Global Coffee Shop Market Global Industry Analysis and Forecast (2026-2032)

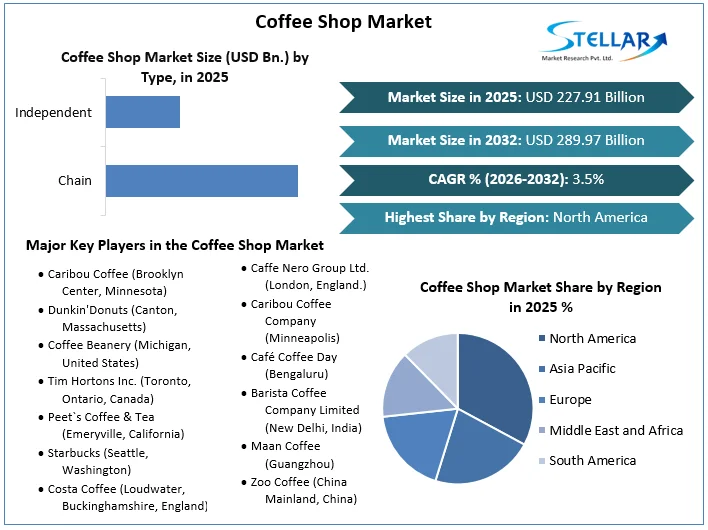

Global Coffee Shop Market size was valued at USD 227.91 Billion in 2025 and the total Global Coffee Shop revenue is expected to grow at 3.5% through 2026 to 2032, reaching nearly USD 289.97 Billion.

Format : PDF | Report ID : SMR_1562

Coffee Shop Market Overview:

Coffee is cultivated in over 70 countries by thousands of farmers as it is one of the major consumed beverages. It is estimated that 2.6 billion cups of coffee are consumed globally every day .The coffee industry is an important and high-value-added business, and it is the second most traded product domain, after crude oil. Coffee shops are considered third places in urban lives separate from work and home, providing places for people to meet, relax, and develop connections. These modern establishments are designed not just for casual coffee breaks but also for social gatherings, meetings, and business events.

The coffee shop market is growing as there is rise in urbanization and disposable income among younger individuals has fueled the growth of contemporary coffee shops in both urban and semi-urban areas. The chain coffee shop and independent coffee shop are catering to the growing demand of global coffee shop market. Urban residents are mainly the key drivers of coffee shop market, as with higher disposable incomes and increase in dining out and visiting coffee shops, these establishments become integral venues for social interactions and local community events. Specialty cafes are on a trend for providing premium coffee and coffee beans from across the world. Exotic Coffee beans, a variety of coffee types, and fancy preparation has made specialty coffee shops a premium destination for business meetings and formal and informal gatherings.

The global coffee shop market is dominated by North America as prominent consumption trend among the youth is maximum due to high disposable income. US been the major contributor in North America as companies like Starbucks, Eight O’clock Coffee Company and Kraft Heinz Company. Europe been the second largest global coffee shop market expected grow at 4% CAGR. APAC is another prominent region in global coffee shop market by ability to spend more money.

To get more Insights: Request Free Sample Report

Global Coffee Shop Market Dynamics:

The increase in consumption of coffee driving the global coffee shop market growth

Coffee is the most popular beverage among the young generation. Urban populations with substantial disposable income tend to spend more on socializing and community gatherings at coffee shops and restaurants. Demand for a variety of cafes and designs where quality coffee and pleasant ambiance has increased in metropolitan and urban cities as the coffee shop market showed promising potential.

Work from remote is gaining popularity, Cafes which are providing free internet, affordable prices and uninterrupted sittings have seen tremendous growth since last year. These cafes are being used as an alternative for Co-working spaces which caused a sudden boost to the coffee shop market.

The fluctuating prices of coffee beans block the coffee shop market

The fluctuating costs in the coffee bean, influenced by factors like supply-demand gaps, reduced production, adverse weather, and escalating labour expenses, present significant challenges for the coffee shop market. This unpredictability not only elevates raw material costs but also compresses profit margins for manufacturers, necessitating adaptive strategies to maintain sustainability and profitability in the coffee shop market. The increasing rivalry in the coffee shop market is creating thin profit margins, especially with rising raw material expenses. For that, manufacturers are compelled to explore alternatives like lower-grade coffee beans and instant coffee solutions. So, the unpredictable coffee bean prices pose a significant challenge, potentially restricting the growth of the coffee shop market.

Global Coffee Shop Market Segment Analysis:

By type, globally the coffee shops are run in ways that are that are in Chain type, and another is independent type. In the independent coffee shops segment showed a gradual increase in coffee shop market share approx. USD 99.78 billion in 2025 and continued during the forecast period. The rising demand for coffee shops in urban areas is encouraging vendors to grow their business activities to provide for the needs of the urban population in developed countries. Independent coffee shops find it difficult to compete with major multinational brands that are growing aggressively. The strong threat from chain coffee shops is expected to limit the growth of the independent coffee shop Market significantly during the forecast period.

As a result, the independent coffee shops segment is expected to witness an accelerating growth momentum in the global independent coffee shop market during the forecast period. Key players like Starbucks (have shops with around 15000 locations), Barista, Café Coffee Day, and Costa Café dominate the chain coffee shop market. Café Coffee Day (CCD) leads with a large market share by opening outlets globally. The chain coffee shops market is expected to grow, and increase in its market value during the forecast period. Also, the younger demographic prefers chain coffee shops. In 2023, the chain coffee shop market reached a valuation of USD 108.6 billion and expects growth in the forecast period.

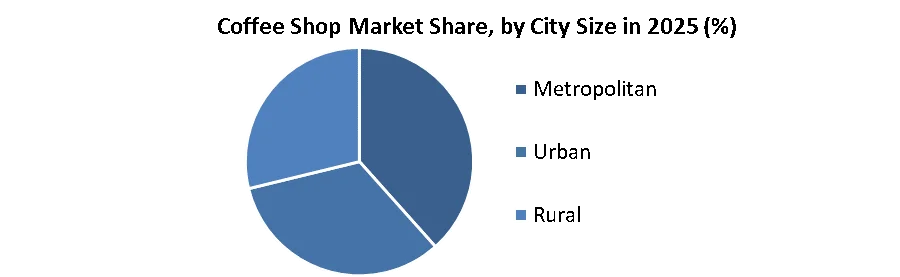

By City Size, Metropolitan areas lead in terms of city size categorization and boast the densest concentration of cafes, also around 55% of market share is generated in metropolitan cities, encompassing both standalone and chain establishments. For instance, Hong Kong hosts approximately 15,000 licensed cafes and eateries, translating to 20.4 such venues per 10,000 residents. Before establishing a new outlet, major cafe brands such as Starbucks, Dunkin' Donuts, and CCD often stipulate specific population density criteria. There's a burgeoning potential in Tier 2 cities, projected to witness significant growth during the forecast period. This growth trajectory has garnered interest from notable chains like McCafe, Dunkin' Donuts, CCD, and Nescafe, signalling forthcoming investments in the regions.

By cities, after metropolitan cities economic growth in urban areas leads to an increase in consumer spending, which positively impacts the global coffee shop market. Also, urban areas tend to have a higher concentration of coffee shops, making it essential for individual coffee shop owners to differentiate themselves from their competitors. Factors that affect a coffee shop's market success in this context include the quality of products, ambiance, and customer service.

Global Coffee Shop Market Regional Insights:

North America is the dominating region of the Global Coffee Shop Market with USD 36 Billion in the US with a total number of coffee shops accounting for approx. 37,249 in 2023. The United States is the largest importer of coffee sourcing directly from producing countries. Like, Starbucks is one of the largest chain coffee shops in the world with approx. 32,541 stores globally. Starbucks is a major coffee seller in the US and outside with total revenue accounting US$ 19.16 billion.

In the Middle East, Kuwait-based coffee delivery app COFE connects consumers to more than 700 branded coffee shops across Kuwait, Saudi Arabia, Egypt, the UAE, and Egypt. The success of the platform demand for delivery in major Middle Eastern coffee shop markets 63% and 56% of Saudi Arabian and UAE consumers respectively indicate they ordered beverage delivery in 2023.

Europe is the fastest-growing Coffee Shop market with a 4% CAGR and is expected to reach 45,400 branded coffee shops across the European region. The European Coffee Shop market is the highest importer of green coffee with a total 86% volume. Coffee culture is growing in Europe at a fast-paced rate with the potential to become the Global Coffee Shop market leader. In the Asia Pacific, China is an emerging Coffee Shop market with a high growth rate and is expected to reach 47.9 billion Yuan by 2023, India is also expected to grow as one of the developing Coffee Shop markets estimated at around USD 600 million in 2023, with a growth rate of 8-9% annually, and with a total of 1192 CCD outlets across 208 cities.

Competitive Landscapes:

Starbucks and McCafe are expected to dominate the global coffee shop market during the forecast period with 22,557 and 5,044 outlets respectively. Their extensive presence makes them tough leaders in the industry. Other coffee chains like Costa Coffee (with 3,036 outlets), Doutor Coffee (1,108 outlets), Coffee Bean and Tea Leaf (925 outlets), and Caffe Nero (683 outlets) are also in range actively dominate in the global coffee shop market during the forecast period. Dutch Bros, Oregon has set a target to reach 800 outlets by the end of 2023 following strong 2022 revenues.

|

Global Coffee Shop Market Scope |

|

|

Market Size in 2025 |

USD 227.91 Bn. |

|

Market Size in 2032 |

USD 289.97 Bn. |

|

CAGR (2026-2032) |

3.5% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By City Size

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Drip Irrigation Systems Market Key Players:

- Caribou Coffee (Brooklyn Center, Minnesota)

- Dunkin'Donuts (Canton, Massachusetts)

- Coffee Beanery (Michigan, United States)

- Tim Hortons Inc. (Toronto, Ontario, Canada)

- Peet`s Coffee & Tea (Emeryville, California)

- Starbucks (Seattle, Washington)

- Costa Coffee (Loudwater, Buckinghamshire, England)

- McCafe (Chicago)

- Dutch Bros. Coffee (Grants Pass, Oregon)

- Caffe Nero Group Ltd. (London, England.)

- Caribou Coffee Company (Minneapolis)

- Café Coffee Day (Bengaluru)

- Barista Coffee Company Limited (New Delhi, India)

- Maan Coffee (Guangzhou)

- Zoo Coffee (China Mainland, China)

- Pacific Coffee (Hong Kong)

- Uegashima coffee (Kobe Ueshima)

- Caffebene (Seoul, South Korea)

- Gloria Jean's Coffees (Castle Hill, Sydney.)

Frequently Asked Questions

The Global Coffee Shop Market is growing at a CAGR of 3.5% during the forecast period 2026-2032.

The Global Coffee Shop Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors and leaders, and market estimation of the forecast period.

The important key players in the Global Coffee Shop Market are – Starbucks, Costa Coffee, Café Coffee Day, McCafe, Barista Coffee Company Limited, Dutch Bros. Coffee, Cafe Coffee Day, Caffe Nero Group Ltd., Coffee Beanery, Caribou Coffee Company, Gloria Jean`s Coffees International Pty Ltd.

The Global Coffee Shop Market is studied from 2020 to 2032.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Coffee Shop Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Coffee Shop Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Coffee Shop Market: Dynamics

4.1. Coffee Shop Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Coffee Shop Market Drivers

4.3. Coffee Shop Market Restraints

4.4. Coffee Shop Market Opportunities

4.5. Coffee Shop Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Coffee Shop Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Coffee Shop Market Size and Forecast, by Type (2025-2032)

5.1.1. Chain

5.1.2. Independent

5.2. Coffee Shop Market Size and Forecast, by City Size (2025-2032)

5.2.1. Metropolitan

5.2.2. Urban

5.2.3. Rural

5.3. Coffee Shop Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Coffee Shop Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Coffee Shop Market Size and Forecast, by Type (2025-2032)

6.1.1. Chain

6.1.2. Independent

6.2. North America Coffee Shop Market Size and Forecast, by City Size (2025-2032)

6.2.1. Metropolitan

6.2.2. Urban

6.2.3. Rural

6.3. North America Coffee Shop Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Coffee Shop Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Coffee Shop Market Size and Forecast, by Type (2025-2032)

7.2. Europe Coffee Shop Market Size and Forecast, by City Size (2025-2032)

7.3. Europe Coffee Shop Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Coffee Shop Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Coffee Shop Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Coffee Shop Market Size and Forecast, by City Size (2025-2032)

8.3. Asia Pacific Coffee Shop Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Coffee Shop Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Coffee Shop Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Coffee Shop Market Size and Forecast, by City Size (2025-2032)

9.3. Middle East and Africa Coffee Shop Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Coffee Shop Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Coffee Shop Market Size and Forecast, by Type (2025-2032)

10.2. South America Coffee Shop Market Size and Forecast, by City Size (2025-2032)

10.3. South America Coffee Shop Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Caribou Coffee (Brooklyn Center, Minnesota)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Dunkin'Donuts (Canton, Massachusetts)

11.3. Coffee Beanery (Michigan, United States)

11.4. Tim Hortons Inc. (Toronto, Ontario, Canada)

11.5. Peet`s Coffee & Tea (Emeryville, California)

11.6. Starbucks (Seattle, Washington)

11.7. Costa Coffee (Loudwater, Buckinghamshire, England)

11.8. McCafe (Chicago)

11.9. Dutch Bros. Coffee (Grants Pass, Oregon)

11.10. Caffe Nero Group Ltd. (London, England.)

11.11. Caribou Coffee Company (Minneapolis)

11.12. Café Coffee Day (Bengaluru)

11.13. Barista Coffee Company Limited (New Delhi, India)

11.14. Maan Coffee (Guangzhou)

11.15. Zoo Coffee (China Mainland, China)

11.16. Pacific Coffee (Hong Kong)

11.17. Uegashima coffee (Kobe Ueshima)

11.18. Caffebene (Seoul, South Korea)

11.19. Gloria Jean's Coffees (Castle Hill, Sydney.)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook