Global Feed Additives Market (2026–2032) Market Size, Trends & Key Players

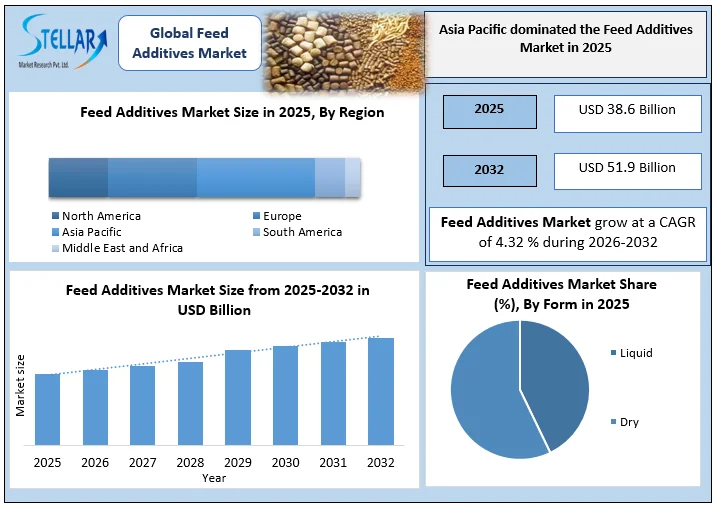

The Global Feed Additives Market is expected to reach USD 51.9 Bn by 2032, trends, regional growth, market drivers, key players, and innovations in manufacturing.

Format : PDF | Report ID : SMR_2900

Global Feed Additives Market Overview

The global feed additives market played a crucial role in modern animal nutrition by enhancing productivity, health, and feed efficiency across livestock, poultry, and aquaculture systems. Feed additives, typically included at 50 mg to 5 g per kilogram of feed, such as amino acids, enzymes, probiotics, antioxidants, organic acids, and binders, improved feed conversion ratios by 3–10%. These performance gains enhanced nutrient digestibility, strengthened immunity, and supported higher milk yields, growth rates, and carcass quality while reducing overall feed costs for producers.

Global Feed Production and Feed Additives Demand Outlook (2024–2025)

Global Compound Feed Production Trends

- Global compound feed production reached approximately 1.396 billion metric tons in 2024 and increased to nearly 1.42 billion metric tons in 2025.

- Growth was driven by poultry sector intensification, dairy yield optimization, and rapid expansion of aquaculture feed production.

- Poultry feed accounted for nearly xx % of global output, followed by pig feed at xx%, with the remainder from ruminant feed and aquafeed.

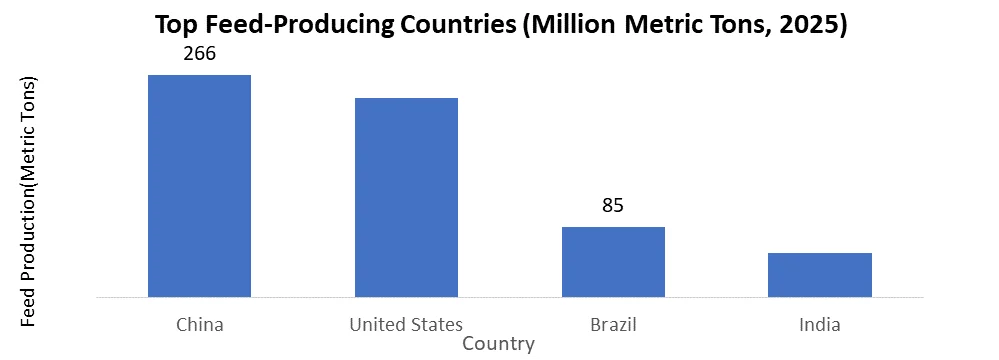

- Feed production was highly concentrated in China, the United States, Brazil, and India, collectively representing xx % of global volumes.

Feed Cost Structure and Impact of Feed Conversion Ratio (FCR)

- Feed costs represented 55–65% of total livestock production expenses.

- A 1% improvement in FCR could reduce production costs by USD 5–15 per metric ton, underscoring the importance of amino acids, enzymes, and organic acids in feed formulations.

Feed Additives Market Key Highlights – 2025

- Global feed production: 1.396 billion MT (2024), sustaining additive demand growth into 2025

- Top feed-producing countries (2025):

- China: 262–270 million MT

- United States: 238 million MT

- Brazil: 83–87 million MT

- India: 52–55 million MT

- Livestock dominance: Poultry accounts for 40–45% of global feed additive consumption

- Fastest-growing application: Aquaculture feed additives, driven by enzyme and probiotic inclusion

- Largest additive segment: Amino acids (methionine and lysine lead demand)

- Supply concentration: Europe and North America dominate high-purity additive exports; Germany and the US remain top exporters

- Regulatory shift: Online EU Feed Additives Register (post-2023) accelerates compliance-driven procurement

To get more Insights: Request Free Sample Report

Feed Additives Market Dynamics

Performance Optimization per Kilogram of Feed

In 2025, producers increasingly prioritized output maximization per unit of feed input. Poultry and swine operations relied heavily on synthetic amino acids, phytase, xylanase, and organic acids to lower formulation costs while maintaining growth performance. Ruminant systems utilized buffers, yeast cultures, and fiber-digesting enzymes to sustain 20–25% crude fiber thresholds, ensuring stable rumen fermentation and milk fat consistency.

Rising poultry consumption accounting for nearly 45% of global per-capita meat protein intake directly amplified demand for poultry feed additives, given poultry’s superior feed efficiency and short production cycles.

Regulatory Pressure and Raw Material Price Volatility

Stringent regulatory frameworks, particularly EU Regulation (EC) No. 1831/2003, continued to shape product development and approval timelines. Compliance requirements increased authorization costs and favored traceable, standardized feed additives. At the same time, volatility in raw material prices—especially petrochemical-linked amino acids, vitamins, and antioxidants—created procurement uncertainty. Smaller feed mills and unorganized players faced challenges in maintaining consistent additive inclusion quality under fluctuating input costs, reinforcing the competitive advantage of organized and integrated feed manufacturers.

Key Feed Additives Regulations

|

Region |

Authority |

Regulation |

Key Impact |

|

EU |

European Commission |

EC No. 1831/2003 |

Strict approval, higher compliance costs, full traceability |

|

EU |

EFSA |

EU Feed Additives Register |

Faster compliance checks, transparent authorization |

|

USA |

FDA (CVM) |

FFDCA |

Safety, labeling, and pre-market approval |

|

USA |

AAFCO |

AAFCO Guidelines |

Ingredient definitions and usage standards |

|

China |

MARA |

Order No. 114 |

Registration and import control |

|

India |

FSSAI |

Animal Feed Regulations, 2020 |

Quality and labeling standards |

|

Brazil |

MAPA |

IN No. 13/2004 |

Commercialization and export compliance |

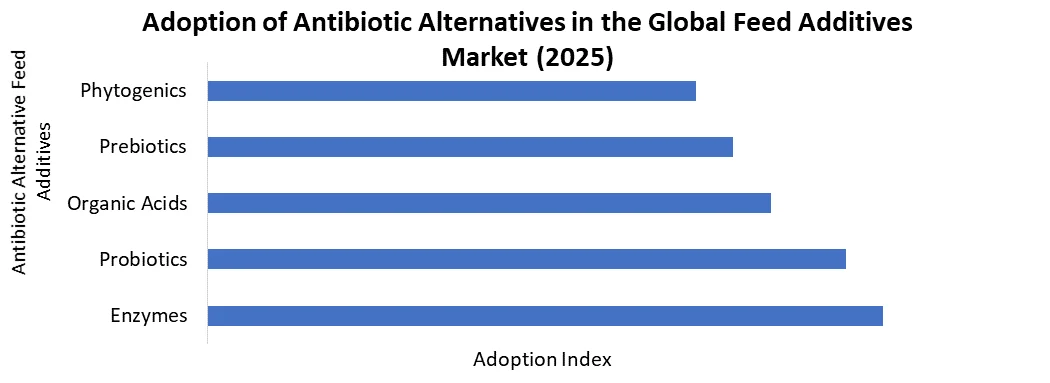

Antibiotic Alternatives and Sustainable Feed Additives

Ongoing restrictions on antibiotic growth promoters (AGPs) accelerated adoption of probiotics, prebiotics, phytogenics, organic acids, and enzymes. Feed additives increasingly functioned as environmental enablers, reducing nitrogen excretion, methane emissions, and phosphorus runoff. Sustainability-linked additives became decisive purchasing criteria in export-oriented livestock markets

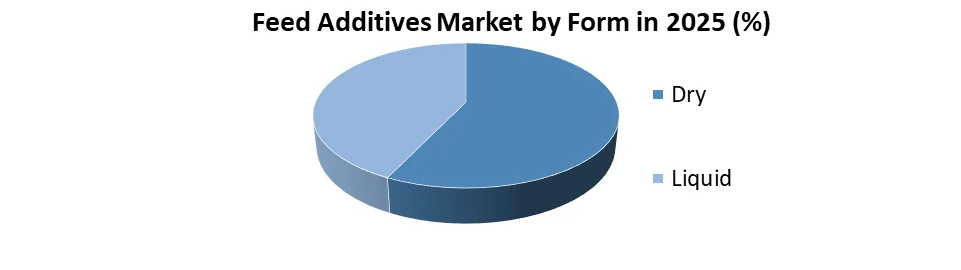

Feed Additives Market – By Form

The dry form dominated the feed additives market in 2025. Due to ease of storage, longer shelf life, and suitability for compound feed mixing. The liquid form is gaining traction in 2025 for targeted applications, precision dosing, and improved bioavailability in aquaculture and livestock feeds. Both forms support efficiency, gut health, and overall animal performance.

Feed Additives Market by Region

Asia-Pacific dominated the global feed additives market in 2025, accounting for 35–40% of total demand. China led regional consumption due to its scale in poultry production, swine herd recovery, and aquaculture feed expansion. India recorded rapid additive demand growth, supported by dairy commercialization and poultry sector integration. Southeast Asia (Vietnam, Indonesia, Philippines) emerged as a secondary growth hub, driven by aquaculture feed demand and rising poultry affordability.

South America, led by Brazil and Chile, experienced above-global-average growth in feed additive usage. Export-oriented poultry and beef production systems supported sustained demand for amino acids, enzymes, and mycotoxin binders. Africa remained an emerging market in 2025, with industrial feed penetration still developing. Growth opportunities were concentrated in vitamin–mineral premixes, mold inhibitors, and mycotoxin binders, particularly in poultry and dairy segments

Feed Additives Market Demand and Supply Analysis

Country-Wise Demand Trends

In 2025, China accounted for approximately 40% of Asia-Pacific feed additive demand, driven by large-scale livestock and poultry operations. India exhibited rapid growth due to dairy and poultry expansion, while the United States maintained high per-capita additive usage, estimated at 10–15 kg per person per year. Brazil’s demand was shaped by export-focused poultry and beef systems, reinforcing its leadership in South America.

Global Feed Additives Supply and Export Landscape

On the supply side, Germany emerged as the largest exporter of feed additives, with exports valued at approximately USD 4.68 billion, particularly in amino acids and enzymes. The United States followed closely, exporting around USD 4.26 billion, supported by integrated production and distribution networks. The Netherlands and France specialized in high-value additives and premixes, serving premium and niche markets.

Competitive Landscape of the Global Feed Additives Market

The animal feed additives market is highly competitive, with leading players focusing on innovation, capacity expansion, and sustainability-driven solutions.

Key Company Developments (2024–2025)

Cargill (US)

- Acquired two feed mills from Company Pet Brands in September 2024 (Denver, Colorado and Kansas City, Kansas)

- Strengthened production capacity and distribution amid growing pet nutrition demand

DSM-Firmenich (Switzerland)

- Partnered with Donau Soja (February 2024)

- Applied the Sustell LCA platform to assess environmental impact across feed and animal protein value chains

Volac International (UK)

- Launched a dedicated feed additives platform in August 2024

- Highlighted capabilities in microbiology, enzymology, immunology, and phytogenic solutions

International Flavors & Fragrances (US)

- Introduced Axtra XAP and Syncra AVI in Europe (June 2024)

- Enhanced poultry gut health, efficiency, and performance across global markets

Other Key Players (Evonik, Adisseo, Nutreco, BASF, ADM)

- Expanded global capacity for methionine, premixes, enzymes, antioxidants, and functional additives

- Focused on low-inclusion, high-efficacy solutions aligned with modern production systems

Global Feed Additives Market Scope

|

Global Feed Additives Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 38.6 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

4.32 % |

Market Size in 2032: |

USD 51.9 Billion |

|

Feed Additives Market Segment Analysis |

By Additive |

Acidifiers Fumaric Acid Lactic Acid Propionic Acid Other Acidifiers Amino Acids Lysine Methionine Threonine Tryptophan Others Antibiotics Bacitracin Penicillins Tetracyclines Tylosin Other Antioxidants Butylated Hydroxyanisole (BHA) Butylated Hydroxytoluene (BHT) Citric Acid Ethoxyquin Propyl Gallate Tocopherols Antioxidants Binders Natural Binders Synthetic Binders Enzymes Carbohydrases Phytases Other Flavors & Sweeteners Flavors Sweeteners Minerals Macrominerals Microminerals Others |

|

|

By Form |

Dry Liquid |

||

|

By Source |

Natural Synthetic |

||

|

By Function |

Gut Health Palatability Enhancers Growth Promoters Immune System Support Other Functions |

||

Feed Additives Market Key Players

- Evonik Industries AG

- Adisseo

- CJ Group

- Novus International

- DSM-Firmenich

- Meihua Group

- Kemin Industries

- Zoetis

- BASF SE

- Sumitomo Chemical

- Archer Daniels Midland (ADM)

- Alltech

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Ajinomoto Co., Inc.

- Novozymes A/S

- Chr. Hansen A/S

- Red Nucleus Solutions LLC

- Nutreco N.V.

- Zinpro Corporation

- Phibro Animal Health Corporation

- Lallemand Inc.

- Global Bio-Chem Technology Group

- Invivo Group (Neovia)

- Palital Feed Additives B.V.

- Orffa International Holding B.V.

- Centafarm SRL

- Amlan International

- Neospark Drugs & Chemicals Pvt. Ltd.

- Global Nutrition International

Frequently Asked Questions

Amino acids dominate the feed additives market, led by methionine and lysine, due to their role in improving feed conversion efficiency and reducing formulation costs.

Poultry has the shortest production cycle and the highest feed conversion efficiency, making it highly sensitive to performance-enhancing additives such as enzymes, amino acids, and probiotics.

Asia-Pacific leads the feed additives market, accounting for approximately 35–40% of global demand, driven by large-scale poultry, swine, and aquaculture production in China and India.

Feed additives reduce nitrogen and phosphorus excretion, lower methane emissions, improve nutrient utilization, and support antibiotic-free animal production systems.

1. Feed Additives Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Feed Additives Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Headquarter

2.3.3. Product Portfolio

2.3.4. End-User

2.3.5. Total Company Revenue (2025)

2.3.6. Certifications

2.3.7. Global Presence

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

2.6. Recent Developments

2.7. Market Positioning & Share Analysis

2.7.1. Company Revenue, Feed Additives Revenue, and Market Share (%)

2.7.2. SMR Competitive Positioning

2.8. Strategic Developments & Partnerships

2.8.1. Mergers, acquisitions, and joint ventures

2.8.2. Expansion into emerging markets

2.8.3. Strategic alliances with OEMs or system integrators

2.8.4. Investments in new production facilities

2.8.5. Sustainability initiatives and green product launches

3. Feed Additives Market: Dynamics

3.1. Feed Additives Market Trends

3.2. Feed Additives Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

4. Feed Additives Industry Value Chain Analysis

4.1. Raw Material Sourcing and Supplier Landscape

4.2. Manufacturing Process and Cost Structure Overview

4.3. Role of Distributors and Feed Premix Companies

4.4. Integration of Value Chain Across Regions

4.5. Margin Analysis at Each Value Chain Stage

4.6. Key Bottlenecks and Optimization Opportunities

5. Regulatory and Policy Framework

5.1. Global Feed Additives Regulatory Overview

5.2. United States Feed Additives Regulations and Compliance

5.3. European Union Feed Safety and Approval Process

5.4. Regulatory Landscape in Asia-Pacific Markets

5.5. Impact of Regulations on Product Innovation

5.6. Future Regulatory Trends and Policy Changes

6. Technological Advancements and Innovation Trends

6.1. Advancements in Enzyme and Probiotic Technologies

6.2. Precision Nutrition and Customized Feed Solutions

6.3. Microencapsulation and Controlled Release Technologies

6.4. Use of Biotechnology in Feed Additives Development

6.5. Digitalization and Automation in Feed Manufacturing

6.6. R&D Investments and Innovation Pipeline

7. Pricing Analysis

7.1. Global Feed Additives Pricing Structure Overview

7.2. Product-Wise Price Comparison Across Regions

7.3. Impact of Raw Material Cost Fluctuations

7.4. Regional Pricing Differences and Margins

7.5. Influence of Regulations on Pricing

7.6. Pricing Forecast and Trend Analysis

8. Supply Chain and Distribution Analysis

8.1. Raw Material Availability and Procurement Trends

8.2. Manufacturing Capacity and Utilization Rates

8.3. Logistics, Storage, and Transportation Challenges

8.4. Role of Distributors and Premix Manufacturers

8.5. Organized vs Unorganized Supply Chain Structure

8.6. Supply Chain Risk Assessment

9. Demand and Supply Analysis

9.1. Global Demand Trends by Livestock Type

9.2. Regional Demand-Supply Gap Assessment

9.3. Country-Wise Production and Consumption Analysis

9.4. Import-Export Trends of Feed Additives

9.5. Impact of Feed Industry Growth on Supply

9.6. Future Demand and Supply Outlook

10. Investment and Expansion Analysis

10.1. Capital Investments in Feed Additives Industry

10.2. Capacity Expansion and New Plant Announcements

10.3. Mergers and Acquisitions Activity Analysis

10.4. Government Support and Subsidy Programs

10.5. Foreign Direct Investment Trends

10.6. Return on Investment and Profitability Outlook

11. Sustainability and ESG Analysis

11.1.1. Environmental Impact of Feed Additives Production

11.1.2. Adoption of Natural and Organic Feed Additives

11.1.3. Carbon Footprint Reduction Initiatives

11.1.4. Animal Welfare and Ethical Nutrition Practices

11.1.5. ESG Compliance and Reporting Standards

11.1.6. Sustainability-Driven Market Opportunities

12. Feed Additives Market: Global Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

12.1. Feed Additives Market Size and Forecast, By Additive (2025-2032)

12.1.1. Acidifiers

12.1.1.1. Fumaric Acid

12.1.1.2. Lactic Acid

12.1.1.3. Propionic Acid

12.1.1.4. Other Acidifiers

12.1.2. Amino Acids

12.1.2.1. Lysine

12.1.2.2. Methionine

12.1.2.3. Threonine

12.1.2.4. Tryptophan

12.1.2.5. Others

12.1.3. Antibiotics

12.1.3.1. Bacitracin

12.1.3.2. Penicillins

12.1.3.3. Tetracyclines

12.1.3.4. Tylosin

12.1.3.5. Other

12.1.4. Antioxidants

12.1.4.1. Butylated Hydroxyanisole (BHA)

12.1.4.2. Butylated Hydroxytoluene (BHT)

12.1.4.3. Citric Acid

12.1.4.4. Ethoxyquin

12.1.4.5. Propyl Gallate

12.1.4.6. Tocopherols

12.1.4.7. Antioxidants

12.1.5. Binders

12.1.5.1. Natural Binders

12.1.5.2. Synthetic Binders

12.1.6. Enzymes

12.1.6.1. Carbohydrases

12.1.6.2. Phytases

12.1.6.3. Other

12.1.7. Flavors & Sweeteners

12.1.7.1. Flavors

12.1.7.2. Sweeteners

12.1.8. Minerals

12.1.8.1. Macrominerals

12.1.8.2. Microminerals

12.1.9. Others

12.2. Feed Additives Market Size and Forecast, By Form (2025-2032)

12.2.1. Dry

12.2.2. Liquid

12.3. Feed Additives Market Size and Forecast, By Source (2025-2032)

12.3.1. Natural

12.3.2. Synthetic

12.4. Feed Additives Market Size and Forecast, By Function (2025-2032)

12.4.1. Gut Health

12.4.2. Palatability Enhancers

12.4.3. Growth Promoters

12.4.4. Immune System Support

12.4.5. Other Functions

12.5. Feed Additives Market Size and Forecast, by Region (2025-2032)

12.5.1. North America

12.5.2. Europe

12.5.3. Asia Pacific

12.5.4. Middle East and Africa

12.5.5. South America

13. North America Feed Additives Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

13.1. North America Feed Additives Market Size and Forecast, By Additive (2025-2032)

13.2. North America Feed Additives Market Size and Forecast, By Form (2025-2032)

13.3. North America Feed Additives Market Size and Forecast, By Source (2025-2032)

13.4. North America Feed Additives Market Size and Forecast, By Function (2025-2032)

13.5. North America Feed Additives Market Size and Forecast, by Country (2025-2032)

13.5.1. United States

13.5.2. Canada

13.5.3. Mexico

14. Europe Feed Additives Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

14.1. Europe Feed Additives Market Size and Forecast, By Additive (2025-2032)

14.2. Europe Feed Additives Market Size and Forecast, By Form (2025-2032)

14.3. Europe Feed Additives Market Size and Forecast, By Source (2025-2032)

14.4. Europe Feed Additives Market Size and Forecast, By Function (2025-2032)

14.5. Europe Feed Additives Market Size and Forecast, by Country (2025-2032)

14.5.1. United Kingdom

14.5.2. France

14.5.3. Germany

14.5.4. Italy

14.5.5. Spain

14.5.6. Sweden

14.5.7. Austria

14.5.8. Rest of Europe

15. Asia Pacific Feed Additives Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

15.1. Asia Pacific Feed Additives Market Size and Forecast, By Additive (2025-2032)

15.2. Asia Pacific Feed Additives Market Size and Forecast, By Form (2025-2032)

15.3. Asia Pacific Feed Additives Market Size and Forecast, By Source (2025-2032)

15.4. Asia Pacific Feed Additives Market Size and Forecast, By Function (2025-2032)

15.5. Asia Pacific Feed Additives Market Size and Forecast, by Country (2025-2032)

15.5.1. China

15.5.2. S Korea

15.5.3. Japan

15.5.4. India

15.5.5. Australia

15.5.6. Indonesia

15.5.7. Malaysia

15.5.8. Vietnam

15.5.9. Taiwan

15.5.10. Rest of Asia Pacific

16. Middle East and Africa Feed Additives Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

16.1. Middle East and Africa Feed Additives Market Size and Forecast, By Additive (2025-2032)

16.2. Middle East and Africa Feed Additives Market Size and Forecast, By Form (2025-2032)

16.3. Middle East and Africa Feed Additives Market Size and Forecast, By Source (2025-2032)

16.4. Middle East and Africa Feed Additives Market Size and Forecast, By Function (2025-2032)

16.5. Middle East and Africa Feed Additives Market Size and Forecast, by Country (2025-2032)

16.5.1. South Africa

16.5.2. GCC

16.5.3. Egypt

16.5.4. Nigeria

16.5.5. Rest of ME&A

17. South America Feed Additives Market Size and Forecast by Segmentation (by Value USD Billion and Volume in 000’ Kilotons) (2025-2032)

17.1. South America Feed Additives Market Size and Forecast, By Additive (2025-2032)

17.2. South America Feed Additives Market Size and Forecast, By Form (2025-2032)

17.3. South America Feed Additives Market Size and Forecast, By Source (2025-2032)

17.4. South America Feed Additives Market Size and Forecast, By Function (2025-2032)

17.5. South America Feed Additives Market Size and Forecast, by Country (2025-2032)

17.5.1. Brazil

17.5.2. Argentina

17.5.3. Chile

17.5.4. Colombia

17.5.5. Rest Of South America

18. Company Profile: Key Players

18.1. Evonik Industries AG

18.1.1. Company Overview

18.1.2. Business Portfolio

18.1.3. Financial Overview

18.1.4. SWOT Analysis

18.1.5. Strategic Analysis

18.1.6. Recent Developments

18.2. Adisseo

18.3. CJ Group

18.4. Novus International

18.5. DSM-Firmenich

18.6. Meihua Group

18.7. Kemin Industries

18.8. Zoetis

18.9. BASF SE

18.10. Sumitomo Chemical

18.11. Archer Daniels Midland (ADM)

18.12. Alltech

18.13. Cargill, Incorporated

18.14. DuPont de Nemours, Inc.

18.15. Ajinomoto Co., Inc.

18.16. Novozymes A/S

18.17. Chr. Hansen A/S

18.18. Red Nucleus Solutions LLC

18.19. Nutreco N.V.

18.20. Zinpro Corporation

18.21. Phibro Animal Health Corporation

18.22. Lallemand Inc.

18.23. Global Bio-Chem Technology Group

18.24. Invivo Group (Neovia)

18.25. Palital Feed Additives B.V.

18.26. Orffa International Holding B.V.

18.27. Centafarm SRL

18.28. Amlan International

18.29. Neospark Drugs & Chemicals Pvt. Ltd.

18.30. Global Nutrition International

19. Key Findings

20. Industry Recommendations

21. Feed Additives Market: Research Methodology