Asia Pacific Transportation Composites Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

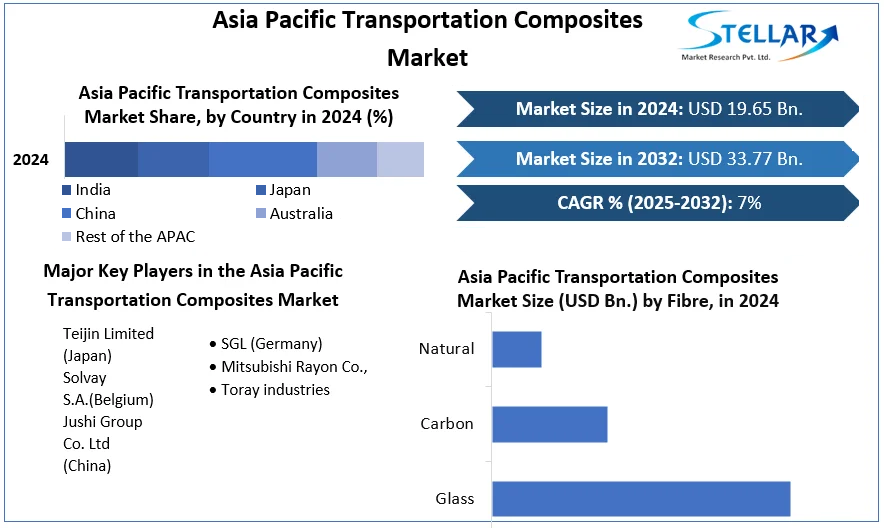

Asia Pacific Transportation Composites Market was valued at USD 19.65 billion in 2024. The Asia Pacific Transportation Composites Market size is estimated to grow at a CAGR of 7 % over the forecast period.

Format : PDF | Report ID : SMR_777

Asia Pacific Transportation Composites Market Definition:

Transportation composites are widely used in a variety of markets, including aquatics, aerospace and defense, automotive, and others. Composites have improved abrasion resistance, greater immobility, high modulus, extraordinary strength, low density, superior chemical resistance, and minimal creep, making them suitable for use in automobile machinery, internal car panels, and aviation constructions, among other applications.

Further, the Asia Pacific Transportation Composites market is segmented by product type, distribution channel, and geography. Based on the Manufacturing Process, the Asia Pacific Transportation Composites market is segmented under compression Molding, Injection molding, and Resin transfer molding. Based on Fibre, the market is segmented under Glass, Carbon, and Natural. Based on Transportation the market is segmented into Airways, Waterways, Railways, and Roadways. By geography, the market covers the major countries in the Asia Pacific i.e., India, China, Japan, Australia, and the Rest of Asia Pacific For each segment, the market sizing has been done based on value (in USD Billion).

To get more Insights: Request Free Sample Report

Asia Pacific Transportation Composites COVID 19 Insights:

PRE-COVID-19 IMPACT: In Asia pacific before the COVID-19, the transportation composites market is experiencing disruption, and new competitors entering the market with innovative solutions are causing value chain adjustments. because the lightweight sector is inextricably linked to the market, these step-change repercussions influence end-users who want to keep lightweight at the forefront. The automotive sector is still under pressure to downplay its greenhouse gas (GHG) emissions. Automotive original equipment manufacturers (OEMs) and their value chain partners are pursuing two unique ways to meet carbon reduction targets: harnessing alternative energy sources with reduced environmental impact and improving vehicle fuel efficiency. Both gain from vehicle mass reduction and increased demand for transportation composites.

COVID-19 IMPACT: The usage of composites in the automotive and transportation market is critical due to the weight savings for a given level of strength. The automobile and rail market are concentrating on reducing vehicle weight, boosting vehicle economy, and utilizing more modern materials. Automobile manufacturers all over the world are suffering as a result of COVID-19. The most affected countries, which are key automobile and transportation manufacturing countries, are the United States, Japan, South Korea, Italy, Germany, and the United Kingdom. The majority of automakers will see a direct impact of the pandemic situation on their income in 2020.

POST-COVID IMPACT: The transportation composites market has seen substantial development, owing to the increased use of composites in commercial airplanes following the pandemic, which has boosted the transportation composites market. Furthermore, the rising need for lightweight parts and fuel-efficient vehicles is expected to boost the transportation composites market over the period. The expanding market for environmentally friendly electric vehicles (EVs) presents a huge potential for the transportation composites market’s major players.

Asia Pacific Transportation Composites Market Dynamics:

Market Drivers: The demand for lightweight materials is increasing. With the increasing growth in demand for lightweight materials in the vehicle market to enhance fuel efficiency, the composites market is increasing. Moreover, the expanding usage of high-performance composites in kinetic buildings, such as advanced composite technologies such as non-composite and biomimetic composite materials to replace traditional materials. As a result, the transportation composites market is expected to develop throughout the+ period due to the rising demand for lightweight materials.

Market Restraints: Recycling-related issues are causing market growth to be stifled. Market pressures limiting the market include tight environmental policies and legislation, as well as rising limits and prices for garbage disposal. Also, the growing use of life cycle inspection as part of the material selection process in a variety of market’s puts composite end-of-life waste management under close examination. For example, it is estimated that 90 % of waste in the United Kingdom currently ends up in landfills, forcing the market to address significant societal and industrial issues. Also, rising plastic waste has prompted governments around the world to enact tough environmental regulations. The introduction of single-use plastic bags in several nations has highlighted the actions taken by governments to address the challenges caused by plastic trash.

Market Opportunities:The Aerospace market’s Growing Market Will Shape New Opportunities: Over the last few years, the application of transportation composites in the aerospace sector has grown and improved. Aircraft manufacturers are taking steps to expand thermoplastic initial structures for business jets and commercial aircraft. Aircraft makers were among the first to use long fiber reinforced thermoplastics technology. To emerge as an effective direction, bearable use of transportation composite for boatbuilding and marine structures. The National Marine Manufacturers Associations, based in Chicago, Illinois, announced in + that sales of other powerboats increased by 4% in 2020 over 2019.

The Asia Pacific dominated the market, accounting for 45.1 % of total revenue. The region's robust vehicle manufacturing market, combined with a high prevalence of electrical and electronic component makers, is expected to drive rising demand. In the composites market, the Asia-Pacific region is the fastest expanding. The robust car manufacturing market in the Asia-Pacific region, together with a high prevalence of electrical and electronic component firms, are likely to fuel composites demand in the region.

By 2030, the Asia Pacific automotive composites sector is expected to increase at a rate of roughly 7.5 %. The region produces the most gasoline-powered vehicles in the world. Furthermore, Asia Pacific produces a significant number of composites, giving automakers in the area a competitive advantage. Vehicle sales are expected to increase in countries such as China, India, Japan, and South Korea. During the planning horizon, Asia Pacific will have the greatest revenue share in the market.

The growing demand in main markets including automotive and transportation, aerospace and defense, building and construction, and electrical and electronics is likely to generate a huge opportunity for market competitors. Also, the rapid growth of cities, as well as the presence of several manufacturers such as Toray market Inc. and Mitsubishi Chemical Holdings Corporation, are likely to positively impact the regional market.

East Asia continues to dominate the transportation composites business, with China producing 60% of glass fiber output. However, due to the implementation of strict environmental and industrial laws, the market has been trending downward in recent years. Innovation is helping players in the East Asian transportation composites market attain market competitiveness.

In China, for example, traditional lay-up production is being phased out. Also, automation is likely to make the East Asian business more competitive. Overall, the East Asian transportation composites market will increasingly rely on technological advancements and product quality improvements, rather than cost-effective labor, resources, and rising manufacturing capacity.

The Asia-Pacific region is expected to lead the rail composites market. In nations such as China, India, and Japan, for example, rising population and urbanization are driving up demand for improved connectivity and more trains. These countries' governments have been investing in the locomotive market, which is fueling demand for the market is examined in the next years.

In recent years, the Chinese government has made significant investments in railways. Lagos Ibadan railway (156 km), Yinxi High-Speed train (618 km), and Shanghai – Hangzhou (794 km) are among the country's active railway projects. According to the railway operator, China will have 146,300-kilo meters of rail lines by the end of 2020, up 20.9 percent from 2015. Furthermore, the operator plans to expand the rail lines by roughly 3,700 kilometers in 2021, after opening 4,933 kilometers of new train lines to traffic in 2020.

Also, in the future years, Indian Railways is planned to complete 58 supercritical and 68 critical projects worth a total of USD 15.44 billion. By December 2021, 27 supercritical projects will be completed, and two more will be delivered by March 2022. In recent years, several metro projects in India have been completed. Phase 2 of the Chennai Metro, Phase 4 of the Delhi Metro, and the East-West Metro in Kolkata are just a few examples. By the beginning of 2025, these projects should be operational.

Also, countries such as Japan and the ASEAN countries have contributed to the market's rise. As a result, demand for rail composites in the region is likely to increase over the period. The usage of composites in the automotive and transportation market is critical due to the weight savings for a given level of strength. The automobile and rail market are concentrating on reducing vehicle weight, boosting vehicle economy, and utilizing more modern materials.

Automobile manufacturers all over the world are suffering as a result of COVID-19. The most affected countries, which are key automobile and transportation manufacturing countries, are the United States, Japan, South Korea, Italy, Germany, and the United Kingdom. The majority of automakers will see a direct impact of the pandemic situation on their income in 2020.

Asia Pacific Transportation Composites Market Segment Analysis:

Based on Manufacturing process: Compression molding, Injection Molding, and resin transfer molding are the different manufacturing processes of transportation composite Compression molding is a high-volume molding technique that produces short cycle times, high component consistency, and the ability to mold metal inserts, ribs, and bosses into the part. Sheet molding (SMC), bulk molding (BMC), thick molding (TMC), and wet molding are some of the materials utilized in compression molding operations (also known as liquid molding or cold molding).

The heated matching metal mold set is installed in a huge hydraulic press during the compression molding process. The press is closed after a pre-weighed quantity of molding compound is loaded into the mold. The material cures quickly under the pressure and temperature of the tool set. Compression molding reduces labor costs by reducing subsequent machining and finishing procedures.

Injection molding entails pouring molten plastic components into a mold, chilling them, and hardening them. The approach is well-suited to the mass-production of items with complex geometries, and it plays a significant role in the field of plastic processing.

Based On Fibre: Glass fibers are commonly used in Fiber-Reinforced Plastic (FRP) (woven or chopped or both). The fibers are embedded in a matrix of polyester, vinyl ester, or epoxy resin. In most cases, FRP is made in an open or one-sided mold. Heavy-duty truck hoods are an example of FRP utilization in the automotive market. A polyester resin matrix is used in Sheet Molded Composite (SMC). It's made out of sheets of resin and a matrix of material usually chopped glass. SMC sheets are placed in a heated mold (two-sided) and compressed molded with heat applied to cure the SMC. Automotive liftgate skins and personal watercraft decks and hulls are examples of typical applications. For gluing FRP and SMC, urethane adhesives are a great choice.

Asia Pacific Transportation Composites Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the Europe market, key players in the market, particularly in this region, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Transportation Composites market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Transportation Composites market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Transportation Composites Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Transportation Composites market report is to help understand which market segments, and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Transportation Composites market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Transportation Composites market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Asia Pacific Transportation Composites market. The report also analyses if the Asia Pacific Transportation Composites market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Transportation Composites market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Transportation Composites market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Transportation Composites market is aided by legal factors.

Asia Pacific Transportation Composites Market Scope:

|

North America Barium Chloride Market |

|

|

Market Size in 2024 |

USD 19.65 Bn. |

|

Market Size in 2032 |

USD 33.77 Bn. |

|

CAGR (2025-2032) |

7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Manufacturing Process

|

|

By Fibre

|

|

|

By Transportation

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Transportation Composites MARKET KEY PLAYERS:

- Teijin Limited (Japan)

- Solvay S.A.(Belgium)

- Jushi Group Co. Ltd (China)

- SGL (Germany)

- Mitsubishi Rayon Co.,

- Toray industries

Frequently Asked Questions

The market size of the Asia Pacific Transportation Composites Market by 2032 is expected to reach USD 33.77 Billion.

The forecast period for the Asia Pacific Transportation Composites Market is 2025-2032.

The market size of the Asia Pacific Transportation Composites Market in 2024 was valued at USD 19.65 Billion.

- Scope of the Report

- Research Methodology

- Research Process

- Asia Pacific Transportation Composites Market: Target Audience

- Asia Pacific Transportation Composites Market: Primary Research (As per Client Requirement)

- Asia Pacific Transportation Composites Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- Asia Pacific Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Stellar Competition matrix

- Asia Pacific Transportation Composites Market Segmentation

- Asia Pacific Transportation Composites Market, By Manufacturing Process (2024-2032)

- Compression Molding process

- Injection Molding process

- Resin Transfer process

- Asia Pacific Transportation Composites Market, By Fiber (2024-2032)

- Glass

- Carbon

- Natural

- Asia Pacific Transportation Composites Market, by Transportation (2024-2032)

- Airways

- Railways

- Roadways

- Waterways

- Asia Pacific Transportation Composites Market, by Country (2024-2032)

-

- India

- China

- Japan

- Australia

- Rest of Asia Pacific

-

- Asia Pacific Transportation Composites Market, By Manufacturing Process (2024-2032)

- Company Profiles

- Key Players

- Teijin Limited (Japan)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Solvay S.A.(Belgium)

- Jushi Group Co. Ltd (China)

- SGL (Germany0

- Mitsubishi Rayon Co.,

- Toray industries

- Teijin Limited (Japan)

- Key Players

- Key Findings

- Recommendations