Asia Pacific Cling Films Market- Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

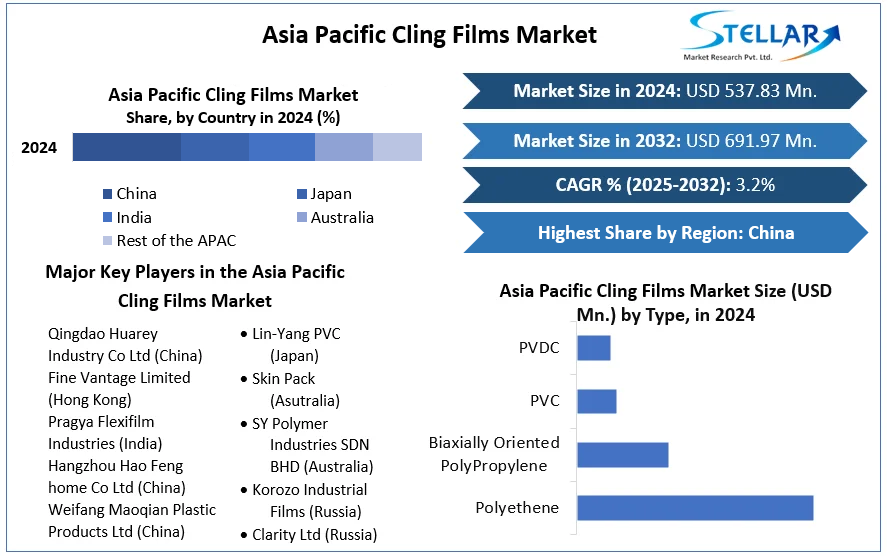

Asia Pacific Cling Films Market size was valued at US$ 537.83 Mn. in 2024 and the total revenue is expected to grow at 3.2% through 2025 to 2032, reaching nearly US$ 691.97 Mn. by 2032.

Format : PDF | Report ID : SMR_1282

Asia Pacific Cling Films Market Overview:

Cling Film is a transparent, thin film that adheres to smooth surfaces. It is made out of polyethene, polyvinylidene chloride (PVC), and polypropylene biaxially oriented polyvinylidene dichloride (PVDC). It's used to pack both edible and non-edible items and can be found in a variety of cast and blow cling products. It's frequently used to keep flowers fresh, close, and safe, as well as to secure refrigerators and shelves.

Cling Films have excellent light transmission, strength, heat resistance, and adhesion. Cling films are more flexible than shrinking traditional films and can combine a variety of products. As a result, they're used across the board, including in food and beverage, health care, and packaging.

Asia Pacific Cling Films Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions. This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2019-2024), statistics, infographics, and presentations are used. The report examines the Asia Pacific Cling Films markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes Asia Pacific Cling Films investor recommendations based on a detailed analysis of the current competitive landscape of the Asia Pacific Cling Films market.

To get more Insights: Request Free Sample Report

COVID-19 pandemic on the Asia Pacific Cling Films Market:

COVID-19 has harmed the GDP of all countries. The globalization and closure of non-essential industries have led to the global economic downturn. The decline in demand from Asia Pacific customers has led to the regional economic downturn and is not expected to recover soon fully.

The packaging value chain plays an essential role in finding proven solutions for the future to meet the demands for the sustainability and efficiency of resources that emerge during the covid-19 violence. Demand is expected to increase for packaging used for food additives, fruits and vegetables, frozen & processed foods, meat, seafood, consumer goods, etc. Consumers switch to online grocery shopping and food delivery for high-quality, safe delivery.

Asia Pacific Cling Films Market Dynamics:

Natural polymer-based films that expected to drive the Asia Pacific Cling Films market

Natural polymer-based films, such as protein-based films and films made of cellulose and its derivatives, are used in the food industry for food processing. As a result, the Asia Pacific Cling Films market is expected to grow. Protein-based food films provide other packaging sources that can be used for nutritious food to reduce food loss, reduce oxygen absorption, reduce lipid migration, improve machine handling structures, and provide physical protection of food.

Plastic film regulations that are too strict can stifle the market

One of the most significant restraints in the Asia Pacific cling film market is the impact of polymers on the environment. Various regulatory bodies have enacted tougher laws against Asia Pacific Cling Films, particularly single-use plastic films, as a result of this.

Asia Pacific Cling Films Market Segment Analysis:

By Type, Polyvinyl Chloride (PVC) is expected to have the largest market share in the Asia Pacific Cling Films. As one of the most widely used food preservatives, polyvinyl chloride (PVC) adhesive film has a significant impact on food safety. By 2024, Polyvinyl chloride (PVC) is expected to earn $ 280.25 million in profit, with a market share of 58.9% in Asia Pacific. By 2032, this market is expected to have grown by 1.8 times its current size.

The use of Polyvinyl Chloride (PVC) Asia Pacific Cling Films has the advantage of forming a bond by attaching itself to the container without the use of glue, which is less expensive. It protects meat and dairy products by inhibiting the growth of microorganisms.

By Form: in 2024, Asia Pacific Cling Films accounted for a significant portion of the global Cling Films market. By reducing waste and lowering processing costs over time, cast film manufacturing equipment adds value. These thin PVC sheets are always flexible at low temperatures and have excellent tear resistance thanks to polymers. They are extremely tear resistant and clear. It is less expensive to use food film instead of other food films. Cast cling films can be used in over 60% to 68 percent of applications, lowering packaging costs per unit and increasing application output. The actor film technique is the most efficient way to make high quality extended wrapping film in the high output category.

By End User, the consumer goods sector is the leading category in the Asia Pacific Cling Films market, followed by food packaging. Food imports account for 60% of the market, with a CAGR of 6.3 percent from 2024 to 2032. Cling films from Asia Pacific have emerged as the most effective packaging solution for processed foods such as meat, seafood, confectionery, processed dairy products, fruits and vegetables, ready-to-eat foods, and so on.

PVC films are excellent wrapping materials in the food industry because they are thin and elastic, and they can be applied to any smooth surface without the use of adhesives. The healthcare industry has seen a significant increase in demand for Asia Pacific Cling Films. With increased health-care investment, the regional demand for food films is expected to rise in the coming forecast period.

Asia Pacific Cling Films Market Regional Insights:

China dominates the Asia Pacific Cling Films market with more than 42%, followed by India, Russia, Japan and others. Alone, the China market predicts a 5.3% growth rate for 2024 -2032 and is projected to hold a market share of xx% by 2032 in the Asia Pacific market. China contributes significantly to Asia Pacific in the production of food packaging; therefore, the country is expected to become the major driving factor for the growth of the Asia Pacific Cling Films market in the forecasted period.

India is also expected to emerge as the fastest growing cling films market in Asia Pacific region. The increase in the population and the adaptation of new technologies are the reasons supporting the growth in India in the coming forecasted period. The Asia Pacific Cling Films market continues to overgrow, driven by economic growth, cost, the changing lifestyle of consumers and the growing number of major players in the country.

The objective of this report is to present an in-depth analysis of the Asia Pacific Cling Films Market to industry stakeholders. The report provides the recent trends in the Asia Pacific Cling Films Market and how these factors will impact on new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the Asia Pacific Cling Films Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the Asia Pacific Cling Films Market report assist the readers to understand which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the Asia Pacific Cling Films Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the Asia Pacific Cling Films Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Asia Pacific Cling Films Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors that help in analyzing how much a government can impact the Market. Economic variables assist in the calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the Asia Pacific Cling Films Market is aided by legal factors.

Asia Pacific Cling Films Market Scope:

|

Asia Pacific Cling Films Market |

|

|

Market Size in 2024 |

USD 537.83 Mn. |

|

Market Size in 2032 |

USD 691.97 Mn. |

|

CAGR (2025-2032) |

3.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By End User

|

|

By Type

|

|

|

By Foam

|

|

|

By Country

|

|

Asia Pacific Cling Films Market Key Players

- Qingdao Huarey Industry Co Ltd (China)

- Fine Vantage Limited (Hong Kong)

- Pragya Flexifilm Industries (India)

- Hangzhou Hao Feng home Co Ltd (China)

- Weifang Maoqian Plastic Products Ltd (China)

- Weihui Huaxing Adhesives Ltd (Japan)

- Denka (Japan)

- Lin-Yang PVC (Japan)

- Skin Pack (Asutralia)

- SY Polymer Industries SDN BHD (Australia)

- Korozo Industrial Films (Russia)

- Clarity Ltd (Russia)

- Tilak Poly Pack (India)

- Specialty Films (Israel)

- PT Tekpak (Indonesia)

Frequently Asked Questions

Polyethene is the leading type segment of Asia Pacific Cling Films market.

The market size of the Asia Pacific Cling Films is expected to reach by USD 691.97 Mn. in Asia Pacific Cling Films Market.

The forecast period of Asia Pacific Cling Films market is 2025-2032

Food is the leading end-user segment of Asia Pacific Cling Films market.

- Scope of the Report

- Research Methodology

- Research Process

- Asia Pacific Cling Films Market: Target Audience

- Asia Pacific Cling Films Market: Primary Research (As per Client Requirement)

- Asia Pacific Cling Films Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Country in 2024(%)

- India

- China

- Japan

- Indonesia

- Australia

- Rest of APAC

- Asia Pacific Stellar Competition matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Country in 2024(%)

- Asia Pacific Cling Films Market Segmentation

- Asia Pacific Cling Films Market, by Type (2024-2032)

- Polyethene

- Biaxially Oriented Poly Propylene

- PVC

- PVDC

- Asia Pacific Cling Films Market, by Foam (2024-2032)

- Cast Cling

- Blow Cling

- Asia Pacific Cling Films Market, by End-User (2024-2032)

- Food

- Healthcare

- Consumer Goods

- Industrial

- Asia Pacific Cling Films Market, by Type (2024-2032)

- Company Profiles

- Key Players

- Qingdao Huarey Industry Co Ltd (China)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Fine Vantage Limited (Hong Kong)

- Pragya Flexifilm Industries (India)

- Hangzhou Hao Feng home Co Ltd (China)

- Weifang Maoqian Plastic Products Ltd (China)

- Weihui Huaxing Adhesives Ltd (Japan)

- Denka (Japan)

- Lin-Yang PVC (Japan)

- Skin Pack (Asutralia)

- SY Polymer Industries SDN BHD (Australia)

- Korozo Industrial Films (Russia)

- Clarity Ltd (Russia)

- Tilak Poly Pack (India)

- Specialty Films (Israel)

- PT Tekpak (Indonesia)

- Qingdao Huarey Industry Co Ltd (China)

- Key Players

- Key Findings

- Recommendations