Europe OLED Market- Industry Analysis and Forecast (2025-2032)

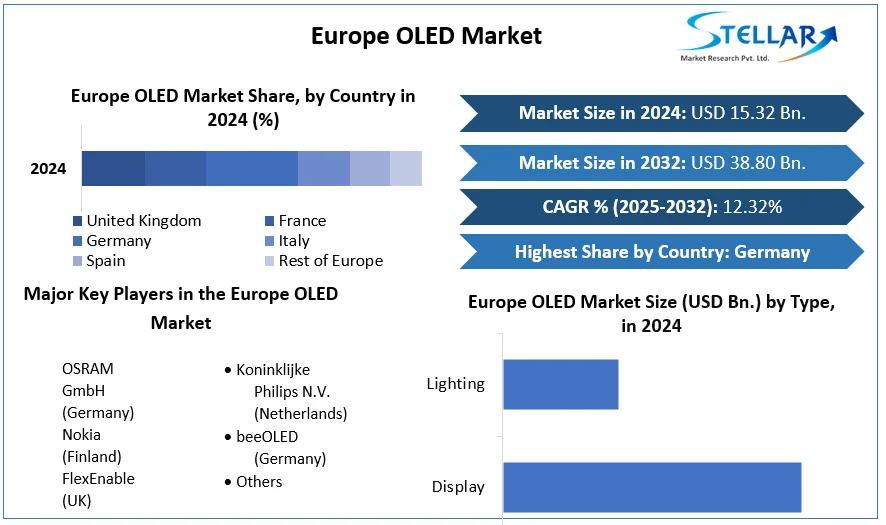

Europe OLED Market size was valued at USD 15.32 Bn. in 2024 and the total Market size is expected to grow at a CAGR of 12.32% from 2025 to 2032, reaching nearly USD 38.80 Bn. by 2032.

Format : PDF | Report ID : SMR_2305

Europe OLED Market Overview:

OLED stands for Organic Light-Emitting Diode, a technology that utilizes organic molecules to produce light through LEDs. Multiple industries are now utilizing a range of OLEDs from the Europe OLED market that focus on passive and active-matrix technologies. OLED displays have found their way into many handheld products since their onset and continue to be popular in the mobile market. OLED displays are used in gaming and audiovisual applications such as programmable push button switches, cameras, PDAs, and a few small TVs, wearables, IT devices, and VR.

Owing to low energy consumption, small OLED displays are well suited for use in portable devices, including smartphones, digital frames, and digital cameras. The OLED market in Europe experiencing robust growth, driven by high demand in consumer electronics, automotive, and lighting sectors. Key OLED manufacturers such as OSRAM, FlexEnable, and others are leading the charge, with significant investments in research and development to enhance OLED efficiency and reduce production costs. These advancements and the competitive landscape underscore Europe's pivotal role in the OLED industry.

- Luxury AV brand Loewe has revealed that it has established its own OLED TV manufacturing line at its headquarters in Kronach, Germany.

To get more Insights: Request Free Sample Report

Europe OLED Market Dynamics:

Rising Demand for OLED Technology in Electronics, Automotive, and Lighting Sectors Drives Europe OLED Market Growth

Organic Light Emitting Diode (OLED) technology, recognized for its vivid screens and low energy consumption, has become popular in different industries such as electronics, automotive, and lighting. The increasing need for high-tech display technologies in consumer gadgets like smartphones, tablets, and TVs is fueled by OLED's exceptional image quality, flexibility, and energy efficiency. Higher spending on research and development from major industry players has resulted in ongoing enhancements in OLED technology, improving its efficiency and decreasing manufacturing expenses.

The United Kingdom is seeing a growing demand for a variety of display technologies including LCD, LED, quantum dot, OLED, and e-paper. The increasing popularity of e-readers and the advancement of user-friendly display devices are driving the demand for e-paper. OLEDs are becoming increasingly popular owing to their application in tablets, laptops, smartwatches, smartphones, and wearables. Pro Display, a vendor from the United Kingdom, offers LCD touch kiosks, LED, and LCD screens to various industry sectors such as healthcare, automotive, transportation, and retail.

The increasing use of OLED technology in automotive display and lighting solutions is driving Europe's OLED market growth, as manufacturers look for new ways to improve vehicle interiors and energy-saving lighting systems. Environmental regulations and consumer demand for eco-friendly products are driving growth for the OLEDs market. Which use less power and have a lower environmental impact than traditional display technologies.

Challenges Faced in European OLED Market

The OLED market in Europe encounters several significant hurdles despite its growth potential. The challenge is the high production cost linked to OLED technology. The costly raw materials and intricate manufacturing processes result in higher expenses compared to traditional display technologies like LCD. Additionally, European OLED manufacturers are up against strong competition from well-established Asian companies. Companies in South Korea and China, possess more advanced production capabilities and benefit from economies of scale.

Another concern is supplying chain vulnerabilities, as the OLED industry depends heavily on a few key suppliers for essential components, making it susceptible to disruptions, particularly during geopolitical tensions or global crises. Strict environmental regulations in Europe, while promoting sustainability, increase operational costs and complicate compliance for OLED producers. Consumer awareness and adoption of OLED technology in Europe are lower compared to other regions, challenging Europe OLED market penetration and growth. Tackling these issues is essential for the European OLED market to reach its full potential.

Europe OLED Market Segment Analysis:

By Technology, Active-Matrix OLED (AMOLED) held the largest share in 2024 for the European OLED Market. AM-OLED stands for Active Matrix OLED (Active-Matrix Organic Light Emitting Diodes). An AMOLED display is an OLED display that is driven by an active-matrix backplane, it is a type of OLED display that achieves high performance. Growing Smartphone users across Europe, integration of innovative technological advancement is the prominent driver behind the OLED market growth. The high adoption of OLED display over LCD and usage of AMOLED display technology in various electronic devices like mobile phones, tablets, smartwatches, laptops, digital cameras, and television are boosting the growth of the OLED market.

Major companies in the electronics sector are projected to drive growth in the OLED display market by rolling out cutting-edge technologies like super AMOLED, super AMOLED advanced, super AMOLED plus, HD super AMOLED, HD super AMOLED plus, full HD super AMOLED, and Quad HD super AMOLED in the forecast period. AMOLED screens have revolutionized visual technology with improved image quality, energy efficiency, and design flexibility. With the growing demand for high-quality screens, numerous companies have emerged as leaders in manufacturing AMOLED displays.

Europe OLED Market Regional Insight:

Germany has dominated the Europe OLED Market, which held the largest market share accounting for XX% in 2024. Robust industrial base, cutting-edge technological capabilities, and large investments in research and development, Germany leads the European OLED market. An extensive industrial infrastructure exists in Germany, which facilitates the creation and manufacturing of OLED technology. Numerous high-tech businesses and manufacturers with a focus on cutting-edge electronics and materials call the nation home.

In the European market, customers are rapidly moving toward OLED TVs. The shift is particularly faster in Western Europe, where countries such as Germany have high income levels. Comprising major countries such as Germany, France, and the United Kingdom, emphasizes automotive applications and robust healthcare infrastructure, driving demand for OLED technology. Consumers in Europe prioritize premium-quality, sustainable, and energy-efficient products.

For instance, the automotive industry in Europe is pivotal, employing 13.8 million people directly and indirectly, with 2.6 million in vehicle manufacturing alone. As a major global producer, it leads in research and development investment. Car manufacturers are increasingly integrating advanced 3D displays like instrument clusters and heads-up displays (HUDs) to provide enhanced information and immersive driving experiences.

Increasing demand for high-quality display technologies in consumer electronics, such as smartphones and televisions. Leading European countries, such as Germany and the UK, have shown significant growth in the adoption of OLED displays for premium devices. The automotive industry in Europe, with its emphasis on advanced display systems for vehicles, has also contributed to this growth. In addition, European consumers' preference for energy-efficient and high-contrast displays has driven the demand for OLED technology. The growth of key players like LG Electronics and Samsung Electronics in the European OLED market has additionally accelerated the growth. R&D investments, the popular trend of smart homes, and the integration of AI and IoT devices using OLED screens have also played a significant role in regional Europe OLED market growth.

Europe OLED Market Competitive Landscape:

Key players in the Europe OLED market are fiercely competitive, leading innovation with substantial investments in research and development. Germany is at the forefront of the market owing to its robust industrial infrastructure and government backing. The United Kingdom and France both play a major role in driving OLED technology forward. The European OLED market shows favorable growth prospects, especially in the automotive and consumer electronics industries.

OSRAM is famous for its advancements in OLED lighting, specifically designed for use in the automotive, architectural, and industrial sectors. The company created OLED panels that are flexible and transparent, increasing design options for lighting.

FlexEnable is an expert in organic electronics and flexible displays. Their inventions consist of pliable OLED screens that are incorporated into wearable technology, devices that fold, and screens used in cars. Their technology permits the creation of OLED screens that are extremely slim, lightweight, and long-lasting.

Europe OLED Market Scope:

|

Europe OLED Market |

|

|

Market Size in 2024 |

USD 15.32 billion. |

|

Market Size in 2032 |

USD 38.80 billion. |

|

CAGR (2025-2032) |

12.32% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type

|

|

By Technology

|

|

|

By End Use

|

|

|

Regional Scope |

UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe |

Europe OLED Market key Players:

- OSRAM GmbH (Germany)

- Nokia (Finland)

- FlexEnable (UK)

- Koninklijke Philips N.V. (Netherlands)

- beeOLED (Germany)

- Others

For Global Scenario:

Frequently Asked Questions

The Market size was valued at USD 15.32 Billion in 2024 and the total Market revnue is expected to grow at a CAGR of12.32 % from 2025 to 2032, reaching nearly USD 38.80 Billion.

The segments covered are Type, Technology, and End Use.

1. Europe OLED Market: Research Methodology

2. Europe OLED Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe OLED Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe OLED Market: Dynamics

4.1. OLED Market Trends

4.2. OLED Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Europe OLED Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Europe OLED Market Size and Forecast, By Type (2024-2032)

5.1.1. Display

5.1.2. Lighting

5.2. Europe OLED Market Size and Forecast, By Technology (2024-2032)

5.2.1. Passive-Matrix OLED (PMOLED)

5.2.2. Active-Matrix OLED (AMOLED)

5.2.3. Transparent OLED

5.2.4. Top-Emitting OLED

5.2.5. Foldable OLED

5.2.6. White OLED

5.3. Europe OLED Market Size and Forecast, By End Use (2024-2032)

5.3.1. Consumer Electronics

5.3.2. Automotive

5.3.3. Retail

5.3.4. Aerospace & Defense

5.3.5. Healthcare

5.3.6. Others

5.4. Europe OLED Market Size and Forecast, by Country (2024-2032)

5.4.1. UK

5.4.2. France

5.4.3. Germany

5.4.4. Italy

5.4.5. Spain

5.4.6. Sweden

5.4.7. Russia

5.4.8. Rest of Europe

6. Company Profile: Key Players

6.1. OSRAM GmbH (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Nokia (Finland)

6.3. FlexEnable (UK)

6.4. Koninklijke Philips N.V. (Netherlands)

6.5. beeOLED (Germany)

6.6. Others

7. Key Findings

8. Industry Recommendations