North America Artificial Photosynthesis Market 2025–2032: Size, Share, Growth Trends, By Technology & Application, Key Players Overview

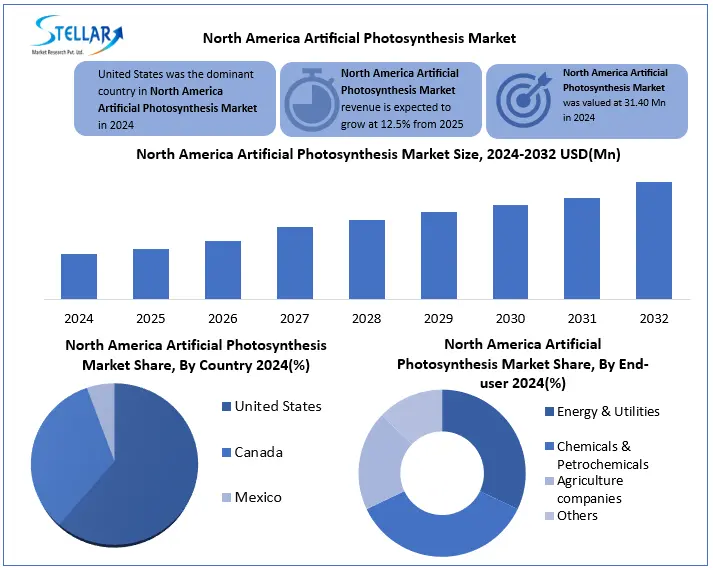

The North America Artificial Photosynthesis Market was estimated at USD 31.40 Mn. in 2024 and is expected to grow at a CAGR of 12.5% from 2025 to 2032, reaching nearly USD 80.57 Mn. by 2032.

Format : PDF | Report ID : SMR_2879

North America Artificial Photosynthesis Market Overview:

Artificial Photosynthesis is a process that mimics natural photosynthesis to convert solar energy into chemical fuels, like hydrogen or other high-energy compounds. North America Artificial photosynthesis market is gaining momentum as a clean energy solution, which is fueled by the increasing global demand for permanent fuel options, especially green hydrogen. Major development drivers include carbon emissions, government-supported R&D initiatives and increasing concerns over rising investments in renewable energy technologies. The availability of main materials such as semiconductor catalysts and frequent solar infrastructure requirement affects the dynamics of supply, but demand is increasing rapidly due to decarbonization goals in areas such as transport, chemicals and power generation. The United States initiatives like the "fuel from sunlight" program of the Department of Energy, which invests over USD 100 million in artificial photosynthesis R&D. Major key players in this market are SunHydrogen, Twelve. Due to technological innovation, North America artificial photosynthesis is ready to play an important role in future energy mix and market growth during forecasted period.

To get more Insights: Request Free Sample Report

North America Artificial Photosynthesis Market Dynamics

The Surge in Green Hydrogen Demand to Boost the North America Artificial Photosynthesis Market

The strongest force powering the North America artificial photosynthesis market is the rising global demand for green hydrogen. As the countries aim for carbon neutrality, hydrogen produced through permanent methods is seen as a major enabler for decarbonizing industries such as steel, aviation and chemicals. In 2024, North America artificial photosynthesis applications in hydrogen production accounts for more than 60% of market share. Governments are majorly funding for artificial photosynthesis technology, with more than 35 countries developing hydrogen roadmaps, this demand is expected to maintain long term investment in artificial photosynthesis technologies.

The Market Faces Restraints Related to Limited Scalability and Commercial Readiness

One of the major roadblocks in North America artificial photosynthesis market is difficulty in scaling from lab to real-world applications. Currently, over 80% of artificial photosynthesis projects are still in pilots or performance stages, reaching very few to commercial placement. Factors such as inconsistent photocatalyst performance, decline in systems over time, and integration complications with existing energy infrastructure obstruct progress. For example, even promising photoelectrochemical cells that achieve 15-20% efficiency in the lab often drop in field conditions.

Diversified End-Uses and Carbon Capture is an Opportunity for North America Artificial Photosynthesis Market.

The future of North America artificial photosynthesis market looks bright. Beyond hydrogen, the technology is produce synthetic hydrocarbons, fertilizers and special chemicals. Innovations in co-electrolysis and photo-electrocatalysis are improving efficiency, with some lab systems reaching solar to chemical efficiencies above 15-20%. the dual benefit of carbon capture using CO2 as a raw material positions artificial photosynthesis as a powerful climate solution. It not only reduce emissions but it actively recycles CO2, making it important to the development of a circular carbon economy. This dual functionality of fuel manufacturing and carbon usage makes artificial photosynthesis an opportunity for a high impact in global markets.

North America Artificial Photosynthesis Market Segment Analysis

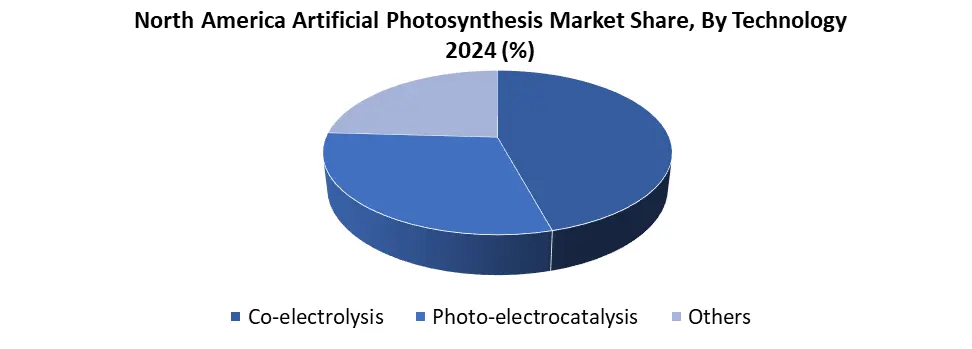

Based on Technology, the North America artificial photosynthesis market is segmented into co-electrolysis, photo-electrocatalysis and others. In that co-electrolysis segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). By 2025, it is estimated to more than 50% of the total technology market, mainly due to its compatibility with existing electrolysis infrastructure and relatively high maturity. Co-electrolysis works simultaneously by reducing carbon dioxide and water in Syngas it is a mixture of hydrogen and carbon monoxide and processed into synthetic fuels like menthol or Fischer-Tropsch diesel. This dualwork capacity not only improves energy efficiency, but also increases carbon use, which is ideal for both fuel production and emission reduction.

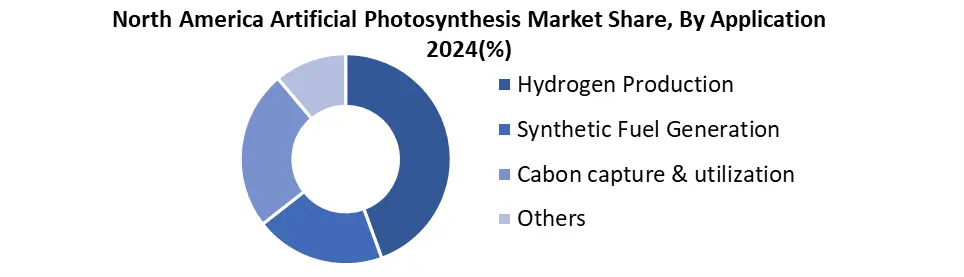

Based on Application, North America artificial photosynthesis market is segmented into Hydrogen production, Synthetic fuel generation, Carbon capture and utilization and others. The Hydrogen production segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). This dominance is fueled by immediate global requirement of clean, carbon-free hydrogen, which are seen as a foundation for decarbonizing sectors to areas such as steel, cement, refining and long-haul transportation. The hydrogen production application has potential to generate hydrogen on-site, and with minimal environmental footprint. According to the International Energy Agency, the global demand for clean hydrogen is reach more than 500 million tonnes annually by 2050, making artificial photosynthesis an important enabler of that transition, particularly in sun-rich regions with limited access to power infrastructure.

North America Artificial Photosynthesis Market Regional Analysis

The United States dominated the Market in 2024 and is expected to hold the largest Market share over the forecast period (2024-2032)

This leadership is fuel by a strong ecosystem of world class research institutes, government funding and early phase commercial activity. The United States play an important role through initiatives like the "fuel from sunlight" program of the Department of Energy, which invests over USD 100 million in artificial photosynthesis R&D. Institutions such as Caltech, National Renewable Energy Laboratory are driving innovation in photo-electrocatalysis and co-electrolysis technologies, collaborating with clean-tech startups and federal labs. The presence of leading startups such as Sunhydrogen and twelve, which is a collaboration with Inflation Reduction Act, has created productive land for pilot-scale projects and commercialization. These factors made United States a dominant country in North America Artificial Photosynthesis Market.

North America Artificial Photosynthesis Market Competitive Landscape

North America Artificial photosynthesis market is currently dominated by research-operating startups and public-private cooperations with increasing number of industrial players entering the area through strategic investment and participation. Key players such as Sunhydrogen, which is developing a nanoparticle-based solar hydrogen panel aimed at decentralized, low-cost green hydrogen production. Another key innovator is Twelve, a carbon transformation company using artificial photosynthesis principles to convert CO2 into jet fuel, chemicals, and plastics.

Recent development in North America Artificial Photosynthesis Market

|

Date

|

Company |

Development |

|

February 18, 2025 |

Twelve (USA) |

Twelve secured an additional USD 83 million in Series?C and project funding. New investors include Amazon’s Climate Pledge Fund, Mitsui, and the Development Bank of Japan, accelerating AirPlant One and expanding global carbon-to-fuel deployments. |

|

September 19, 2024 |

Twelve (USA) |

Twelve unveiled a massive USD 645 million fund raise led by TPG Rise Climate to scale its technology converting CO2 into sustainable aviation fuel (E?Jet). |

|

North America Artificial Photosynthesis Market Scope |

|

|

Market Size in 2024 |

USD 31.40 Mn. |

|

Market Size in 2032 |

USD 80.57 Mn. |

|

CAGR (2024-2032) |

12.5% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Technology Co-electrolysis Photo-electrocatalysis Others |

|

By Application Hydrogen Production Synthetic Fuel Generation Carbon capture and utilization Others |

|

|

By End-user Energy & Utilities Chemicals & Petrochemicals Agriculture companies Others |

|

Key Players in the North America Artificial Photosynthesis Market

- SunHydrogen (USA)

- Twelve (USA)

- Heliogen (USA)

- Opus 12 (USA)

- Berkeley Lab – Liquid Sunlight Alliance (USA)

- Hypersolar Inc. (USA)

- Caltech – Joint Center for Artificial Photosynthesis (USA)

Frequently Asked Questions

The Market Faces Restraints Related to Limited Scalability and Commercial Readiness.

Diversified End-Uses and Carbon Capture is an Opportunity for North America Artificial Photosynthesis Market.

SunHydrogen and Twelve are the key competitors in the North American Artificial Photosynthesis Market.

1. North America Artificial Photosynthesis Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Artificial Photosynthesis Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Artificial Photosynthesis Market: Dynamics

3.1. North America Artificial Photosynthesis Market Trends

3.2. North America Artificial Photosynthesis Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Artificial Photosynthesis Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. North America Artificial Photosynthesis Market Size and Forecast, By Technology (2024-2032)

4.1.1. Co-electrolysis

4.1.2. Photo-electrocatalysis

4.1.3. Others

4.2. North America Artificial Photosynthesis Market Size and Forecast, By Application (2024-2032)

4.2.1. Hydrogen Production

4.2.2. Synthetic Fuel Generation

4.2.3. Carbon capture and utilization

4.2.4. Others

4.3. North America Artificial Photosynthesis Market Size and Forecast, By End-user (2024-2032)

4.3.1. Energy & Utilities

4.3.2. Chemicals & Petrochemicals

4.3.3. Agriculture companies

4.3.4. Others

4.4. North America Artificial Photosynthesis Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1 SunHydrogen (USA)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2 SunHydrogen (USA)

5.3 Twelve (USA)

5.4 Heliogen (USA)

5.5 Opus 12 (USA)

5.6 Berkeley Lab – Liquid Sunlight Alliance (USA)

5.7 Hypersolar Inc. (USA)

5.8 Caltech – Joint Center for Artificial Photosynthesis (USA)

6 Key Findings

7 Analyst Recommendations