Laser Cladding Market Global Industry analysis and Forecast (2026-2032) by type, revenue, end-use industry and region

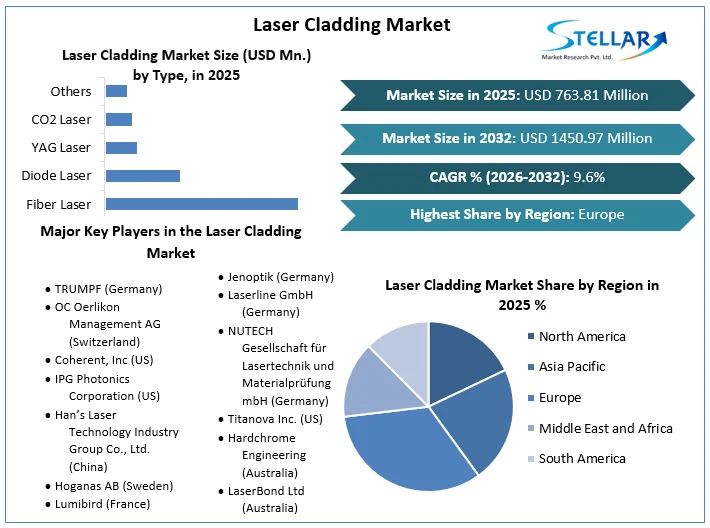

Laser Cladding Market was valued at USD 763.81 Mn. in 2025. The Global Laser Cladding Market is estimated to grow at a CAGR of 9.6% and expected to reach USD 1450.97 Mn. over the forecast period.

Format : PDF | Report ID : SMR_1171

Laser Cladding Market Overview:

Cladding is the process of restoring the finish or surface of things, parts, or materials that have become worn out through time. It improves the object's aesthetics and functionality by adding a fresh surface layer on top of the basic material during refurbishment or revision. Laser cladding is a hard-facing procedure that involves melting the coating material and a thin substrate layer with a high-powered laser beam, resulting in a pore- and crack-free coating that is 50–2 mm thick and perfectly attached to the substrate.

The Laser Cladding System is a welding technology that uses laser energy as a heat source to melt and weld material with a variety of desirable metallurgical qualities onto a part with minimal chemical dilution.

The application of laser cladding systems is expanding beyond the automobile to the petroleum industries. Welding is a critical component of the automotive and mechanical industries' demand. Aside from these, the laser cladding market is being boosted by its application in the repair and rejuvenation of high-value components such as internal combustion engines and military equipment.

To get more Insights: Request Free Sample Report

Laser Cladding Market Dynamics:

The laser cladding market is primarily driven by the automobile industry, which has numerous uses. The market is expanding because of the reducing cost of laser cladding systems. Because high tensile forming materials are employed in the automotive sector, the technology used in them should have a cost influence on the manufacturer. Despite the market's many indulging assets, the increasing use of laser cladding systems that include carcinogenic material which causes cancer is a major drawback.

Fiber lasers widely used in laser cladding applications.

The industrial sector is presently the main market for fibre lasers, with a lot of activity at the kilowatt-class power level right now. Their application in automotive works is particularly intriguing. The automotive industry is transitioning to high-strength steel in order to build cars that exceed durability criteria while remaining relatively light for better fuel efficiency; the issue is how to cut the high-strength steel. Fiber lasers are used in this situation. Traditional machine tools, for example, struggle to punch holes in this type of steel; nevertheless, fibre lasers can quickly cut these holes.

Rising need for rapid manufacturing practice.

The phrase "rapid manufacturing" refers to the methods and processes that allow for quick and flexible prototyping and production of series parts. Applying surface coatings for surface enhancement, quick manufacturing, fixing worn-out parts, developing novel alloys, and other industrial tasks are all possible with laser cladding. As a result, the demand for rapid manufacturing utilising the laser cladding method is gradually expanding, which is likely to drive up laser cladding market.

Laser cladding techniques have improved.

Laser cladding technology is advancing at a rapid pace, and it can be used to modify surfaces. With these improvements, laser cladding applications have extended to include a wide range of industrial applications in aerospace and military, medical technology, consumer electronics, and other fields. For example, the Fraunhofer Institute for Production Technology (IPT) in Germany has conducted substantial research and developed an additive manufacturing (AM) technology. The wire and powder-based laser cladding technologies are combined in this procedure. This hybrid method, according to the researchers, generates a protective tool coating that is more wear-resistant, resource-efficient, cost-efficient, and environmentally friendly.

Lack of skilled professionals.

Due to a decrease in the number of welders and engineers in the region, the welding and surface modification business has been facing a serious shortage in recent years, particularly in the United States. Concerns about retirement replacements, negative impressions of the profession, such as repetitive and tedious work structures, low pay, working in filthy settings, and a lack of long-term professional development prospects, all contribute to the shortage.

COVID-19 Impact:

COVID-19's effects on the laser cladding market and consumer demand have a negative impact on the laser industry as a whole. The majority of laser producers and raw material providers are headquartered in China, hence laser manufacturing is projected to drop faster than expected in the short term. The laser industry continues to rely largely on China for laser manufacturing, including the manufacture of subcomponents such as laser sources, galvanometers, output couplers, and other components. Due to the pandemic, component supplies have been disrupted, resulting in a limited availability of laser items.

Some laser manufacturers may raise their prices momentarily. The immediate effect is that the supply shortage may put downward pressure on laser system prices. Manufacturers of laser systems would have to watch out for supply chain interruptions in China in the future. However, as the situation improves, it is predicted that manufacturing may gradually return to normal over the following few years, providing a consistent supply of laser systems.

Laser cladding market segment analysis:

By type: Laser cladding market is segmented into Fiber Laser, Diode Laser, YAG Laser, CO2 Laser and others on the basis of type.

During the forecast period, the laser cladding market for diode lasers is expected to have the biggest market share. High-power direct diode lasers (DDL) have become increasingly popular in recent years, and are mostly employed in heat processing applications. When compared to traditional varieties like carbon dioxide (CO2) and yttrium aluminium garnet (YAG) lasers, high-power DDLs save a lot of energy. As a result, diode lasers are predicted to have the largest market share.

By revenue: Laser cladding market is segmented into laser revenues and system revenues on the basis of revenue.

The laser revenue market is expected to develop at the fastest CAGR During the forecast period. The revenue created from the sales of various types of lasers for cladding purposes, such as YAG lasers, fibre lasers, diode lasers, and CO2 lasers, is referred to as laser revenue. Each of these technologies has applications in a variety of industries, including aerospace and defence, automotive, and mining. Several laser manufacturers have secured contracts to produce lasers for cladding applications over the years. TRUMPF, for example, delivered the billionth tiny laser to STMicroelectronics, a French manufacturer of electronics and semiconductors for smartphones, in December 2019.

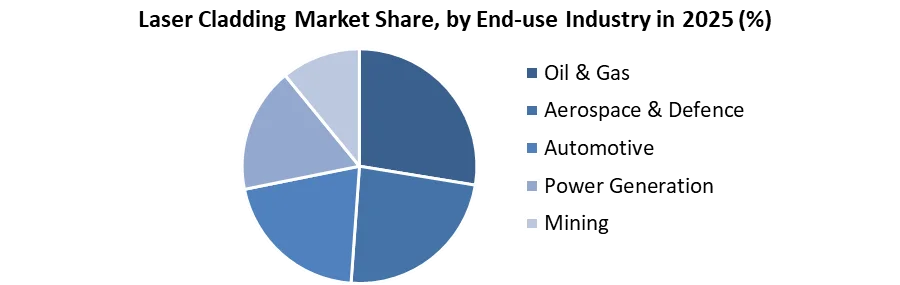

By end-use industry: Laser cladding market is segmented into Oil & Gas, Aerospace & Defence, Automotive, Power Generation and Mining on the basis of revenue.

The aerospace and defence end-use industry is predicted to grow at the fastest rate during forecast period. One of the earliest sectors to use laser cladding was the aircraft industry. Many critical components in an aeroplane engine are laser-clad. In the aircraft sector, leading engine manufacturers are implementing 3D printing, cold spray, and laser cladding. AMAG, a primary aluminium and premium cast and rolled aluminium product provider, inaugurated a new high-tech cladding station in March 2019 to increase the quality of coils and sheets for heat exchangers and the aircraft sector.

Laser cladding market regional insights:

Laser cladding market is segmented into North America, Europe, Asia Pacific, Middle East and Africa and South America on the basis of region.

Europe is expected to be the largest market for laser cladding during the forecast period due to the high adoption rate of laser cladding technology by automotive and mechanical engineering organisations, as well as the benefits offered by laser cladding, such as better wear resistance and repair of damaged or worn surfaces. Furthermore, due to increased demand from the automotive and mechanical engineering, as well as semiconductor equipment industries, Germany is predicted to lead the region markets in Europe.

North America is predicted to have the second-largest market share because of the demand for laser cladding techniques, namely among automotive, security & defence, and semiconductor industries in this area. Because of the increased need for laser cladding to improve wear resistance in objects, the United States is likely to lead the country-level market in North America. Laser cladding also improves, repairs, and reinforces the surfaces of metal components, allowing for the production of higher-quality consumer electronics.

Due to the progressive expansion in manufacturing techniques, notably among oil and gas producers, the Middle East and Africa and South America markets are predicted to grow strongly during the research period.

The objective of the report is to present a complete picture of global Laser cladding market. Data from past years is compiled to anticipate the future prospects of this market. Porter's five forces help to identify where power lies in a business situation. This is useful both in understanding the strength of an organisation's current competitive position, and the strength of a position that an organisation may look to move into. The report helps in identifying competitive rivalry currently running in the Laser cladding market. It also helps to understand bargaining power of suppliers and consumers.

The report also presents PESTLE analysis which helps to gain a macro picture of Laser cladding market. Political factors help to identify the influence of government over Laser cladding market. Economic factors a have direct impact on a company’s long-term prospects in a market. The economic environment may affect how a company dealing in Laser cladding price their products or influence the supply and demand model. Social factors, such as demographics and culture can impact the Laser cladding market by influencing peak buying periods, purchasing habits, and lifestyle choices.

Technological factors may have a direct or an indirect influence on an industry. The legal and regulatory environment can affect the policies and procedures of an industry, and can control employment, safety and regulations. Environmental factors include all those relating to the physical environment and to general environmental protection requirements.

Laser cladding market scope:

|

Laser Cladding Market |

|

|

Market Size in 2025 |

USD 763.81 Mn. |

|

Market Size in 2032 |

USD 1450.97 Mn. |

|

CAGR (2026-2032) |

9.6% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By Revenue

|

|

|

By End-use Industry

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Laser cladding market key players:

- TRUMPF (Germany)

- OC Oerlikon Management AG (Switzerland)

- Coherent, Inc (US)

- IPG Photonics Corporation (US)

- Han’s Laser Technology Industry Group Co., Ltd. (China)

- Hoganas AB (Sweden)

- Lumibird (France)

- Lumentum Operations LLC (US)

- Curtiss-Wright Corporation (US)

- Jenoptik (Germany)

- Laserline GmbH (Germany)

- NUTECH Gesellschaft für Lasertechnik und Materialprüfung mbH (Germany)

- Titanova Inc. (US)

- Hardchrome Engineering (Australia)

- LaserBond Ltd (Australia)

- Praxair S.T. Technology Inc. (US)

- Alabama Specialty Products Inc. (US)

- YANMAR HOLDINGS CO. LTD (India)

Frequently Asked Questions

TRUMPF (Germany), OC Oerlikon Management AG (Switzerland), Coherent, Inc (US), IPG Photonics Corporation (US), Han’s Laser Technology Industry Group Co., Ltd. (China), Hoganas AB (Sweden), Lumibird (France), Lumentum Operations LLC (US), Curtiss-Wright Corporation (US), Jenoptik (Germany), Laserline GmbH (Germany), NUTECH Gesellschaft für Lasertechnik und Materialprüfung mbH (Germany), Titanova Inc. (US), Hardchrome Engineering (Australia), LaserBond Ltd (Australia), Praxair S.T. Technology Inc. (US), Alabama Specialty Products Inc. (US) and YANMAR HOLDINGS CO. LTD (India)are the key players in Laser cladding market.

Diode laser is dominating the Laser cladding market.

The segments covered in Laser cladding market report are based on type, revenue, end-use industry and region.

The forecast period for the Laser cladding market is 2026-2032.

- Scope of the Report

- Research Methodology

- Research Process

- Global Laser Cladding Market: Target Audience

- Global Laser Cladding Market: Primary Research (As per Client Requirement)

- Global Laser Cladding Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2025(%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry:- M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2025(%)

- Global Laser Cladding Market Segmentation

- Global Laser Cladding Market, by Region (2025-2032)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Laser Cladding Market, by Type (2025-2032)

- Fiber Laser

- Diode Laser

- YAG Laser

- CO2 Laser

- Others

- Global Laser Cladding Market, by Revenue (2025-2032)

- Laser revenues

- System revenues

- Global Laser Cladding Market, by End-use Industry (2025-2032)

- Oil & Gas

- Aerospace & Defence

- Automotive

- Power Generation

- Mining

- Global Laser Cladding Market, by Region (2025-2032)

- North America Laser Cladding Market Segmentation

- North America Laser Cladding Market, by Type (2025-2032)

- Fiber Laser

- Diode Laser

- YAG Laser

- CO2 Laser

- Others

- North America Laser Cladding Market, by Revenue (2025-2032)

- Laser revenues

- System revenues

- North America Laser Cladding Market, by End-use Industry (2025-2032)

- Oil & Gas

- Aerospace & Defence

- Automotive

- Power Generation

- Mining

- North America Laser Cladding Market, by Country (2025-2032)

- United States

- Canada

- Mexico

- North America Laser Cladding Market, by Type (2025-2032)

- Europe Laser Cladding Market Segmentation

- Europe Laser Cladding Market, by Type (2025-2032)

- Europe Laser Cladding Market by Revenue (2025-2032)

- Europe Laser Cladding Market by End-use Industry (2025-2032)

- Europe Laser Cladding Market, by Country (2025-2032)

- Asia Pacific Laser Cladding Market Segmentation

- Asia Pacific Laser Cladding Market, by Type (2025-2032)

- Asia Pacific Laser Cladding Market, by Revenue (2025-2032)

- Asia Pacific Laser Cladding Market, by End-use Industry (2025-2032)

- Asia Pacific Laser Cladding Market, by Country (2025-2032)

- Middle East and Africa Laser Cladding Market Segmentation

- Middle East and Africa Laser Cladding Market, by Type (2025-2032)

- Middle East and Africa Laser Cladding Market, by Revenue (2025-2032)

- Middle East and Africa Laser Cladding Market, by End-use Industry (2025-2032)

- Middle East and Africa Laser Cladding Market, by Country (2025-2032)

- South America Laser Cladding Market Segmentation

- South America Laser Cladding Market, by Type (2025-2032)

- South America Laser Cladding Market, by Revenue (2025-2032)

- South America Laser Cladding Market, by End-use Industry (2025-2032)

- South America Laser Cladding Market, by Country (2025-2032)

- Company Profiles

- Key Players

- TRUMPF (Germany)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- OC Oerlikon Management AG (Switzerland)

- Coherent, Inc (US)

- IPG Photonics Corporation (US)

- Han’s Laser Technology Industry Group Co., Ltd. (China)

- Hoganas AB (Sweden)

- Lumibird (France)

- Lumentum Operations LLC (US)

- Curtiss-Wright Corporation (US)

- Jenoptik (Germany)

- Laserline GmbH (Germany)

- NUTECH Gesellschaft für Lasertechnik und Materialprüfung mbH (Germany)

- Titanova Inc. (US)

- Hardchrome Engineering (Australia)

- LaserBond Ltd (Australia)

- Praxair S.T. Technology Inc. (US)

- Alabama Specialty Products Inc. (US)

- YANMAR HOLDINGS CO. LTD (India)

- TRUMPF (Germany)

- Key Players

- Key Findings

- Recommendations