Corporate Wellness Market- Global Industry Analysis and Forecast (2025-2032) by Service, Delivery Model and End-User

The Corporate Wellness Market size was valued at US$ 69.45 Bn. in 2024 and the total Global Corporate Wellness Market revenue is expected to grow at a CAGR of 7.1%% from 2025 to 2032, reaching nearly USD 120.23 Bn.

Format : PDF | Report ID : SMR_1643

Corporate Wellness Market Overview

The term "corporate wellness" describes the policies and programs that businesses use to encourage and support their workers' general health and well-being. Beyond only basic health advantages, this idea encompasses work-life balance, financial security, social relationships, and physical, mental, and emotional well-being. Proficient corporate wellness initiatives cultivate a constructive workplace atmosphere, augment workforce involvement, and augment efficiency. They result in decreased healthcare expenses, a decrease in absenteeism, and an improvement in worker satisfaction and retention. Corporate wellness Market programs usually encompass a variety of activities and services, including work-life balance assistance, stress management training, mental health seminars, preventative health screenings, fitness programs, and healthy eating initiatives. They also use technology to monitor development, involve staff, and provide personalized content according to each user's requirements.

The Corporate Wellness Market is driven by several factors such as a Rise in Awareness and Emphasis on Employee Well-Being, Technical Advancements, Increasing investment in Mental Health and Stress Management Programs, and Holistic Approach and personalization toward the employees. The Corporate Wellness Market growth is hindered by some major restraints such as the High Cost of Workplace Wellness, Limited Program Offering, Concerns about Data Privacy and Security, Slow adoption, and Lack of Awareness. The Corporate Wellness Market is segmented into 3 components mainly- By Service, Delivery Model, and End-User.

The Corporate Wellness Market is dominated by the North American Region holding a Corporate Wellness market share of 38.01% in 2023. The domination is majorly attributed to the rising shift towards employee wellness, the availability of wellness providers, and the rise in the investments of employers. North America is followed by Europe having the second-largest market share primarily because of the rising adoption of corporate wellness services conducted by organizations for enhancing workplace productivity. On the other hand APAC region is projected to witness the highest CAGR for the projected time frame because of its growing number of organizations, rise in awareness, and growing investments by employers to take corporate wellness more seriously for their employees.

The Middle-eastern region has also shown promising growth with some important contributing variables being the growing prevalence of chronic illnesses, businesses' increased investments in corporate wellness initiatives for staff members, and employers' expanding use of these services to lower work-related health issues. Some of the dominant players in the Corporate Wellness Market include- Wellness Corporate Solutions, LLC, EXOS, ComPsych Corporation, Virgin Pulse Inc., Quest Diagnostics, ADURO, INC., Beacon Health Options, Fitbit, Inc., Privia Health, Vitality Group, Wellsource, Inc., Central Corporate Wellness, Marino Wellness, Truworth Wellness Technologies Pvt. Ltd, and SOL Wellness.

To get more Insights: Request Free Sample Report

Corporate Wellness Market Dynamics

Drivers

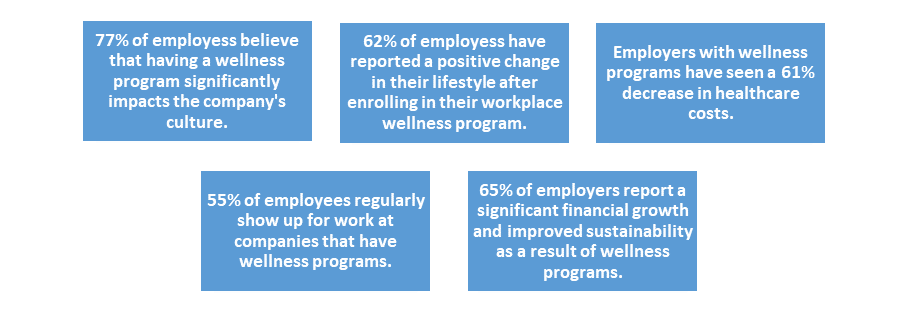

Rising Awareness and Emphasis on Employee Well-Being- The increase in awareness and focus on employee wellness has significantly impacted the corporate wellness market as organizations realize its impact on the overall success of the business. Investing in wellness programs helps reduce absenteeism, which means fewer lost work hours and lower operating costs. According to the research conducted by MMR, businesses with highly engaged employees see an 81% difference in absenteeism and a 14% increase in productivity. Wellness programs increase employee engagement, which improves collaboration, creativity, and productivity. Promoting wellness leads to better disease management, lowers healthcare costs, and improves employee morale. Integrating technology into corporate wellness programs makes them more accessible, engaging, and personalized, increasing employee engagement. Today's workforce expects companies to prioritize employee wellness, making wellness programs attractive for recruiting and retaining top talent.

Proactively promoting employee wellness leads to significant savings by reducing the impact of absenteeism. Wellness programs promote a positive company culture and increase employee satisfaction and loyalty. Modern wellness programs address multiple dimensions of wellness, such as mental health support, financial wellness education, and social connections. Customized wellness initiatives and game elements increase employee engagement and long-term behavior change. Growing awareness of mental health issues has led to an emphasis on supporting the mental well-being of employees.

For instance, A video series called "resilience training" was produced by Google and covers topics including breathing, sleeping, managing anxiety, and more. More than 30,000 workers at Google have participated in the series and made use of the various tools and resources to prioritize their mental well-being. Google enhanced its pre-pandemic check-ins, known as "TEA check-ins" (an abbreviation for thoughts, energy, and attention) in addition to the video series. Employees can talk about burnout, worry, and stress with their managers and co-workers at these check-ins. Due to this increased awareness and emphasis on employee well-being, particularly in North America in the Corporate Wellness market, every 9 in 10 organizations offer at least one wellness incentive, 70% of employers have improved their physical environments to encourage healthy behaviors and 91% of employees in organizations run by executives who support wellbeing initiatives believe they are motivated to achieve their best at work.

Technological Advancements- The impact of technological advancements on corporate wellness programs is undeniable, and it’s prompting a significant paradigm shift in how employers perceive and prioritize employee health which ultimately helps the Corporate Wellness market to grow immensely. The substantial influence of technology on individuals' physical, mental, and social well-being is encouraging more companies to embrace innovative solutions to augment their wellness initiatives in the Corporate Wellness market. Employees select when and where to engage in wellness activities thanks to fitness applications, online tools, and virtual coaching platforms, which allow them to fit wellness initiatives into their busy schedules and varied lifestyles. Due to the introduction of Wearable Devices, Employees access tailored exercise routines, nutritional guidance, and stress management strategies, ensuring that the wellness program aligns with their unique health goals and addresses specific areas of concern.

On the other hand, due to the use of mobile apps, it is feasible for workers to maintain a healthy lifestyle, keep an eye on their diet, and keep tabs on their stress levels. Mobile apps frequently offer mindfulness activities as well, which have a significant positive impact on mental health. Mobile applications, with their tailored data, useful built-in reminders, and advice on living a healthy lifestyle, are not only improving people's lives individually but also fostering an environment of general well-being at the workplace. Other Technological advancements include- Online Health Assessments, Virtual Wellness Classes, Gamification, Telemedicine, Health Management Platforms, and Virtual Reality.

Restraints faced by the Corporate Wellness Market

High Cost of Workplace Wellness- The significant expense of carrying out working environment wellbeing programs is difficult for some associations, especially small and medium-sized organizations with restricted financial plans. The expense of executing well-being projects incorporates costs like buying hardware, recruiting health advisors, and offering motivations to energize representative cooperation. This significant expense is a significant controlling variable for the corporate health market, as numerous associations do not have the monetary assets to put resources into thorough well-being programs. Almost 50% of managers accept that cost suppositions concerning working environment wellbeing programs are the main test they face.

This cost-cognizant methodology has spurred organizations across different businesses to integrate health programs into their tasks. Notwithstanding, the significant expense of executing these projects be a huge hindrance for small and medium-sized organizations. The expense of carrying out health projects is difficult for associations in non-industrial nations, where spending plan limitations and restricted mindfulness ruin the acknowledgment of these projects by managers as well as workers. This absence of mindfulness regarding the corporate health programs limits the Corporate Wellness market development partially.

Slow Adoption and Lack of Awareness- Low Employee Participation and Engagement generally occur because numerous workers are ignorant about their organization's well-being programs and related benefits in the Corporate Wellness market. This absence of information can bring about a lack of engagement and decreased interest. Managers should effectively impart the subtleties of their health programs, including objectives, prizes, and impetuses, to spur representatives. Despite the advantages of corporate health programs, there is an absence of mindfulness among representatives about the reasons, points, and expected compensations of these projects. This absence of mindfulness confines market development somewhat. Businesses should give workers every one of the particulars and appropriate data about corporate health projects to support investment. For Instance,

- In the U.S., over 550 corporate proprietors offer worker well-being programs in their associations. However, even though these programs are widely available, the primary reason why many employees are unaware of their company's health programs is a communication gap.

- During the COVID-19 pandemic, businesses have had to adjust to new work environments and overcome a variety of obstacles, so the slow adoption and lack of awareness have been particularly challenging. This has additionally featured the significance of successfully conveying the subtleties and advantages of well-being projects to workers.

Corporate Wellness Market Segmentation

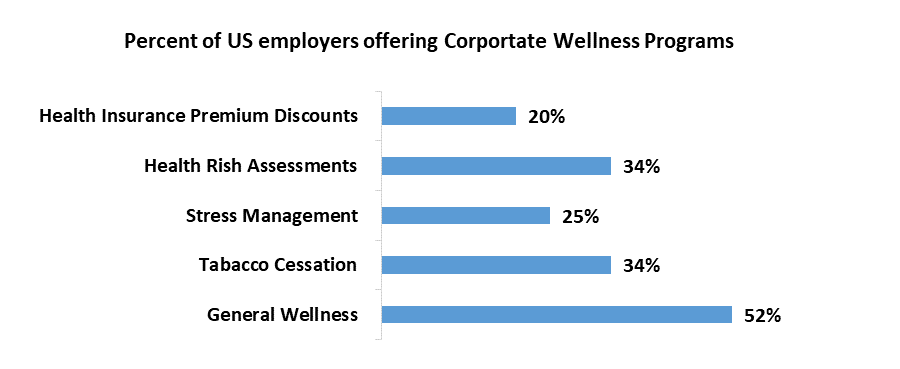

By Service, is further segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others in the Corporate Wellness market. The health risk assessment implies assessing workers' well-being gambles with utilizing polls, clinical trials, and different techniques. As per Amazing Perspective Exploration, the wellbeing risk evaluation section held the biggest income share in the corporate health market in 2023. Fitness includes Membership-based wellness applications like Peloton, Quiet, and Headspace have acquired huge prominence among partnerships hoping to incorporate wellness into their health programs.

SmokeFreeTXT, developed by researchers from the Mayo Clinic, is a free text messaging program that supports smokers trying to quit. Organizations like Pivot Wellbeing offer distant outer muscle well-being screening administrations, empowering early identification and intercession for conditions like joint inflammation and back torment. Nutrisystem, Noom, and WW Global Inc. are driving players in the sustenance and weight-the-board area, taking special care of corporate clients looking to develop worker wellbeing results further.

By End-User, the Corporate Wellness market is segmented into large enterprises, small enterprises, and medium-sized enterprises. The Corporate well-being market is portioned by end clients into large enterprises and small and Medium-Sized enterprises (SMEs). Large enterprises ruled the worldwide market in 2023 with a market share of 50%, with the rising speculation by organizations to consolidate well-being programs for their employees being one of the key variables in the Corporate Wellness market. The rising mindfulness among huge associations and managers to consolidate health programs to expand the group's efficiency, work on their confidence, lessen pressure and non-appearance, and lift self-awareness is driving the development of this portion.

Competitive Landscape for the Corporate Wellness Market

The Competitive landscape for the Corporate Wellness Market consists of various big players as well as some emerging organizations. Some of them are- Wellness Corporate Solutions, LLC, EXOS, ComPsych Corporation, Virgin Pulse Inc., Quest Diagnostics, ADURO, INC., Beacon Health Options, Fitbit, Inc., Privia Health, Vitality Group, Wellsource, Inc., Central Corporate Wellness, Marino Wellness, Truworth Wellness Technologies Pvt. Ltd, and SOL Wellness. These businesses compete based on product usability, inventiveness, customer contentment, and geographic reach. To maintain and improve their position in the market, they employ a variety of strategies. For Instance,-

This Saves Lives sold to Good Worldwide in December 2022. This deal demonstrates the potential for celebrity involvement in corporate wellness solutions. Actors Ryan Reynolds, Hugh Jackman, Blake Lively, and Taylor Swift sold their snack brand This Saves Lives to Good Worldwide, an organization providing sustainable nutrition solutions.

Companies like Novozymes and Chr. Hansen merged, indicating industry consolidation. This impacts the landscape of corporate wellness offerings.

Beacon Health Options- The company has raised a total funding of $3.73M over 2 rounds and was acquired by Anthem on June 6, 2019, from Bain Capital Private Equity and Diamond Castle Holdings.

LifeSpeak acquired Wellbeats for USD 93 million, marking the company's fourth acquisition in 9 months.

|

Corporate Wellness Market Scope |

|

|

Market Size in 2024 |

USD 69.45 Bn |

|

Market Size in 2032 |

USD 120.23 Bn |

|

CAGR (2025-2032) |

7.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Service

|

|

By Delivery Model

|

|

|

By End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Corporate Wellness Market Key Players

- Wellness Corporate Solutions

- LLC

- EXOS

- ComPsych Corporation

- Virgin Pulse Inc.

- Quest Diagnostics

- ADURO, INC.

- Beacon Health Options

- Fitbit, Inc.

- Privia Health

- Vitality Group

- Wellsource, Inc.

- Central Corporate Wellness

- Marino Wellness

- Truworth Wellness Technologies Pvt. Ltd

- SOL Wellness

Frequently Asked Questions

There are 3 major types of End-User modes in Corporate Wellness Market, namely; Large Enterprises, Small Enterprises, and Medium-Sized Enterprises.

Include Wellness Corporate Solutions, LLC, EXOS, ComPsych Corporation, Virgin Pulse Inc., Quest Diagnostics, ADURO, INC., Beacon Health Options, Fitbit, Inc., Privia Health, Vitality Group, Wellsource, Inc., Central Corporate Wellness, Marino Wellness, Truworth Wellness Technologies Pvt. Ltd, and SOL Wellness.

North America holds the largest market share in the Corporate Wellness Market.

7.1% CAGR is the growth rate of the Corporate Wellness Market.

1. Corporate Wellness Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Corporate Wellness Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Corporate Wellness Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Corporate Wellness Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Corporate Wellness Market Size and Forecast by Segments (by Value USD Million)

5.1. Corporate Wellness Market Size and Forecast, By Service (2024-2032)

5.1.1. health risk assessment

5.1.2. fitness

5.1.3. smoking cessation

5.1.4. health screening

5.1.5. nutrition and weight management

5.1.6. stress management

5.1.7. others

5.2. Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

5.2.1. On-Site

5.2.2. Off-Site

5.2.3. Web-Based

5.3. Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

5.3.1. Large Enterprises

5.3.2. Small Enterprises

5.3.3. Medium-Sized Enterprises

5.4. Corporate Wellness Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Corporate Wellness Market Size and Forecast (by Value USD Million)

6.1. North America Corporate Wellness Market Size and Forecast, By Service (2024-2032)

6.1.1. health risk assessment

6.1.2. fitness

6.1.3. smoking cessation

6.1.4. health screening

6.1.5. nutrition and weight management

6.1.6. stress management

6.1.7. others

6.2. North America Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

6.2.1. On-Site

6.2.2. Off-Site

6.2.3. Web-Based

6.3. North America Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

6.3.1. Large Enterprises

6.3.2. Small Enterprises

6.3.3. Medium- Sized Enterprises

6.4. North America Corporate Wellness Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Corporate Wellness Market Size and Forecast (by Value USD Million)

7.1. Europe Corporate Wellness Market Size and Forecast, By Service (2024-2032)

7.2. Europe Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

7.3. Europe Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

7.4. Europe Corporate Wellness Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Corporate Wellness Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Corporate Wellness Market Size and Forecast, By Service (2024-2032)

8.2. Asia Pacific Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

8.3. Asia Pacific Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

8.4. Asia Pacific Corporate Wellness Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Corporate Wellness Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Corporate Wellness Market Size and Forecast, By Service (2024-2032)

9.2. Middle East and Africa Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

9.3. Middle East and Africa Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

9.4. Middle East and Africa Corporate Wellness Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Corporate Wellness Market Size and Forecast (by Value USD Million)

10.1. South America Corporate Wellness Market Size and Forecast, By Service (2024-2032)

10.2. South America Corporate Wellness Market Size and Forecast, By Delivery Model (2024-2032)

10.3. South America Corporate Wellness Market Size and Forecast, By End-User (2024-2032)

10.4. South America Corporate Wellness Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Wellness Corporate Solutions

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. LLC

11.3. EXOS

11.4. ComPsych Corporation

11.5. Virgin Pulse Inc.

11.6. Quest Diagnostics

11.7. ADURO, INC.

11.8. Beacon Health Options

11.9. Fitbit, Inc.

11.10. Privia Health

11.11. Vitality Group

11.12. Wellsource, Inc.

11.13. Central Corporate Wellness

11.14. Marino Wellness

11.15. Truworth Wellness Technologies Pvt. Ltd

11.16. SOL Wellness

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook