Fish Oil Market Industry Analysis and Forecast (2026-2032) Drivers, Statistics, Dynamics, Segmentation by Process, Product and End-Users

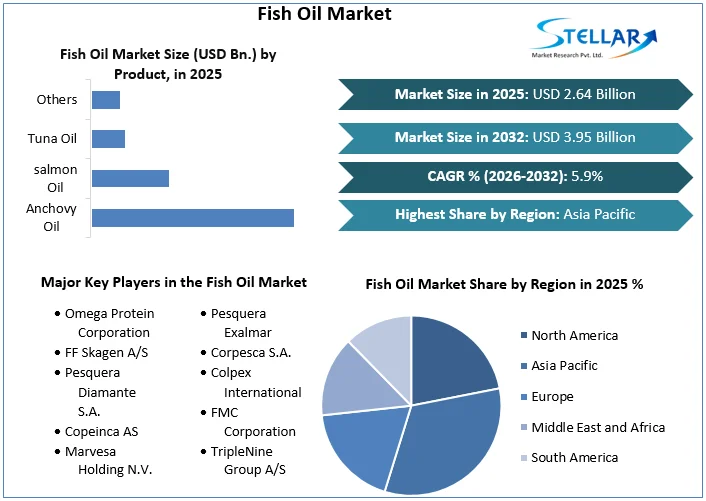

The Global Fish Oil Market size was valued at USD 2.64 Billion in 2025 and the total Fish Oil revenue is expected to grow at a CAGR of 5.9% from 2026 to 2032, reaching nearly USD 3.95 Billion by 2032.

Format : PDF | Report ID : SMR_1602

The Fish Oil Market Overview

Fish oil is a dietary supplement made from the tissues of fatty or oily fish, like salmon, trout, mackerel, tuna, herring, and sardines. Because of its high concentration of omega-3 fatty acids, especially docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA), it has gained a particular importance. These omega-3 fatty acids are vital for many body processes, such as the control of inflammation and cardiovascular health and many more. With dose differences among formulations, fish oil supplements generally offer approximately 1,000 mg of fish oil, comprising 180 mg of EPA and 120 mg of DHA. It is well known that the omega-3 fatty acids in fish oil compete with arachidonic acid in the pathways of cyclooxygenase and lipoxygenase, consequently influencing physiological functions. Fish oil consumption has been linked to a number of health advantages, and triglyceride levels have been found to be reduced by products containing omega-3 fatty acids. On the other hand, anyone thinking about using fish oil supplements should be informed of the possible hazards and seek the guidance of medical professionals for specific recommendations.

The Global Fish market has witnessed a significant growth over the years due to several trends like the Increase in Aquaculture Activities, Health and Wellness trends and many more. The market has also positively impacted by some key driving factors which includes Increased Usage in Cosmetics, Rise in the focus on Omega-3 market and also certain Government recommendations in some countries, which has propelled the Overall growth for the Fish Oil Market.

The Global Fish Oil Market is primarily dominated by Asia-pacific, North America and Europe. With, Asia Pacific dominating the overall market for the Fish Oil with the largest share in the market of more than 32%. The region is driven by countries like China, India and Japan which uses fish oil as aqua feed. The Asian Pacific region is followed by North America with holding the second largest share in the market of about 27% with the U.S. being the biggest fish oil producer and consumer. Europe is considered to be the next emerging player in the Fish Oil Market with, Germany and UK contributing prominently in the region. The major key players who dominates the Fish Oil Market globally includes Omega Protein Corporation, FF Skagen A/S, Pesquera Diamante S.A., Copeinca AS, Marvesa Holding N.V., Pesquera Exalmar, Corpesca S.A., Colpex International, FMC Corporation, and TripleNine Group A/S.

To get more Insights: Request Free Sample Report

Fish Oil Market Dynamics

Trends-

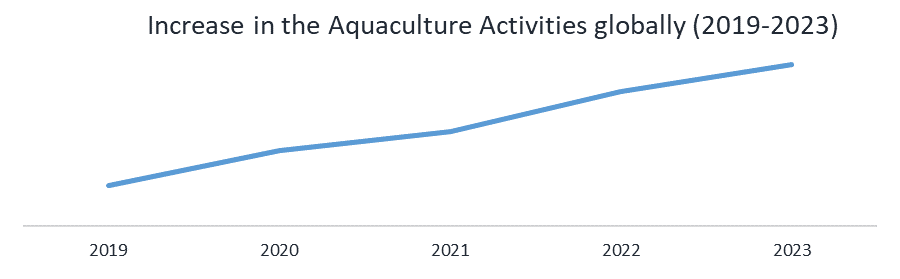

Increase in Aquaculture Activities, Aquaculture Activities refers to the breeding, raising, and harvesting of aquatic organisms, essentially farming in water. It encompasses the controlled cultivation of fish, shellfish, and aquatic plants in both marine and freshwater environments. Aquaculture is heavily dependent on the Fish Oil since it is used in fish feed, which supports the market's expansion. Aquaculture had a market worth of USD 245 million in 2021, and by 2030, it is projected to reach USD 532 million. Also, there have been many Fish Products start up introducing in the market which primarily relies on the Aquaculture which are seeing significant growth. It is therefore, expected that the growing emphasis on fish production increase demand for fish oil.

Health and Wellness, as a greater number of individuals are becoming aware of the health advantages of consuming fish oil, the market for fish oil has grown significantly. Customers who are concerned about their health are realizing the benefits of omega-3 fatty acids for heart, brain, and mental wellness which is ultimately driving the Fish Oil Market forward. Consequently, the demand for the fish oil market also surged in the Market, thanks to the consistent and positive growth of the Omega-3 market contributing to the overall growth of fish oil products. The demand for fish oils specialty sections in hypermarkets and supermarkets is rising, concluding that the global fish oil market is primed for expansion. Specialty online retailers have emerged in the fish oil market, giving customers easy access to a wide variety of fish oil products. These online stores serve customers looking for certain fish oil choices as well as providing the convenience of purchasing from any location, which enhances the market's expansion and general accessibility. Also, the overall demand saw a significant rise with the global consumption of fish oil surged to 3.6 million metric tons in 2022, witnessing a growth of 5.6% from the previous year.

Fish Oil Markets Drivers

Increased Usage in Cosmetics, the cosmetics sector is seeing a sharp increase in demand for fish oil, which is an important change from its conventional use as a dietary supplement. The rich concentration of omega-3 fatty acids in fish oil, which are recognized for their nourishing and skin-improving qualities, is the reason for this rising use of fish oil in cosmetic goods. Fish oil is being used in cosmetic formulations, especially skincare and hair care items, to capitalize on its moisturizing properties, which help to hydrate skin and encourage a glowing, healthy complexion. Fish oil is a beneficial ingredient in skincare products because of the anti-inflammatory qualities of omega-3s, which help ease skin issues and support the overall wellness-focused approach of beauty products.

Applications for fish oil have grown beyond skincare to include hair care products too. Fish oil contains omega-3 fatty acids, which are known to improve overall hair health, strengthen hair follicles, and lessen hair loss. Fish oil is being used by cosmetic industries to enhance shampoos, conditioners, and hair treatments, leveraging these advantages. This driving factor not only serves customers looking for all-natural beauty solutions, but it also grows the market for fish oil and demonstrates its usefulness outside of the conventional nutritional supplement space.

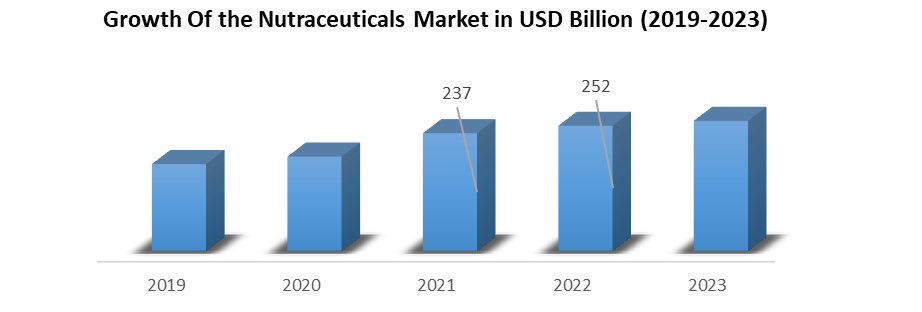

Nutraceutical Industry, The surge in consumer interest in preventative healthcare is driving the incredible development of the nutraceutical business. This pattern is especially noticeable in the rise in demand for nutraceuticals, such as supplements containing fish oil. When it comes to taking care of their health, consumers are becoming more proactive and looking for preventive measures rather than just reactive ones. Omega-3 fatty acid-rich fish oil supplements are becoming more and more well-known due to their possible health advantages, which has led to a major increase in the nutraceutical sector.

The shift in consumers' perceptions of supplements from optional extras to necessary parts of their daily routines is a major driver of this increase. As more people become aware of the potential health benefits of fish oil, they are adding these supplements to their daily routines. Fish oil contains omega-3 fatty acids, which are widely known for their beneficial effects on heart health, brain function, and general wellbeing. Customers see these supplements as a proactive move toward upholding a healthy lifestyle as knowledge about the benefits of fish oil for cardiovascular health and cognitive function grows. This change in customer behaviour is a major factor in the rising demand for nutraceuticals, particularly fish oil supplements, which has led to the significant market expansion seen in recent years.

Government Recommendations, The U.S. and Canadian fish oil markets are driven by government recommendations for the consumption of Omega-3 fatty acids, such as DHA and EPA. According to the 2020–2025 Dietary Guidelines for Americans published by the federal government, food should be the main source of nutrients, and seafood is a significant source of Omega–3 fatty acids. The Food and Drug Administration (FDA) of the United States has authorized qualified health claims for EPA and DHA-containing conventional foods and dietary supplements. These claims suggest that EPA and DHA consumption together lower blood pressure and hence lower the risk of coronary heart disease. Due to these suggestions, people are becoming more aware of the advantages Omega-3 fatty acids offer for their health and are using fish oil supplements because they are a handy way to get EPA and DHA. This concludes that the governments of several nations are actively taking part in creating awareness among the masses for the consumption of Fish Oil which significantly contribute to the expansion of the Fish Oil Market in the forecasting period.

Restraints Faced By the Fish Oil Market

Alternative Sources, The availability of substitute Omega-3 fatty acid sources such walnuts, chia seeds, and flaxseed have a variety of effects on the market's expansion for fish oil. Even though these plant-based substitutes for fish oil include Omega-3 fatty acids, customers prefer them because of dietary choices or limitations. Possible replacements for fish oil include other sources of Omega-3 fatty acids such stearidonic acid and algal oils. For example, algae oils present a prospective substitute source of DHA and EPA, while stearidonic acid has been found to have the ability to enhance EPA levels in fatty acids. The growing need for EPA and DHA is being met by looking into these alternate sources, especially since large-scale fish harvesting for Omega-3 fatty acids is no longer seen to be sustainable ultimately affecting the overall Fish Oil Market.

Environmental Concerns, Fish oil supplies have impacted by fishing rules and environmental concerns, making it more difficult to meet the rising demand for the Fish Oil globally. One such rising concern is the decrease in the production of fish oil from specific fisheries, mostly as a result of large juvenile captures and other problems. The world supply of fish oil has decreased by more than 12% as a result, posing difficulties for producers of aquaculture feed. The Fish Oil Market also faces a concerning challenge from the Aquaculture Industry’s feed flexibility. The flexibility of feed ingredients offered by aquaculture companies has increased, for example, rapeseed oil is used in place of fish oil. Due to this dilution, the sector has increased without being totally dependent on fish oil. Fish oil supply is impacted by fishing's negative environmental effects, such as overfishing and industrial fishing's effects on other ecosystem components. The environmental sustainability of aquaculture production is also an issue because it has a negative impact on the ecosystem when fish from the wild are mixed with pond water.

Fish Oil Market Segmentation

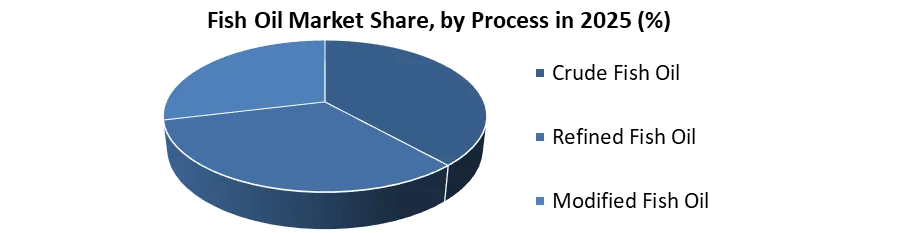

By Process, The Fish Oil Market is further divided into Crude Fish Oil, Refined Fish Oil and Modified Fish Oil. Crude Fish Oil is obtained by the first extraction method and is found in its natural state. It is generally utilized in industrial applications like aquaculture and animal feed and contains pollutants and impurities. The basic ingredient used to make refined and modified fish oil is called crude fish oil. Refined Fish Oil refers to the purer and of higher quality oil since it undergoes rigorous purification procedures to eliminate pollutants and impurities.

It is used for a variety of purposes, such as food and beverage goods, medications, nutritional supplements, and human consumption. Because of its exceptional quality and purity, refined fish oil holds the largest market share in the process industry. Whereas, Fish oil that has been specifically altered to improve its qualities or customize it for a given use is referred to as modified fish oil. Processes like concentration, enrichment, or adding particular chemicals to the fish oil are a few examples of this. Aquaculture, food and beverage, and nutritional supplement industries are just a few of the end-user businesses that employ modified fish oil.

By Product, The Fish Oil Market by Product is segmented into Anchovy Oil, Salmon Oil, Tuna Oil and others. With the Anchovy oil being the most commonly used fish oil in the market, accounting for the largest market share. It is obtained from anchovy fish and is used in various applications, including aquaculture feed, dietary supplements, and pharmaceuticals. The Anchovy Fish Oil is followed by the Salmon Fish oil holding the second largest market share. It is used in various applications, including dietary supplements, pet food, and aquaculture feed. Tune Oil is obtained from Tuna Fish and its application includes aquaculture feed, dietary supplements, pharmaceuticals, and pet food.

By End-User, Segment is further classified into Aquaculture, Animal Feed, Nutritional Supplements, Pharmaceuticals and others. In Aquaculture, Fish Oil offers vital nutrients for the growth and development of farmed fish, fish oil is a crucial component of aqua feed products. Animal Feed uses Fish Oil for improving the health and productivity of livestock, such as poultry and pigs. Nutritional Supplements are popular among consumers seeking to improve their health and well-being, as they are rich in Omega-3 fatty acids, which have numerous health benefits. Fish Oil is also used in pharmaceutical products to treat various health conditions, such as heart disease and high blood pressure. Fish Oil is also used in functional foods, cosmetics, and other applications.

Competitive Landscape of the Fish Oil Market

The US, Germany, Australia, India, and China are the main nations driving the demand for fish oil, and these regions control about 15% of the market share. Over the next ten years, the fish oil market in North America is expected to rise at a compound annual growth rate (CAGR) of almost 6.7%. The fish oil market is dominated by the Asia-Pacific region, especially China, and is projected to increase significantly in the next years. Omega Protein Corporation, FF Skagen A/S, Pesquera Diamante S.A., Copeinca AS, Marvesa Holding N.V., Pesquera Exalmar, Corpesca S.A., Colpex International, FMC Corporation, and TripleNine Group A/S are the Key Players dominating the Fish Oil Market globally.

The Omega Protein Corporation recently completed the construction of the Health and Science Centre (HSC) in Virginia, which is the only fully-integrated fish oil processing facility in the United States, making the firm go one step ahead in the Fish Oil Market. Two new premix locations were opened by DSM Nutritional Products in Guayaquil, Ecuador, and Tocipá, Colombia, as part of its global premix portfolio making its strong foothold in the Fish Oil Market. The company has also been able to maintain its position in the animal nutrition and health sector and enhance its production capacities thanks to this expansion. The Firm has also launched two strategic initiatives, 'Fit for Growth' and 'We Make it Possible,' to pave the way for future growth in the animal nutrition and health market.

Which help the organization to enhance its operational efficiency, address various market difficulties, and institute a transparent and accountable framework. GC Rieber VivoMega, a global supplier of omega-3 concentrates involves an investment of $75 million spread over five years. The investment is intended to improve the technology platforms and production capabilities of the business. Also, Pelagia (EPAX) a company headquartered in Norway, in 2023 invested $40 million in an effort to improve the manufacturing of omega-3 supplements with a high concentration. Through this investment, the re-esterification process was improved, and specialized equipment was purchased to enhance the manufacturing process as a whole.

|

Fish Oil Market Scope |

|

|

Market Size in 2025 |

USD 2.64 Bn. |

|

Market Size in 2032 |

USD 3.95 Bn. |

|

CAGR (2026-2032) |

5.9% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Process

|

|

By Product

|

|

|

By End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Fish Oil Market

- Omega Protein Corporation

- FF Skagen A/S

- Pesquera Diamante S.A.

- Copeinca AS

- Marvesa Holding N.V.

- Pesquera Exalmar

- Corpesca S.A.

- Colpex International

- FMC Corporation

- TripleNine Group A/S

Regional Breakdown:

Europe Fish Oil Market: Industry Analysis and Forecast (2024-2030)

Asia Pacific Fish Oil Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

The Fish Oil Market is expected to grow at a CAGR of 5.9% during forecasting period 2026-2032.

Fish Oil Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The important key players in the Fish Oil Market are – Omega Protein Corporation, FF Skagen A/S, Pesquera Diamante S.A., Copeinca AS, Marvesa Holding N.V., Pesquera Exalmar, Corpesca S.A., Colpex International, FMC Corporation, and TripleNine Group A/S

The Global Market is studied from 2026 to 2032.

1. Fish Oil Market: Research Methodology

2. Fish Oil Market: Executive Summary

3. Fish Oil Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Fish Oil Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Fish Oil Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Fish Oil Market Size and Forecast, by Process mode (2025-2032)

5.1.1. Crude Fish Oil

5.1.2. Refined Fish Oil

5.1.3. Modified Fish Oil

5.2. Fish Oil Market Size and Forecast, by Product Type(2025-2032)

5.2.1. Anchovy Oil

5.2.2. salmon Oil

5.2.3. Tuna Oil

5.2.4. Others

5.3. Fish Oil Market Size and Forecast, by End-User(2025-2032)

5.3.1. Aquaculture

5.3.2. Animal Feed

5.3.3. Nutritional Supplements

5.3.4. Pharmaceuticals

5.3.5. Others

5.4. Fish Oil Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Fish Oil Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Fish Oil Market Size and Forecast, by Process mode (2025-2032)

6.1.1. Crude Fish Oil

6.1.2. Refined Fish Oil

6.1.3. Modified Fish Oil

6.2. North America Fish Oil Market Size and Forecast, by Product (2025-2032)

6.2.1. Anchovy Oil

6.2.2. salmon Oil

6.2.3. Tuna Oil

6.2.4. Others

6.3. North America Fish Oil Market Size and Forecast, by End-User (2025-2032)

6.3.1. Aquaculture

6.3.2. Animal Feed

6.3.3. Nutritional Supplements

6.3.4. Pharmaceuticals

6.3.5. Others

6.4. North America Fish Oil Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Fish Oil Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Fish Oil Market Size and Forecast, by Process mode (2025-2032)

7.1.1. Crude Fish Oil

7.1.2. Refined Fish Oil

7.1.3. Modified Fish Oil

7.2. Europe Fish Oil Market Size and Forecast, by Product (2025-2032)

7.2.1. Anchovy Oil

7.2.2. salmon Oil

7.2.3. Tuna Oil

7.2.4. Others

7.3. Europe Fish Oil Market Size and Forecast, by End-User (2025-2032)

7.3.1. Aquaculture

7.3.2. Animal Feed

7.3.3. Nutritional Supplements

7.3.4. Pharmaceuticals

7.3.5. Others

7.4. Europe Fish Oil Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Fish Oil Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Fish Oil Market Size and Forecast, by Process mode (2025-2032)

8.1.1. Crude Fish Oil

8.1.2. Refined Fish Oil

8.1.3. Modified Fish Oil

8.2. Asia Pacific Fish Oil Market Size and Forecast, by Product (2025-2032)

8.2.1. Anchovy Oil

8.2.2. salmon Oil

8.2.3. Tuna Oil

8.2.4. Others

8.3. Asia Pacific Fish Oil Market Size and Forecast, by End-User (2025-2032)

8.3.1. Aquaculture

8.3.2. Animal Feed

8.3.3. Nutritional Supplements

8.3.4. Pharmaceuticals

8.3.5. Others

8.4. Asia Pacific Fish Oil Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Fish Oil Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Fish Oil Market Size and Forecast, by Process mode (2025-2032)

9.1.1. Crude Fish Oil

9.1.2. Refined Fish Oil

9.1.3. Modified Fish Oil

9.2. Middle East and Africa Fish Oil Market Size and Forecast, by Product (2025-2032)

9.2.1. Anchovy Oil

9.2.2. salmon Oil

9.2.3. Tuna Oil

9.2.4. Others

9.3. Middle East and Africa Fish Oil Market Size and Forecast, by End-User (2025-2032)

9.3.1. Aquaculture

9.3.2. Animal Feed

9.3.3. Nutritional Supplements

9.3.4. Pharmaceuticals

9.3.5. Others

9.4. Middle East and Africa Fish Oil Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Fish Oil Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Fish Oil Market Size and Forecast, by Process mode (2025-2032)

10.1.1. Crude Fish Oil

10.1.2. Refined Fish Oil

10.1.3. Modified Fish Oil

10.2. South America Fish Oil Market Size and Forecast, by Product (2025-2032)

10.2.1. Anchovy Oil

10.2.2. salmon Oil

10.2.3. Tuna Oil

10.2.4. Others

10.3. South America Fish Oil Market Size and Forecast, by End-User (2025-2032)

10.3.1. Aquaculture

10.3.2. Animal Feed

10.3.3. Nutritional Supplements

10.3.4. Pharmaceuticals

10.3.5. Others

10.4. South America Fish Oil Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Oracle

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

12. Omega Protein Corporation

13. FF Skagen A/S

14. Pesquera Diamante S.A.

15. Copeinca AS

16. Marvesa Holding N.V.

17. Pesquera Exalmar

18. Corpesca S.A.

19. Colpex International

20. FMC Corporation

21. TripleNine Group A/S