BB Cream Market Industry Analysis and Forecast (2025-2032)

The BB Cream Market size was valued at USD 4.03 Bn. in 2024 and the total BB Cream revenue is expected to grow at a CAGR of 9% from 2025 to 2032, reaching nearly USD 8.03 Bn. by 2032.

Format : PDF | Report ID : SMR_1856

BB Cream Market Overview:

The global cosmetic industry is worth 300 Billion dollars with a CAGR estimated at 4.2% by 2030. BB cream represents a 3.7 USD million market with an expected CAGR of 9%, which is a 4% share of the parent market. BB creams offer an all-in-one solution that is used for color cosmetics, skincare, sun care, etc. The fact that BB cream has multiple purposes and often falls in an affordable price range has made it popular among consumers with a limited budget and busy routines.

The BB Cream industry presents an appealing prospect for manufacturers, retailers, and designers to capitalize on. By continuing agreement with evolving consumer preferences and advancements in technology, there exists the significant potential for innovative, stylish, and modern lifestyles. Whether it's through creative storage solutions the BB Cream market offers exciting avenues to create looks that are both practical and visually appealing.

The reports provide the latest BB Cream market developments, potential areas for future growth, and information about the competitive landscape. The BB Cream market has experienced remarkable growth, fuelled by growing consumer appreciation for its visual demand and considering incorporating sustainability, the demand for efficiency, and cost-effectiveness in the supply chain. Reports include a detailed assessment of market segments, such as Packaging Type, Application, Sales Channels, and Regions, providing a view of the market landscape.

The BB Cream market research analyses the global BB cream market trends, key drivers, challenges, and opportunities in the industry. In addition, the latest Future of BB Cream review report provides the market size outlook across types, applications, and other segments across the world and regions. It provides data-driven insights and actionable recommendations for companies in the BB Cream industry.

To get more Insights: Request Free Sample Report

BB Cream Market Dynamics:

Plant-based BB cream with Sustainability and Clean Beauty

Sustainability and clean beauty are crucial considerations for consumers. Brands are incorporating eco-friendly practices into product development and packaging, appealing to environmentally-conscious consumers. The growing consumer consciousness for high-quality, premium, and eco-friendly beauty products is increasing its adoption. Manufacturers are developing numerous skincare BB creams for sensitive, oily, and dry skin consumers to boost the United States market. These manufacturers are promoting sustainability by adding natural and organic ingredients in BB creams, which are growing the BB cream market reach.

These factors are contributing to a key role in the global market and The United States records 21.1% of the global BB cream market share in 2023. The rapidly growing well-being, makeup, and cosmetic sector is advancing the demand for BB cream in the country. Making BB Cream titanium dioxide or zinc oxide includes developing a white plant-based base cream which is higher in cost. Instead, BB cream market manufacturers are prioritizing discovering alternatives to TiO2, such as microcrystalline cellulose, to enhance sustainability in BB cream formulations and also help drive the BB cream market. these natural pigments are used to adjust the tint, ensuring sustainability, up-to-standard coverage, stability over time, light exposition, and making them cost-effective.

For instance, as a Korean brand, “Thank you Farmer” was created as a reaction to the beauty industry’s claims (whitening, tightening, anti-aging). Thank You Farmer offers slow and little effects through the use of natural farm-grown ingredients. At least 80 % of the ingredients used are plant-based and all products are paraben-free, sulfate-free, and cruelty-free. With this, the other key players like organic harvest, include L’Oreal S.A.; The Estee Lauder Companies Inc.; The Clorox Company are making innovations toward the BB cream product.

Effortless Skincare Solutions drives the BB cream market

The demand for effortless skincare solutions is filling the gap between makeup and skincare is a key driver of the BB Cream market in the forecast period. BB creams make even with the trend of embracing natural features while addressing minor imperfections, offering a comprehensive approach to beauty. BB creams serve as a versatile cosmetic product that combines the qualities of skincare and makeup. BB cream offers attributes such as moisturization, sun protection, color correction, and skin tone evening. This multifaceted approach appeals to consumers seeking efficient and time-saving solutions for their beauty regimens.

The influence of the Asian beauty market, especially the South Korean BB cream market, introduced the BB cream trend which rapidly spread globally, influencing beauty routines and preferences. In the South Korean BB cream market on male beauty trends in 2023, around 12.8 % of respondents were using BB cream. In 2023, men in South Korea were using an average of 7 cosmetic products, and rising the BB cream demand in the market.

BB Cream Market Segment Analysis:

By Packaging Type, Tube packaging was the largest segment, accounting for 87.4% of the BB cream market share in 2023. In the personal care industry, squeezable plastic tubes have always been used for convenient packaging and handling. However, they are becoming popular in the skincare industry owing to the growing demand for facial cleansers and moisturizers. This has inspired many companies to add more value to their product by creating multifunctional packaging, the current most successful being the BB cream market. Packaging is also an important aspect of any product to make it cost-effective and BB Cream product is cost-effective for consumers that combines with functionality and packaging. Many products are formulated for specific skin types. As these creams are primarily packaged in plastic over glass, the market for tubes is expected to witness significant growth over the forecast period.

BB Cream Market Regional Insight:

Asia Pacific region dominated the BB cream market in the year 2024 and is expected to continue its dominance during the forecast period, compared to other regions Factors such as consumer demand, purchasing power, market competition, and economic conditions likely played a role in Asia Pacific dominance in this market segment during the forecast 2025-2032.

India holds a share of 8.6% of the global BB cream market. The growing urbanization, rising youth population, and changing consumer lifestyle are driving sales of the Indian BB cream market. Consumers are gathering for functions such as weddings, Festivals, and other events, increasing the demand for BB cream in the country. The advanced cosmetic industry and skincare-centric culture are increasing the adoption of high-quality BB creams. Japan has an advanced technological beauty sector with high-quality skincare products that improve skin issues. For this reason, Japan records a share of 9.7% of the global BB cream market.

BB Cream Market Competitive Landscape:

The global BB cream market is highly competitive due to the presence of several key players. These companies are innovating their products with sustainability to capture consumers' attention. The key players are offering natural ingredients in BB cream to reduce wrinkles, skin damage, pigmentation, and dark spots.

Key players are promoting non-toxic products with their innovations by investing a huge amount in research and development in the BB cream industry and the BB cream market. These players are making efforts to offer the best quality products without any side effects.

Key Players in the BB Cream Market include L’Oreal S.A.; The Estee Lauder Companies Inc.; The Clorox Company; L'Occitane International S.A.; AmorePacific Corporation; Stila Styles LLC; and Tarte Inc.

BB Cream Market Scope:

|

BB Cream Market |

|

|

Market Size in 2024 |

USD 4.03 Billion |

|

Market Size in 2032 |

USD 8.03 Billion |

|

CAGR (2025-2032) |

9 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Packaging Type Tube/Bottle Air Cushion |

|

By Application Oily Skin Dry Skin Combination Skin |

|

|

By Sales Channel Online Offline |

|

|

Regional Scope |

North America - United States, Canada, and Mexico Europe - UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific - China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Rest of the Middle East and Africa South America - Brazil, Argentina, Rest of South America

|

BB Cream Market Key Players:

- Maybelline (United States)

- Pilgrim (United States)

- The Estee Lauder Companies Inc. (United States)

- Coty Inc. (United States)

- Revlon Inc. (United States)

- DermaCo. (United Kingdom)

- L'Oreal International (Europe)

- Christian Dior SE (Europe)

- INGLOT Cosmetics (Europe)

- Avon Products Inc. (United Kingdom)

- Sugar Cosmetics co. (India)

- Lakme (India)

- Ponds (India)

- MyGlam (India)

- Nykaa (India)

- THANK YOU, FARMER CO. (South Korea),

- Shiseido Company Ltd. (Japan)

- Amorepacific Group. (South Korea)

Frequently Asked Questions

Asia Pacific is expected to hold the largest share of the BB Cream market.

The Market size of the BB Cream market was valued at USD 4.03 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 9% from 2025 to 2032, reaching nearly USD 8.03 Billion by 2032.

The segments covered in the market report are packaging Type, Application, Sales Channels, and Region.

The BB cream market's intense competition drives brands to innovate and differentiate their products. The right balance between introducing new features and maintaining core functionality is challenging.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. BB Cream Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global BB Cream Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. BB Cream Market: Dynamics

4.1. BB Cream Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. BB Cream Market Drivers

4.3. BB Cream Market Restraints

4.4. BB Cream Market Opportunities

4.5. BB Cream Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. BB Cream Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

5.1.1. Tube/Bottle

5.1.2. Air Cushion

5.2. BB Cream Market Size and Forecast, by Application (2024-2032)

5.2.1. Oily Skin

5.2.2. Dry Skin

5.2.3. Combination Skin

5.3. BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

5.4. BB Cream Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America BB Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

6.1.1. Tube/Bottle

6.1.2. Air Cushion

6.2. North America BB Cream Market Size and Forecast, by Application (2024-2032)

6.2.1. Oily Skin

6.2.2. Dry Skin

6.2.3. Combination Skin

6.3. North America BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

6.3.1. Online

6.3.2. Offline

6.4. North America BB Cream Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe BB Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

7.2. Europe BB Cream Market Size and Forecast, by Application (2024-2032)

7.3. Europe BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

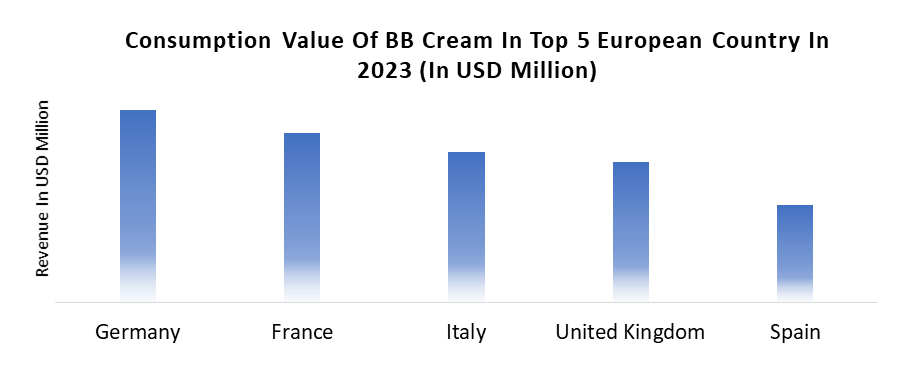

7.4. Europe BB Cream Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific BB Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

8.2. Asia Pacific BB Cream Market Size and Forecast, by Application (2024-2032)

8.3. Asia Pacific BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

8.4. Asia Pacific BB Cream Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa BB Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

9.2. Middle East and Africa BB Cream Market Size and Forecast, by Application (2024-2032)

9.3. Middle East and Africa BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

9.4. Middle East and Africa BB Cream Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America BB Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America BB Cream Market Size and Forecast, by Packaging Type (2024-2032)

10.2. South America BB Cream Market Size and Forecast, by Application (2024-2032)

10.3. South America BB Cream Market Size and Forecast, by Sales Channel (2024-2032)

10.4. South America BB Cream Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Maybelline (United States)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Pilgrim (United States)

11.3. The Estee Lauder Companies Inc. (United States)

11.4. Coty Inc. (United States)

11.5. Revlon Inc. (United States)

11.6. DermaCo. (United Kingdom)

11.7. L'Oreal International (Europe)

11.8. Christian Dior SE (Europe)

11.9. INGLOT Cosmetics (Europe)

11.10. Avon Products Inc. (United Kingdom)

11.11. Sugar Cosmetics co. (India)

11.12. Lakme (India)

11.13. Ponds (India)

11.14. MyGlam (India)

11.15. Nykaa (India)

11.16. THANK YOU, FARMER CO. (South Korea),

11.17. Shiseido Company Ltd. (Japan)

11.18. Amorepacific Group. (South Korea)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook