Mexico Laptop Market: Industry Analysis and Forecast (2024-2030)

The Mexico Laptop Market size was valued at USD 1.76 Bn. in 2023 and the total Mexico Laptop revenue is expected to grow at a CAGR of 3.84% from 2024 to 2030, reaching nearly USD 2.3 Bn. in 2030.

Format : PDF | Report ID : SMR_2114

Mexico Laptop Market Overview-

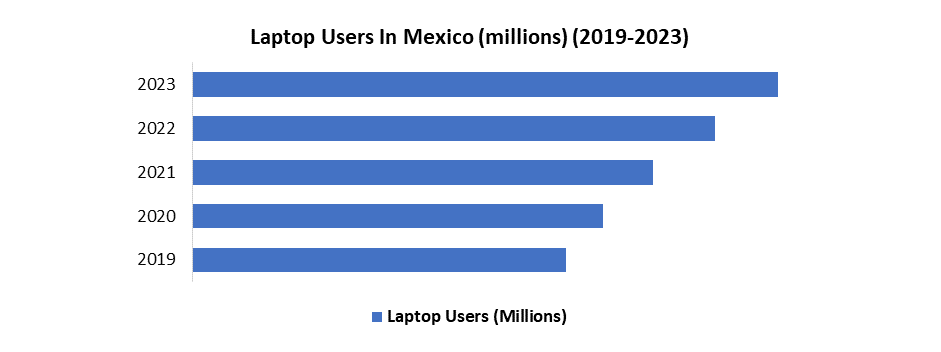

The Mexico laptop market is on a steady growth trajectory, buoyed by several key drivers. Increased demand for mobile computing, spurred by trends in remote work, online learning, and growing internet accessibility, has driven the market forward. Growing disposable incomes have made laptops more attainable for a broader consumer base, while declining prices have further enhanced affordability. Government initiatives aimed at fostering digital inclusion have also played a pivotal role in increasing laptop ownership rates across the Mexico country.

This research report offers a thorough analysis of the Mexico Laptop market, utilizing segmentation by criteria and regions to forecast revenue growth. It investigates trends within each submarket, analyzing pivotal growth drivers, opportunities, and challenges shaping market dynamics. Recent industry developments, including expansions, product launches, partnerships, mergers, and acquisitions, are scrutinized to map out the competitive landscape. The report strategically profiles key market players, evaluating their core competencies across sub-segments. By synthesizing these insights, the report provides a comprehensive understanding of the current state and potential future directions of the Mexico Laptop market, empowering stakeholders to make informed business decisions.

To get more Insights: Request Free Sample Report

Mexico Laptop Market Dynamics:

Increasing demand for mobile computing to drive the Mexico Laptop Market.

The surging demand for mobile computing significantly drives the Mexico laptop market thanks to several key factors. Primarily, portability and productivity are crucial, laptops enable users to work or study seamlessly on the go. This is particularly vital for students balancing on-campus and remote learning, as well as professionals requiring mobility for meetings and presentations. The versatility and convenience of laptops cater to the dynamic needs of a mobile workforce and academic environment, thereby driving market growth.

The growing demand for mobile computing is a major driver for increased functionality in the laptop market. Modern laptops possess the capability to handle demanding tasks such as video editing, data analysis, and complex software applications. This improved functionality makes them indispensable tools for professionals requiring robust performance, students engaging in advanced coursework, and casual users seeking versatile computing solutions. As a result, the Mexico laptop market is experiencing significant growth and fueled by the necessity for powerful and adaptable mobile computing devices.

The convergence of devices is a significant driver in the Mexico laptop market. Modern laptops, equipped with touchscreens and detachable keyboards, bridge the gap between desktop computers and tablets. This multifunctionality allows them to serve as both a robust desktop replacement and a portable tablet, eliminating the need for multiple devices. This versatility appeals to consumers seeking cost-effective, all-in-one solutions, thereby driving market growth. Laptops offering combined functionality enhance user convenience and represent a strategic advantage in today's tech-driven environment.

Mexico Laptop Market Segment Analysis.

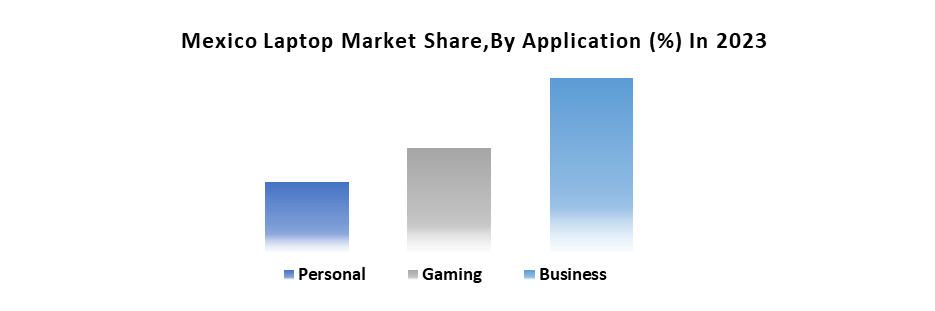

Based on Application, the Business segment held the largest market share of about 50% in the Mexico Laptop Market in 2023. According to the Stellar Marker Research analysis, the segment is further expected to grow at a CAGR of 3.85% during the forecast period. The Mexico Laptop Market leads with rapid technological advancements and widespread smart device adoption. Seamless data connectivity and progressive integration cater to consumer demands for interconnectedness and efficiency, solidifying its dominance.

The increased demand for productivity tools is a significant factor driving the laptop market. Businesses rely on laptops to operate essential productivity software, including document editing suites, project management tools, and communication platforms. This ongoing necessity for efficient, portable computing solutions drives consistent market growth. As companies prioritize mobility and digital workflows, the demand for versatile laptops that support these applications continues to surge, further strengthening the Mexico laptop market’s growth and ensuring sustained industry momentum.

The rise of remote work arrangements in Mexico, particularly post-pandemic, has significantly boosted the business segment. Laptops have become essential for employees to access company networks, collaborate online, and maintain productivity while working from home. This shift has driven increased demand for reliable, high-performance laptops, directly impacting market growth. As remote work continues to be a prevalent model, the need for efficient, portable computing solutions sustain this upward market trend.

Businesses typically follow a refresh cycle for laptops, replacing aging models with newer ones. This consistent replacement demand sustains the market, ensuring steady growth. As technology advances and remote work persists, the need for up-to-date laptops will continue to drive market dynamics.

Mexico Laptop Market Scope:

|

Mexico Laptop Market Scope |

|

|

Market Size in 2023 |

USD 1.76 Billion |

|

Market Size in 2030 |

USD 2.3 Billion |

|

CAGR (2024-2030) |

3.84% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

Leading Key Players in the Mexico Laptop Market s

- HP (Hewlett-Packard)

- Dell

- Lenovo

- Apple

- Acer

- ASUS

- Others

Frequently Asked Questions

Economic instability and battery life are expected to be the major restraining factors for the Mexico Laptop market growth.

The Mexico Laptop Market size was valued at USD 1.76 Billion in 2023 and the total Mexico Laptop revenue is expected to grow at a CAGR of 3.84% from 2024 to 2030, reaching nearly USD 2.3 Billion by 2030.

1. Mexico Laptop Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. Mexico Laptop Market Import Export Landscape

2.1 Import Trends

2.2 Export Trends

2.3 Regulatory Compliance

2.4 Major Export Destinations

2.5 Import-Export Disparities

3. Mexico Laptop Market: Dynamics

3.1.1 Market Drivers

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the Mexico Laptop Industry.

4. Mexico Laptop Market: Market Size and Forecast by Segmentation (Value) (2023-2030)

4.1 Mexico Laptop Market Size and Forecast, By Type (2023-2030)

4.1.1 Traditional Laptop

4.1.2 2-in-1 Laptop

4.2 Mexico Laptop Market Size and Forecast, By Application (2023-2030)

4.2.1 Personal

4.2.2 Gaming

4.2.3 Business

5. Mexico Laptop Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2023)

5.3.5 Company Locations

5.4 Leading Mexico Laptop Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 HP (Hewlett-Packard)

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Dell

6.3 Lenovo

6.4 Apple

6.5 Acer

6.6 ASUS

6.7 Others

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Mexico Laptop Market: Research Methodology