South Africa Corporate Travel Market: Size, Share, Trends by Service, End user industry, Dynamics, Key Players, and Forecast 2025-2032

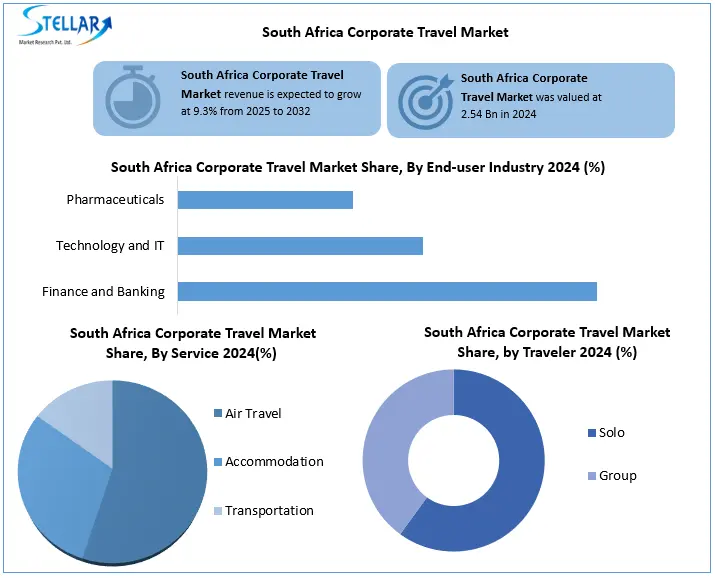

The South Africa Corporate Travel Market was estimated at USD 2.54 Bn. in 2024 and is expected to grow at a CAGR of 9.3% from 2025 to 2032, reaching nearly USD 5.17 Bn. by 2032.

Format : PDF | Report ID : SMR_2808

South Africa Corporate Travel Market Overview:

South Africa Corporate Travel Market includes trips for business purposes, such as meetings, conferences, sales, training and client visits, with a growing focus on digital transformation and automated travel management solutions.

South Africa corporate travel market has been growing due to rising demand from banking, financial services, IT, manufacturing, mining and consulting sectors. Increasing emphasis on structured travel management, cost efficiency and employee safety is fueling demand for professional corporate travel solutions. Growing adoption of digital booking platforms, integration of AI-driven expense management tools and the rising preference for sustainable and compliant travel options support the market’s relevance for both SMEs and large enterprises. Advancements in digital travel ecosystems, along with increasing use of automation and analytics, are improving efficiency, transparency and scalability of corporate travel programs.

South Africa remains the leading market for corporate travel in Sub Saharan Africa, supported by its diverse economy, strong financial sector, international connectivity and role as a regional business hub. Johannesburg, Cape Town and Durban anchor the majority of corporate travel demand due to high concentrations of multinational companies, financial institutions and event venues. Key players in the South Africa corporate travel market include BidTravel, Tourvest Travel Services and Club Travel Corporate. These companies are focusing on digital transformation, expanding corporate booking platforms, enhancing data driven travel management services and investing in sustainability oriented solutions to meet evolving client expectations.

The report covers South Africa corporate travel market dynamics, structure by analyzing market segments and projecting market size. It includes a clear representation of competitive analysis of key players by service offerings, pricing, financial position, product portfolio, growth strategies and regional presence in the South Africa corporate travel market.

To get more Insights: Request Free Sample Report

South Africa Corporate Travel Market Dynamics

Automated Travel Management Solutions to Fuel South Africa Corporate Travel Market Growth

Technological advancements in corporate travel management platforms including AI powered expense reporting, real time booking optimization and mobile first travel apps are transforming the South Africa corporate travel landscape. These solutions enhance cost transparency, compliance and efficiency, pushing their adoption among both SMEs and large enterprises. Integration of duty of care features, travel risk management tools and sustainability focused travel planning is driving market penetration across industries. Growing demand for real time analytics is enabling companies to optimize travel budgets, while cloud based platforms are ensuring scalability and seamless integration with global corporate systems.

Economic Volatility and Cost Pressures to restrain South Africa Corporate Travel Market

A major restraint for the South Africa corporate travel market is the high sensitivity of business travel demand to economic fluctuations and currency instability. Frequent depreciation of the South African Rand against major currencies like the US Dollar and Euro makes international travel significantly more expensive for companies. Rising airfare, accommodation and visa costs add further pressure to corporate travel budgets, especially for SMEs with limited resources. For example, while multinational corporations may absorb fluctuating costs through global contracts, many local firms scale back or delay business trips during periods of economic uncertainty, limiting overall market growth.

Sustainable Travel Integration to create Opportunity for the South Africa Corporate Travel Market

A rapidly emerging opportunity in the South Africa corporate travel market is the adoption of end to end digital travel platforms, driven by increasing demand for seamless booking, expense management, and sustainability tracking. This trend is opening doors for AI-powered travel apps, real-time expense monitoring tools, and integrated duty-of-care solutions. Tech-forward travel management companies are developing platforms that provide dynamic pricing insights, carbon footprint calculators, and compliance dashboards, enabling businesses to optimize both costs and sustainability goals. Some platforms even integrate with HR and finance systems, allowing travel managers to gain actionable insights, improve policy adherence, and support greener, more responsible corporate travel programs.

South Africa Corporate Travel Market Segment

Based on Service, the air travel segment dominated the South Africa corporate travel market in 2024 and is expected to hold the largest market share over the forecast period (2025–2032). This dominance is driven by the heavy reliance of corporates on domestic and international flights for business meetings, conferences, and cross-border projects. Covering nearly 50–55% of total corporate travel spend in 2024, air travel remains the backbone of the industry. Frequent routes between Johannesburg, Cape Town and Durban, alongside outbound connections to Europe, Asia and the rest of Africa, drive consistent demand. The segment further benefits from negotiated corporate rates, frequent flyer programs, and increasing adoption of digital booking platforms.

Based on End-User Industry, the Finance and banking segment dominated the South Africa corporate travel market in 2024. Finance and banking sector rely heavily on corporate travel for client meetings, investor presentations and regulatory interactions. Frequent travel is required for attending regional and international conferences, financial summits and cross border business negotiations. Safe, efficient and compliant travel arrangements are prioritized to ensure minimal disruption to business operations and adherence to corporate travel policies. Corporate travel solutions that provide real time expense tracking and risk management are especially valued in this sector.

Based on Traveler, Solo traveler segment dominated the South Africa corporate travel market in 2024 and is expected to maintain the largest market share over the forecast period (2025–2032). Business executives, consultants and project staff primarily travel individually for client meetings, site inspections, and conferences, which makes solo travel the most frequent mode in corporate itineraries. Covering about 65–70% of total corporate travel volume in 2024, this segment benefits from the flexibility and efficiency of managing single person bookings. Digital booking platforms, loyalty programs and policy compliant expense tools are widely used to streamline solo travel arrangements.

South Africa Corporate Travel Market Competitive Landscape

The South Africa corporate travel market is dominated by a few major players, including BidTravel, Tourvest Travel Services, Flight Centre Travel Group (FCTG), which together account for over 60% of the market share in 2024. Their leadership is driven by strong client bases, nationwide networks and comprehensive service portfolios covering flights, hotels, ground transport, and MICE. These players focus on digital platforms, AI driven expense tools and sustainability solutions to strengthen competitiveness, while smaller firms target SMEs with cost effective and tailored offerings.

|

South Africa Corporate Travel Market Scope |

|

|

Market Size in 2024 |

USD 2.54 Bn. |

|

Market Size in 2032 |

USD 5.17 Bn. |

|

CAGR (2024-2032) |

9.3% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Service Air Travel Accommodation Ground Transportation |

|

by End User industry Finance and Banking Technology and IT Healthcare and Pharmaceuticals |

|

|

By Traveler Solo Group |

|

South Africa Corporate Travel Market Key Players

- Rennies BCD Travel

- Tourvest Travel Services

- Club Travel Corporate

- GILTEDGE

- Sure Corporate

- Travel With Flair

- BidTravel

- XL Travel Group

- CWT South Africa

Frequently Asked Questions

Market Faces Restraints Related to Economic Volatility and Cost Pressures.

Digital Travel Platforms and Sustainable Travel Integration is an Opportunity for the South Africa Corporate Travel Market.

Rennies BCD Travel, Tourvest Travel Services, Club Travel Corporate, GILTEDGE are the key competitors in the South Africa corporate travel market.

The air travel segment dominated the South Africa corporate travel market.

1. South Africa corporate travel market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. South Africa corporate travel market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. South Africa corporate travel market: Dynamics

3.1. South Africa corporate travel market Trends

3.2. South Africa corporate travel market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. South Africa corporate travel market: Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. South Africa corporate travel market Size and Forecast, By Service (2024-2032)

4.1.1. Air Travel

4.1.2. Accommodation

4.1.3. Ground Transportation

4.2. South Africa corporate travel market Size and Forecast, By End User Industry (2024-2032)

4.2.1. Finance and Banking

4.2.2. Technology and IT

4.2.3. Healthcare and Pharmaceuticals

4.3. South Africa corporate travel market Size and Forecast, By Traveler (2024-2032)

4.3.1. Solo

4.3.2. Group

5. Company Profile: Key Players

5.1 Rennies BCD Travel

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2 Tourvest Travel Services

5.3 Club Travel Corporate

5.4 GILTEDGE

5.5 Sure Corporate

5.6 Travel With Flair

5.7 BidTravel

5.8 XL Travel Group

5.9 CWT South Africa

5 Key Findings

6 Industry Recommendations