Acidity Regulators Market - Global Industry Analysis and Forecast (2025-2032)

The Acidity Regulators Market size was valued at USD 8.38 Bn. in 2024 and the total Global Acidity Regulators revenue is expected to grow at a CAGR of 7.9 % from 2025 to 2032, reaching nearly USD 15.40 Bn. by 2032.

Format : PDF | Report ID : SMR_1719

Acidity Regulators Market Overview

Acidity regulator is a vital ingredient used in various foods & beverages as an additive to maintain the acidity or alkalinity of the food. Acidity regulators are organic acids or mineral acids, bases, neutralizing agents, and buffering agents.

The report from Stellar Market Research presents a thorough analysis of the Acidity Regulators Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The analysis of the acidity regulators market scope provides a detailed comprehension of the complex network of processes and stakeholders involved in the production, distribution, and application of these additives. The research objective is to understand the current landscape of usage, applications, and management strategies for this food additive

Key players play a crucial role in driving innovation and improving product efficacy, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the acidity regulators market, ensuring continuous transactions between suppliers and end-users. Additionally, the analysis evaluates the cost-profit ratio, assessing companies' financial capabilities for investing in research and development to introduce new products or enhance existing ones.

The market scope includes opportunities in new product development and advancements in formulation technologies, which propel market growth and innovation. Through quantitative research methods, the report offers statistical data on the effectiveness of acidity regulators in various applications and their impact on market trends. Competitive intelligence analysis aids in comprehending market dynamics, competitor strategies, and customer perceptions, empowering market players to gain a competitive advantage in the global acidity regulators market.

To get more Insights: Request Free Sample Report

Acidity Regulators Market Dynamics

Growing Influence of Processed Foods and Beverages

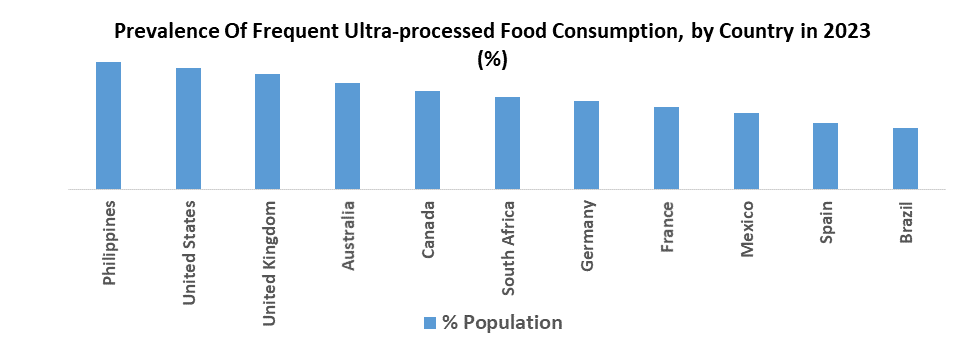

The global Acidity Regulators Market is experiencing significant growth owing to the increasing consumption of processed foods and beverages. This trend has a positive impact on the value chain analysis as it drives the demand for acidity regulators, which are essential additives that enhance flavors, prolong shelf life, and maintain product quality in processed foods and beverages. As the consumption of these products continues to rise, there is a strong potential for feasibility studies to establish new production facilities, reflecting the growing market demand.

This surge in demand also translates to improved profit margins for companies operating in the acidity regulator market. Additionally, it necessitates the expansion of the workforce in production, distribution, and research and development sectors, with wages varying based on skillsets and regional differences. The acidity regulator market contributes to the financial matrix of various stakeholders, generating tax revenue and potentially creating new job opportunities.

As processed foods and beverages become increasingly integrated into modern diets driven by changing lifestyles, urbanization, and convenience, the demand for acidity regulators across various segments such as sauces, condiments, dressings, bakery, and confectionery continues to surge. This reflects the widespread use of these additives across the food industry. The increasing demand for acidity regulators is reflected in significant growth forecasts and market size assessments, pointing toward a strong path for the Acidity Regulators Market.

- SMR analysis says, the exports of food and beverages rose by 12% in 2021 to $7.9 billion (£5.9 billion).

- According to SMR analysis data, in 2021 an India-based retail intelligence platform of choice for brands and retailers, sales of packaged foods increased by 95% year on year, led by ready-to-eat products and rising out-of-home consumption.

Stringent Regulations on the Use of Food Additives

Strict regulations on the addition of food additives pose significant market barriers to entry in the global acidity regulatory market. These stringent standards have been frightening for new entrants and smaller players in the market. The approval processes and compliance requirements are rigorous, requiring thorough documentation, extensive testing, and adherence to labeling regulations. This adds complexity and cost to bringing acidity regulators to market. The volatility in regulatory frameworks across different regions adds another layer of complexity to market entry.

Additionally, concerns about reimbursement for compliance-related expenses and potential fines for non-compliance discourage new players from entering the market. It has been essential for market players to stay up-to-date on evolving trade policies to ensure an uninterrupted supply chain. Additionally, the regulatory pressures drive market consolidation, favoring larger, established players with the resources and expertise to navigate complex regulatory landscapes. The global acidity regulator market faces significant challenges owing to stringent regulations, including barriers to entry, navigating regulatory volatility, managing reimbursement concerns, and complying with trade policies.

Acidity Regulators Market Segment Analysis

By Product, According to SMR research, the Citric Acid segment is the largest in 2024. It holds about 30% of the market share and dominates the acidity regulatory market. Citric acid is popular for boosting flavors, controlling acidity, and preserving food. Its natural source, gentle flavor, and versatility in various food and drink recipes make it a top pick for manufacturers, particularly in the food and beverage sector. Citribel, Cargill Incorporated, and Archer Daniels Midland Company are the major leading players in the Acidity Regulators Market. The growth in consumer preferences for healthier and natural ingredients further boosts the demand for citric acid as a safe and effective acidity regulator.

Companies focus on branding strategies like product differentiation, packaging innovations, and marketing campaigns to enhance brand equity and stay ahead in the market. The production costs of citric acid are influenced by raw materials, energy expenses, and manufacturing processes. Manufacturers aim to enhance efficiency despite the costs to meet the rising demand for citric acid. Globalization greatly influences the dominance of the citric acid segment. The acidity regulator market growth and competitiveness are fueled by the import and export of citric acid raw materials and finished products. Its unique characteristics, adaptability, and positive reception are key factors in its leading position within the acid regulators market.

Additionally, Phosphoric acid, the second largest has popularity in the beverage industry and plays a significant role in its market share within the acidity regulators market. The increasing demand for acidity regulators in processed foods, particularly in beverages, has been a major factor driving the growth of the phosphoric acid segment.

Acidity Regulators Market Regional Analysis

Asia Pacific has been the dominant force in the Acidity Regulators Market, with a number of key companies and manufacturers leading the way in terms of growth and innovation. These industry leaders have successfully built strong brands that resonate with consumers throughout the region. The region's dominance because of its favorable trade finance policies facilitate seamless transactions and promote international trade relationships and fosters the growth in acidity regulators market.

Market penetration in Asia Pacific is significant, with China, India, Japan, and South Korea being top selling regions. China is a primary market for acidity regulators owing to its large population and rapid industrialization while India offers opportunities with its increasing consumption of processed foods and beverages. The dominance of Asia Pacific in the acidity regulators market has a significant economic impact, playing a crucial role in the region's overall growth and development.

This industry generates substantial revenue and creates numerous employment opportunities across different countries, fostering economic prosperity and sustaining livelihoods. Additionally, the region benefits from increased foreign investments and the establishment of manufacturing facilities, which further stimulate economic activity, leading to positive growth and trade balances.

- The top 3 exporters of Acidity regulators are Vietnam followed by China and India at the 3rd spot.

Acidity Regulators Market Competitive Landscape

The competitive landscape of the Acidity Regulators market includes key players such as Archer Daniels Midland Company (United States) , Kerry Group (Ireland), Bertek Ingredient Incorporation (Canada), Celrich Products Pvt. Ltd. (India), Chemelco International B.V. (Netherlands), Cargill Incorporated (United States), Fuerst Day Lawson Ltd (United Kingdom), etc. These companies play a significant role in the production and distribution of acidity regulators globally, catering to various industries like beverages, processed food, bakery and confectionery, sauces, condiments, and dressing, among others. The market is characterized by competitive dynamics, market share, and strategies employed by these key players to maintain their position and drive growth in the industry.

- Corbion extended its collaboration with Azelis, a leading global provider of innovative services in the specialty chemicals and food ingredients sectors, to promote Corbion's products in Malaysia and Singapore in 2023.

- In 2023, Cargill's salt division reached an agreement with CIECH Group, a well-known provider of evaporated salt goods.

- In 2023, ADM, a global human and animal nutrition company agreed to the acquisition of Fuerst Day Lawson Limited, a portfolio company of Highlander Partners, L.P.

- In 2022, Bartek Ingredients announced the construction of the world's largest production factory for malic and food-grade fumaric acid, which is currently under development.

|

Acidity Regulators Market Scope |

|

|

Market Size in 2024 |

USD 8.38 Bn. |

|

Market Size in 2032 |

USD 15.40 Bn. |

|

CAGR (2025-2032) |

7.9 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Product Citric Acid Phosphoric Acid Acetic Acid Maleic Acid Lactic Acid Others |

|

|

By Application Food & Beverages Sauces, Condiments, And Dressings Bakery & Confectionery Processed Food Others |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Acidity Regulators Market

- Archer Daniels Midland Company (United States)

- Kerry Group (Ireland)

- Bertek Ingredient Incorporation (Canada)

- Celrich Products Pvt. Ltd. (India)

- Chemelco International B.V. (Netherlands)

- Cargill Incorporated (United States)

- F.B.C Industries Inc (United States)

- Roquette (France)

- Jungbunzlauer Suisse AG (Switzerland)

- Foodchem International Corporation (China)

- FBC Industries Inc. (United States)

- Bartek Ingredients Inc. (Canada)

- The Dow Chemical Company (United States)

- Corbion Purac (Netherlands)

- Prinova Solutions LLP (India)

- Gadot Biochemical Industries (Israel)

- Pharmatrans Sanaq AG (Switzerland)

- Advanced Biotech (New Jersey)

- Jiangsu Kolod Food Ingredients Co., Ltd. (China)

Frequently Asked Questions

Growing demand for processed and packaged food and beverages and rising awareness of the health benefits of acidity regulators are the drivers of the acidity regulators market.

Investors can capitalize on the acidity regulators market by considering companies focused on natural ingredients, catering to emerging markets, or developing applications beyond food and beverages.

The Market size was valued at USD 8.38 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 7.9 % from 2025 to 2032, reaching nearly USD 15.40 billion.

The segments covered in the market report are source, product, application, and region.

1. Acidity Regulators Market: Research Methodology

2. Acidity Regulators Market: Executive Summary

3. Acidity Regulators Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Global Import-Export Analysis

5. Acidity Regulators Market: Dynamics

5.1. Market Driver

5.1.1. Demand for clean-label acidity regulators

5.1.2. The use of natural and organic acidity regulators

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

5.11. Analysis of Government Schemes & Initiatives for the Acidity Regulators Market

6. Acidity Regulators Market Size and Forecast by Segments (by Value Units)

6.1. Acidity Regulators Market Size and Forecast, by Product (2024-2032)

6.1.1. Citric Acid

6.1.2. Phosphoric Acid

6.1.3. Acetic Acid

6.1.4. Maleic Acid

6.1.5. Lactic Acid

6.1.6. Others

6.2. Acidity Regulators Market Size and Forecast, by Application (2024-2032)

6.2.1. Food & Beverages

6.2.2. Sauces, Condiments, And Dressings

6.2.3. Bakery & Confectionery

6.2.4. Processed Food

6.2.5. Others

6.3. Acidity Regulators Market Size and Forecast, by Region (2024-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Acidity Regulators Market Size and Forecast (by Value Units)

7.1. North America Acidity Regulators Market Size and Forecast, by Product (2024-2032)

7.1.1. Citric Acid

7.1.2. Phosphoric Acid

7.1.3. Acetic Acid

7.1.4. Maleic Acid

7.1.5. Lactic Acid

7.1.6. Others

7.2. North America Acidity Regulators Market Size and Forecast, by Application (2024-2032)

7.2.1. Food & Beverages

7.2.2. Sauces, Condiments, And Dressings

7.2.3. Bakery & Confectionery

7.2.4. Processed Food

7.2.5. Others

7.3. North America Acidity Regulators Market Size and Forecast, by Country (2024-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Acidity Regulators Market Size and Forecast (by Value Units)

8.1. Europe Acidity Regulators Market Size and Forecast, by Product (2024-2032)

8.1.1. Citric Acid

8.1.2. Phosphoric Acid

8.1.3. Acetic Acid

8.1.4. Maleic Acid

8.1.5. Lactic Acid

8.1.6. Others

8.2. Europe Acidity Regulators Market Size and Forecast, by Application (2024-2032)

8.2.1. Food & Beverages

8.2.2. Sauces, Condiments, And Dressings

8.2.3. Bakery & Confectionery

8.2.4. Processed Food

8.2.5. Others

8.3. Europe Acidity Regulators Market Size and Forecast, by Country (2024-2032)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Austria

8.3.8. Rest of Europe

9. Asia Pacific Acidity Regulators Market Size and Forecast (by Value Units)

9.1. Asia Pacific Acidity Regulators Market Size and Forecast, by Product (2024-2032)

9.1.1. Citric Acid

9.1.2. Phosphoric Acid

9.1.3. Acetic Acid

9.1.4. Maleic Acid

9.1.5. Lactic Acid

9.1.6. Others

9.2. Asia Pacific Acidity Regulators Market Size and Forecast, by Application (2024-2032)

9.2.1. Food & Beverages

9.2.2. Sauces, Condiments, And Dressings

9.2.3. Bakery & Confectionery

9.2.4. Processed Food

9.2.5. Others

9.3. Asia Pacific Acidity Regulators Market Size and Forecast, by Country (2024-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Acidity Regulators Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Acidity Regulators Market Size and Forecast, by Product (2024-2032)

10.1.1. Citric Acid

10.1.2. Phosphoric Acid

10.1.3. Acetic Acid

10.1.4. Maleic Acid

10.1.5. Lactic Acid

10.1.6. Others

10.2. Middle East and Africa Acidity Regulators Market Size and Forecast, by Application (2024-2032)

10.2.1. Food & Beverages

10.2.2. Sauces, Condiments, And Dressings

10.2.3. Bakery & Confectionery

10.2.4. Processed Food

10.2.5. Others

10.3. Middle East and Africa Starch-based bio plastics Market Size and Forecast, by Country (2024-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

11.1. South America Acidity Regulators Market Size and Forecast, by Product (2024-2032)

11.1.1. Citric Acid

11.1.2. Phosphoric Acid

11.1.3. Acetic Acid

11.1.4. Maleic Acid

11.1.5. Lactic Acid

11.1.6. Others

11.2. South America Acidity Regulators Market Size and Forecast, by Application (2024-2032)

11.2.1. Food & Beverages

11.2.2. Sauces, Condiments, And Dressings

11.2.3. Bakery & Confectionery

11.2.4. Processed Food

11.2.5. Others

11.3. South America Acidity Regulators Market Size and Forecast, by Country (2024-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Archer Daniels Midland Company (United States)

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Kerry Group (Ireland)

12.3. Bertek Ingredient Incorporation (Canada)

12.4. Celrich Products Pvt. Ltd. (India)

12.5. Chemelco International B.V. (Netherlands)

12.6. Cargill Incorporated (United States)

12.7. F.B.C Industries Inc (United States)

12.8. Roquette (France)

12.9. Jungbunzlauer Suisse AG (Switzerland)

12.10. Foodchem International Corporation (China)

12.11. FBC Industries Inc. (United States)

12.12. Bartek Ingredients Inc. (Canada)

12.13. The Dow Chemical Company (United States)

12.14. Corbion Purac (Netherlands)

12.15. Prinova Solutions LLP (India)

12.16. Gadot Biochemical Industries (Israel)

12.17. Pharmatrans Sanaq AG (Switzerland)

12.18. Advanced Biotech (New Jersey)

12.19. Jiangsu Kolod Food Ingredients Co., Ltd. (China)

13. Key Findings

14. Industry Recommendations