Casing Cementation Hardware Market: Industry Analysis and Forecast (2025-2032)

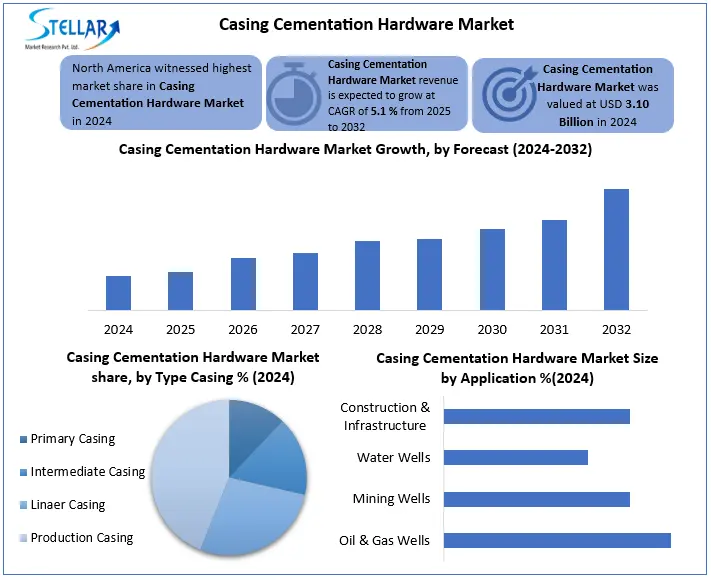

Casing Cementation Hardware Market was valued at USD 3.10 Billion in 2024. The Total Casing Cementation Hardware Market revenue is expected to grow by CAGR 5.1% from 2025 to 2032 and reach nearly USD 4.62 Billion in 2032.

Format : PDF | Report ID : SMR_2794

Casing Cementation Hardware Market Overview

Casing cementation hardware oil and gas refers to a group of downhole mechanical components used during the cementing phase of well construction. These products are installed with cover string (steel pipe) and are essential for effective cement placements, zonal isolation and wellborn integrity.

Casing Cementation Hardware Market growth has been inspired by increasing global drilling activities, tough integrity rules and smart cementing tools. The production cover dominates the market due to its important role in long -term well stability. increasing demand from digital integration and carbon capture and storage (CCS) projects. North America leads the Casing Cementation Hardware Market shell gas discovery and fuel by advanced oilfield service capabilities. The demand for reliable cementation hardware is increasing in both onshore and offshore areas, especially in deep and ultra-deep wells. Trade and tariffs have increased the cost of casing cementation hardware by 8–15%, mainly due to 25% tariffs on imported steel in markets like the U.S. This has led to higher prices for float equipment and centralizers, along with supply chain disruptions. manufacturers are shifting toward local production and alternative sourcing to reduce dependency on tariff-affected regions.

To get more Insights: Request Free Sample Report

Casing Cementation Hardware Market Dynamics

Rising Demand for Well Integrity and Zonal Isolation to Drive the Casing Cementation Hardware Market Growth

Casing Cementation Hardware Market Oil and gas operators need to ensure strict compliance with safety and environmental standards, as the environmental protection agency (EPA) and equivalent global bodies increase regulatory pressure. Zonal isolation is necessary to prevent cross-polls between hydrocarbon zones and freshwater aquifers, to reduce gas migration and maintain overall wellbore integrity. there is a growing demand for advanced cementation tools such as float collar, centralizer, cementing plugs and stage tools. In 2024, it was estimated that more than 70% of new drilled wells used cementation hardware globally, especially in high pressure, high-power (HPHT) and unconventional drilling environment.

Digital Integration and Smart Cementation Tools to create significant opportunities in the market

Casing Cementation Hardware Market, which is pushed towards operational efficiency and automation by the oil and gas industry. IOT-competent cementation tools, real-time downhole data monitoring, and adopting automated cementing systems are changing traditional well-making practices. These smart system operators help operators to monitor cement placements, pressure and temperature with high accuracy, which reduces the risk of poor zonal isolation and expensive remedial operations. According to industry research, digital cementing solutions reduce non-productive time (NPT) by 20–30%, and improve the quality of cement bonds in complex wells. Major Olfield Services provider are investing in R&D to develop advanced float collar, centralizer and stage tools embedded with data transmission capabilities. As the energy sector rapidly embraces digitization, especially in areas such as North America, wise and automated solutions manufacturers are well deployed to capitalize on this growing Casing Cementation Hardware Market section.

Cost Barriers to Limit Casing Cementation Hardware Market Growth for Small Oil & Gas Firm

Particularly for small and medium-sized oils and gas operators, high-grade materials, efficient labour, logistics and regulatory compliance, increase the total cost of ownership as expenses related to compliance. This financial burden prevent investment in quality hardware, well increase the risk of integrity failures and forces small players to delay the upgrade or rely on cost-sharing models with service companies such as Schlumberger and Halliburton. While the progress in durable materials, automation, and future maintenance provides long-term cost-saving capacity, immediate financial stress is a significant restraint in Casing Cementation Hardware Market development.

Casing Cementation Hardware Market Segment Analysis

Based on Type casing, the market is segmented into primary casing, intermediate casing, liner casing, production casing. The production casing segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. long term integrity and efficient hydrocarbon extraction, especially in shell and unconventional drilling where high pressure and corrosive atmosphere demands durable material, due to its important role in completing the well in completion. This section benefits from deep water discovery, horizontal drilling and increase in workover activities, an estimated 40–45% market share, while intermediate cover occurs at 25–30%, mainly used to separate pressure areas in deep wells. Surface covering accounts for 20%, shallow wells focus on stability, and the liner cover, used as an extension in deep wells, makes the remaining 10–15%. Development is further inspired by technological progress in corrosion-resistant alloys and expansion of drilling activities in areas such as North America.

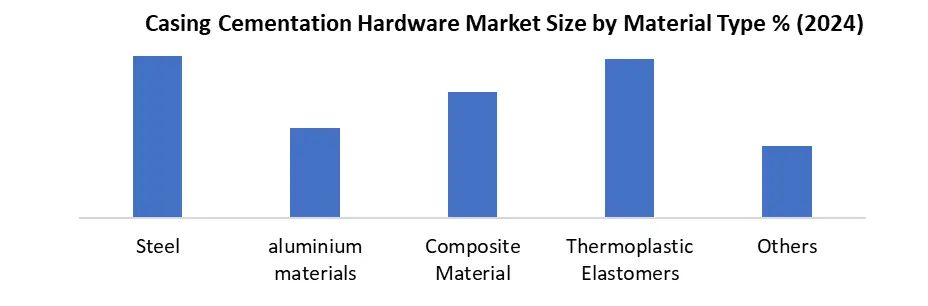

Based on Material Type the market is segmented into steel, aluminium materials, composite materials, thermoplastic elastomers and others. the steel segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period.its unmatched power, durability and cost-effectiveness in rigid drilling environment. Steel, especially high-grade carbon and alloy variants, remain preferred options as it withstands excessive pressure, temperature and corrosive situations faced in both traditional and unconventional wells (eg, shell, deepwater). While options such as overall materials are receiving traction for their rust resistance and light properties, they are still high costs than steel and limited load-bearing capacity than steel. the steel continues to lead the Casing Cementation Hardware Market supported by its proven credibility, comprehensive availability and compatibility of advanced drilling technologies.

Based on Application, the market is segmented into the Oil and Gas Wells, Geothermal Wells, Water Wells, Mining Wells, Construction and Infrastructure. The oil & gas wells segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Hydrocarbons require constant global demand, widespread drilling activities in shell and deep-water reserves, and high-demonstration steel cover to withstand excessive pressure and temperature in complex well designs. While segments such as geotomal and water wells are growing, they remain smaller than that of oil and gas requires stronger and frequent cover solutions, especially in unconventional plays and offshore developments, unite the Casing Cementation Hardware Market leadership of the region.

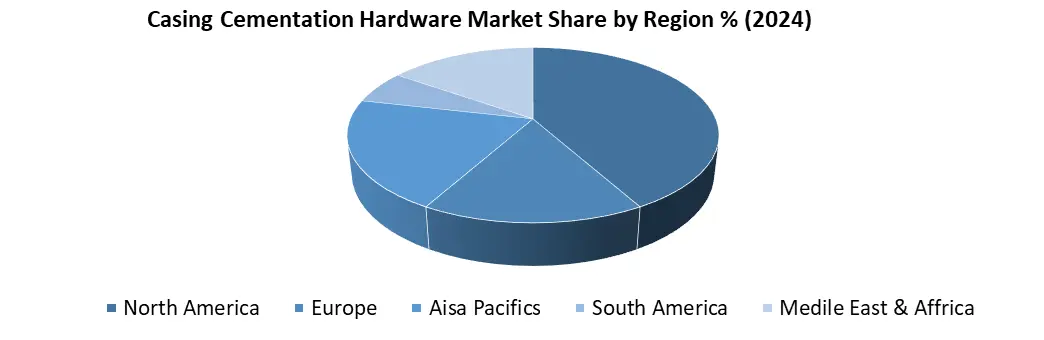

Based on Region, North America dominated the market in 2024 & is expected to hold largest share during the forecast period. casing cementation hardware market with a 38-42% revenue share driven by its thriving unconventional energy sector. The U.S. accounts for over 75% of regional demand. The undisputed leader in the Global Casing Cementation Hardware Market takes command of the largest market share. This dominance mainly stems from the unconventional oil and gas fields that boost the area, especially in the United States where shell Permian Basin plays like Eagle Ford, and Baken requires large quality cover for its widespread horizontal drilling and hydraulic fracturing operations.

Canadian oil sand and tight gas development contribute further to this strong market position. The region benefits from the world's highest active rig count, state -of -the -art drilling technologies and concentration of major cover manufacturers and service providers. The leadership of North America is reinforced by continuous technological progression in the premium cover material, which includes corrosion resistant alloys designed for hard -downhole conditions. Well -established energy creates a strong ecosystem for the infrastructure, favourable investment climate, and government policies supporting domestic energy production. while focusing on increasing LNG export market and energy security drives, maintaining drilling activity, ensuring that North America maintains its competitive edge in both traditional and unconventional applications, which removes other global Casing Cementation Hardware Markets in consumption and innovation.

Casing Cementation Hardware Market Competitive Landscape

Covering through Tanneris and Valourek differentiated strengths dominated the competitive landscape of the Casing Cementation Hardware Market. Tanneris goes with 28% global market share, operated by its vertical integrated models and dominance in shell-rich regions such as North America. Its Rig Direct Digital Supply Chain and Doples connections give it an increase in cost efficiency for high-volume onshore projects. The 19% of the market share, Valoureke, focuses on premium solutions such as its ownership Vam series, which is 40% of Europe's demand for offshore and HPHT cover. While Tanneris thrives in volume-operated markets, the Valllox excels in high-margins below, Aramco contract. Tenaris strong margin and maintains low length, while Vallourec prefer R&D for energy transition technologies. In price-sensitive segments, both Chinese players such as TPCOs face growing competition, but their technical rackets are at the forefront of tanneris and metallurgical-dialogue-they are at the forefront.

Key Development Casing Cementation Hardware Market

In July 16, 2024, NOV Inc. launched its Digital Cementing Platform, featuring smart float equipment and real-time analytics. This development enhances the precision of cement placement and significantly reduces non-productive time (NPT) during well construction.

In March 4, 2025, Vallourec partnered with TotalEnergies to test smart casing connectors with embedded sensors for cement bonding evaluation. This advancement strengthens well integrity monitoring and supports the shift toward digital well infrastructure.

In May 8,2025, Tenaris launched the Blue Dock Cementation Tool Series, designed specifically for carbon capture and storage (CCS) wells. This innovation supports the growing demand for low-carbon energy solutions and enhances cementing performance in CCS projects.

|

The Casing Cementation Market Scope |

|

|

Market Size in 2024 |

USD 3.10 Billion |

|

Market Size in 2032 |

USD 4.62 Billion |

|

CAGR (2025-2032) |

5.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Casing Primary Casing Intermediate Casting Linear Casting Production Casting |

|

By Material Type Steel Aluminium Alloys Composite Materials Thermoplastic Elastomers Others |

|

|

By Application Oil and Gas Wells Geothermal Wells Mining Wells Water Wells Construction and Infrastructure |

|

|

Regional Scope |

North America- US, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in Casing Cementation Hardware Market

North America

- Tenaris (Luxembourg)

- Vallourec (France)

- U.S. Steel Tubular Products (Pittsburgh, USA)

- ArcelorMittal (Luxembourg)

- TMK (IPSCO) (Russia)

- NOV (National Oilwell Varco) (Houston, USA)

Europe

- Voestalpine (Austria)

- Salzgitter AG (Germany)

- Chelpipe Group (Russia)

- SB International (Italy)

- Corinth Pipeworks (Greece)

Asia-Pacific

- TPCO (Tianjin Pipe) (China)

- JFE Steel (Japan)

- Nippon Steel (Japan)

- Jindal Saw (India)

- Hilong Group (China)

- SeAH Steel (South Korea)

- Husteel (South Korea)

South America

- Ternium (Luxembourg)

- Techint Group (Argentina)

- TenarisConfab (Brazil)

Middle East & Africa

- Saudi Arabian Amiantit (KSA)

- Al Gharbia Pipe (UAE)

- Egyptian Steel (Egypt)

Frequently Asked Questions

North America led the market in 2024 with over 38–42% revenue share, driven by shale drilling and advanced oilfield services.

The market was valued at approximately USD 3.10 billion in 2024.

Production casing dominated due to its vital role in ensuring long-term well integrity and performance in deep and unconventional wells.

The rise of digital cementing tools and carbon capture and storage (CCS) projects are key opportunities boosting market development.

1. Casing Cementation Hardware Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Casing Cementation Hardware Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Casing Cementation Hardware Market: Dynamics

3.1. Casing Cementation Hardware Market Trends by Region

3.1.1. North America Casing Cementation Hardware Market Trends

3.1.2. Europe Casing Cementation Hardware Market Trends

3.1.3. Asia Pacific Casing Cementation Hardware Market Trends

3.1.4. Middle East and Africa Casing Cementation Hardware Market Trends

3.1.5. South America Casing Cementation Hardware Market Trends

3.2. Casing Cementation Hardware Market Dynamics

3.2.1. Global Casing Cementation Hardware Market Drivers

3.2.2. Global Casing Cementation Hardware Market Restraints

3.2.3. Global Casing Cementation Hardware Market Opportunities

3.2.4. Global Casing Cementation Hardware Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Casing Cementation Hardware Industry

4. Casing Cementation Hardware Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

4.1.1. Primary Casing

4.1.2. Intermediate Casing

4.1.3. Linear Casing

4.1.4. Production Casing

4.2. Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

4.2.1. Steel

4.2.2. Aluminium Alloys

4.2.3. Composite Materials

4.2.4. Thermoplastic Elastomers

4.2.5. Others

4.3. Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

4.3.1. Oil and Gas Wells

4.3.2. Mining Wells

4.3.3. Water Wells

4.3.4. Construction & Infrastructure

4.4. Casing Cementation Hardware Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Casing Cementation Hardware Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

5.1.1. Primary Casing

5.1.2. Intermediate Casing

5.1.3. Linear Casing

5.1.4. Production Casing

5.2. North America Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

5.2.1. Steel

5.2.2. Aluminium Alloys

5.2.3. Composite Materials

5.2.4. Thermoplastic Elastomers

5.2.5. Others

5.3. North America Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

5.3.1. Oil & Gas Wells

5.3.2. Mining Wells

5.3.3. Water Wells

5.3.4. Construction & Infrastructure

5.4. North America Casing Cementation Hardware Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

5.4.1.1.1. Primary Casing

5.4.1.1.2. Intermediate Casing

5.4.1.1.3. Linear Casing

5.4.1.1.4. Production Casing

5.4.1.2. United States Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

5.4.1.2.1. Steel

5.4.1.2.2. Aluminium Alloys

5.4.1.2.3. Composite Materials

5.4.1.2.4. Thermoplastic Elastomers

5.4.1.3. United States Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Oil & Gas Wells

5.4.1.3.2. Mining Wells

5.4.1.3.3. Water Wells

5.4.1.3.4. Construction & Infrastructure

5.4.2. Canada

5.4.2.1. Canada Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

5.4.2.1.1. Primary Casing

5.4.2.1.2. Intermediate Casing

5.4.2.1.3. Linear Casing

5.4.2.1.4. Production Casing

5.4.2.2. Canada Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

5.4.2.2.1. Steel

5.4.2.2.2. Aluminium Alloys

5.4.2.2.3. Composite Materials

5.4.2.2.4. Thermoplastic Elastomers

5.4.2.2.5. Others

5.4.2.3. Canada Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

5.4.2.3.1. Oil & Gas Wells

5.4.2.3.2. Minig Wells

5.4.2.3.3. Water Wells

5.4.2.3.4. Construction & Infrastructure

5.4.2.4. Mexico Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

5.4.2.4.1. Primary Casing

5.4.2.4.2. Intermediate Casing

5.4.2.4.3. Linare Casing

5.4.2.4.4. Production Casing

5.4.2.5. Mexico Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

5.4.2.5.1. Steel

5.4.2.5.2. Aluminium Alloys

5.4.2.5.3. Composite Materials

5.4.2.5.4. Thermoplastic Elatomers

5.4.2.5.5. Others

5.4.2.6. Mexico Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

5.4.2.6.1. Oil & Gas Wells

5.4.2.6.2. Mining Wells

5.4.2.6.3. Water Wells

5.4.2.6.4. Construction & Infrastructure

6. Europe Casing Cementation Hardware Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.2. Europe Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.3. Europe Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

6.4. Europe Casing Cementation Hardware Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.1.2. United Kingdom Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.1.3. United Kingdom Casing Cementation Hardware Market Size and Forecast, End-User (2024-2032)

6.4.2. France

6.4.2.1. France Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.2.2. France Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.2.3. France Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.3.2. Germany Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.3.3. Germany Casing Cementation Hardware Market Size and Forecast, End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.4.2. Italy Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.4.3. Italy Casing Cementation Hardware Market Size and Forecast, End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.5.2. Spain Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.5.3. Spain Casing Cementation Hardware Market Size and Forecast, End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.6.2. Sweden Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.6.3. Sweden Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.7.2. Austria Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.7.3. Austria Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

6.4.8.2. Rest of Europe Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

6.4.8.3. Rest of Europe Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Casing Cementation Hardware Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.2. Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.3. Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Casing Cementation Hardware Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.1.2. China Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.1.3. China Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.2.2. S Korea Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.2.3. S Korea Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.3.2. Japan Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.3.3. Japan Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.4.2. India Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.4.3. India Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.5.2. Australia Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.5.3. Australia Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.6.2. Indonesia Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.6.3. Indonesia Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.7.2. Philippines Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.7.3. Philippines Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.8.2. Malaysia Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.8.3. Malaysia Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.9.2. Vietnam Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.9.3. Vietnam Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.10.2. Thailand Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.10.3. Thailand Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

7.4.11.2. Rest of Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Casing Cementation Hardware Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

8.2. Middle East and Africa Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

8.3. Middle East and Africa Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Casing Cementation Hardware Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

8.4.1.2. South Africa Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

8.4.1.3. South Africa Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

8.4.2.2. GCC Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

8.4.2.3. GCC Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

8.4.3.2. Nigeria Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

8.4.3.3. Nigeria Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

8.4.4.2. Rest of ME&A Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

8.4.4.3. Rest of ME&A Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

9. South America Casing Cementation Hardware Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

9.2. South America Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

9.3. South America Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

9.4. South America Casing Cementation Hardware Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

9.4.1.2. Brazil Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

9.4.1.3. Brazil Casing Cementation Hardware Market Size and Forecast, End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

9.4.2.2. Argentina Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

9.4.2.3. Argentina Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Casing Cementation Hardware Market Size and Forecast, By Casing (2024-2032)

9.4.3.2. Rest of South America Casing Cementation Hardware Market Size and Forecast, By Material Type (2024-2032)

9.4.3.3. Rest of South America Casing Cementation Hardware Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. Tenaris

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2. Vallourec

10.3. U.S. Steel Tubular Products

10.4. ArcelorMittal

10.5. TMK (IPSCO)

10.6. NOV (National Oilwell Varco)

10.7. Voestalpine

10.8. Salzgitter AG

10.9. Chelpipe Group

10.10. SB International

10.11. Corinth Pipeworks

10.12. TPCO (Tianjin Pipe)

10.13. JFE Steel

10.14. Nippon Steel

10.15. Jindal Saw

10.16. Hilong Group

10.17. SeAH Steel

10.18. Husteel

10.19. Ternium

10.20. Techint Group

10.21. TenarisConfab

10.22. Saudi Arabian Amiantit

10.23. Al Gharbia Pipe

10.24. Egyptian Steel

11. Analyst Recommendations

12. Casing Cementation Hardware Market: Research Methodology