North America Seed Treatment Market- Global Industry Analysis and Forecast (2025-2032)

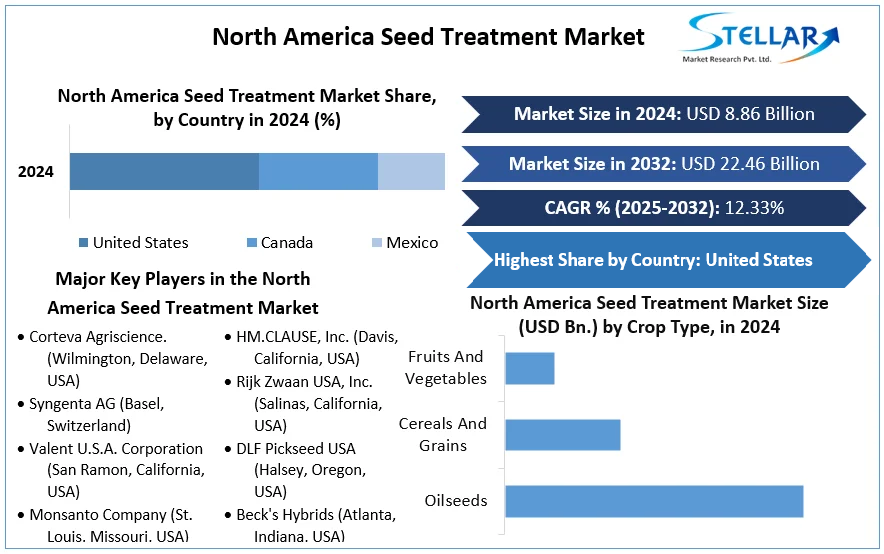

North America Seed Treatment Market size was valued at USD 8.86 Bn. in 2024 and the total North America Seed Treatment Market size is expected to grow at a CAGR of 12.33% from 2025 to 2032, reaching nearly USD 22.46 Bn. by 2032.

Format : PDF | Report ID : SMR_2229

North America Seed Treatment Market Overview

Seed Treatment refers to the application of chemical or biological agents to seeds to enhance their growth and protect them from diseases, pests, and environmental stressors. This market is crucial for improving crop yields and quality across various agricultural sectors. The seed treatment process includes a range of functions such as seed protection, enhancement, priming, disinfection, and the application of plant growth regulators. These treatments ensure seeds have better germination rates, increased resistance to pathogens, and enhanced growth performance.

North America's seed treatment sector is highly developed, with a robust infrastructure for production, manufacturing, and distribution. The market is characterized by several key players who provide a diverse range of products tailored to different crop types and treatment needs. Major manufacturers in this region include companies like Bayer CropScience, Syngenta, and BASF, among others. The distribution reach is extensive, with products available through a network of distributors and directly to large-scale agricultural operations.

The industry has shown strong market performance, with significant investments in research and development driving innovation and expanding product offerings. Financially, the seed treatment market has seen steady growth, with a growing emphasis on sustainable and environmentally friendly solutions. The demand for seed treatments is high owing to the increasing need for improved crop productivity and resilience against climatic and environmental challenges.

The North American seed treatment market is driven by the agricultural sector's demand for effective crop protection and growth enhancement solutions. Major products developed in this market include advanced biological treatments, plant growth regulators, and novel seed coatings.

- For instance, the introduction of EVOIA’s AmpliFYR and Clean Crop Technologies’ cold plasma treatments represents significant innovations in seed treatment technology. These products are designed to improve seedling establishment, enhance resistance to abiotic stress, and provide cleaner, more sustainable treatment options. The market also observes growing interest in precision agriculture technologies and integrated seed treatment solutions that offer customized benefits based on specific crop needs.

To get more Insights: Request Free Sample Report

North America Seed Treatment Market Dynamics

Embracing Advanced Digital Seed Testing: The Future of Seed Treatment Innovation

The North American seed treatment industry is rapidly evolving, driven by technological advancements that enhance seed quality and efficiency. One notable innovation is the LemnaTec SeedAIxpert, a cutting-edge digital phenotyping system designed to streamline seed testing processes. This system utilizes high-resolution industrial cameras and advanced image processing algorithms, including machine learning, to automate and refine seed germination and seedling emergence assessments. By providing rapid, accurate analysis of seed quality traits—such as germination rates, seedling growth, and morphological parameters—SeedAIxpert not only saves time and labor but also significantly improves data quality.

Its ability to handle a wide range of seed types and integrate with climate-controlled environments positions it as a game-changer in seed treatment technology. The system supports paper-based germination assays, seed purity tests, and seedling quality evaluations, addressing the limitations of traditional manual methods. With automation options for high-throughput systems, SeedAIxpert is setting a new standard in seed testing, ensuring more reliable results and facilitating advanced seed treatments that boost crop yields and efficiency across North America.

The Vital Role of Agronomists in Advancing Seed Treatment Innovation

The agronomist’s expertise is crucial in supporting and managing field trials for both new and commercial seed treatments. Agronomists bring a deep understanding of soil health, plant physiology, and environmental factors that influence seed treatment efficacy. They design and conduct detailed field trials, ensuring accurate performance assessments of various treatments across diverse crops and conditions. Their meticulous planning and robust data analysis underpin reliable results, guiding informed decisions for improving seed genetics and enhancing yields.

Additionally, agronomists play a key role in bridging communication between R&D teams, seed companies, researchers, and farmers, fostering collaboration and continuous innovation. Their practical insights into seed treatment application and integration into farming practices further support sustainable and profitable agriculture. By leveraging their expertise, Germain’s, and North America ensures the development of effective seed treatments that meet the evolving needs of modern agriculture, paving the way for a more productive and resilient agricultural future.

Advancing Agricultural Efficiency with New Technologies

The North American seed treatment market holds significant opportunities for growth, driven by the need to address critical challenges in agriculture. The future of the seed treatment market is closely tied to the adoption of innovative technologies and sustainable practices that enhance crop yields and reduce environmental impact.

- Technological Innovations and Efficiency Gains: New technologies, including autonomous systems, artificial intelligence (AI), and machine learning, are transforming the agricultural landscape. These innovations enable precise applications of fertilizers and seeds through intelligent soil analysis and automated machinery. For example, the use of AI to coordinate planting and treatment activities make agricultural processes more efficient and self-regulating than ever before. This technological shift not only improves yields but also addresses labor shortages by automating mundane and labour-intensive tasks.

- Simulation and Testing for Reliability: The validation and testing of new agricultural technologies are crucial for their safe and effective implementation. Hardware-in-the-loop (HIL) and software-in-the-loop (SIL) simulations offer efficient alternatives to on-site testing, allowing for the simulation of various environmental conditions and the testing of control units. These methods ensure data security and reliability, accelerating the development of innovative agricultural solutions.

As the agricultural sector continues to evolve, the integration of advanced technologies and sustainable practices will drive the growth of the seed treatment market in North America, addressing the pressing needs of an ever-growing world population and ensuring a more efficient and sustainable agricultural future.

North America Seed Treatment Market Segment Analysis

By Application Technique, The Seed Coating segment commands a XX % market share in 2024 thanks to its multifunctional benefits. Seed coating involves applying materials to seeds to enhance their shape, size, weight, and surface uniformity, thereby improving plantability and handling efficiency. This method also allows for the incorporation of active compounds such as fungicides, insecticides, and bio-stimulants, offering protection against pests and diseases and promoting healthier plant growth. The increasing demand for sustainable agriculture practices drives the adoption of seed coating, as it reduces the need for excessive chemical usage and minimizes environmental impact.

- Bayer AG and Syngenta are leading companies that provide seed coating solutions extensively used by farmers

- The analysis by Stellar indicated that around 76% of soybean growers in the U.S. also use seed treatment products, highlighting the prevalence of seed coating in these crops.

Seed Dressing holds a substantial portion of the market owed to its simplicity and cost-effectiveness. This technique involves applying protective chemical or biological substances directly to the seed surface to shield against pests and diseases. Typically performed just before planting, seed dressing ensures immediate protection, enhancing germination rates and seedling vigor. The growing awareness of seed-borne diseases and the need for efficient crop protection solutions bolster the demand for seed dressing, making it a staple in the seed treatment market.

- Data from the USDA indicates that a significant percentage of wheat growers use seed dressing techniques to protect their crops. For instance, over 70% of wheat acres planted in the U.S. receive some form of seed treatment, including seed dressing.

- The use of seed dressing is particularly high in crops like canola and cereals, with adoption rates exceeding 60% in some regions.

Although Seed Pelleting occupying a smaller market share compared to seed coating and seed dressing, seed pelleting is gaining traction, particularly for precision agriculture. This method involves encapsulating seeds in a protective coating, increasing their size and weight to ensure uniform shape and ease of handling. Pelleting improves planting accuracy and efficiency, especially for small or irregularly shaped seeds, by ensuring smooth flow through mechanical planting equipment. The incorporation of growth regulators and protective agents within the pellet further enhances seed performance and crop establishment. As the agricultural sector increasingly embraces precision farming techniques, the demand for seed pelleting is expected to rise for instance,

- Sakata Seed America and other companies use seed pelleting for crops like lettuce and carrots, which require precise planting.

- According to the National Agricultural Statistics Service (NASS), precision planting, which often involves seed pelleting, is used by more than 60% of vegetable farmers in North America.

North America Seed Treatment Market Regional Analysis

The North American seed treatment market is thriving, driven by significant advancements in agricultural technology and an increasing focus on sustainable farming practices. The United States, Canada, and Mexico are the primary contributors to this market, each exhibiting unique trends and growth dynamics. The U.S. dominates the North American seed treatment market, with high adoption rates of advanced seed treatment technologies among farmers. The widespread use of seed treatments such as seed coating, seed dressing, and seed pelleting in crops like corn, soybean, and wheat is driven by the need to enhance seed performance, protect against pests and diseases, and improve overall crop yields. The prevalence of precision farming techniques and increasing awareness of sustainable agriculture practices further bolster market growth.

- Approximately 83% of corn growers in the U.S. use some form of seed treatment for growing crops.

In Canada, the seed treatment market is expanding steadily, with a strong emphasis on seed coating and seed dressing. The Canadian market benefits from the country's robust agricultural sector, particularly in the production of canola, wheat, and barley. The Canadian government's support for innovative agricultural practices and sustainable farming also contributes to the market's growth, as farmers increasingly adopt seed treatment technologies to enhance crop productivity and reduce environmental impact.

- According to the Canadian Seed Trade Association, over 60% of canola and 70% of cereal crops in Canada are treated with seed treatments to ensure optimal germination and seedling Vigor.

Mexico's seed treatment market is experiencing moderate growth, driven by the increasing adoption of seed dressing and pelleting techniques. The Mexican government’s initiatives to improve agricultural productivity and sustainability have encouraged the use of seed treatments among local farmers. The focus on improving seed quality and yield, coupled with the growing demand for high-value crops, is expected to drive the market's expansion in the coming years.

- According to the Mexican Ministry of Agriculture (SADER), approximately 40% of corn and 35% of sorghum crops in Mexico are treated with seed treatments to protect against pests and diseases.

North America Seed Treatment Market Competitive Landscape

The North American seed treatment market is characterized by a dynamic competitive landscape with several regional players striving to innovate and capture market share. Key regional players are leveraging technological advancements and strategic collaborations to enhance their offerings and meet the evolving needs of the agricultural sector. The market is marked by a blend of established multinational companies and emerging players, each contributing to the diverse array of seed treatment solutions available.

Companies are focusing on expanding their product portfolios, integrating advanced technologies, and addressing sustainability concerns to differentiate themselves in this competitive environment. Additionally, regulatory compliance and regional agricultural practices significantly influence market dynamics, prompting players to adapt their strategies to local conditions and requirements for instance,

Corteva Agriscience stands out as a dominant player with a significant market presence, driven by its extensive portfolio and innovative solutions. With a revenue of approximately $17.8 billion in 2024, Corteva continues to set industry standards. A recent highlight in Corteva's offerings is the launch of their LumiTreo fungicide seed treatment, introduced on August 29, 2024. This advanced product, part of the LumiGEN portfolio, combines three effective fungicides to tackle key early-season diseases in soybeans, including Phytophthora sojae, a major threat to soybean yields in North America.

LumiTreo not only enhances disease protection but also offers added insect protection when used in conjunction with an imidacloprid insecticide. This new treatment reflects Corteva’s commitment to advancing seed treatment technology through rigorous research and development, supported by their state-of-the-art Corteva Center for Seed Applied Technologies (CSAT).

In contrast, Albaugh LLC is an emerging player in the seed treatment sector with a more focused and niche approach. Albaugh reported revenues of around $2.2 billion in 2024. While significantly smaller in scale compared to Corteva, Albaugh has carved out a niche in providing cost-effective and specialized seed treatment solutions. The company focuses on serving regional markets with tailored products and has been expanding its portfolio through strategic acquisitions and partnerships.

Despite its smaller size, Albaugh’s emphasis on affordability and targeted solutions allows it to compete effectively in specific segments of the seed treatment market. The contrast between Corteva Agriscience and Albaugh LLC highlights the diversity within the Seed Treatment market, showcasing how established players with extensive resources offer comprehensive, integrated solutions while emerging players focus on niche areas with innovative, specialized offerings.

|

North America Seed Treatment Market Scope |

|

|

Market Size in 2024 |

USD 8.86 Bn. |

|

Market Size in 2032 |

USD 22.46 Bn. |

|

CAGR (2025-2032) |

12.33 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Treatment Type

|

|

By Crop Type

|

|

|

By Application Technique

|

|

|

By Function

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico |

North America Seed Treatment Market Key Players

- Corteva Agriscience. (Wilmington, Delaware, USA)

- Syngenta AG (Basel, Switzerland)

- Valent U.S.A. Corporation (San Ramon, California, USA)

- Monsanto Company (St. Louis, Missouri, USA)

- Chemtura Corporation (Philadelphia, Pennsylvania, USA)

- E.I. Du Pont De Nemours and Company (Wilmington, Delaware, USA)

- Albaugh LLC (Ankeny, Iowa, USA)

- Land O'Lakes, Inc. (Arden Hills, Minnesota, USA)

- BASF SE (USA)

- Sakata Seed America, Inc. (Morgan Hill, California, USA)

- HM.CLAUSE, Inc. (Davis, California, USA)

- Rijk Zwaan USA, Inc. (Salinas, California, USA)

- DLF Pickseed USA (Halsey, Oregon, USA)

- Beck's Hybrids (Atlanta, Indiana, USA)

- AgReliant Genetics, LLC (Westfield, Indiana, USA)

- GROWMARK, Inc. (Bloomington, Illinois, USA)

- Nufarm Americas Inc (Alsip, Illinois, USA)

- Loveland Products, Inc (Greeley, Colorado, USA)

- Arysta LifeScience North America, LLC (Cary, North Carolina, USA)

- Marrone Bio Innovations, Inc. (Davis, California, USA)

- Others Players

Frequently Asked Questions

Treated seeds are seeds that have been lightly coated with various products that enhance plant vigor and help protect them from a variety of diseases and pests that attack the seed and seedlings following planting.

The Market size was valued at USD 8.86 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 12.33 % from 2025 to 2032, reaching nearly USD 22.46 Billion.

The segments covered are Treatment Type, Crop Type, Application Technique, and Function.

1. North America Seed Treatment Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. North America Seed Treatment Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. North America Seed Treatment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. North America Seed Treatment Market: Dynamics

4.1. North America Seed Treatment Market Trends

4.2. North America Seed Treatment Market Drivers

4.3. North America Seed Treatment Market Restraints

4.4. North America Seed Treatment Market Opportunities

4.5. North America Seed Treatment Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. North America Seed Treatment Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Thousand Tons) (2024-2032)

5.1. North America Seed Treatment Market Size and Forecast, by Treatment Type (2024-2032)

5.1.1. Chemical Treatment

5.1.2. Biological Treatment

5.2. North America Seed Treatment Market Size and Forecast, by Crop Type (2024-2032)

5.2.1. Oilseeds

5.2.2. Cereals And Grains

5.2.3. Fruits And Vegetables

5.2.4. Others

5.3. North America Seed Treatment Market Size and Forecast, by Application Technique (2024-2032)

5.3.1. Seed Coating

5.3.2. Seed Dressing

5.3.3. Seed Pelleting

5.4. North America Seed Treatment Market Size and Forecast, by Function (2024-2032)

5.4.1. Seed Protection

5.4.2. Seed Enhancement

5.4.3. Plant Growth Regulator

5.4.4. Seed Priming

5.4.5. Seed Disinfection

5.5. North America Seed Treatment Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. Company Profile: Key Players

6.1. Corteva Agriscience. (Wilmington, Delaware, USA)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Syngenta AG (Basel, Switzerland)

6.3. Valent U.S.A. Corporation (San Ramon, California, USA)

6.4. Monsanto Company (St. Louis, Missouri, USA)

6.5. Chemtura Corporation (Philadelphia, Pennsylvania, USA)

6.6. E.I. Du Pont De Nemours and Company (Wilmington, Delaware, USA)

6.7. Albaugh LLC (Ankeny, Iowa, USA)

6.8. Land O'Lakes, Inc. (Arden Hills, Minnesota, USA)

6.9. BASF SE (USA)

6.10. Sakata Seed America, Inc. (Morgan Hill, California, USA)

6.11. HM.CLAUSE, Inc. (Davis, California, USA)

6.12. Rijk Zwaan USA, Inc. (Salinas, California, USA)

6.13. DLF Pickseed USA (Halsey, Oregon, USA)

6.14. Beck's Hybrids (Atlanta, Indiana, USA)

6.15. AgReliant Genetics, LLC (Westfield, Indiana, USA)

6.16. GROWMARK, Inc. (Bloomington, Illinois, USA)

6.17. Nufarm Americas Inc (Alsip, Illinois, USA)

6.18. Loveland Products, Inc (Greeley, Colorado, USA)

6.19. Arysta LifeScience North America, LLC (Cary, North Carolina, USA)

6.20. Marrone Bio Innovations, Inc. (Davis, California, USA)

6.21. Others Players

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook