Asia Pacific Lecithin and Phospholipids Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

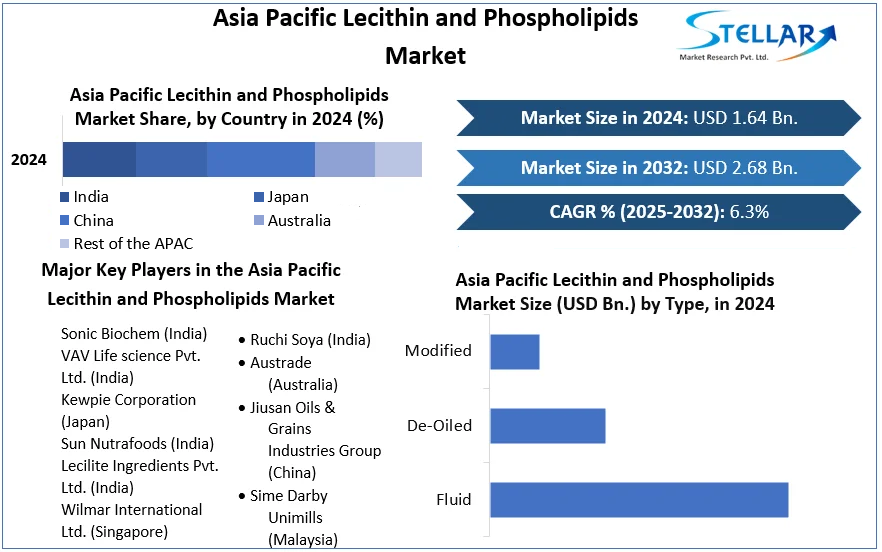

Asia Pacific Lecithin and Phospholipids market was valued at USD 1.64 billion in 2024. The Asia Pacific Lecithin and Phospholipids Market is estimated to grow at a CAGR of 6.3% and expected to reach USD 2.68 billion by 2032

Format : PDF | Report ID : SMR_711

Asia Pacific Lecithin and Phospholipids Market Overview:

Asia Pacific Lecithin and Phospholipids Market report examines the market's growth drivers as well as its segments. Data has been provided by market participants, and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements that are currently occurring across all industry sectors. To provide key data analysis for the historical period (2019-2024), statistics, infographics, and presentations are used. The report examines the Asia Pacific Lecithin and Phospholipids market’s, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes investor recommendations based on a detailed analysis of the current competitive landscape of the Asia Pacific Lecithin and Phospholipids market.

Lecithin is used to treat illnesses including Alzheimer's and dementia. It is used to treat eczema, liver disease, gallbladder disease, high cholesterol, depression, and anxiety. Lecithin is often used as a food addition to prevent the separation of ingredients. It's also utilised in the production of processed meats and ready-to-eat meals as a lubricant or emulsifier. These broad applications are expected to drive the demand for lecithin and phospholipids during the forecast period.

Lecithin is found in a variety of foods, including chocolate, ice cream mayonnaise, and salad dressing. Due to its ability to act as an emulsifier, lecithin is utilised in a variety of ready-to-eat foods. Many creamy foods with a high oil content use lecithin to bind the oil and water together while keeping the fat separate. In a chocolate bar, for example, lecithin keeps the cocoa butter and cocoa solids together. In addition to emulsification, lecithin is used to preserve foods, provide moisture, and extend the shelf life of things.

To get more Insights: Request Free Sample Report

Asia Pacific Lecithin and Phospholipids Market Dynamics:

The market is primarily driven by rising global consumer demand for clean-label and all-natural food items. Consumer awareness of the detrimental health impacts of synthetic emulsifiers has grown dramatically in recent years, and as a result, customers are increasingly opting for clean label and all natural food items. Furthermore, due to its tremendous health benefits, it has become extremely popular in the pharmaceutical and personal care industries.

Moreover, the growing vegan and flexitarian population around the Asia Pacific is supporting the use of plant-based and natural components in food products. Over the next few years, these consumer trends are expected to increase demand for lecithin and phospholipids in the market.

Individual soy lecithin allergies, the health risks involved with the use of hexane to extract lecithin from soybeans, and the market's constantly varying raw material prices are all big challenges.

Asia Pacific Lecithin and Phospholipids Market Segment Analysis:

By Source, The Asia Pacific Lecithin and Phospholipids Market is segmented into Soy, Sunflower, Rapeseed and Egg on the basis of source.

According to the Report, the soy segment is expected to account for the majority of the market. The ease with which soy-derived components can be extracted compared to sunflower or egg-derived compounds, as well as the widespread availability of soy in many countries, are the main reasons for soy-sourced lecithin's dominance. Due to GMO concerns about soy lecithin, demand for alternative sources of lecithin, such as sunflower and rapeseed, has shifted away from soy. In the lecithin market, the sunflower category is expected to grow at a healthy CAGR during the forecast period, while in the phospholipids market, the egg market is expected to develop at the fastest CAGR over the forecast years. GMO concerns are a big stumbling block to the lecithin market's growth. Consumers confront a huge challenge with soy allergies, which is driving the growth of the lecithin market.

By Type, The Asia Pacific Lecithin and Phospholipids Market is segmented into Fluid, De-Oiled and Modified on the basis of type. Fluid lecithin with a high nutritional value is currently manufactured by key manufacturers, which is assisting fluid lecithin sales to increase tremendously. Additionally, there is a growing market for protein-enhanced immunity-support goods like lecithin. Due to standardized fluid mixes of vegetable oils and natural phospholipids that are naturally stable and easy to use, fluid lecithin holds the greatest proportion of the overall Asia Pacific lecithin market.

By Application, The Asia Pacific Lecithin and Phospholipids Market is segmented into Feed, Food, Industrial and Healthcare on the basis of application. Due to the rise in preference for protein-rich diets in developing nations like China, the feed market is the largest segment in terms of application.

Asia Pacific Lecithin and Phospholipids Market Regional Insights:

Due to the extensive use of lecithin and phospholipids in medications and as animal feed in Asia-Pacific, the region leads the market. In terms of value and volume, Asia Pacific is expected to be the fastest-growing region for lecithin and phospholipids. The animal feed segment, in conjunction with the food and beverage industry, has aided in the growth of the lecithin and phospholipids market in this region. Agriculture and food processing industries accounted for more than a quarter of the GDP of Asia Pacific developing countries in 2019, according to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP).

The market for phospholipid products has increased as a result of differences in customer preferences for natural components. In the Asia Pacific region, rising youth populations and increased health awareness have pushed consumers to seek out better alternatives such as food supplements. Additionally, increased demand for bakery items such as cakes, pastries, and cookies will raise lecithin demand in the region.

Growing demand for nutraceuticals for various ailments, as well as an ageing population, are likely to provide possibilities for manufacturers and end-use industries to flourish in the phospholipids market. The fastest-growing markets for phospholipids are expected to be Japan and South Korea. Phospholipids have a large market in India, with a high adoption rate for phospholipid-based nutritional and health supplements.

China is likely to give a lucrative expansion opportunity. Due to its healthy business environment, lack of regulatory compliance, low taxes and customs, and competitive currency activities, the country has earned the title "the world's factory." The increase in demand for lecithin is helping to boost the country's supply. Furthermore, as a result of the impact of Covid-19 on the country, health trends such as immunity-boosting foods have grown rather prevalent around the world. As a result, customers choose food products that include lecithin. Through 2021, China is expected to grow at a 9.6% CAGR in the East Asia region, with a market share of 47.3 percent.

In India, lecithin is widely employed in the production of convenience foods and cosmetic goods. Furthermore, as the world's second-largest population, top lecithin manufacturers are focusing on partnering with local players in the Indian market, as this would create lucrative prospects and allow key manufacturers to enter the market at a faster speed. During the valuation period, the Indian market is predicted to develop at a very promising CAGR of 8.4%, accounting for a market share of over 45 percent in the South Asia region.

The objective of the report is to present a complete picture of global Asia Pacific Lecithin and Phospholipids market. Data from past years is compiled to anticipate the future prospects of this market. Porter's five forces help to identify where power lies in a business situation. This is useful both in understanding the strength of an organisation's current competitive position, and the strength of a position that an organisation may look to move into. The report helps in identifying competitive rivalry currently running in the Lecithin and Phospholipids market. It also helps to understand bargaining power of suppliers and consumers.

The report also presents PESTLE analysis which helps to gain a macro picture of Asia Pacific Lecithin and Phospholipids market. Political factors help to identify the influence of government over Asia Pacific Lecithin and Phospholipids market. Economic factors a have direct impact on a company’s long-term prospects in a market. The economic environment may affect how a company dealing in Asia Pacific Lecithin and Phospholipids market price their products or influence the supply and demand model. Social factors, such as demographics and culture can impact the Asia Pacific Lecithin and Phospholipids market by influencing peak buying periods, purchasing habits, and lifestyle choices. Technological factors may have a direct or an indirect influence on an industry. The legal and regulatory environment can affect the policies and procedures of an industry, and can control employment, safety and regulations. Environmental factors include all those relating to the physical environment and to general environmental protection requirements.

Asia Pacific Lecithin and Phospholipids market scope:

|

Asia Pacific Lecithin and Phospholipids Market |

|

|

Market Size in 2024 |

USD 1.64 Bn. |

|

Market Size in 2032 |

USD 2.68 Bn. |

|

CAGR (2025-2032) |

6.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Application

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Lecithin and Phospholipids Market Key Players:

- Sonic Biochem (India)

- VAV Life science Pvt. Ltd. (India)

- Kewpie Corporation (Japan)

- Sun Nutrafoods (India)

- Lecilite Ingredients Pvt. Ltd. (India)

- Wilmar International Ltd. (Singapore)

- Ruchi Soya (India)

- Austrade (Australia)

- Jiusan Oils & Grains Industries Group (China)

- Sime Darby Unimills (Malaysia)

- Sun Nutrafoods (India)

Frequently Asked Questions

Sonic Biochem (India), VAV Life science Pvt. Ltd. (India), Kewpie Corporation (Japan), Sun Nutrafoods (India), Lecilite Ingredients Pvt. Ltd. (India), Wilmar International Ltd. (Singapore), Ruchi Soya (India), Austrade (Australia), Jiusan Oils & Grains Industries Group (China), Sime Darby Unimills (Malaysia) and Sun Nutrafoods (India) are the key players in Asia Pacific Lecithin and Phospholipids Market.

Feed, Food, Industrial and Healthcare are the applications in the Asia Pacific Lecithin and Phospholipids Market.

The segments covered in Asia Pacific Lecithin and Phospholipids Market report are based on source, type, application and region.

The forecast period for the Asia Pacific Lecithin and Phospholipids Market is 2025-2032.

1. Asia Pacific Lecithin and Phospholipids Market: Research Methodology

2. Asia Pacific Lecithin and Phospholipids Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Lecithin and Phospholipids Market: Dynamics

3.1. Asia Pacific Lecithin and Phospholipids Market Trends

3.2. Asia Pacific Lecithin and Phospholipids Market Drivers

3.3. Asia Pacific Lecithin and Phospholipids Market Restraints

3.4. Asia Pacific Lecithin and Phospholipids Market Opportunities

3.5. Asia Pacific Lecithin and Phospholipids Market Challenges

3.6. PORTER’s Five Forces Analysis

3.7. PESTLE Analysis

3.8. Technological Roadmap

3.9. Value Chain Analysis and Supply Chain Analysis

3.10. Regulatory Landscape

4. Asia Pacific Lecithin and Phospholipids Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

4.1. Asia Pacific Lecithin and Phospholipids Market Size and Forecast, by Source (2024-2032)

4.1.1. Soy

4.1.2. Sunflower

4.1.3. Rapeseed

4.1.4. Egg

4.2. Asia Pacific Lecithin and Phospholipids Market Size and Forecast, by Type (2024-2032)

4.2.1. Fluid

4.2.2. De-Oiled

4.2.3. Modified

4.3. Asia Pacific Lecithin and Phospholipids Market Size and Forecast, by Application (2024-2032)

4.3.1. Feed

4.3.2. Food

4.3.3. Industrial

4.3.4. Healthcare

4.4. Asia Pacific Lecithin and Phospholipids Market Size and Forecast, by Country (2024-2032)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. South Korea

4.4.5. Australia

4.4.6. ASEAN

4.4.7. Rest of APAC

5. Asia Pacific Lecithin and Phospholipids Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Sonic Biochem (India)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. VAV Life science Pvt. Ltd. (India)

6.3. Kewpie Corporation (Japan)

6.4. Sun Nutrafoods (India)

6.5. Lecilite Ingredients Pvt. Ltd. (India)

6.6. Wilmar International Ltd. (Singapore)

6.7. Ruchi Soya (India)

6.8. Austrade (Australia)

6.9. Jiusan Oils & Grains Industries Group (China)

6.10. Sime Darby Unimills (Malaysia)

6.11. Sun Nutrafoods (India)

7. Key Findings

8. Industry Recommendations