Private Security Market: Size, Share, by Service, Application, region and Industry Forecast 2025-2032

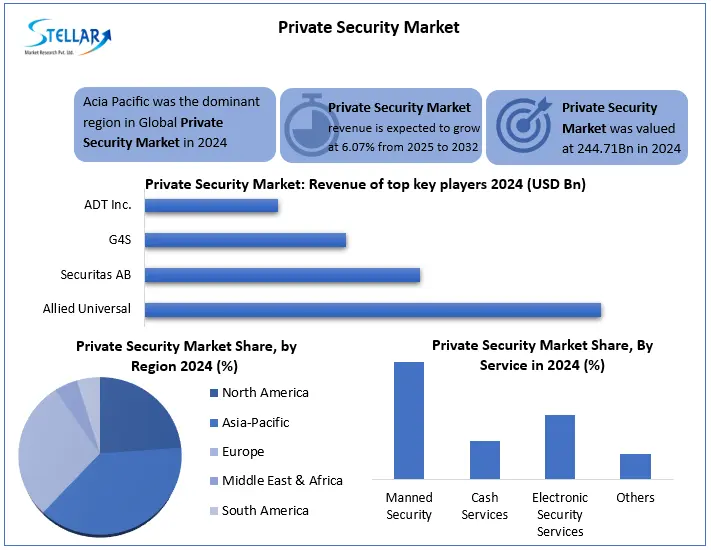

Private Security Market was estimated at USD 244.71 Bn in 2024 and is expected to grow at a CAGR of 6.07% from 2025 to 2032, reaching nearly USD 392.24 Bn by 2032.

Format : PDF | Report ID : SMR_2810

Private Security Market Overview

The private Security Market includes companies and organizations that provide security services to clients, including physical security, surveillance, access control, and other services for businesses and organizations.

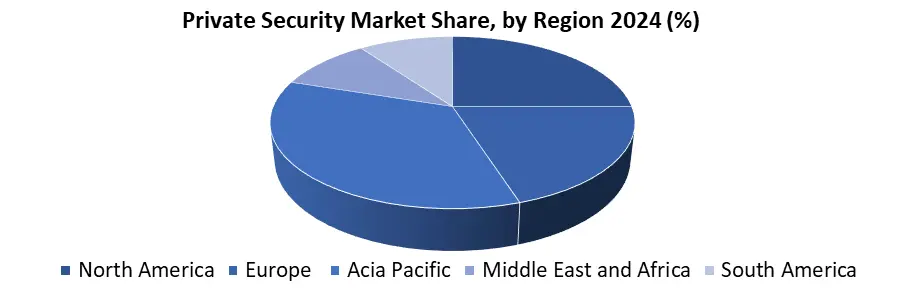

Private Security Market is growing steadily, and the growth is driven by crime, terrorism, and violence increases. For that reason, companies and individuals are investing more in physical security services, electronic services, and cyber security in an attempt to remain safe. These security services are provided by trained professionals, not belonging to any government security agency. During the COVID-19 pandemic, the need for the security market is increasing to monitor health habits and manage the crowd in the healthcare sector. Asia Pacific was the front runner of the Private Security Market in 2024, as crime rates are increasing and there are infrastructure projects. The coming together of intelligent security technologies and the rising need for cyber security solutions are expected to create new avenues, thus making the Private Security Market highly dynamic and competitive during the forecasted period.

To get more Insights: Request Free Sample Report

Private Security Market Dynamics

Rising Security Threats are Major Drivers to Fuel the Private Security Market

The Private Security Market is influenced by transformative forces, where growing security challenges, technological advancement, and the development of infrastructure drive the growth of the Private Security Market. The rising corporate security, housing protection, and public safety demand are boosting both manpower and technologically driven needs. Moreover, rising crime rates in urban areas highlight the need for stronger security measures to maintain security for citizens and property protection. Furthermore, the incorporation of intelligent surveillance technology, AI-based monitoring, and urbanization speed up the requirement for innovative private security solutions even more.

The Market Faces Restraint Related to High Service Costs for implementing advanced security technologies

The industry is disturbed by high costs of services, regulatory barriers, and labor shortages that can restrain potential growth. The industry is highly fragmented in nature with many small and medium-sized enterprises and industry leaders such as global giants makes the private security market competitive. Many firms choose cost-effective security methods, avoiding the entire use of new technology that impacts the growth potential of the Private Security Market. Additionally, the absence of standard training, the differences in regional regulations, and low uptake of integrated security platforms also pose scalability and efficiency risks to private security services.

Technology advancement and Rising Urbanization are the Growth opportunities for the Private Security Market

The integration of Artificial Intelligence, IoT, and big data analytics is providing real-time monitoring, threat detection, and improved surveillance functions. The rising need for cybersecurity solutions is another significant opportunity for the Private Security Market. Moreover, the development of smart cities and mega-events is fueling greater demand for high-tech private security solutions. Also, partnerships among private security firms and governments and investments in autonomous security technologies like drones and robots are providing new opportunities for market expansion and innovation.

Private Security Market Segment Analysis

Based on Services Type, the market is segmented into Manned security, cash services, electronics security services, and Commercial. The manned security segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032). Manned security means the Security guard that provides physical protection to the property and personnel. It is dominant due to the increase in crime in urban areas, terrorism, and other security gaps. An electronic security system uses software and electronics to perform a crowd of safety tasks to increase the safety of a specified area. These systems monitor and collect data from subsystems, allowing operators to interpret data, determine reactions, and respond to events. The increasing demand for distance monitoring is estimated to promote the development of this section.

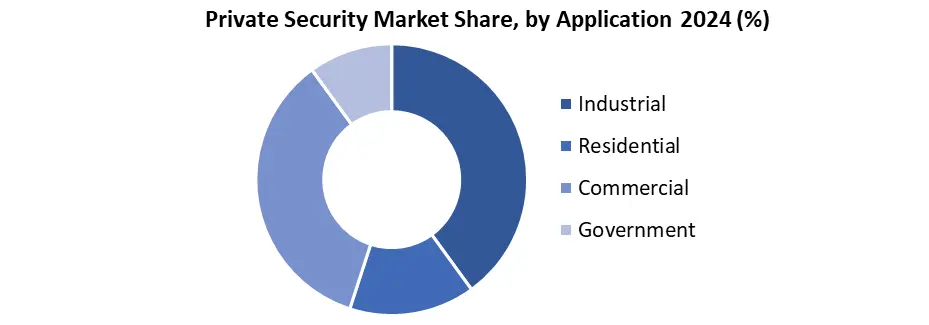

Based on Applications, the market is segmented into Industrial, Residential, Commercial, and Government. The industrial segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032). due to the rising demand for asset protection. It includes construction traffic control, Supervision during manufacturing, vehicle watch, and other security services. The residential segment is also expected the fastest-growing segment during the forecasted period due to the rising demand for the safety and security of homes. Many residential areas also hire security guards to protect the premises. Residential security refers to safeguarding individuals and their belongings from privacy invasion, disruptions, or any other threat that may compromise the safety of the residents.

Based on End-User, the market is segmented into infrastructure, manufacturing, energy and utilities, Banking, Financial Services and Insurance (BFSI), ports and airports, and Commercial. The manufacturing sector dominates the market and registers significant growth due to the rising demand for asset protection. The manufacturing industry is very broad, ranging from producing advanced fighter aircraft, ventilators, pharmaceuticals, automobiles and more. The BFSI segment is expected to be the fastest-growing segment as a result of the growing need for cash management services.

Private Security Market Regional Analysis

In 2024, Asia Pacific dominated the Private Security Market. The region is expected to be the fastest growing area in the private security market during the forecast period. Due to the increase in the rate of dangers, crime and terrorism. In this region, China, India and Japan are the leading countries in this market. During the forecast period, it is expected to be a trend upwards and the Asia Pacific Market occupies a stake in the market of about 123.4 billion billion in 2032. North America captured the second largest market share in 2024. Private security industry in the US is a large and growing area. This includes Allied Universal, Garda World and G4S, which provide services to physical security to executive protection and phenomenon protection.

Private Security Market Competitive Landscape

The Asia Pacific Private Security industry is very competitive with a combination of global giants and regional players providing varied security solutions. Dominant companies like Allied Universal, Securitas AB, and ADT Inc. leading the market in manned guarding and electronic surveillance to risk consulting services. Local players like China Security and Surveillance Technology Inc. and TOPSGRUP (India), are tightening their grip through regional offerings and integration of technology. Demand for domestic and business security solutions is increasing, making the Asia Pacific region a key contributor to the Global Private Security Market.

|

Private Security Market Scope |

|

|

Market Size in 2024 |

USD 244.71 Bn. |

|

Market Size in 2032 |

USD 392.24 Bn. |

|

CAGR (2024-2032) |

6.07% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Service Type Manned Security Cash Services Electronic Security Services Commercial |

|

By Application Industrial Residential Commercial Government |

|

|

By End-user Infrastructure Manufacturing Banking Financial Services Ports and Airports |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of the Private Security Market

North America

- Allied Universal (California)

- ADT Inc. (Florida)

- Brinks Inc. (Virginia)

- Stanley Security (Indiana)

- Pinkerton (Michigan)

- Secureworks (Georgia)

- Genesis Security (Illinois)

- U.S. Security Associates (Georgia)

- OnGuard Security (California)

- Sentry Security Service (California)

- Fidelis Security (Florida)

- ISG (New York)

- Baxter International Inc. (Illinois)

- Securiguard (Canada)

Europe

- G4S (London)

- Control Risks (London)

- Chubb Fire & Security (Reigate)

- Redline Security (London)

- Securitas AB (Stockholm)

- Loomis AB (Stockholm)

- Tyco International (Cork)

- Group 4 Falck (Copenhagen)

- PSS (Paris)

Asia-Pacific

- SIS New Delhi

- FMS Tech (Bangalore)

- MPS Security (Chennai)

- Kapoor Security (Dubai)

- Elite Security Group (Dubai)

Frequently Asked Questions

The Manned security segment is the leading segment in the Private Security Market.

G4S, Securitas AB, Allied Universal, ADT Inc., are the top players in the Private Security Market.

High Service Costs for implementing advanced security technologies are the restraint for the Private Security Market.

The Industrial application dominates the market.

1. Private Security Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Private Security Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Private Security Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Private Security Market: Dynamics

3.1. Private Security Market Trends by Region

3.1.1. North America Private Security Market Trends

3.1.2. Europe Private Security Market Trends

3.1.3. Asia Pacific Private Security Market Trends

3.1.4. Middle East & Africa Private Security Market rends

3.1.5. South America Private Security Market Marke Trends

3.2. Private Security Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Private Security Market Industry

4. Private Security Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Private Security Market Size and Forecast, By Service (2024-2032)

4.1.1. Manned Security

4.1.2. Cash Services

4.1.3. Electronic Security Services

4.1.4. Others

4.2. Private Security Market Size and Forecast, By Application (2024-2032)

4.2.1. Industrial

4.2.2. Residential

4.2.3. Commercial

4.2.4. Government

4.3. Private Security Market Size and Forecast, By End-user (2024-2032)

4.3.1. Infrastructure

4.3.2. Manufacturing

4.3.3. Energy and Utilities

4.3.4. Banking Financial Services

4.3.5. Ports and Airports

4.4. Private Security Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Private Security Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Private Security Market Size and Forecast, By Service (2024-2032)

5.1.1. Manned Security

5.1.2. Cash Services

5.1.3. Electronic Security Services

5.1.4. Others

5.2. North America Private Security Market Size and Forecast, By Application (2024-2032)

5.2.1. Industrial

5.2.2. Residential

5.2.3. Commercial

5.2.4. Government

5.3. North America Private Security Market Size and Forecast, By End-user (2024-2032)

5.3.1. Infrastructure

5.3.2. Manufacturing

5.3.3. Energy and Utilities

5.3.4. Banking Financial Services

5.3.5. Ports and Airports

5.4. North America Private Security Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Private Security Market Size and Forecast, By Service (2024-2032)

5.4.1.1.1. Manned Security

5.4.1.1.2. Cash Services

5.4.1.1.3. Electronic Security Services

5.4.1.1.4. Others

5.4.1.2. United States Private Security Market Size and Forecast, By Applications (2024-2032)

5.4.1.2.1. Industrial

5.4.1.2.2. Residential

5.4.1.2.3. Commercial

5.4.1.2.4. Government

5.4.1.3. United States Private Security Market Size and Forecast, By End-user (2024-2032)

5.4.1.3.1. Infrastructure

5.4.1.3.2. Manufacturing

5.4.1.3.3. Energy and Utilities

5.4.1.3.4. Banking Financial Services

5.4.1.3.5. Ports and Airports

5.4.2. Canada

5.4.2.1. Canada Private Security Market Size and Forecast, By Service (2024-2032)

5.4.2.1.1. Manned Security

5.4.2.1.2. Cash Services

5.4.2.1.3. Electronic Security Services

5.4.2.1.4. Others

5.4.2.2. Canada Private Security Market Size and Forecast, By Applications (2024-2032)

5.4.2.2.1. Industrial

5.4.2.2.2. Residential

5.4.2.2.3. Commercial

5.4.2.2.4. Government

5.4.2.3. Canada Private Security Market Size and Forecast, By End-user (2024-2032)

5.4.2.3.1. Infrastructure

5.4.2.3.2. Manufacturing

5.4.2.3.3. Energy and Utilities

5.4.2.3.4. Banking Financial Services

5.4.2.3.5. Ports and Airports

5.4.3. Mexico

5.4.3.1. Mexico Private Security Market Size and Forecast, By Service (2024-2032)

5.4.3.1.1. Manned Security

5.4.3.1.2. Cash Services

5.4.3.1.3. Electronic Security Services

5.4.3.1.4. Others

5.4.3.2. Mexico Private Security Market Size and Forecast, By Applications (2024-2032)

5.4.3.2.1. Industrial

5.4.3.2.2. Residential

5.4.3.2.3. Commercial

5.4.3.2.4. Government

5.4.3.3. Mexico Private Security Market Size and Forecast, By End-user (2024-2032)

5.4.3.3.1. Infrastructure

5.4.3.3.2. Manufacturing

5.4.3.3.3. Energy and Utilities

5.4.3.3.4. Banking Financial Services

5.4.3.3.5. Ports and Airports

6. Europe Private Security Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Private Security Market Size and Forecast, By Service (2024-2032)

6.2. Europe Private Security Market Size and Forecast, By Applications (2024-2032)

6.3. Europe Private Security Market Size and Forecast, By End-user (2024-2032)

6.4. Europe Private Security Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Private Security Market Size and Forecast, By Service (2024-2032)

6.4.1.2. United Kingdom Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.1.3. United Kingdom Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.2. France

6.4.2.1. France Private Security Market Size and Forecast, By Service (2024-2032)

6.4.2.2. France Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.2.3. France Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Private Security Market Size and Forecast, By Service (2024-2032)

6.4.3.2. Germany Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.3.3. Germany Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Private Security Market Size and Forecast, By Service (2024-2032)

6.4.4.2. Italy Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.4.3. Italy Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Private Security Market Size and Forecast, By Service (2024-2032)

6.4.5.2. Spain Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.5.3. Spain Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Private Security Market Size and Forecast, By Service (2024-2032)

6.4.6.2. Sweden Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.6.3. Sweden Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Private Security Market Size and Forecast, By Service (2024-2032)

6.4.7.2. Austria Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.7.3. Austria Private Security Market Size and Forecast, By End-user (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Private Security Market Size and Forecast, By Service (2024-2032)

6.4.8.2. Rest of Europe Private Security Market Size and Forecast, By Applications (2024-2032)

6.4.8.3. Rest of Europe Private Security Market Size and Forecast, By End-user (2024-2032)

7. Asia Pacific Private Security Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Private Security Market Size and Forecast, By Service (2024-2032)

7.2. Asia Pacific Private Security Market Size and Forecast, By Applications (2024-2032)

7.3. Asia Pacific Private Security Market Size and Forecast, By End-user (2024-2032)

7.4. Asia Pacific Private Security Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Private Security Market Size and Forecast, By Service (2024-2032)

7.4.1.2. China Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.1.3. China Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Private Security Market Size and Forecast, By Service (2024-2032)

7.4.2.2. S Korea Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.2.3. S Korea Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Private Security Market Size and Forecast, By Service (2024-2032)

7.4.3.2. Japan Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.3.3. Japan Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.4. India

7.4.4.1. India Private Security Market Size and Forecast, By Service (2024-2032)

7.4.4.2. India Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.4.3. India Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Private Security Market Size and Forecast, By Service (2024-2032)

7.4.5.2. Australia Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.5.3. Australia Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Private Security Market Size and Forecast, By Service (2024-2032)

7.4.6.2. Indonesia Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.6.3. Indonesia Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Private Security Market Size and Forecast, By Service (2024-2032)

7.4.7.2. Philippines Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.7.3. Philippines Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Private Security Market Size and Forecast, By Service (2024-2032)

7.4.8.2. Malaysia Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.8.3. Malaysia Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Private Security Market Size and Forecast, By Service (2024-2032)

7.4.9.2. Vietnam Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.9.3. Vietnam Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Private Security Market Size and Forecast, By Service (2024-2032)

7.4.10.2. Thailand Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.10.3. Thailand Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Private Security Market Size and Forecast, By Service (2024-2032)

7.4.11.2. ASEAN Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.11.3. ASEAN Private Security Market Size and Forecast, By End-user (2024-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Private Security Market Size and Forecast, By Service (2024-2032)

7.4.12.2. Rest of Asia Pacific Private Security Market Size and Forecast, By Applications (2024-2032)

7.4.12.3. Rest of Asia Pacific Private Security Market Size and Forecast, By End-user (2024-2032)

8. Middle East and Africa Private Security Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Private Security Market Size and Forecast, By Service (2024-2032)

8.2. Middle East and Africa Private Security Market Size and Forecast, By Applications Model (2024-2032)

8.3. Middle East and Africa Private Security Market Size and Forecast, By End-user (2024-2032)

8.4. Middle East and Africa Private Security Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Private Security Market Size and Forecast, By Service (2024-2032)

8.4.1.2. South Africa Private Security Market Size and Forecast, By Applications Model (2024-2032)

8.4.1.3. South Africa Private Security Market Size and Forecast, By End-user (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Private Security Market Size and Forecast, By Service (2024-2032)

8.4.2.2. GCC Private Security Market Size and Forecast, By Applications Model (2024-2032)

8.4.2.3. GCC Private Security Market Size and Forecast, By End-user (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Private Security Market Size and Forecast, By Service (2024-2032)

8.4.3.2. Nigeria Private Security Market Size and Forecast, By Applications Model (2024-2032)

8.4.3.3. Nigeria Private Security Market Size and Forecast, By End-user (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Private Security Market Size and Forecast, By Service (2024-2032)

8.4.4.2. Rest of ME&A Private Security Market Size and Forecast, By Applications Model (2024-2032)

8.4.4.3. Rest of ME&A Private Security Market Size and Forecast, By End-user (2024-2032)

9. South America Private Security Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032)

9.1. South America Private Security Market Size and Forecast, By Service (2024-2032)

9.2. South America Private Security Market Size and Forecast, By Applications (2024-2032)

9.3. South America Private Security Market Size and Forecast, By End-user (2024-2032)

9.4. South America Private Security Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Private Security Market Size and Forecast, By Service (2024-2032)

9.4.1.2. Brazil Private Security Market Size and Forecast, By Applications (2024-2032)

9.4.1.3. Brazil Private Security Market Size and Forecast, By End-user (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Private Security Market Size and Forecast, By Service 2025-2032)

9.4.2.2. Argentina Private Security Market Size and Forecast, By Applications (2024-2032)

9.4.2.3. Argentina Private Security Market Size and Forecast, By End-user (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Private Security Market Size and Forecast, By Service (2024-2032)

9.4.3.2. Rest Of South America Private Security Market Size and Forecast, By Applications (2024-2032)

9.4.3.3. Rest Of South America Private Security Market Size and Forecast, By End-user (2024-2032)

10. Company Profile: Key Players

10.1 Allied Universal

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 ADT Inc.

10.3 Brinks Inc.

10.4 Stanley Security

10.5 Pinkerton

10.6 Secureworks

10.7 Genesis Security

10.8 U.S. Security Associates

10.9 OnGuard Security

10.10 Sentry Security Service

10.11 Fidelis Security

10.12 ISG

10.13 Baxter International Inc.

10.14 Securiguard

10.15 G4S

10.16 Control Risks

10.17 Chubb Fire & Security

10.18 Redline Security

10.19 Securitas AB

10.20 Loomis AB

10.21 Tyco International

10.22 Group 4 Falck

10.23 PSS

10.24 SIS

10.25 FMS Tech

10.26 MPS Security

10.27 Kapoor Security

10.28 Elite Security Group

10 Key Findings & Analyst Recommendations

11 Private Security Markets: Research Methodology