Succulent Plant Market: Size, Share, Trends, by Type, Plant Size, Region and Forecast (2024-2032)

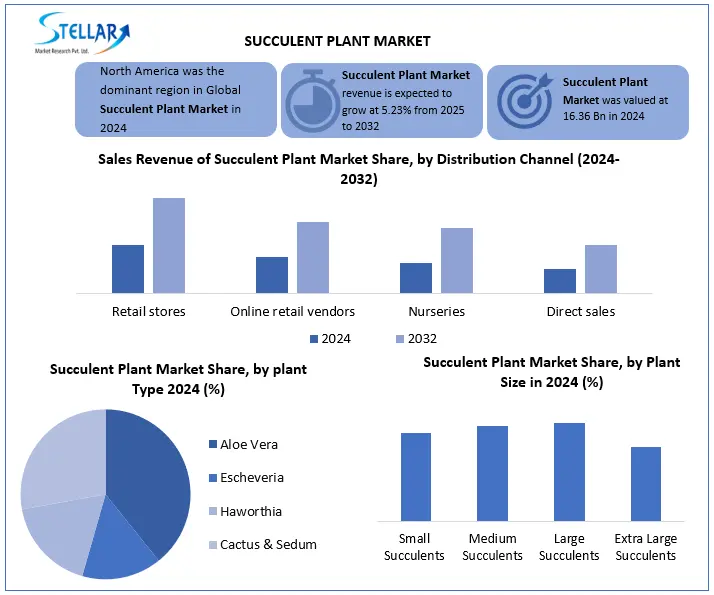

Succulent Plant Market was valued at USD 10.88 Bn in 2024 and is expected to grow at a CAGR of 5.23% from 2025 to 2032, reaching nearly USD 16.36 Bn by 2032.

Format : PDF | Report ID : SMR_2802

Succulent Plant Market Overview

A succulent plant is a sort of plant with thick, fleshy tissues adapted for storing water. These plants are generally observed in arid or semi-arid regions and survive long durations of drought. Examples encompass aloe vera, cacti, and jade plants.

There is an increasing demand for indoor plant life to enhance oxygen degrees within the house. Such plants are growing in any established order, along with places of work, houses, and indoor residences. The succulent plant marketplace is expanding all of sudden due to the growing hobby in indoor gardening and increasing consumer hobby in aesthetics and fitness benefits. In addition, developing hobby in sustainable horticulture practices has opened possibilities for the improvement of green and organic succulent merchandise. The growing style for terrace farming and indoor farming is expected to create appealing opportunities for the marketplace.

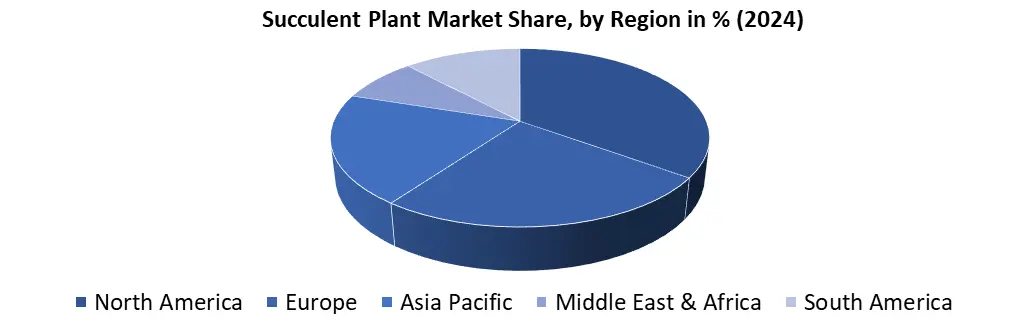

North America is a dominant region in the succulent plant market sales due to the excessive call for succulents in landscape gardening and home decor. Europe is every other developing market for succulents because of the increasing fashion of rooftop gardening.

To get more Insights: Request Free Sample Report

Succulent Plant Market Dynamics

The Growing Popularity of Succulents as Decorative and Air-Purifying to Fuel the Succulent Plant Market

Succulents are trending for their precise appearance, low renovation requirements, and capacity to flourish in numerous environments. Increasing urbanization makes the succulent plant demandable because of the compact and occasional-care plant. Also, it calls for less water, for that reason, it is a great preference for busy consumers. Social media have an impact on increases in the Succulent Plant Market Share. Social media like Instagram and Pinterest are played a major role in increasing the market share of succulent plants. Home styling and lifestyle blogs are performed regularly by social media fuel the succulent plant market.

Overharvesting and Variations in Climate Condition to Restrain the Succulent Plant Market

The Succulent Plant Market faces demanding situations associated with overharvesting and unsustainable farming practices, which reduces certain succulent species. Changes in climate situations and transportation troubles also can have an effect on deliver chains. It influences on a Succulent Plant Market increase. Logistics and transportation concerns further impact the supply chain, especially for imported varieties or loads that need specialized handling. In addition, greater concern for the environmental consequences of mass production and overharvesting is calling for stricter laws, which can limit market expansion in certain markets. All these factors together hinder the overall growth of the Succulent Plant Market, even with its growing popularity.

The adoption of succulents in the corporate to Boost the succulent plant market

The incorporation of the succulent plant in hotels, offices, and restaurants for their interior layout increases the majority purchases. Moreover, the upward thrust of e-commerce plant outlets has elevated market attain. There is also a growing trend of succulent plant-themed gifts which generate extra revenue inside the Succulent Plant Market. Moreover, team up with event planners and interior designers are opening new promotional avenues and distribution channels, which are also fueling market growth.

Succulent Plant Market Segment Analysis

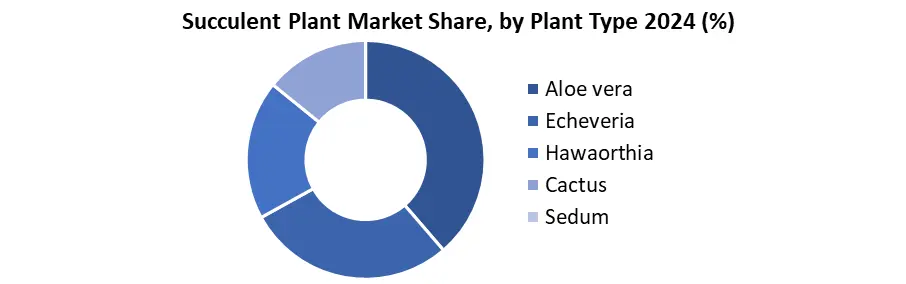

Based on Plant Type, the Succulent Plant Market is segmented into categories like Aloe Vera, Echeveria, Haworthia, Cactus, and Sedum. The Aloe vera segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032). The popularity of aloe vera is largely responsible for its dual appeal as a decorative and medicinal plant. Its universally known medical applications induce rapid consumer demand from residential and commercial markets in especially dermatology, wound healing and gastrointestinal wellness. Aloe Vera is also extremely flexible, extremely simple to grow, and low maintenance, which gives it an attractive option for almost any climate and growing conditions.

Based on Plant Size, the Succulent Plant market is segmented into small succulents (2-4 inches), medium size succulents (4-12 inches), large succulents (12-23 inches), and extra-large succulents (24 inches & above) (24 inches and above). The large succulent segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032).

Large succulent is popular due to its sensational visual effects and ability, which are used in internal and external design. Their sensational size and sensational presence present them perfectly for residential landscaping and commercial design, especially in hotels, corporate lobby areas and Upscale retail environment. Giant succulents suit best their dramatic look, thus used in luxurious landscaping, business interior designs, and enterpiece interior designs. They are also widely used in luxurious garden designs, roof designs, and outdoor patios.

Based on Distribution Channel, the Succulent plant market is divided into retail stores, online retail vendors, nurseries, and direct sales. The retail vendors segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032). Retail shops, such as garden centers, home reform godowns and lifestyle centers, are popular among consumers for the benefits of physical examination and on-a-spot purchase. Customers like to buy in-store to assess the plant health, size, and see before creating a final commitment to buy. In addition, retail traders usually supply expert advice, maintenance tips, and carefully selected plants suited to regional climates and tastes, enriching the shopping experience. Seasonal sales, in-store classes, and collaborations with regional growers also make them a strong player in the marketplace.

Succulent Plant Market Regional Analysis

North America Dominated the Succulent Plant Market

North America is the dominating region in succulent plant market due to the developing call for landscaping and home decor. The regions' arid regions, which include California and Arizona, favour drought-resistant plants, making Succulents a classy choice. Also, the developing hobby in indoor gardening and the convenience of e-trade platforms are growing sales. Europe is some other predominant market for succulents, there is a developing fashion for green locations and roof gardens. Also, there is a growing trend of indoor greenery in houses and workplaces.

Succulent Plant Market Competitive Landscape

The Succulent plant market has a numerous range of foremost players in the market, every of which contributes to competition in different methods. Large retail tiers like Home Depot, Lowe’s, and Walmart dominate the marketplace with an extensive range of succulent plants available in bodily shops. Also, online marketplaces consisting of Amazon, ETSY, and EBAY have massive boom, permitting small carriers and person manufacturers to reach a comprehensive customer base globally. In North America, groups like Altman Plants, Costa Farms dominate the market with sizable distribution networks and online income channels. Costa Farms is a company with strong sustainability commitments and employs creative cultivation methods to reduce environmental impact.

|

Succulent Plant Market Scope |

|

|

Market Size in 2024 |

USD 10.88 Bn. |

|

Market Size in 2032 |

USD 16.36 Bn. |

|

CAGR (2024-2032) |

5.23% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Plant Type Aloe Vera Escheveria Haworthia Cactus & Sedum |

|

By Plant Size Small Succulents (2-4 inches) Medium Succulents (4-12 inches) Large Succulents (12-23 inches) Extra-large succulents (24 inches & above) |

|

|

By Distribution Channel Retail stores Online retail vendors Nurseries Direct sales |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Thailand, Malaysia, Vietnam, Indonesia, Philippine, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Chile, Peru, Rest of South America |

Key Players in the Succulent Plant Market

North America

- Costa Farms (USA)

- Altman Plants (USA)

- Mountain Crest Gardens (USA)

- The Sill (USA)

- Leaf & Clay (USA)

- Succulent Market (USA)

- Proven Winners (USA)

- Cactus King (USA)

- Bloomscape (USA)

Europe

- Surreal Succulents (UK)

- Edelcactus BV (Netherlands)

- De Cactus Specialist (Netherlands)

- Desert Plants of Avalon (Ireland)

- Uhlig Kakteen (Germany)

- CactusArt (Italy)

- Plantas de Interior (Spain)

- Kakteengarten (Austria)

Asia-Pacific

- NurseryLive (India)

- Harwood Gardens (Australia

Frequently Asked Questions

The key Competitors in the Succulent Plant Market is The Succulent Source, Succulent Market, Leaf & Clay, Succulent Gardens, and Greenhouse Megastore.

The Growing Popularity of Succulents as Decorative and Air-purifying to Fuel the Succulent Plant Market.

Overharvesting and Variations in Climate conditions are the challenges for the Succulent Plant Market.

The Aloe vera plant type dominate the market.

1. Succulent Plant Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Succulent Plant Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. Distribution Channels Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Succulent Plant Market: Dynamics

3.1. Succulent Plant Market Trends

3.2. Succulent Plant Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Succulent Plant Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

4.1.1. Aloe Vera

4.1.2. Escheveria

4.1.3. Haworthia

4.1.4. Cactus & sedum

4.2. Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

4.2.1. Small Succulents (2-4 inches)

4.2.2. Medium Succulents (4-12 inches)

4.2.3. Large Succulents (12-23 inches)

4.2.4. Extra-large succulents (24 inches & above)

4.3. Succulent Plant Market Size and Forecast, By Distribution Channels (2024-2032)

4.3.1. Retail Stores

4.3.2. Online Retail Vendors

4.3.3. Nurseries

4.3.4. Direct Sales

4.4. Succulent Plant Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Succulent Plant Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

5.1.1. Aloe Vera

5.1.2. Escheveria

5.1.3. Haworthia

5.1.4. Cactus & sedum

5.2. North America Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

5.2.1. Small Succulents (2-4 inches)

5.2.2. Medium Succulents (4-12 inches)

5.2.3. Large Succulents (12-23 inches)

5.2.4. Extra-large succulents (24 inches & above)

5.3. North America Succulent Plant Market Size and Forecast, By Distribution Channels (2024-2032)

5.3.1. Retail Stores

5.3.2. Online Retail Vendors

5.3.3. Nurseries

5.3.4. Direct Sales

5.4. North America Succulent Plant Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

5.4.1.1.1. Aloe Vera

5.4.1.1.2. Escheveria

5.4.1.1.3. Haworthia

5.4.1.1.4. Cactus & sedum

5.4.1.2. United States Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

5.4.1.2.1. Small Succulents (2-4 inches)

5.4.1.2.2. Medium Succulents (4-12 inches)

5.4.1.2.3. Large Succulents (12-23 inches)

5.4.1.2.4. Extra-large succulents (24 inches & above)

5.4.1.3. United States Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Retail Stores

5.4.1.3.2. Online Retail Vendors

5.4.1.3.3. Nurseries

5.4.1.3.4. Direct Sales

5.4.2. Canada

5.4.2.1. Canada Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

5.4.2.1.1. Aloe Vera

5.4.2.1.2. Escheveria

5.4.2.1.3. Haworthia

5.4.2.1.4. Cactus & sedum

5.4.2.2. Canada Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

5.4.2.2.1. Small Succulents (2-4 inches)

5.4.2.2.2. Medium Succulents (4-12 inches)

5.4.2.2.3. Large Succulents (12-23 inches)

5.4.2.2.4. Extra-large succulents (24 inches & above)

5.4.2.3. Canada Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.3.1. Retail Stores

5.4.2.3.2. Online Retail Vendors

5.4.2.3.3. Nurseries

5.4.2.3.4. Direct Sales

5.4.3. Mexico

5.4.3.1. Mexico Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

5.4.3.1.1. Aloe Vera

5.4.3.1.2. Escheveria

5.4.3.1.3. Haworthia

5.4.3.1.4. Cactus & sedum

5.4.3.2. Mexico Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

5.4.3.2.1. Small Succulents (2-4 inches)

5.4.3.2.2. Medium Succulents (4-12 inches)

5.4.3.2.3. Large Succulents (12-23 inches)

5.4.3.2.4. Extra-large succulents (24 inches & above)

5.4.3.3. Mexico Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.3.3.1. Retail Stores

5.4.3.3.2. Online Retail Vendors

5.4.3.3.3. Nurseries

5.4.3.3.4. Direct Sales

6. Europe Succulent Plant Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.2. Europe Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.3. Europe Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Succulent Plant Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.1.2. United Kingdom Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.1.3. United Kingdom Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.2. France

6.4.2.1. France Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.2.2. France Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.2.3. France Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.3.2. Germany Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.3.3. Germany Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.4.2. Italy Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.4.3. Italy Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.5.2. Spain Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.5.3. Spain Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.6.2. Sweden Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.6.3. Sweden Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.7.2. Russia Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.7.3. Russia Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

6.4.8.2. Rest of Europe Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

6.4.8.3. Rest of Europe Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Succulent Plant Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.2. Asia Pacific Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.3. Asia Pacific Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Succulent Plant Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.1.2. China Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.1.3. China Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.2.2. S Korea Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.2.3. S Korea Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.3.2. Japan Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.3.3. Japan Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.4.2. India Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.4.3. India Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.5.2. Australia Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.5.3. Australia Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.6.2. Indonesia Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.6.3. Indonesia Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.7.2. Malaysia Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.7.3. Malaysia Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.8.2. Philippines Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.8.3. Philippines Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.9.2. Thailand Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.9.3. Thailand Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.10.2. Vietnam Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.10.3. Vietnam Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

7.4.11.2. Rest of Asia Pacific Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

7.4.11.3. Rest of Asia Pacific Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Succulent Plant Market Size and Forecast (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.2. Middle East and Africa Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.3. Middle East and Africa Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Succulent Plant Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.4.1.2. South Africa Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.4.1.3. South Africa Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.4.2.2. GCC Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.4.2.3. GCC Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.4.3.2. Egypt Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.4.3.3. Egypt Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.4.4.2. Nigeria Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.4.4.3. Nigeria Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

8.4.5.2. Rest of ME&A Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

8.4.5.3. Rest of ME&A Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Succulent Plant Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.2. South America Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.3. South America Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Succulent Plant Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.4.1.2. Brazil Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.4.1.3. Brazil Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.4.2.2. Argentina Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.4.2.3. Argentina Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.4.3.2. Colombia Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.4.3.3. Colombia Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.4.4.2. Chile Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.4.4.3. Chile Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.5. Rest of South America

9.4.5.1. Rest of South America Succulent Plant Market Size and Forecast, By Plant type (2024-2032)

9.4.5.2. Rest of South America Succulent Plant Market Size and Forecast, By Plant size (2024-2032)

9.4.5.3. Rest of South America Succulent Plant Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1 Costa Farms

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2 Altman Plants

10.3 Mountain Crest Gardens

10.4 The Sill

10.5 Leaf & Clay

10.6 Succulent Market

10.7 Proven Winners

10.8 Cactus King

10.9 Bloomscape

10.10 Surreal Succulents

10.11 Edelcactus BV

10.12 De Cactus Specialist

10.13 Desert Plants of Avalon

10.14 Uhlig Kakteen

10.15 CactusArt

10.16 Plantas de Interior

10.17 Kakteengarten

10.18 NurseryLive

10.19 Harwood Gardens

11 Key Findings and Analyst Recommendations

12 Succulent Plant Market: Research Methodology