Industry 4.0 Market: Analysis of Global Market Share of Industrial IoT and Cyber-Physical Systems in Industry 4.0 Ecosystems

The Industry 4.0 Market is expected to reach from USD 257.41 billion in 2025 to USD 1147.40 billion by 2032, at a CAGR of 23.8 % during the forecast period. The demand for automation in manufacturing has been a significant driver for the industry 4.0 market. In 2025, the global deployment of Connected IOT devices was reached to value USD 22.4 Billion, reflecting a 14% annual growth over 2024 and highlighting the expanding adoption of Industry 4.0.

Format : PDF | Report ID : SMR_276

Industry 4.0 Market Overview

Industry 4.0 adoption is primarily driven by the usage of Industrial 4.0 technologies like the Internet of Things (IoT), Artificial intelligence (AI), and big data analytics in manufacturing. It empowers manufacturers to improve efficiency, automate processes, and new innovative products and services. In 2025, 542,000 Units advanced robots were Installed. Asia Pacific region has accounted for more than 73% of new deployments compared with 15.8% in Europe and 8.90% in the Americas. China has recorded the 54% of global deployments of advanced robots in 2025.

Key Market Highlights

- Based on the End user industry, Industrial manufacturing sector held the dominant share of 34% in 2025 and Pharmaceuticals & healthcare manufacturing segment is expected to grow at a more than 25% rate of CAGR during the forecast period.

- North America held the maximum share in the AI in manufacturing Market with a share of 43.05% in 2025.

- In the Global Industry 4.0 Market, North America accounted 36% share in 2025 and USA is projected to be continue its dominance during the forecast period.

- Large Enterprises held the leading position in the industry 4.0 technologies market with a share of 66% in the global Industry 4.0 Market in 2025

- In Asia Pacific, Japan has maintained its second leading position for installation of industrial robots, with 44,000 units installed in 2025.

To get more Insights: Request Free Sample Report

Private 5G Networks: Becoming A Cornerstone of Industry 4.0.

The private 5G offers dedicated, low-latency connectivity within a defined area, which is permitting real-time automation, AI-driven predictive maintenance, seamless integration of IoT sensors, and improved workforce safety. It helps to drive operational efficiency and smart manufacturing use cases over traditional wireless systems. EMSTEEL Group, who is one of the largest steels and building materials manufacturer has launched private 5G network in the manufacturing industry collaborating with UAE. Global Private 5G Networks Market was valued at 3.85 Bn and it is expected to grow at a CAGR of 36.7% rate during the forecast period.

Artificial Intelligence: More than 90% of Manufacturers are expected to invest into AI/ML in the forecast Year (2025-2032)

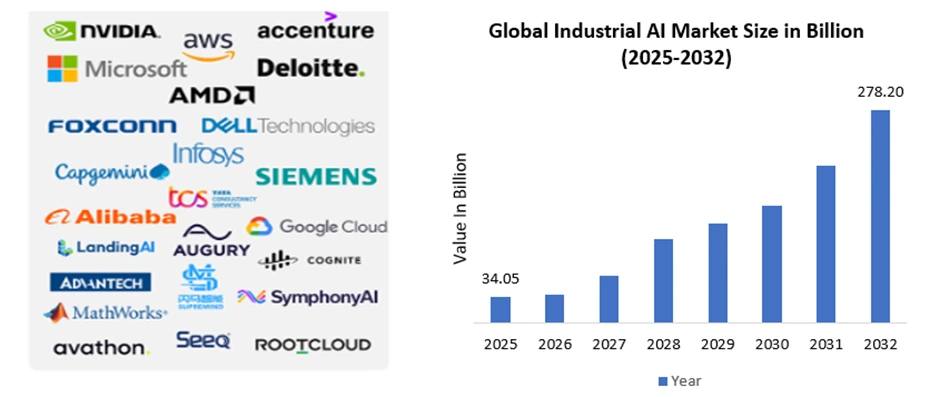

The adoption of AI in the second half of 2025 has increased by 1.2 % compared to the first half of the year across the globe. The adoption rate of AI across developed region is at 24.7% of the working age population, which is far higher than the adoption rate as 14.1% across underdeveloped countries. Accroding to the SMR Analysis, 40% of Manufcaturing sectors are focusing to invest in factory automation hardware, 32% are expected to focus on active sensors and more than 25% are expected to prioritize computer vision systems in the near future. Our analysis also states that more than 85% of manufacturing companies are expected growth by investing in AI-powered smart factories. The AI in manufacturing market was valued at USD 34.05 billion in 2025 and is expected to grow at a more than 35% rate of CAGR during the forecast period.

Industry 4.0 Market Segment Analysis

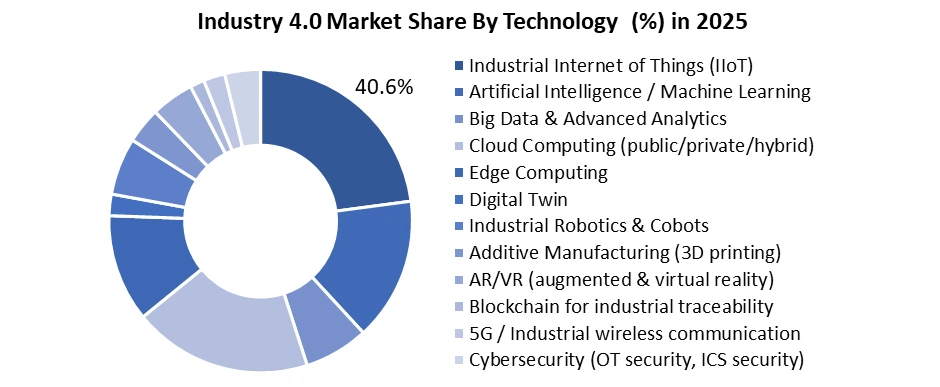

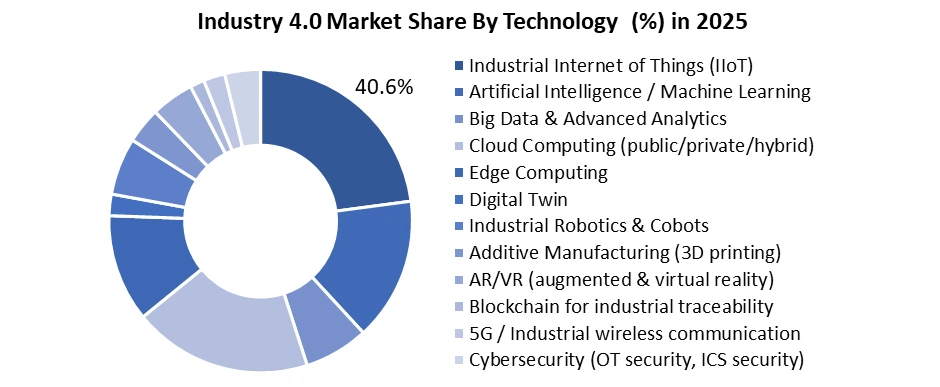

Industrial Internet of Things (IIoT) held the dominant position in the global Industry 4.0 market with a share of more than 40% in 2025. It lies at the heart of Industry 4.0, which enabling machines to communicate to one another and human operators. It also facilitates real-time data exchange and insights, which drives efficiency, productivity and flexible operations. An adoption of Internet of Things is expected to improve more than 22% in productivity of employee over the forecast period. Advanced robotice adoption makes operations more flexible and easier to quickly adjust to changing production needs. It helps to save cost by replacing a single shift worker. The global industrial internet of things market size was valed at USD 196.4 Bn in 2025.

The digital twin market was valued at USD 36.19 billion in 2025 and it is expected to grow at a CAGR of 35% during the forecast period. The digital twins are expected to cut maintenance costs by 15% to 55% in the forecast year (2025-2032). It is also expected to cut down on the time when assets were not working by 20%. The global augmented reality market was valued at USD 83.65 billion in 2025 and is projected to grow at a 37% rate of CAGR during the forecast period. Smart contracts are expected to cut lower transaction fees by up to 50% and administrative costs by 40% in manufacturing sector using blockchain technology.

Industry 4.0 Market Regional Analysis:

North America held a dominant position with a global industry 4.0 market share of 36% in 2025. High investments in automation and IoT technologies across industries like automotive, electronics, and pharmaceuticals are some of the prominent drivers behind the IOT devices adoption. The United States is a key adopter of smart manufacturing solutions, with key technology providers encouraging forward AI, IIoT, and cybersecurity innovations. Europe follows closely, with strong adoption in Germany, France, and the UK. Currently, European Commission has adopted Horizon Europe work programme for 2026-2027 with a USD 16.33 Bn investment to drive innovations across Strategic goals of Europe Union. It includes achievement of climate neutrality, increasing the use of artificial intelligence (AI) in research and innovation and safeguarding resilience in a rapidly changing world. In the UK, more than 75% of financial firms use some form of artificial intelligence. AI adoption has permitted financial, banking, and insurance companies to rely on automated data analysis tools, workflow automation solutions that reduce human errors.

- USA is the leader in AI infrastructure and frontier model development with a 28.3% usage rate in 2025.

- United Arab Emirates, Singapore, Norway, Ireland, France, and Spain have invested early in digital infrastructure, AI skilling, and government adoption.

- Despite government initiatives such as “Make in India” or “Digital India” have given a boost, Adoption of Industry 4.0 in India has been slack compared to many other leading countries like the United States of America, Germany and China

Industry 4.0 Market Competitive Landscape:

2026 is highlighting a dynamic structure of next-generation technology providers in the Global Industry 4.0 Market. The startups are representing strong innovation drive across RTLS, digital twins, IIoT, robotics, edge computing, AI-driven analytics, and smart manufacturing systems. Startups like ViTrack Solutions and Scitech Industries are empowering shop-floor visibility and operational efficiency through RTLS and IIoT Industrial 4.0 platforms. The MetAI and PlockControl are integrating adoption of digital twins for smarter design, simulation, and manufacturing optimization. The startup players like Makon Teknoloji, Industry Tech Solutions, and Robco are enabling flexible, robotics-led factory automation, reinforced by edge computing and vision AI solutions from companies like Things Embedded and BlueCore Technology. The landscape is showing a digital platform shift toward data-centric, autonomous, and sustainable manufacturing models, strengthening the Industry 4.0 market’s role in enlightening productivity, quality, risk management, and long-term industrial competitiveness.

Recent Developments:

|

Date |

Description |

|

2025 |

Bharat Sanchar Nigam Limited (BSNL) and Numaligarh Refinery Limited (NRL) has signed a Memorandum of Understanding (MoU). Both companies are expected to collaborate to deploy India’s first 5G CNPN (Captive Non-Public Network) inside the refinery sector, steering in a new era of secure, ultra-reliable, and real-time industrial connectivity. |

|

2025 |

Rockwell Automation made a strategic investment in RightHand Robotics, enhancing its logistics automation portfolio by integrating robotic piece-picking with AutoStore ASRS and OTTO Motors AMRs. |

|

2025 |

Ericsson deployed private 5G at Jaguar Land Rover’s Solihull plant, enabling real-time IoT data and vision analytics as part of the UK-funded West Midlands 5G program |

INDUSTRY 4.0 Market Scope

|

INDUSTRY 4.0 Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2019 to 2025 |

Market Size in 2025: |

USD 257.41 Bn |

|

Forecast Period 2025 to 2032 CAGR: |

23.8 % |

Market Size in 2032: |

USD 1,147.40 Bn |

|

INDUSTRY 4.0 Market Segments Covered: |

By Component |

Hardware Software Services |

|

|

By Technology |

Industrial Internet of Things (IIoT) Artificial Intelligence / Machine Learning Big Data & Advanced Analytics Cloud Computing (public/private/hybrid) Edge Computing Digital Twin Industrial Robotics & Cobots Additive Manufacturing (3D printing) AR/VR (augmented & virtual reality) Blockchain for industrial traceability 5G / Industrial wireless communication Cybersecurity (OT security, ICS security) |

||

|

By Deployment Model |

On-Premises Cloud Hybrid |

||

|

By Enterprise Size

|

Large Enterprises Small & Medium Enterprises (SMEs) |

||

|

By End-Use Industry |

Automotive Electronics & semiconductor manufacturing Industrial manufacturing / discrete manufacturing Process industries (chemicals, oil & gas, refining) Food & beverages Pharmaceuticals & healthcare manufacturing Metals & mining Energy & power (utilities) Aerospace & defense Packaging Logistics & warehousing Pulp & paper Others |

||

INDUSTRY 4.0 industry key Players

- Siemens AG

- ABB Ltd.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Cisco Systems Inc.

- Intel Corporation

- IBM Corporation

- Nvidia Corporation

- DENSO Corporation

- Fanuc Corporation

- Hewlett Packard Enterprise

- Robert Bosch GmbH

- SAP SE

- Stratasys Ltd.

- Swisslog Holding AG

- Techman Robot Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Cognex Corporation

- Toshiba Corporation

- Universal Robots

- PTC Inc.

- AVEVA Group

- Oracle Corporation

- Microsoft Corporation

- Google Cloud (Alphabet Inc.)

- Infor

- Epicor Software Corporation

- KUKA AG

- Pepperl+Fuchs SE

- Addverb Technologies

- Unitronics

- FORCAM GmbH

- Radixweb

- Visual Decisions

- Expert Global Solutions

- Bosch Rexroth AG

- Festo AG & Co. KG

- TRUMPF GmbH + Co. KG

- Kion Group

Frequently Asked Questions

North America held the dominant position in the Global Industry 4.0 Market in 2025.

The Global Industry 4.0 Market is growing at a CAGR of 23.8% during the forecasting period 2025-2032.

The industry 4.0 market is expected to reach to a Value USD 1147.40 Bn by 2032.

Established players like Siemens AG, Rockwell Automation, ABB Ltd., Schneider Electric, Honeywell International, and Emerson Electric are offering broad portfolios spanning Industrial Internet of Things (IIoT), advanced analytics, digital twins, and robotic automation.

1. INDUSTRY 4.0 Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global INDUSTRY 4.0 Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2024

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. INDUSTRY 4.0 Market: Dynamics

3.1. INDUSTRY 4.0 Market Trends

3.2. INDUSTRY 4.0 Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Pricing & Cost Structure Analysis (2025)

4.1.1. Average Selling Price Trends by Hardware Product

4.1.2. Technology Cost Impact (AI, Robotics, IoT)

4.1.3. Manufacturing Cost Structure

4.1.4. Regional Price Variations

4.1.5. Incentive-Driven Pricing

4.1.6. Future Pricing Outlook

5. Technology Landscape

5.1.1. IIoT Adoption & Trends

5.1.2. AI & Machine Learning Innovations

5.1.3. Industrial Robotics & Cobots Developments

5.1.4. Digital Twin Technology

5.1.5. Edge Computing & Cloud Solutions

5.1.6. Cybersecurity for Industrial Systems

5.1.7. 5G Integration in Manufacturing

5.1.8. Blockchain for Traceability & Supply Chain Management

6. Regulatory & Policy Framework

6.1.1. Global Industry 4.0 Regulations

6.1.2. Technology Standards Impact

6.1.3. Data Privacy and Cybersecurity Regulations

6.1.4. Subsidies & Incentives for Industry 4.0 Adoption

6.1.5. Health & Safety Standards in Smart Factories

6.1.6. Policy Outlook for Industry 4.0 Technologies

7. End User Adoption Trends (2025)

7.1.1. Purchase Decision Factors for Industry 4.0 Technologies

7.1.2. Price Sensitivity in Industry 4.0 Solutions

7.1.3. Brand Perception in Industrial Automation

7.1.4. Adoption Trends by Region & Industry

7.1.5. Small & Medium Enterprises (SMEs) vs Large Enterprises

7.1.6. Cost of Ownership and ROI Analysis in Industry 4.0

8. INDUSTRY 4.0 Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

8.1.1. Hardware

8.1.2. Software

8.1.3. Services

8.2. INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

8.2.1. Industrial Internet of Things (IIoT)

8.2.2. Artificial Intelligence / Machine Learning

8.2.3. Big Data & Advanced Analytics

8.2.4. Cloud Computing (public/private/hybrid)

8.2.5. Edge Computing

8.2.6. Digital Twin

8.2.7. Industrial Robotics & Cobots

8.2.8. Additive Manufacturing (3D printing)

8.2.9. AR/VR (augmented & virtual reality)

8.2.10. Blockchain for industrial traceability

8.2.11. 5G / Industrial wireless communication

8.2.12. Cybersecurity (OT security, ICS security)

8.3. INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

8.3.1. On-Premises

8.3.2. Cloud

8.3.3. Hybrid

8.4. INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

8.4.1. Large Enterprises

8.4.2. Small & Medium Enterprises (SMEs)

8.5. INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

8.5.1. Automotive

8.5.2. Electronics & semiconductor manufacturing

8.5.3. Industrial manufacturing / discrete manufacturing

8.5.4. Process industries (chemicals, oil & gas, refining)

8.5.5. Food & beverages

8.5.6. Pharmaceuticals & healthcare manufacturing

8.5.7. Metals & mining

8.5.8. Energy & power (utilities)

8.5.9. Aerospace & defense

8.5.10. Packaging

8.5.11. Logistics & warehousing

8.5.12. Pulp & paper

8.5.13. Others

8.6. INDUSTRY 4.0 Market Size and Forecast, By Region (2025-2032)

8.6.1. North America

8.6.2. Europe

8.6.3. Asia Pacific

8.6.4. Middle East and Africa

8.6.5. South America

9. North America INDUSTRY 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. North America INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

9.2. North America INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

9.3. North America INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

9.4. North America INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

9.5. North America INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

9.6. North America INDUSTRY 4.0 Market Size and Forecast, by Country (2025-2032)

9.6.1. United States

9.6.2. Canada

9.6.3. Mexico

10. Europe INDUSTRY 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. Europe INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

10.2. Europe INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

10.3. Europe INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

10.4. Europe INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

10.5. Europe INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

10.6. Europe INDUSTRY 4.0 Market Size and Forecast, by Country (2025-2032)

10.6.1. United Kingdom

10.6.1.1. United Kingdom INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

10.6.1.2. United Kingdom INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

10.6.1.3. United Kingdom INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

10.6.1.4. United Kingdom INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

10.6.1.5. United Kingdom INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

10.6.2. France

10.6.3. Germany

10.6.4. Italy

10.6.5. Spain

10.6.6. Sweden

10.6.7. Russia

10.6.8. Rest of Europe

11. Asia Pacific INDUSTRY 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

11.1. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

11.2. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

11.3. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

11.4. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

11.5. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

11.6. Asia Pacific INDUSTRY 4.0 Market Size and Forecast, by Country (2025-2032)

11.6.1. China

11.6.2. S Korea

11.6.3. Japan

11.6.4. India

11.6.5. Australia

11.6.6. Indonesia

11.6.7. Malaysia

11.6.8. Philippines

11.6.9. Thailand

11.6.10. Vietnam

11.6.11. Rest of Asia Pacific

12. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast (by Value in USD Million) (2025-2032)

12.1. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

12.2. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

12.3. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

12.4. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

12.5. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

12.6. Middle East and Africa INDUSTRY 4.0 Market Size and Forecast, by Country (2025-2032)

12.6.1. South Africa

12.6.2. GCC

12.6.3. Egypt

12.6.4. Nigeria

12.6.5. Rest of ME&A

13. South America INDUSTRY 4.0 Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

13.1. South America INDUSTRY 4.0 Market Size and Forecast, By Component (2025-2032)

13.2. South America INDUSTRY 4.0 Market Size and Forecast, By Technology (2025-2032)

13.3. South America INDUSTRY 4.0 Market Size and Forecast, By Deployment Model (2025-2032)

13.4. South America INDUSTRY 4.0 Market Size and Forecast, By Enterprise Size (2025-2032)

13.5. South America INDUSTRY 4.0 Market Size and Forecast, By End-Use Industry (2025-2032)

13.6. South America INDUSTRY 4.0 Market Size and Forecast, by Country (2025-2032)

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Colombia

13.6.4. Chile

13.6.5. Rest Of South America

14. Company Profile: Key Players

14.1. Siemens AG

14.1.1. Company Overview

14.1.2. Business Portfolio

14.1.3. Financial Overview

14.1.4. SWOT Analysis

14.1.5. Strategic Analysis

14.1.6. Recent Developments

14.1.7. BYD Auto

14.2. ABB Ltd.

14.3. Rockwell Automation, Inc.

14.4. Schneider Electric SE

14.5. Cisco Systems Inc.

14.6. Intel Corporation

14.7. IBM Corporation

14.8. Nvidia Corporation

14.9. DENSO Corporation

14.10. Fanuc Corporation

14.11. Hewlett Packard Enterprise

14.12. Robert Bosch GmbH

14.13. SAP SE

14.14. Stratasys Ltd.

14.15. Swisslog Holding AG

14.16. Techman Robot Inc.

14.17. Mitsubishi Electric Corporation

14.18. Emerson Electric Co.

14.19. Cognex Corporation

14.20. Toshiba Corporation

14.21. Universal Robots

14.22. PTC Inc.

14.23. AVEVA Group

14.24. Oracle Corporation

14.25. Microsoft Corporation

14.26. Google Cloud (Alphabet Inc.)

14.27. Infor

14.28. Epicor Software Corporation

14.29. KUKA AG

14.30. Pepperl+Fuchs SE

14.31. Addverb Technologies

14.32. Unitronics

14.33. FORCAM GmbH

14.34. Radixweb

14.35. Visual Decisions

14.36. Expert Global Solutions

14.37. Bosch Rexroth AG

14.38. Festo AG & Co. KG

14.39. TRUMPF GmbH + Co. KG

14.40. Kion Group

15. Key Findings

16. Analyst Recommendations

17. INDUSTRY 4.0 Market: Research Methodology