Canadian Cable Connector Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

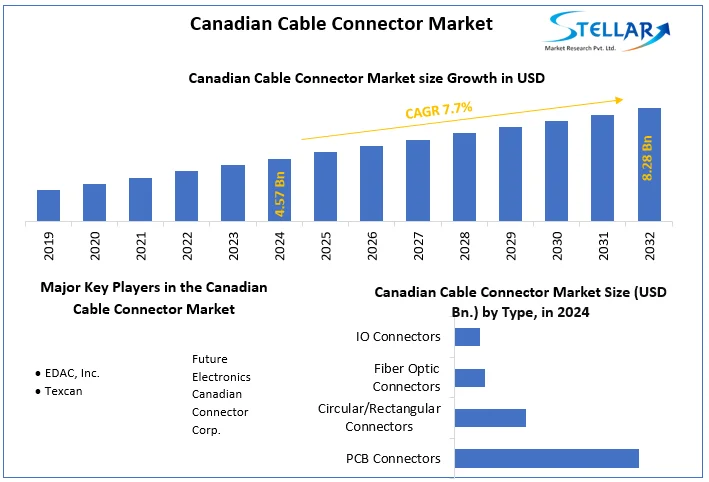

Canadian Cable Connector Market size was valued at US$ 4.57 Billion in 2024 and the total Canadian Cable Connector revenue is expected to grow at 7.7% through 2025 to 2032, reaching nearly US$ 8.28 Billion.

Format : PDF | Report ID : SMR_93

Canadian Cable Connector Market Overview:

North American consumption is projected to be driven by a growing trend of bigger data output per device, increased complexity, and an increasing number of LAN nodes, according to research analyst Peter Jewett. When it comes to various LAN installations, cable connectors are essential components.

The rising number of broadband connections in Canada has supported the growth of the Cable connectors market studied through (2025-2032).

According to the International Telecommunication Union, the number of global fixed broadband subscriptions increased by 2.3% each year during the preceding five years in Canada.

The growth of broadband connections are expected offer an opportunity for the Canadian market to flourish because the building blocks of these connections demand electrical connectors.

To get more Insights: Request Free Sample Report

Canadian Cable Connector Market Dynamics:

The regular wear and tear of cables and connectors is a key limitation on the canadian cable connector market's growth. The widespread usage of these cables puts them at risk of considerable damage, which can interrupt signal transmission and obstruct current activities. In the forecast period (2025-2032), remote advancements such as 5G and administrative automation are expected to account for a significant percentage of the Canadian Cable Connector Market growth.

The short lifespan of tiny devices and telephones is impacting the need for cable connections, which is a problem in the Canadian cable connector market. The constant evolution of consumer electronics and cellphones necessitates the replacement of cable connectors for these mobile devices.

Canadian Cable Connector Market Segment Analysis:

By Product, the power cable segment is expected to grow at the fastest rate of 8.5% in the forecast period (2025-2032). This can be attributed to the competitive landscape in the Canadian power generation sector.

Electricity generation, transmission, and distribution in Canada are generally governed by provincial governments. Provincial Crown utilities and regulatory bodies are where provincial governments exercise their authority.

Electricity was formerly delivered mostly by vertically integrated electric companies, which were frequently provincial Crown corporations with monopoly powers e.g.Hydro.

Some big industrial power consumers, such as aluminium producers, have developed their own electrical producing plants to fulfil their own needs.

The organisation of the power business has changed dramatically during the last decade. The generating, transmission, and distribution activities of electric utilities have been separated in most provinces.

In addition, several provinces have shifted to a more competitive generating system, with the private sector increasingly playing a role, resulting in the emergence of independent power producers.

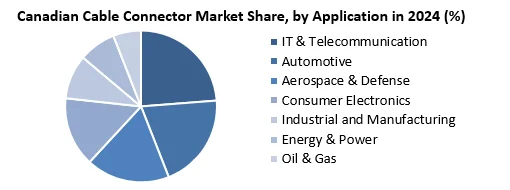

By Vertical, the automotive segment is expected to dominate the Canadian cable connector market in 2030. This can be attributed to Canada being one of the largest exporter of cars in 2024 with US$ 42.1 billion worth of exports.

Automotive manufacturing is one of Canada's most important industries, accounting for 10.2% of manufacturing GDP and 22.5% of manufacturing trade. Canada manufactures passenger cars, trucks, and buses, as well as auto components and systems, truck bodywork and trailers, tires, etc. More than 120,000 people work directly in the auto sector in car assembly and auto parts production, with another 370,000 working in distribution and aftermarket sales and service.

Ontario has a strong concentration of automotive manufacturing, with 100% of Canada's light vehicle production, 381 component manufacturers, and 92% of industry shipments.

Canadian Cable Connector Market Regional Insights:

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Canadian Cable Connector market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants.

The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Canadian Cable Connector market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Canadian Cable Connector market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Major breakthroughs in the Canadian Cable Connector industry are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events.

Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations.

Canadian Cable Connector Market Scope:

|

Canadian Cable Connector Market |

|

|

Market Size in 2024 |

USD 4.57 Bn. |

|

Market Size in 2032 |

USD 8.28 Bn. |

|

CAGR (2025-2032) |

7.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Type

|

|

|

By Application

|

|

|

Regional Scope |

Canada |

Canadian Cable Connector Market Players

-

Texcan

-

Canadian Connector Corp.

Frequently Asked Questions

The regular wear and tear of cables and connectors is a key limitation on the Canadian cable connector market's growth.

Future Electronics, Texcan etc.

the power cable segment is expected to grow at the fastest rate of 8.5% in the forecast period (2025-2032)

1. Canadian Cable Connector Market: Research Methodology

2. Canadian Cable Connector Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Canadian Cable Connector Market: Dynamics

3.1. Canadian Cable Connector Market Trends

3.2. Canadian Cable Connector Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Canadian Cable Connector Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

4.1. Canadian Cable Connector Market Size and Forecast, by Product (2024-2032)

4.1.1. Coaxial Cable/Electronic Wire

4.1.2. Fiber Optics Cable

4.1.3. Power Cable

4.1.4. Signal and Control Cable

4.1.5. Telecom and Data Cable

4.2. Canadian Cable Connector Market Size and Forecast, by Type (2024-2032)

4.2.1. PCB Connectors

4.2.2. Circular/Rectangular Connectors

4.2.3. Fiber Optic Connectors

4.2.4. IO Connectors

4.3. Canadian Cable Connector Market Size and Forecast, by Application (2024-2032)

4.3.1. IT & Telecommunication

4.3.2. Automotive

4.3.3. Aerospace & Defense

4.3.4. Consumer Electronics

4.3.5. Industrial and Manufacturing

4.3.6. Energy & Power

4.3.7. Oil & Gas

5. Canadian Cable Connector Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. EDAC, Inc.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Texcan

6.3. Future Electronics

6.4. Canadian Connector Corp.

7. Key Findings

8. Industry Recommendations