Standing Desk Market Size, Ergonomic Innovation and Workplace Trends

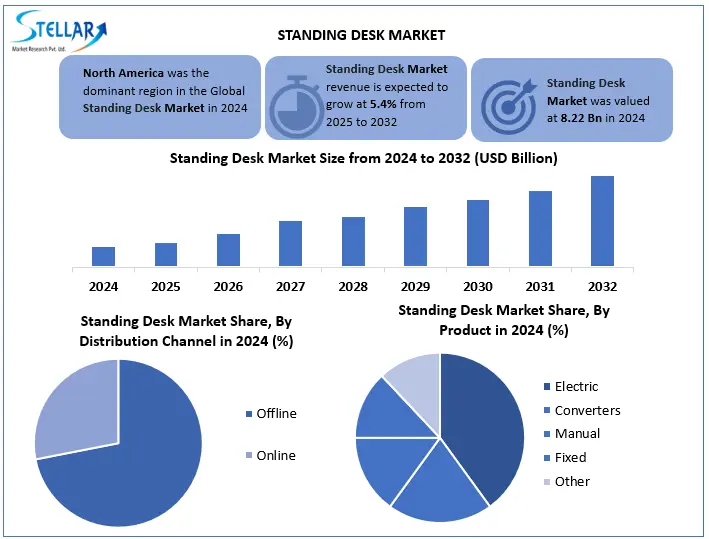

Standing Desk Market size was valued at USD 8.22 Bn in 2024, and is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 12.52 Bn by 2032.

Format : PDF | Report ID : SMR_2803

Standing Desk Market Overview

Desk designed for writing, reading, or drawing during standing or perched on a high stool is known as a standing desk. Standing desks are customized to the meet specific needs, such as desks for architectural drafting or specific types of telephone desks. While some standing desks are utilized during standing, others use a hand crank, electric motor, or counterweight mechanism allowing users to sit or stand. Some desks are placed on the top of an existing desk for standing or taken down for the sitting as they are made similarly to teacher lecterns.

Standing desk market is expanding across the globe steadily due to the rising consumer and organizational focus on ergonomic health solutions, with studies showing 87% of employees now prioritize ergonomic workspaces and 35% of global workers seeking standing desks for home offices. Technological innovations like electric height adjustment and smart tracking features are further enhancing product appeal.

Trade policies, particularly U.S. tariffs on Chinese components and EU anti-dumping duties, are significantly impacting supply chains and pricing, forcing manufacturers to relocate production and optimize logistics.

Standing Desk Market Recent Developments

|

Year |

Company |

Development |

Details |

|

3-May-2025 |

FlexiSpot |

Launch of Comhar Electric Standing Desk at Discount |

Price reduced to $290 (from $400) features USB ports, built in drawer, height range 28.9"–46.5". |

|

12-February-2025 |

Herman Miller |

Launch of Spout Sit-to-Stand Desk |

Features four motorized legs, USB-C charging, 400 lbs lift capacity, cable management, optional wheels. Priced $2,300–$3,400. |

|

15-November-23 |

Herman Miller &Design Within Reach |

Launch of 3D Product Configurators |

Online configurators for desk customization, pricing visualization, and sharing design combinations to improve user experience. |

To get more Insights: Request Free Sample Report

Standing Desk Market Dynamics

Ergonomic Innovation and Workplace Shifts to Drive the Standing Desk Market Growth

Due to the rising consumers and organizational awareness of health and comfort, the standing desk market is expanding steadily worldwide. Standing desks became more popular due to the desks capacity to lower the hazards connected with extended sitting, as sedentary lifestyles raise worries about a condition including obesity, cardiovascular disease, and back discomfort. As per study 87% of employees want ergonomic workspaces, with sit and stand desks. In order to improve workplace satisfaction and the productivity, industries actively invest in the ergonomic office furniture as a part of employee health initiative. As demand is increased for the remote and hybrid work, 35% global employees look for home office arrangements that are both comfortable and health conscious. Standing desks became more pleasing and convenient due to the technological innovations like electric height adjustment and clever features like usage tracking and reminders. Additionally, the standing desk market includes wide range of tastes and a price range due to the availability of numerous models, ranging from entry level converters to the expensive electric workstations.

Structural and Economic Restrains to the Standing Desk Market Growth

Advanced standing desks are expensive, is a restrictive particularly for the small firms and budget conscious consumers. High quality electric models from brands like Herman Miller or Steelcase run $800 to $2,500, putting them out of reach for many small businesses and individuals. Lack of knowledge about an ergonomic health and restricted access to high quality products hamper standing desk market growth in many developing nations. Nearly half of U.S. and European office workers use standing desks, adoption drops below 20% in countries like India and Brazil.

Even among companies that have invested in standing desks, there are concerns about measurable returns. While 70% of large organizations have implemented standing desk programs, follow-up studies show only about half of employees report sustained productivity or health improvements. This uncertainty has led some corporations to reevaluate their ergonomic furniture budgets.

Standing Desk Market Segment Analysis

Based on the Product, Standing Desk Market is segmented as fixed, manual, electric, converters, with electric adjustable standing desk segment as a dominant product in 2024 and is expected to hold largest market share during forecast period. Dominance is due to increased the need for ergonomic solutions and a greater convenience and usefulness. Electric standing desks are ideal for both home and the office settings as, in contrast to manual or a permanent desk, it enables users to easily change desks height with the single button press. A broad spectrum of customers is drawn to this products simplicity of use and accurate, seamless height adjustments. The companies are making a significant investment in an electric standing desk to enhance employee comfort, productivity, and wellbeing, particularly in technology and the knowledge dependent sectors.

Based on the Distribution Channel, Standing Desk Market is segmented as online and offline, with offline distribution channel segment as a dominant in 2024 and is expected to hold largest market share during forecast period. Dominance is due to the nature of the product and customer preferences. Customers prefer to personally evaluate standing desks for the stability, construction quality, and ergonomic features before making a purchase as they are frequently high involvement purchases. In addition to offering individualized advice from salespeople, offline channels including furniture showrooms, office supply stores, and specialty ergonomic retailers offer a hands-on experience. Additionally, companies who buy in bulk for offices frequently depend on offline vendors that provide installation services and post-purchase assistance. Offline channels continue to dominate because they better meet the tactile and service-based needs of customers, even if internet sales are expanding quickly due to ease and a greater selection of products.

Standing Desk Market Regional Analysis

The standing desk market is dominated by the North America. The main causes of this dominance are growing awareness of the negative health effects of sedentary lifestyles and the growing popularity of ergonomic workplace supplies. Strong purchasing power, well established business sector, and increased consumer health consciousness are driving the trend in nations like the US and Canada. Additionally, the market is expanding due to presence of significant standing desk manufacturers, a quick uptake of work from home policies, and proactive workplace wellness initiatives. The regions supremacy is also greatly influenced by the government programs that support employee wellness and the rising need for flexible work arrangements.

Standing Desk Market Competitive Landscape

Number of major players shape the competitive landscape of the standing desk market, with Herman Miller Inc. leading due to its strong brand reputation, innovative design, and the ergonomic focus. The company has solidified its position through ongoing research and the development, high quality product offerings, and a strategic move like its merger with Knoll to form MillerKnoll, expanding its global reach and product portfolio. Steelcase Inc, another dominant player, known for its wide range of ergonomic office solutions and strong relationships with corporate clients, its focus on the sustainability and smart workspace design gives it a competitive edge in the enterprise segment. Ergotron, Inc. specializes in sit stand desk solutions and monitor arms, making a name for itself with technology driven ergonomic products that serve the healthcare, educational, and commercial sectors.

Standing Desk Market Trade and Tariffs

Worldwide standing desk market is greatly impacted by the trade regulations and tariffs. The United States continues to impose 25% tariffs on a steel frame and 7.5% on motors manufactured in the China, raises the cost of production. The EU also places the 6.5% anti-dumping duty on some imported goods. Standing desk manufacturers are enforced through these policies to change their prices or move their supply chains to countries like Mexico and Vietnam that are immune from the tariffs. To stay competitive, businesses are using alternative sourcing and localized production techniques more and more. Innovation in logistics and material selection is fueled by the trade environment; some brands employ bonded warehouses to cut expenses. In the standing desk sector, these factors still influence price, supply chains, and marketing tactics.

|

Impact of Trade and Tariffs on the Standing Desk Market |

||

|

Factor |

Impact |

Description |

|

Import Costs |

25% tariff on Chinese steel frames. 7.5% tariff on electric motors |

Tariffs on raw materials like steel, aluminum, and electronic components raise production costs by 12-18% for standing desk manufacturers. |

|

Retail Pricing |

8-10% price hike in EU markets. 22% price increase for Chinese-made electric desks |

Manufacturers pass tariff costs to consumers, making premium desks 30-40% more expensive in tariff-affected regions. |

|

Supply Chain Strategy |

40% of U.S. standing desk imports now from Vietnam. 35% of manufacturers relocated production to Mexico. |

Companies are diversifying suppliers to low-tariff countries, with Vietnam becoming the primary alternative to China. |

|

SME Competitiveness |

60% of small manufacturers report profit margin erosion |

Small and medium enterprises face 20-25% higher relative costs compared to large corporations with global supply chains. |

|

Standing Desk Market Scope |

|

|

Market Size in 2024 |

USD 8.22 Bn. |

|

Market Size in 2032 |

USD 12.52 Bn. |

|

CAGR (2024-2032) |

5.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Fixed Manual Electric Converters |

|

By Distribution Channel Offline Online |

|

|

By End Use Residential Commercial |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Standing Desk Market Key Players

North America

- Herman Miller Inc. (USA)

- Steelcase Inc. (USA)

- Ergotron, Inc. (USA)

- Humanscale Corporation (USA)

- VARIDESK (Vari) (USA)

- Uplift Desk (USA)

- Xdesk (USA)

- Knoll, Inc. (USA)

- iMovR (USA)

- LifeSpan Fitness (USA)

Europe

- IKEA (Sweden)

- Kinnarps AB (Sweden)

- HÅG (Flokk Group) (Norway)

- Herman Miller Ltd. (Europe branch) (UK)

- Actiforce Europe GmbH (Germany)

- Sedus Stoll AG (Germany)

- Assmann Büromöbel GmbH (Germany)

- Spacetronik (Poland)

- Markant Office Furniture (Netherlands)

- Rehomy Ergonomics (Netherlands)

Asia-Pacific

- Okamura Corporation (Japan)

- Kokuyo Co., Ltd. (Japan)

- Godrej Interio (India)

- Fezibo (China)

- Loctek Ergonomic Technology Corp. (China)

- Jiecang Linear Motion Technology (China)

Middle East & Africa

- Mahmayi Office Furniture (UAE)

- Royal Furniture (UAE)

- OFIS Office Furniture (Easa Saleh Al Gurg Group) (UAE)

South America

- Tecno Mobili (Brazil)

Frequently Asked Questions

Customers prefer offline channels to evaluate stability, ergonomics, and receive expert advice for such high-involvement purchases.

North America's dominance is driven by ergonomic awareness, high spending power, strong corporate wellness initiatives, and major manufacturer presence.

Features like electric height adjustment and usage tracking have enhanced the appeal and user experience of standing desks.

Herman Miller’s merger with Knoll to form MillerKnoll expanded its global presence and product portfolio, reinforcing its market leadership.

1. Standing Desks Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Standing Desks Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Standing Desks Market: Dynamics

3.1. Standing Desks Market Trends by Region

3.1.1. North America Standing Desks Market Trends

3.1.2. Europe Standing Desks Market Trends

3.1.3. Asia Pacific Standing Desks Market Trends

3.1.4. Middle East and Africa Standing Desks Market Trends

3.1.5. South America Standing Desks Market Trends

3.2. Standing Desks Market Dynamics

3.2.1. Global Standing Desks Market Drivers

3.2.2. Global Standing Desks Market Restraints

3.2.3. Global Standing Desks Market Opportunities

3.2.4. Global Standing Desks Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Micromotor Industry

4. Standing Desks Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Standing Desks Market Size and Forecast, By Product (2024-2032)

4.1.1. Fixed

4.1.2. Manual

4.1.3. Electric

4.1.4. Converters

4.2. Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

4.2.1. Offline

4.2.2. Online

4.3. Standing Desks Market Size and Forecast, By End Use (2024-2032)

4.3.1. Residential

4.3.2. Commercial

4.4. Standing Desks Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Standing Desks Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Standing Desks Market Size and Forecast, By Product (2024-2032)

5.1.1. Fixed

5.1.2. Manual

5.1.3. Electric

5.1.4. Converters

5.2. North America Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Offline

5.2.2. Online

5.3. North America Standing Desks Market Size and Forecast, By End Use (2024-2032)

5.3.1. Residential

5.3.2. Commercial

5.4. North America Standing Desks Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Standing Desks Market Size and Forecast, By Product (2024-2032)

5.4.1.1.1. Fixed

5.4.1.1.2. Manual

5.4.1.1.3. Electric

5.4.1.1.4. Converters

5.4.1.2. United States Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.2.1. Offline

5.4.1.2.2. Online

5.4.1.3. United States Standing Desks Market Size and Forecast, By End Use (2024-2032)

5.4.1.3.1. Residential

5.4.1.3.2. Commercial

5.4.1.4. Canada Standing Desks Market Size and Forecast, By Product (2024-2032)

5.4.1.4.1. Fixed

5.4.1.4.2. Manual

5.4.1.4.3. Electric

5.4.1.4.4. Converters

5.4.1.5. Canada Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.5.1. Offline

5.4.1.5.2. Online

5.4.2. Canada Standing Desks Market Size and Forecast, By End Use (2024-2032)

5.4.2.1.1. Residential

5.4.2.1.2. Commercial

5.4.3. Mexico

5.4.3.1. Mexico Standing Desks Market Size and Forecast, By Product (2024-2032)

5.4.3.1.1. Fixed

5.4.3.1.2. Manual

5.4.3.1.3. Electric

5.4.3.1.4. Converters

5.4.3.2. Mexico Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.3.2.1. Offline

5.4.3.2.2. Online

5.4.3.3. Mexico Standing Desks Market Size and Forecast, By End Use (2024-2032)

5.4.3.3.1. Residential

5.4.3.3.2. Commercial

6. Europe Standing Desks Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Standing Desks Market Size and Forecast, By Product (2024-2032)

6.2. Europe Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.3. Europe Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4. Europe Standing Desks Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.1.2. United Kingdom Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.1.3. United Kingdom Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.2. France

6.4.2.1. France Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.2.2. France Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.2.3. France Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.3.2. Germany Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.3.3. Germany Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.4.2. Italy Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.4.3. Italy Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.5.2. Spain Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.5.3. Spain Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.6.2. Sweden Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.6.3. Sweden Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.7.2. Austria Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.7.3. Austria Standing Desks Market Size and Forecast, By End Use (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Standing Desks Market Size and Forecast, By Product (2024-2032)

6.4.8.2. Rest of Europe Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.8.3. Rest of Europe Standing Desks Market Size and Forecast, By End Use (2024-2032)

7. Asia Pacific Standing Desks Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Standing Desks Market Size and Forecast, By Product (2024-2032)

7.2. Asia Pacific Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Asia Pacific Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4. Asia Pacific Standing Desks Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.1.2. China Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.1.3. China Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.2.2. S Korea Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2.3. S Korea Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.3.2. Japan Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3.3. Japan Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.4. India

7.4.4.1. India Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.4.2. India Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4.3. India Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.5.2. Australia Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5.3. Australia Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.6.2. Indonesia Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6.3. Indonesia Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.7.2. Philippines Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7.3. Philippines Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.8.2. Malaysia Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8.3. Malaysia Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.9.2. Vietnam Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9.3. Vietnam Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.10.2. Thailand Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10.3. Thailand Standing Desks Market Size and Forecast, By End Use (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Standing Desks Market Size and Forecast, By Product (2024-2032)

7.4.11.2. Rest of Asia Pacific Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11.3. Rest of Asia Pacific Standing Desks Market Size and Forecast, By End Use (2024-2032)

8. Middle East and Africa Standing Desks Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Standing Desks Market Size and Forecast, By Product (2024-2032)

8.2. Middle East and Africa Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Middle East and Africa Standing Desks Market Size and Forecast, By End Use (2024-2032)

8.4. Middle East and Africa Standing Desks Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Standing Desks Market Size and Forecast, By Product (2024-2032)

8.4.1.2. South Africa Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.1.3. South Africa Standing Desks Market Size and Forecast, By End Use (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Standing Desks Market Size and Forecast, By Product (2024-2032)

8.4.2.2. GCC Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2.3. GCC Standing Desks Market Size and Forecast, By End Use (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Standing Desks Market Size and Forecast, By Product (2024-2032)

8.4.3.2. Nigeria Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3.3. Nigeria Standing Desks Market Size and Forecast, By End Use (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Standing Desks Market Size and Forecast, By Product (2024-2032)

8.4.4.2. Rest of ME&A Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4.3. Rest of ME&A Standing Desks Market Size and Forecast, By End Use (2024-2032)

9. South America Standing Desks Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Standing Desks Market Size and Forecast, By Product (2024-2032)

9.2. South America Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. South America Standing Desks Market Size and Forecast, By End Use (2024-2032)

9.4. South America Standing Desks Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Standing Desks Market Size and Forecast, By Product (2024-2032)

9.4.1.2. Brazil Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.1.3. Brazil Standing Desks Market Size and Forecast, By End Use (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Standing Desks Market Size and Forecast, By Product (2024-2032)

9.4.2.2. Argentina Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2.3. Argentina Standing Desks Market Size and Forecast, By End Use (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Standing Desks Market Size and Forecast, By Product (2024-2032)

9.4.3.2. Rest Of South America Standing Desks Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3.3. Rest Of South America Standing Desks Market Size and Forecast, By End Use (2024-2032)

10. Company Profile: Key Players

10.1. Herman Miller Inc. (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Steelcase Inc. (USA)

10.3. Ergotron, Inc. (USA)

10.4. Humanscale Corporation (USA)

10.5. VARIDESK (Vari) (USA)

10.6. Uplift Desk (USA)

10.7. Xdesk (USA)

10.8. Knoll, Inc. (USA)

10.9. iMovR (USA)

10.10. LifeSpan Fitness (USA)

10.11. IKEA (Sweden)

10.12. Kinnarps AB (Sweden)

10.13. HÅG (Flokk Group) (Norway)

10.14. Herman Miller Ltd. (Europe branch) (UK)

10.15. Actiforce Europe GmbH (Germany)

10.16. Sedus Stoll AG (Germany)

10.17. Assmann Büromöbel GmbH (Germany)

10.18. Spacetronik (Poland)

10.19. Markant Office Furniture (Netherlands)

10.20. Rehomy Ergonomics (Netherlands)

10.21. Okamura Corporation (Japan)

10.22. Kokuyo Co., Ltd. (Japan)

10.23. Godrej Interio (India)

10.24. Fezibo (China)

10.25. Loctek Ergonomic Technology Corp. (China)

10.26. Jiecang Linear Motion Technology (China)

10.27. Mahmayi Office Furniture (UAE)

10.28. Royal Furniture (UAE)

10.29. OFIS Office Furniture (Easa Saleh Al Gurg Group) (UAE)

10.30. Tecno Mobili (Brazil)

11. Key Findings

12. Analyst Recommendations

13. Standing Desks Market: Research Methodology