Canned Alcoholic Beverages Market- Global Industry Analysis and Forecast (2025-2032)

Canned Alcoholic Beverages Market size was valued at USD 20.67 Bn. in 2024 and the total market is expected to grow at a CAGR of 20.12 % from 2025 to 2032, reaching nearly USD 89.60 Bn. by 2032.

Format : PDF | Report ID : SMR_1763

Canned Alcoholic Beverages Market Overview:

The market for canned alcoholic beverages is expected to experience high growth due to the convenience offer. Canned alcoholic beverages are easy to carry and store, making them a popular choice among consumers. Additionally, the trend of convenience-oriented products is on the rise, especially among millennials who prefer on-the-go options. Canned alcoholic beverages provide a convenient option for consumers to enjoy their favourite drinks without the need for additional mixers or glassware. The convenience factor is expected to drive the demand for canned alcoholic beverages in the market

The report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments. The report helps the Canned Alcoholic Beverages manufacturers, new entrants, and industry chain-related companies in the market with information on the revenues, production, and average price for the overall market and the sub-segments across the different segments, by product type, by distribution Channel, and by regions.

To get more Insights: Request Free Sample Report

Canned Alcoholic Beverages Market Dynamics:

Driving Factors and Trends in the Canned Alcoholic Beverages Market

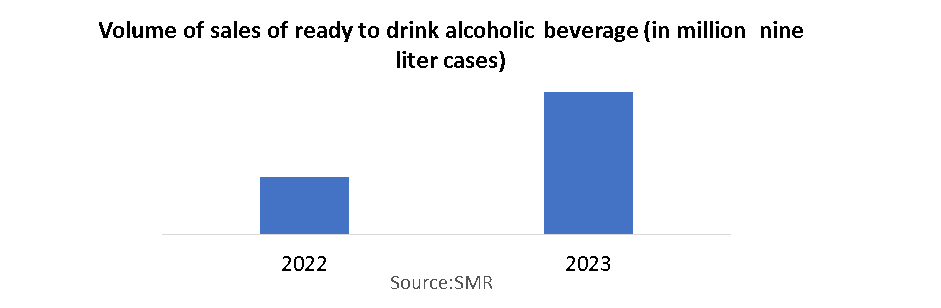

Consumer convenience and portability preferences, environmental concerns encouraging recyclable packaging, and the rising appeal of outdoor and on the go social activities like outdoor gathering, picnics and festivals, contributed to the rising demand for Canned Alcoholic Beverages Market. Rising interest in alcoholic beverages across the globe are expected to boost the growth of canned alcoholic beverages market. Alcoholic beverage producers invest in the category to capture revenue from the trends while maintaining customer loyalty to the brands’ original alcoholic versions. Among low-alcohol offerings, ready-to-drink cocktails are growing particularly fast, benefitting from increasing demand for flavoured and convenience drinks in casual gatherings.

The Rise of At-Home Cocktails and Ready-to-Drink Beverages in Canned Alcoholic Beverages Market

The rising trend of at-home cocktail has emerging trend in Canned Alcoholic Beverages Market. As more consumers enjoy socializing and entertaining at home, the demand for pre-mixed cocktails that offer the taste and experience of a professionally-made drink has increased. Canned cocktails provide an accessible and hassle-free alternative to traditional mixology, appealing to consumers who desire convenience without compromising on quality or taste.

RTDs are just plain convenient and as the variety and quality of RTDs has increased, so has the popularity of the drinks. Because the type of beverage speaks directly to the current needs and desires of consumers, it is safe to say that RTDs continue to be a bright spot in the market. RTD’s or ‘Ready to Drink’ are currently riding a wave of relative global success and are particularly popular in the UK. Many RTDs are produced at around 4-5% ABV. High ABV means more cost, from both an increase in spirit used and a higher taxation on the finished product. The average consumer doesn’t want to pay too much for a canned drink, even if the contents are the same as a drink in a pub.

Canned Alcoholic Beverages Market Segment Analysis:

A hard seltzer is a type of flavored alcoholic beverage that contains carbonated or sparkling water, alcohol, and fruit flavorings. It is an alternative to other alcoholic drinks, such as beer, wine, and spirits, that is low in calories and carbs. The meteoric rise of hard seltzers in the US has been enabled by a confluence of trends including consumer demand for convenience, refreshing flavours and ‘better for you’ products. The availability of the alcohol base impacts the cost and production time of hard seltzers. Willingly available alcohol bases such as GNS or cane sugar faster and less expensive, while less common bases such as agave have a higher cost and longer production time.

The ingredients (yeast, fruit flavorings, nutrients, and so on) and alcohol base impact the cost of production. The alcohol base accounts for the majority of prices and need to factor in taxes, particularly the Federal Exercise Tax (FET), when calculating the total cost. Along with the filtration and packaging costs, also consider the cost of licensing and permitting. GNS bases have the highest production costs thanks to the high FET, while wine and malt bases have the lowest production costs owing to their lower FET and s Taxes vary from state to state.

Canned Alcoholic Beverages Market Regional Analysis:

The North America held highest Market share in 2024 for the Canned Alcoholic Beverages Market. The U.S. ready-to-drink (RTD) beverage market has seen considerable growth, accounting for nearly 12% of the total alcoholic beverage market, surpassing the U.S. wine market. Growth has been driven primarily by hard seltzers, but post-pandemic, the RTD category is undergoing a transformation. North America aluminium can market very robust and the outlook is extremely favourable. Demand for aluminium beverage cans is projected to grow at a rate of 5 % annually through to 2030.

Asia Pacific is fastest growing region in 2024 for Canned Alcoholic Beverages Market. Owing to Increased awareness about health and fitness among consumers, growing popularity of flavored alcohols and a surge in tourism in the region are additional contributing to the growth of this market. While the liquor market in India has seen change in trends in the 2024 with demand for quality products and mixers growing, especially around the urban areas, the pandemic only hastened the process.

“Ready-to-drink (RTD) beverages have been in the market for a few years now and continue to gain popularity in India. The products offer consumers a hassle-free and on-the-go drinking experience. The proliferation of cocktail culture birthed the concept of RTDs. The ease of drinking straight out of the pack and the innovative flavours makes them popular among day-drinkers and youth

Canned Alcoholic Beverages Market Scope:

- In February 2023, Vita Coco, a leading coconut water brand, and Captain Margo, a rum brand, launched the RTD alcohol drink Vita Coco Spiked with Captain Morgan. The new product offers three rum-based cocktails, pina colada, strawberry and lime mojito. The newly launched ‘Vita Coco Spiked with Captain Morgan is commercially available across the United States

- In February 2023, the fastest growing beer company, Bira 91, announced its entry into the hard seltzers category by launching the ‘Grizly’ hard seltzers ale. The Grizly by Bira 91 brings cocktails, wine and beer in one can. The canned alcoholic beverage by Bira 91 contains all-natural ingredients with low-sugar content.

- In January 2023, Chicago-based Molson Coors Beverage Company launched ‘Roxie’, a zero-proof canned cocktail. Roxie comes in three flavors in canned packaging, Ripe with Passionfruit, Lost in Mango and Forbidden Pineapple. The company has made canned alcohol available in its online store.

- In November 2023, Brown-Forman announced the sale of Finlandia vodka to The Coca-Cola Company for $220 million

Canned Alcoholic Beverages Market Scope:

|

Canned Alcoholic Beverages Market |

|

|

Market Size in 2024 |

USD 20.67 Bn. |

|

Market Size in 2032 |

USD 89.60 Bn. |

|

CAGR (2025-2032) |

20.12 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Product

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Canned Alcoholic Beverages Market Key Players:

- Anheuser-Busch InBev (Belgium)

- Heineken (Netherlands)

- Carlsberg (Denmark)

- Molson Coors (Canada)

- Pernod Ricard (France)

- Bacardi (Bahamas)

- Constellation Brands (United States)

- LVMH (France)

- Campari Group (Italy)

- United Breweries Group (India)

- Carlsberg India (India)

- Asahi Breweries (Japan)

Frequently Asked Questions

RTD is trend for the market growth.

The Market size was valued at USD 20.67 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of5.20.12% from 2025 to 2032, reaching nearly USD 89.60 Billion.

The segments covered in the market report are By Flavor and Distribution Channel.

1. Canned Alcoholic Beverages Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Canned Alcoholic Beverages Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Canned Alcoholic Beverages Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Canned Alcoholic Beverages Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

4.11.3. Government Schemes and Initiatives

5. Canned Alcoholic Beverages Market Size and Forecast by Segments (by Value USD Million and Volume in Litres)

5.1. Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

5.1.1. Wine

5.1.2. RTD Cocktails

5.1.3. Hard Seltzers

5.2. Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. On-Trade

5.2.2. Liquor Stores

5.2.3. Online

5.2.4. Others

5.3. Canned Alcoholic Beverages Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Canned Alcoholic Beverages Market Size and Forecast (by Value USD Million and Volume in Litres)

6.1. North America Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

6.1.1. Wine

6.1.2. RTD Cocktails

6.1.3. Hard Seltzers

6.2. North America Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

6.2.1. On-Trade

6.2.2. Liquor Stores

6.2.3. Online

6.2.4. Others

6.3. North America Canned Alcoholic Beverages Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Canned Alcoholic Beverages Market Size and Forecast (by Value USD Million and Volume in Litres)

7.1. Europe Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

7.2. Europe Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Europe Canned Alcoholic Beverages Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Canned Alcoholic Beverages Market Size and Forecast (by Value USD Million and Volume in Litres)

8.1. Asia Pacific Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

8.2. Asia Pacific Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Asia Pacific Canned Alcoholic Beverages Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Canned Alcoholic Beverages Market Size and Forecast (by Value USD Million and Volume in Litres)

9.1. Middle East and Africa Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

9.2. Middle East and Africa Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. Middle East and Africa Canned Alcoholic Beverages Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Canned Alcoholic Beverages Market Size and Forecast (by Value USD Million and Volume in Litres)

10.1. South America Canned Alcoholic Beverages Market Size and Forecast, By Product (2024-2032)

10.2. South America Canned Alcoholic Beverages Market Size and Forecast, By Distribution Channel (2024-2032)

10.3. South America Canned Alcoholic Beverages Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Anheuser-Busch InBev (Belgium)

11.1.1. Company Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Heineken (Netherlands)

11.3. Carlsberg (Denmark)

11.4. Molson Coors (Canada)

11.5. Pernod Ricard (France)

11.6. Bacardi (Bahamas)

11.7. Constellation Brands (United States)

11.8. LVMH (France)

11.9. Campari Group (Italy)

11.10. United Breweries Group (India)

11.11. Carlsberg India (India)

11.12. Asahi Breweries (Japan)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook