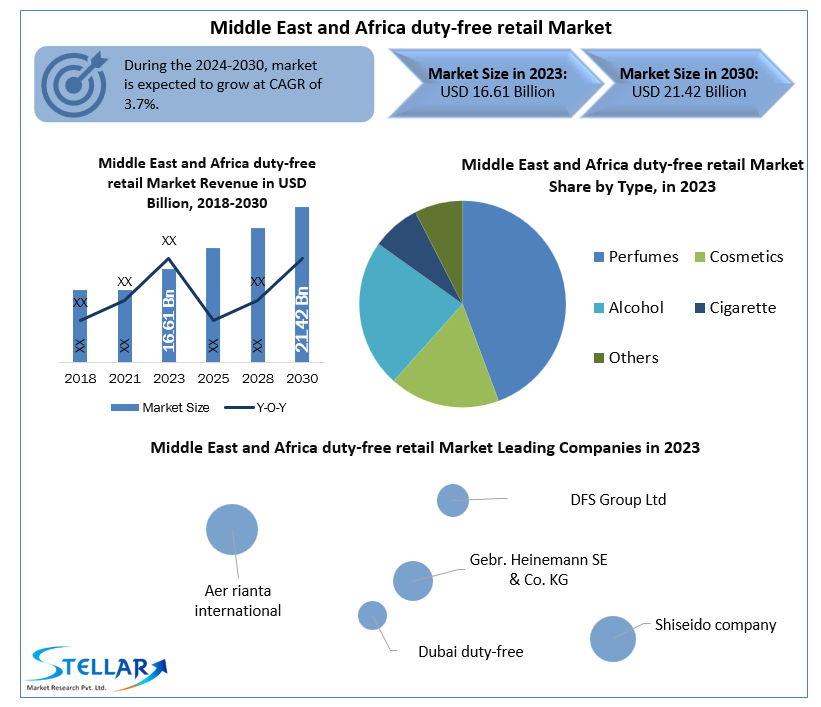

The Middle East and African duty-free retail Market was valued at USD 16.61 billion in 2023. The Middle East and African duty-free retail market size are estimated to grow at a CAGR of 3.7 % over the forecast period.

Format : PDF | Report ID : SMR_1113

Middle East and Africa duty-free retail Market Definition:

Duty-free shopping refers to the concept of providing customers with goods on which import duties are not applied. International travelers have a great chance to save money on a wide range of goods, including tobacco, cosmetics, and perfume.

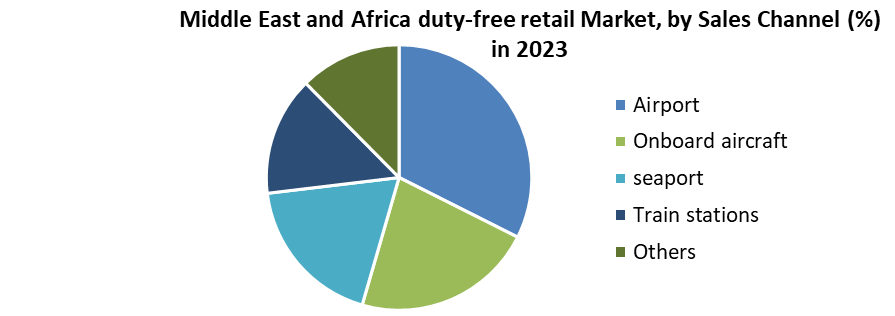

Further, the Middle East and Africa market is segmented by product type, distribution channel, and geography. Based on type, the Middle East and Africa market is segmented into Perfumes, Cosmetics, Alcohol, Cigarettes, and Others. Based on the Sales Channel, the Duty-Free Retail market is segmented under the channels of Airports, Onboard aircraft, seaports, train stations, and others. By geography, the market covers the major countries in the Middle East and Africa i.e., South Africa, Nigeria, Saudi Arabia, UAE, Kuwait, Egypt, and the Rest of the Middle East and Africa for each segment, the market sizing, and forecast have been done based of value (in USD Million/Billion).

To get more Insights: Request Free Sample Report

Middle East and Africa duty-free retail COVID 19 Insights:

Market players struggled with the COVID-19 pandemic's onslaught. As a result of the drop in product demand, the outlook for duty-free retailing was not good given the decline in air travel in 2021. According to Airports Council International (ACI), which has its headquarters in Canada, airport sales fell by 90% to USD 39 billion in the second quarter of 2021. In addition, the popularity of trade protectionism in the middle east and Africa, Australia, China, and the United States hurt sales of hamper duty-free goods. A decline in the tourism market also had a significant impact on the industrial outlook.

The COVID-19 pandemic, which affected duty-free retail sales, caused a substantial fall in travelers to the Middle East and Africa in the year 2020. However, it is expected that more passengers will arrive in 2021 due to expanding immunization programs around the world and the opening of several international borders to visitors and travelers. To Tow customers into their stores and encourage sales as travel picks back up, duty-free businesses are concentrating on customer-centric techniques like offering alluring discounts, holding promotional events, and providing engaging experiences.

Middle East and Africa duty-free retail Market Dynamics:

Cities like Dubai are becoming more important hubs for international trade. Projects to grow and renovate airports in the Middle East and Africa present duty-free operators with numerous chances to innovate and modernize retail layouts. As a result of COVID 19's impact on consumer purchasing behavior, duty-free retailers and operators are positioning themselves for the future by investing in digital technologies inside their stores. Travelers growing concerns about their safety prompted merchants to consider several strategies to inspire trust in their ability to make purchases, including offering digital alternatives and implementing contactless technology. Airport operators are correct to raise their attention on their beauty and cosmetics divisions, increasing space allocation, as health beauty is one of the major retail categories in duty-free shopping.

The major Duty-free Vendors in the Middle East and Africa:

In the UAE duty-free market in 2020, Dubai Duty-Free will continue to hold a leading position. Tourism will increase when the pandemic eases since it is a desirable and secure location. The retailer will benefit from further store growth, e-commerce integration, and improved customer service. The retailer's supremacy is fueled by its presence at the international airports of Dubai and Al Maktoum. As COVID-19 restrictions were relaxed earlier than others in the region, Dubai gained even greater notoriety as a significant travel and transportation hub. This contributed to its increase in market share along with the retailers' airport growth. As COVID-19 restrictions were relaxed earlier than others in the region, Dubai gained even greater notoriety as a significant travel and transportation hub.

A swift turnaround in tourism due to cultural events like Dubai Expo 2020 and better conditions in the UAE are responsible for the minor improvement. Due to oil's volatility and a collective drive toward the usage of electric-powered technology, major Gulf countries have been aggressive in reforming their economies to become less dependent on it over the long term. Recovery was significantly hindered by the COVID-19 variation that was found in South Africa and subsequent waves of the virus. Therefore, over 2020, duty-free sales are anticipated to increase by more than 4%. The tourism market is now receiving more attention and funding. Dubai loosened its alcohol laws in 2019 to draw more tourists.

The UAE Nation Brand initiative and other tourism-related initiatives in Dubai, such as Expo 2021, will further boost tourism in the nation. It is expected that the FIFA World Cup 2022 in Qatar will draw a sizable number of visitors, creating tremendous prospects for duty-free retail in the area. Additionally, several retailers are working with duty-free shops to offer unique or limited edition items, which is advancing the market.

The Middle East and Africa duty-free retail Market Segment Analysis:

By Type,

Market segments for Jewelry, fashion, and accessories are growing more quickly than beauty products.

The market's overall sales have shown that beauty products, cosmetics, and Jewelry have contributed the most, followed by other goods including colognes, alcohol, and cigarettes. Due to the variety of Jewelry designs available to buyers, gold and precious gems have also been one of the market categories in the Middle Eastern market with strong performance. During the study period, there was also considerable demand for cosmetics and colognes, making them some of the goods with the most market sales transactions.

By Sales Channel, The Middle East and African duty-free retailing market are divided into airports, onboard aircraft, seaports, and others based on application. The segment for airports commands the biggest market share, followed by the segments for others, seaport, and on-board. The airport duty-free retailing facility facilitates the pre-ordering of duty-free goods, giving customers the option of receiving their purchases at the airport or on a flight. By enabling travelers to travel with less luggage, the possibility of paying an over baggage tax is further diminished.

The demand for the Middle East and Africa travel beauty retail market is expected to be driven by the growing popularity of travel and tourism as well as the growing millennial population. However, severe government regulations on shopping in airports may further limit the market's growth tourism.

The Middle East and Africa travel beauty retail market may benefit from several factors, including several rowing collaborative partnerships among upscale and premium brands. The growth of the market will probably be hampered over the period by a lack of knowledge about travel retail.

This Middle East and Africa travel beauty retail market study contains market share, recent trends, and product pipeline analysis. It also examines the influence of domestic and localized market competitors and examines potential in terms of new income pockets.

The Middle East and Africa duty-free retail Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the Europe market key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Middle East and African duty-free retail market to the stakeholders in the industry. The report provides trends that are most dominant in the Middle East and African duty-free retail market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Middle East and African duty-free retail Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in The Middle East and Africa duty-free retail market report is to help understand which market segments, rand, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Middle East and African duty-free retail market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Middle East and African duty-free retail market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Middle East and African duty-free retail market. The report also analyses if the Middle East and African duty-free retail market are accessible for new players to gain a foothold in the market, do they enter or exit the market regularly, and if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Middle East and African duty-free retail market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Middle East and African duty-free retail market. Understanding the impact of the surrounding environment and the influence of environmental concerns on The e East and African duty-free retail market is aided by legal factors.

Middle East and Africa Duty-Free Retail Market Scope:

|

Middle East and African duty-free retail Market |

|

|

Market Size in 2023 |

USD 16.61 Bn. |

|

Market Size in 2030 |

USD 21.42 Bn. |

|

CAGR (2024-2030) |

3.7% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Sales Channel

|

|

|

Country Scope |

South Africa GCC Egypt Nigeria Rest of the Middle East and Africa |

The Middle East and Africa duty-free retail Market Key Players:

- Aer rianta international

- DFS Group Ltd

- Gebr. Heinemann SE & Co. KG

- Dubai duty-free

- Shiseido company

- Lagardère Travel retail

- Dubai Duty-Free (UAE)

Frequently Asked Questions

The market size of the Middle East and African duty-free retail Market by 2030 is expected to reach USD 21.42 Billion.

The forecast period for the Middle East and African duty-free retail Market is 2024-2030.

The market size of the Middle East and African duty-free retail Market in 2023 was valued at USD 16.61 Billion.

- Scope of the Report

- Research Methodology

- Research Process

- The Middle East and Africa Market: Target Audience

- The Middle East and Africa Market: Primary Research (As per Client Requirement)

- The Middle East and Africa Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- the Middle East & Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Stellar Competition matrix

- The Middle East and Africa Market Segmentation

- The Middle East and Africa Market, by Type (2023-2030)

- Perfumes

- Alcohol

- Cigarette

- Others

- The Middle East and Africa Market, by Sales Channel (2023-2030)

- Airport

- Onboard aircraft

- Seaport

- Train stations

- Others

- The Middle East and Africa Market, by Country (2023-2030)

- South Africa

- Ethiopia

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- The Middle East and Africa Market, by Type (2023-2030)

- Company Profiles

- Key Players

- Aer Rianta international

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- DFS group ltd

- Gebr Heinemann SE & CO. kg

- Dubai duty-free

- Shiseido company

- Lagardere Travel retail

- Dubai duty-free retail (UAE)

- Aer Rianta international

- Key Players

- Key Findings

- Recommendations