Wellness Water Market: Global Industry Analysis and Forecast (2025-2032)

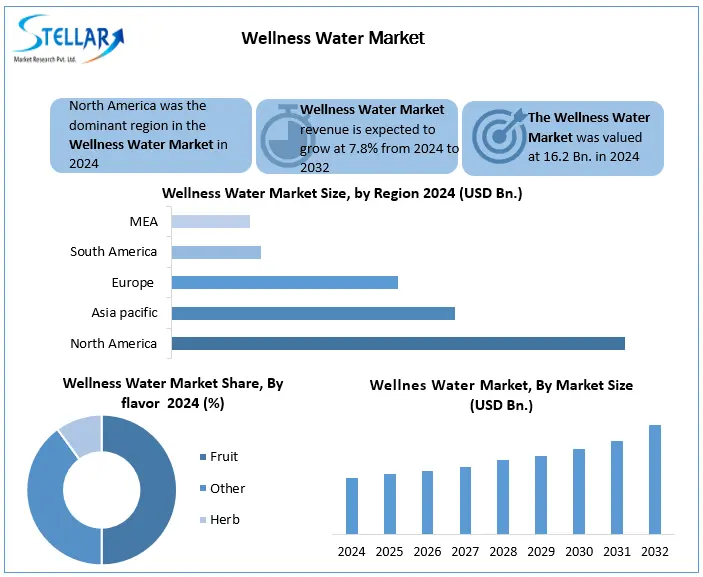

Wellness Water Market size was valued at USD 16.2 Bn. in 2024. The Global Wellness Water Industry revenue is expected to grow by 7.8% from 2024 to 2032, reaching nearly USD 29.54 Bn. by 2032.

Format : PDF | Report ID : SMR_2813

Wellness Water Market Overview:

Wellness water is a type of functional drink used to improve physical and mental health through increased hydration, which contains with vitamins, minerals, antioxidants, natural flavorings, herbal extract and electrolytes. Since early 2010, the global wellness water market has experienced significant development, rising consumer awareness of health and wellness, mostly in developed economies. Key trends in the wellness water market are rising demand for functional and natural ingredients and innovation in product formulation.

In North America, the primary consumers are the United States (U.S.) and Canada, millennials, fitness enthusiasts and busy professionals. Nestlé Waters and Danone S.A. are the top companies in the global wellness water market. Global trade policies and tariffs affect the wellness water market by raising import prices and influencing market access.

India charges a 7.5% customs duty plus additional taxes on imported wellness water, China puts on a 5.5% tariff and 13% VAT, while the U.S. imposes tariffs between 10% and 30% depend on the country of origin. These tariffs rise product prices, impacting competitiveness and consumer demand.

To get more Insights: Request Free Sample Report

Wellness Water Market Dynamics:

Increasing Health Consciousness to Boost the Wellness Water Market

The wellness water market is expanding significantly driven by the growing health consciousness of consumers because of consumers seek healthier beverage options due to rising issues about obesity, diabetes and heart disease. People are selecting functional water options enhanced with vitamins, minerals and herbal extracts over artificial drinks and sugary sodas. Also, the World Health Organization (WHO) and other international initiatives that promote natural ingredients, clean intake and preventive healthcare have rising demand for wellness-focused products. Also, growing urbanization and disposable incomes assist this by enabling consumers to purchase high-end health beverages. Consumers' knowledge is being shaped and more thoughtful purchasing decisions are being influenced by the increased availability of health information through digital channels.

Preference for Natural and Organic Products to Boost the Wellness Water Market

The preference for natural and organic products is rising because of consumers are actively searching healthier substitute options due to Increasing public awareness about the negative health effects of artificial additives, preservatives and chemicals. Wellness water contains with natural minerals, organic herbs, vitamins and plant extracts that offer a clean-label alternatives that support overall well-being and hydration. Also, environmental awareness encourages consumers to select products from sustainable, organic farming practices that avoid harmful pesticides.

Increased usage of synthetic flavoring essence to Restraint Wellness Water Market Growth

Essence is a major ingredient that is used in flavoring wellness water. Increased usage of synthetic flavoring essence is restraining the wellness water market growth, since it has been linked to dental issues in consumers as a result of long-term consumption. According to the American Dental Association, synthetic flavoring essences such as citric acid affect the teeth and lead to erosion. The prolonged consumption of flavored water dissolves away the layer of enamel and affects the structural integrity. The damage further leads to hypersensitivity and rise the chances of the formation of cavities and tooth erosion.

Wellness Water Market Segment Analysis:

Based On Flavor, the wellness water market is segmented into fruit flavor, herb flavor and other. As of 2024, the most dominant flavor segment in the wellness-water market is fruit-flavored wellness water, because fruit flavors are mostly well-liked and familiar to an extensive range of people across diverse demographics and age groups. They suggest a refreshing and edible taste that makes drinking water more agreeable. As of 2024, globally, fruit-flavored substitute products were reported for 50 to 60% of flavored water. It involves flavors like lemon, berry, and tropical blends.

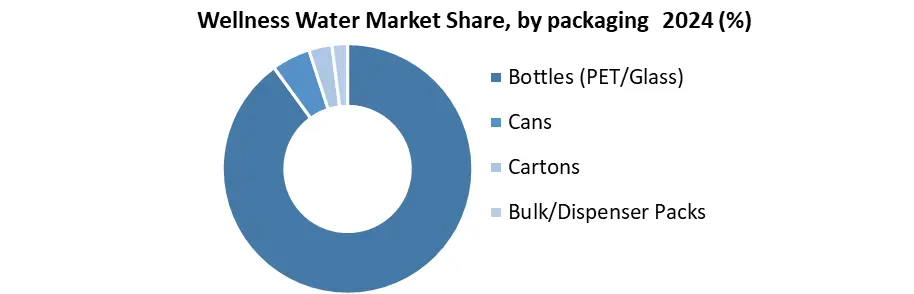

Based on Packaging, the wellness water market is divided into Bottles (PET/Glass), cans, cartons and bulk/dispenser packs. The Plastic bottles, mainly PET (Polyethylene Terephthalate), is the most dominant packaging segment in the wellness water market, because of their less charge, mainly for wide production, lightweight and strong nature, helping transportation and handling, flexibility in design allowing for consumer-friendly features, and the well-established global infrastructure for their production and recycling. one of the most impactful current developments is Light-weighting, engineering bottles with thinner walls and optimized shapes that use up to 20% less PET without sacrificing strength or reliability.

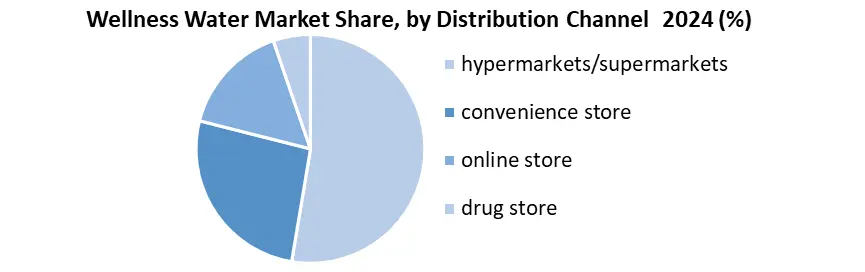

Based on Distribution Channel, the wellness water market is divided into Hypermarkets/Supermarkets, convenience stores, drug stores, online stores and others. The supermarkets and hypermarkets are the most dominant distribution channels in the wellness water market. due to their strong reach, increased footfall and the ease of one-stop shopping. These retail formats provide an extensive variability of wellness water brands, permitting consumers to compare options easily. Supermarkets and hypermarkets frequently run promotions and discounts, making wellness water extra accessible and appealing to a broader audience. The availability of wellness water in these stores also builds customer trust, as shoppers are more likely to purchase from established retailers they frequent regularly. Also, the strategic placement of wellness water products in prominent locations within these stores enhances visibility and encourages impulse purchases.

Wellness Water Market Regional Analysis

North America is the most dominant region in the global wellness water market, accounting for over one-third of the global market share in 2024. Because of high health-conscious consumers, strong economic conditions and advanced retail infrastructure. The U.S. leads the Wellness Water market due to its large base of fitness enthusiasts and growing awareness of the benefits of functional beverages. Consumers in North America are risingly seeking out enhanced water options that provide additional health benefits such as improved hydration, vitamins and minerals.

Wellness Water Market Competitive Analysis

Nestlé and Danone S.A. are the top companies in the wellness water market globally. Nestlé Waters operates an extensive portfolio, including global brands such as Perrier, San Pellegrino and Nestlé Pure Life, offering both sparkling and still wellness waters enriched with minerals or sourced from natural springs. Its strong sustainability commitments and global distribution network give a wide competitive edge. Danone S.A. is recognised for its premium natural spring water brands such as Evian and Volvic, more focusing on purity, natural sourcing and wellness driven hydration. Danone highlights eco-conscious packaging and health branding, appealing to upscale, health-aware consumers.

Wellness Water Market Recent Developments

- In March 2025, PepsiCo’s acquisition of Poppi for around $2 Bn. Poppi, a fast-growing prebiotic soda brand, had been acquisition traction among health-conscious Gen Z clients because of its gut-health benefits, clean ingredients, and strong social media presence, mainly on TikTok.

- In March 2022, a beverage manufacturer, Nirvana Water Sciences Corp is enhanced its product line by launching Nirvana HMB + Vitamin D3 natural spring water at Expo West in California. This new product encourages muscle repair and immunity.

- In July 2022, Flow Beverage Corp., a US-based beverage manufacturer, extended its Flow Vitamin-Infused Water product range with three additional organic Flavors: cherry, citrus and elderberry. The newly developed vitamin-infused water is available directly to US customers via its website.

|

Wellness Water Market Scope |

|

|

Market Size in 2024 |

USD 16.2 Bn. |

|

Market Size in 2032 |

USD 29.54 Bn. |

|

CAGR (2024-2032) |

7.8% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Flavor Fruit Herb Other |

|

By Packaging Type Bottles (PET/Glass) Cans Cartons Bulk/Dispenser Packs |

|

|

By Distribution Channel Hypermarkets/supermarkets Convenience store Drug store Online store Other |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Wellness Water Market

North America

- The Coca-Cola Company (USA)

- PepsiCo Inc. (USA)

- Keurig Dr Pepper Inc. (USA)

- VOSS Water (USA)

- Hint Water Inc. (USA)

- The Alkaline Water Company Inc. (USA)

- Nirvana Water Sciences Corp. (USA)

- Flow Beverage Corp. (Canada)

- Disruptive Beverages Inc. (USA)

- Trimino Brands LLC (USA)

- BlueTriton Brands Inc. (USA)

- Ayala's Herbal Water (USA)

- Talking Rain Beverage Company (USA)

- WTRMLN WTR (USA)

- HFactor (USA)

- Penta Water Company (USA)

- AquaHydrate Inc. (USA)

- Gatorade (USA)

- Essentia Water (USA)

Europe

- Nestlé S.A. (Switzerland)

- Danone S.A. (Netherlands)

- Acqua Minerale San Benedetto S.p.A. (Italy)

- Vichy Catalan Corporation (Spain)

- Badoit (France)

Asia pacific

- Tata Group (India)

- Suntory Holdings Limited (Japan)

- Otsuka Holdings Co., Ltd. (Japan)

- Asahi Group Holdings (Japan)

Frequently Asked Questions

North America is the most dominant region in the wellness water market.

Increasing Health Consciousness drives the wellness water market.

Nestlé Waters and Danone S.A. are the top players in the global wellness water market.

1. Wellness Water Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Wellness Water Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Wellness Water Market: Dynamics

3.1. Wellness Water Market Trends

3.2. Wellness Water Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Wellness Water Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Wellness Water Market Size and Forecast, By Flavor (2024-2032)

4.1.1. Fruits

4.1.2. Herb

4.1.3. Other

4.2. Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

4.2.1. Bottles (PET/Glass)

4.2.2. Cans

4.2.3. Cartons

4.2.4. Bulk/Dispenser Packs

4.3. Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Hypermarkets/Supermarkets

4.3.2. Convenience Store

4.3.3. Drug Store

4.3.4. Online Store

4.3.5. other

4.4. Wellness Water Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Wellness Water Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Wellness Water Market Size and Forecast, By Flavor (2024-2032)

5.1.1. Fruits

5.1.2. Herb

5.1.3. Other

5.2. North America Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

5.2.1. Bottles (PET/Glass)

5.2.2. Cans

5.2.3. Cartons

5.2.4. Bulk/Dispenser Packs

5.3. North America Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Hypermarkets/Supermarkets

5.3.2. Convenience Store

5.3.3. Drug Store

5.3.4. Online Store

5.3.5. other

5.4. North America Wellness Water Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Wellness Water Market Size and Forecast, By Flavor (2024-2032)

5.4.1.1.1. Fruit

5.4.1.1.2. Herb

5.4.1.1.3. Other

5.4.1.2. United States Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

5.4.1.2.1. Bottles (PET/Glass)

5.4.1.2.2. Cans

5.4.1.2.3. Cartons

5.4.1.2.4. Bulk/Dispenser Packs

5.4.1.3. United States Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Hypermarkets/Supermarkets

5.4.1.3.2. Convenience Store

5.4.1.3.3. Drug Store

5.4.1.3.4. Online Store

5.4.1.3.5. Other

5.4.2. Canada

5.4.2.1. Canada Wellness Water Market Size and Forecast, By Flavor (2024-2032)

5.4.2.1.1. Fruit

5.4.2.1.2. Herb

5.4.2.1.3. Other

5.4.2.2. Canada Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

5.4.2.2.1. Bottles (PET/Glass)

5.4.2.2.2. Cans

5.4.2.2.3. Cartons

5.4.2.2.4. Bulk/Dispenser Packs

5.4.2.3. Canada Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.3.1. Hypermarkets/Supermarkets

5.4.2.3.2. Convenience Store

5.4.2.3.3. Drug Store

5.4.2.3.4. Online Store

5.4.2.3.5. Other

5.4.3. Mexico

5.4.3.1. Mexico Wellness Water Market Size and Forecast, By Flavor (2024-2032)

5.4.3.1.1. Fruit

5.4.3.1.2. Herb

5.4.3.1.3. Other

5.4.3.2. Mexico Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

5.4.3.2.1. Bottles (PET/Glass)

5.4.3.2.2. Cans

5.4.3.2.3. Cartons

5.4.3.2.4. Bulk/Dispenser Packs

5.4.3.3. Mexico Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.3.3.1. Hypermarkets/Supermarkets

5.4.3.3.2. Convenience Store

5.4.3.3.3. Drug Store

5.4.3.3.4. Online Store

5.4.3.3.5. other

6. Europe Wellness Water Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.2. Europe Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.3. Europe Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Wellness Water Market Size and Forecast, By End-User (2024-2032)

6.5. Europe Wellness Water Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.1.2. United Kingdom Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.1.3. United Kingdom Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.2. France

6.5.2.1. France Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.2.2. France Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.2.3. France Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.3.2. Germany Wellness Water Market Size and Forecast, By Packaging Type 2024-2032)

6.5.3.3. Germany Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.4.2. Italy Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.4.3. Italy Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.5.2. Spain Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.5.3. Spain Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.6.2. Sweden Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.6.3. Sweden Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.7.2. Russia Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.7.3. Russia Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Wellness Water Market Size and Forecast, By Flavor (2024-2032)

6.5.8.2. Rest of Europe Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

6.5.8.3. Rest of Europe Wellness Water Market Size and Forecast By Distribution Channel (2024-2032)

7. Asia Pacific Wellness Water Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.2. Asia Pacific Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.3. Asia Pacific Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Wellness Water Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.1.2. China Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.1.3. China Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.2.2. S Korea Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.2.3. S Korea Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.3.2. Japan Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.3.3. Japan Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.4.2. India Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.4.3. India Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.5.2. Australia Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.5.3. Australia Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.6.2. Indonesia Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.6.3. Indonesia Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.7.2. Malaysia Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.7.3. Malaysia Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.8.2. Philippines Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.8.3. Philippines Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.9.2. Thailand Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.9.3. Thailand Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.10.2. Vietnam Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.10.3. Vietnam Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Wellness Water Market Size and Forecast, By Flavor (2024-2032)

7.4.11.2. Rest of Asia Pacific Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Wellness Water Market Size and Forecast (by Value in USD Bn.) (2024-2032

8.1. Middle East and Africa Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.2. Middle East and Africa Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.3. Middle East and Africa Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Wellness Water Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.4.1.2. South Africa Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.4.1.3. South Africa Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.4.2.2. GCC Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.4.2.3. GCC Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.4.3.2. Egypt Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.4.3.3. Egypt Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3.4. Egypt Wellness Water Market Size and Forecast, By End-User (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.4.4.2. Nigeria Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.4.4.3. Nigeria Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Wellness Water Market Size and Forecast, By Flavor (2024-2032)

8.4.5.2. Rest of ME&A Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

8.4.5.3. Rest of ME&A Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Wellness Water Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032

9.1. South America Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.2. South America Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.3. South America Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Wellness Water Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.4.1.2. Brazil Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.4.1.3. Brazil Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.4.2.2. Argentina Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.4.2.3. Argentina Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.4.3.2. Colombia Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.4.3.3. Colombia Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.4.4.2. Chile Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.4.4.3. Chile Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest of South America Wellness Water Market Size and Forecast, By Flavor (2024-2032)

9.4.5.2. Rest of South America Wellness Water Market Size and Forecast, By Packaging Type (2024-2032)

9.4.5.3. Rest of South America Wellness Water Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1. Nestlé S.A. (Switzerland)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Danone S.A. (Netherlands)

10.3. The Coca-Cola Company (USA)

10.4. PepsiCo Inc. (USA)

10.5. Keurig Dr Pepper Inc. (USA)

10.6. VOSS Water (USA)

10.7. Hint Water Inc. (USA)

10.8. Tata Group (Mumbai, India)

10.9. The Alkaline Water Company Inc. (USA)

10.10. Nirvana Water Sciences Corp. (USA)

10.11. Balance Water Company LLC (Australia)

10.12. Flow Beverage Corp. (Canada)

10.13. Disruptive Beverages Inc. (USA)

10.14. Acqua Minerale San Benedetto S.p.A. (Italy)

10.15. Vichy Catalan Corporation (Spain)

10.16. Trimino Brands LLC (USA)

10.17. Suntory Holdings Limited (Japan)

10.18. BlueTriton Brands Inc. (USA)

10.19. Otsuka Holdings Co., Ltd. (Japan)

10.20. Ayala's Herbal Water (USA)

10.21. Talking Rain Beverage Company (USA)

10.22. WTRMLN WTR (USA)

10.23. HFactor (USA)

10.24. Penta Water Company (USA)

10.25. AquaHydrate Inc. (USA)

10.26. Gatorade (USA)

10.27. Badoit (France)

10.28. Essentia Water (USA)

10.29. Clearly Canadian (Canada)

11. Key Findings

12. Industry Recommendations

13. Wellness Water Market: Research Methodology