North America Interchangeable Lens Market- Industry Analysis and Forecast (2025-2032)

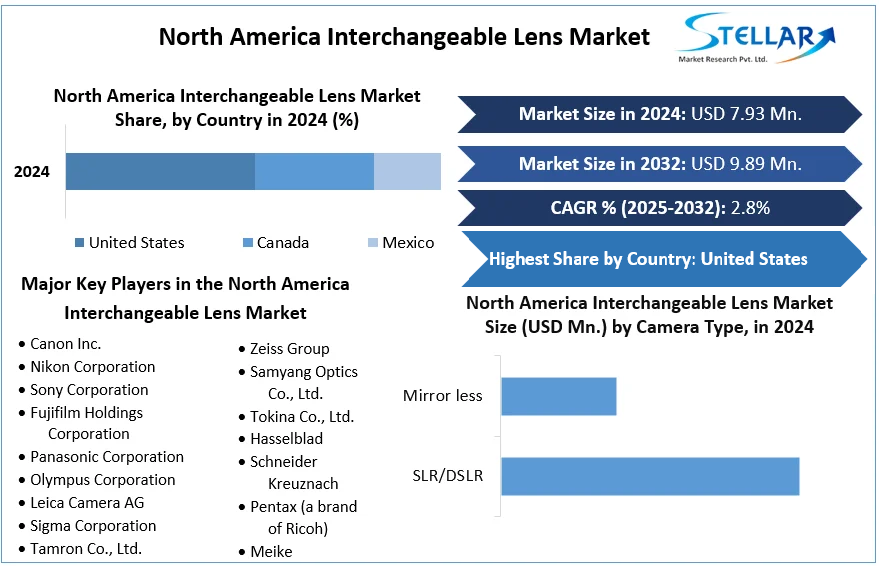

The North America Interchangeable Lens Market size was valued at USD 7.93 Mn. in 2024 and the total North America Interchangeable Lens Market size is expected to grow at a CAGR of 2.8% from 2025 to 2032, reaching nearly USD 9.89 Mn.

Format : PDF | Report ID : SMR_2202

North America Interchangeable Lens Market Overview

An interchangeable lens is able to be attached and detached from a DSLR or Mirrorless camera. A camera body equipped with the ability to interchange lenses allows the user to employ a variety of creative shooting scenarios.

The market for interchangeable lenses in North America is expanding significantly, propelled by developments in photography and videography technologies. The foundation of the market has been strengthened by the presence of well-known manufacturers and brands in North America. Robust market performance is a result of both inventive designs and high-quality production standards. The interchangeable lens market structure has been enhanced by the demand for interchangeable lenses across different segments, such as professional photographers, enthusiasts, and content creators. North American interchangeable lens production facilities place a high value on accuracy and quality, guaranteeing that lenses fulfill demanding specifications. A strong market presence and higher sales have resulted from this emphasis on excellence of the region.

- From 2003 to 2024, Canon maintained a top position based on the digital camera market share.

- Canon has lost approximately 7% of its market share in 2024.

To get more Insights: Request Free Sample Report

North America Interchangeable Lens Market Dynamics

Surging Interchangeable Lens Sales in North America

Interchangeable lens sales in North America have surged, driven by advancements in mirrorless camera technology and growing interest among enthusiasts and professionals. Recent social media trends have boosted demand for high-quality lenses. For instance, the launch of Sony's new G Master Series lenses in 2023 sparked significant consumer interest, contributing to sales growth of interchangeable lenses in North America. Competitive pricing and improved online retail strategies have also played crucial roles. Additionally, interchangeable lens manufacturers have extended their product lines to meet diverse consumer preferences, ensuring a wide range of options at various price points, further stimulating market growth.

The interchangeable lens market is driven by technological advancements enhancing image quality through precise light manipulation. For Instance, Canon's innovations include careful selection of lens materials, aspherical lens design, and special coatings, enabling diverse visual expressions. To ensure supply chain stability, Canon is consolidating production in politically stable regions and reinforcing automation technology. In addition, Nikon is also renovating its Tochigi Prefecture factory, consolidating facilities to focus on high-end interchangeable lenses. A robust manufacturing system that can adjust to changes in demand is what this calculated move seeks to achieve.

To strengthen its production facilities for interchangeable lenses and microscope objectives, Nikon has committed to investing 100 Million yen by 2030. Collaborating with tech giants to integrate advanced features and distribution channels, notable players like Nikon have enhanced product accessibility through partnerships with camera manufacturers and retailers.

Navigating Challenges in the Interchangeable Lens Industry

The rate at which technology is advancing necessitates constant investment and innovation, making it one of the primary challenges facing the interchangeable lens industry. Smartphone cameras are another market threat, with noticeable improvements in lens quality and versatility. Some of the economic factors that restrict North America's Interchangeable Lens market growth are trade tariffs, raw material prices, production costs, and pricing strategies has have hindered market growth.

An additional hindrance to the growth of the interchangeable lens industry is the requirement for comprehensive consumer education and promotional campaigns emphasizing the advantages of interchangeable lenses in comparison to fixed-lens systems. Addressing the effects of lens production and disposal on the environment is another challenging matter. Among these difficulties is finding an equilibrium between affordability and innovation.

North America Interchangeable Lens Market Segment Analysis

Based on the Lens, Zoom Lens dominated the market in 2024 and is expected to maintain its dominance through the forecast period with an increasing CAGR. The demand for interchangeable lenses in North America has grown, driven by the convenience and versatility of zoom lenses in meeting diverse photographic needs. Unlike prime lenses, which have a fixed focal length, zoom lenses allow photographers to adjust the focal length, enabling them to capture both wide-angle and close-up shots with a single lens.

This adaptability is especially beneficial in dynamic settings such as events, wildlife, and sports photography, where changing lenses frequently can lead to missed opportunities. For instance, a wedding photographer can seamlessly switch from wide-angle group shots to close-up portraits without the need to swap lenses, ensuring every moment is captured.

Zoom lenses are also designed with advanced optical stabilization features to minimize the risk of blurry photos owing to camera shake, which is particularly useful at longer focal lengths or in low-light conditions. Technological advancements have led to the development of high-quality zoom lenses that rival prime lenses in image quality. Renowned for their sharpness, durability, and performance, zoom lenses are favored by both professionals and enthusiasts. Examples include the Canon 70-200mm f/2.8 and Nikon 24-70mm f/2.8, which are highly regarded for their exceptional optical performance.

North America Interchangeable Lens Market Country Analysis

United States dominated the interchangeable lens market in 2024 and is expected to maintain its dominance through the forecast period with an increasing CAGR. Because of its strong consumer base that has a high demand for photography and videography equipment, big investments in research and development, and sophisticated technological infrastructure, the United States leads the world market for interchangeable lenses. Followed by Canada and Mexico. It enables the transfer of products and technology. While Mexico gains from favorable trade agreements and a developing middle class with rising purchasing power, Canada's market has been strengthened by robust economic stability and high consumer disposable income.

This region has a substantial import and export economy, with the United States bringing in top-notch optical parts from Germany and Japan and exporting advanced lenses and completed goods to international destinations. In the case of the United States higher imports of German-made specialty lens coatings to improve the performance of locally produced interchangeable lenses, demonstrating the importance of trade alliances and the interconnectedness of global supply chains in preserving market dominance.

A growing number of both professional and amateur photographers has been driving the interchangeable lens market in the United States, demonstrating significant profit potential. As a result of strong consumer demand for premium, adaptable camera gear, the interchangeable lens industry's revenue has been growing steadily. The growing popularity of mirrorless cameras and advances in interchangeable lens technology have led to significant increases in sales reported by major interchangeable lens manufacturers. Interchangeable lens manufacturers have seen an increase in profit margins as a result of this change in the average selling price.

Additionally, as people attempt to create content of a professional caliber, the growth of social media and content creation has increased the demand for interchangeable lenses. The pattern of revenue also indicates a growing inclination towards lenses that have specific features, like image stabilization and wide apertures, to meet particular needs in photography.

- The United States imports most of its Nikon lenses from India, Thailand, and Mexico.

- In 2023, the United States of America achieved the highest Canon sales, resulting in a 30% share, resulting in 1,312.4 Million yen.

North America Interchangeable Lens Market Competitive Landscape

The competitive landscape of the North America Interchangeable Lens Market has been characterized by a dynamic mix of established industry leaders and innovative newcomers. Major players focus on enhancing product quality, diversifying offerings, and adopting advanced technologies to maintain a competitive edge. Market competition has been driven by the continuous demand for high-performance lenses suitable for various applications such as photography, videography, and professional imaging. Companies have increased investment in research and development to introduce lenses with superior optical performance, improved durability, and enhanced user convenience. Additionally, strategic collaborations and mergers are prevalent as firms seek to expand their market presence and leverage synergies.

Canon Inc. and Nikon Corporation stand out as prominent manufacturers in the interchangeable lens market. Canon boasts a comprehensive portfolio of lenses that cater to diverse photographic needs, from amateur to professional. Its lenses are renowned for their precision engineering, exceptional image quality, and innovative features such as Image Stabilization and fast autofocus. Canon's commitment to innovation is evident in its continuous development of advanced optical technologies and proprietary lens coatings.

Nikon, on the other hand, is celebrated for its robust and reliable lenses that deliver outstanding sharpness and clarity. Nikon's lenses often feature cutting-edge technology, including vibration reduction systems and advanced autofocus mechanisms, enhancing their performance in various shooting conditions. The company emphasizes user experience, ensuring that its lenses offer seamless compatibility with Nikon's extensive range of camera bodies. Nikon's dedication to quality and durability makes its lenses a preferred choice for both enthusiasts and professionals.

Panasonic Corporation of North America is a leading provider of Consumer Lifestyle technologies, as well as innovative Smart Mobility, Sustainable Energy, Immersive Experiences, and Integrated Supply Chain solutions. The company is the principal North American subsidiary of Osaka, Japan-based Panasonic Holdings Corporation. One of Interbrand’s Top 100 Best Global Brands of 2023, Panasonic is a leading technology partner and integrator to businesses, government agencies, and consumers across the region.

|

Interchangeable Lens Market |

|

|

Market Size in 2024 |

USD 7.93 Mn. |

|

Market Size in 2032 |

USD 9.89 Mn. |

|

CAGR (2025-2032) |

2.8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Focal Length

|

|

By Camera Type

|

|

|

By Lens Type

|

|

|

Country Scope |

|

North America Interchangeable Lens Market Key Players

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Olympus Corporation

- Leica Camera AG

- Sigma Corporation

- Tamron Co., Ltd.

- Ricoh Imaging Company, Ltd.

- Zeiss Group

- Samyang Optics Co., Ltd.

- Tokina Co., Ltd.

- Hasselblad

- Schneider Kreuznach

- Pentax (a brand of Ricoh)

- Meike

- Voigtländer

- XXX Ltd.

Frequently Asked Questions

Economic and financial aspects are expected to restrained market growth.

The Market size was valued at USD 7.93 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 2.8 % from 2025 to 2032, reaching nearly USD 9.89 Million.

The segments covered in the market report are by focal length, camera type, and Distribution channel.

1. North America Interchangeable Lens Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. North America Interchangeable Lens Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. North America Interchangeable Lens Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. North America Interchangeable Lens Market: Dynamics

4.1. North America Interchangeable Lens Market Trends

4.2. North America Interchangeable Lens Market Drivers

4.3. North America Interchangeable Lens Market Restraints

4.4. North America Interchangeable Lens Market Opportunities

4.5. North America Interchangeable Lens Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. North America Interchangeable Lens Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Interchangeable Lens Market Size and Forecast, by Focal Length (2024-2032)

5.1.1. Equal to 35mm and Larger than 35mm

5.1.2. Smaller than 35mm

5.2. North America Interchangeable Lens Market Size and Forecast, by Camera Type (2024-2032)

5.2.1. SLR/DSLR

5.2.2. Mirror less

5.3. North America Interchangeable Lens Market Size and Forecast, by Lens Type (2024-2032)

5.3.1. Zoom Lens

5.3.2. Prime Lens

5.3.3. Telephoto Lens

5.3.4. Special Lens

5.3.5. Others

5.4. North America Interchangeable Lens Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Company Profile: Key Players

6.1. Canon Inc.

6.1.1. Company Overview

6.1.2. Product Portfolio

6.1.2.1. Product Name

6.1.2.2. Product Details (Price, Features, etc)

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Nikon Corporation

6.3. Sony Corporation

6.4. Fujifilm Holdings Corporation

6.5. Panasonic Corporation

6.6. Olympus Corporation

6.7. Leica Camera AG

6.8. Sigma Corporation

6.9. Tamron Co., Ltd.

6.10. Ricoh Imaging Company, Ltd.

6.11. Zeiss Group

6.12. Samyang Optics Co., Ltd.

6.13. Tokina Co., Ltd.

6.14. Hasselblad

6.15. Schneider Kreuznach

6.16. Pentax (a brand of Ricoh)

6.17. Meike

6.18. Voigtländer

6.19. XXX Ltd.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook