Europe LED Lighting Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

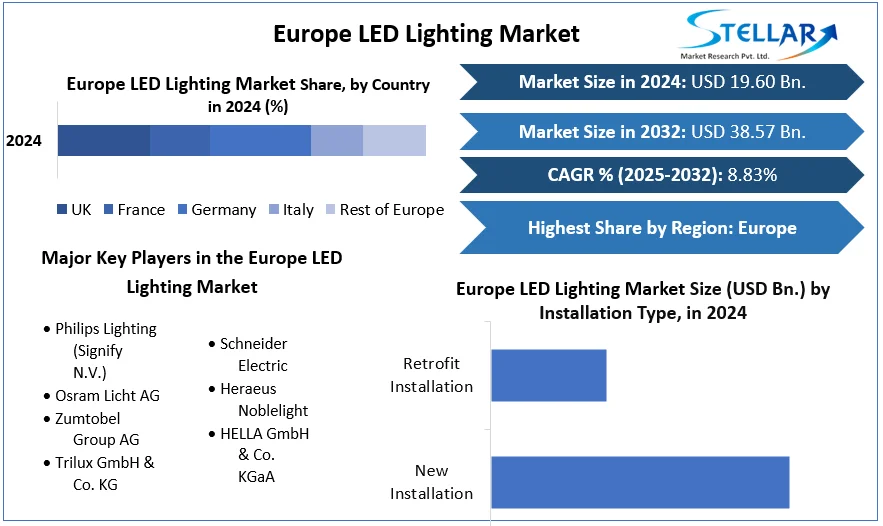

Europe LED Lighting Market size was valued at USD 19.60 Bn. in 2024 and is expected to reach USD 38.57 Bn. by 2032, at a CAGR of 8.83%.

Format : PDF | Report ID : SMR_2340

Europe LED Lighting Market Overview

LED lights are advanced lighting solutions utilizing light-emitting diodes known for their energy efficiency and long lifespan. The Europe LED lighting market encompasses the development, distribution, and consumption of these lighting products across European countries.

Demand in the Europe LED Lighting Market remains robust due to technical innovation and regulations associated with energy efficiency. A growing trend from traditional lighting sources to LED solutions is also part of other larger trends toward smart and sustainable technologies. This would not only facilitate enhanced savings in energy but also reduce maintenance costs for both the residential and commercial sectors.

In terms of product consumption, LED lights are increasingly preferred for their lower operational costs and adaptability in various applications. Residential is the biggest segment due to greater demand from consumers for energy-efficient products that provide aesthetic and functional values as well. In Europe LED Lighting Market, the value chain of lighting spans from the manufacturing process to the eventual links until end use, emphasizing technological innovation and efficiency.

Germany stands out as the dominant player in the Europe LED lighting market due to its progressive regulations and technological expertise. This country contains leading manufacturers of LED lighting solutions, such as Signify N.V. and Osram Licht AG, which are crucial in driving market growth through innovation and strategic market positioning. Further pushing its performance is the increasing adoption across segments, showcasing a strong and growing demand for the LED solution in Europe.

To get more Insights: Request Free Sample Report

Europe LED Lighting Market Dynamics:

Smart Technologies are the new trend that leads Europe's LED Lighting Market growth

The Europe LED lighting market is witnessing several significant trends that are driving its evolution. Integration with Smart Technologies is a major trend, as evidenced by Signify N.V.'s launch of the Philips Hue smart lighting range in 2022, offering enhanced control and customization through smart devices. Recent innovations, such as Signify's WiZ smart lighting system and the energy-efficient MASTER LEDtube UE introduced in 2023, further underscore the shift towards smarter and more efficient lighting solutions. Another factor that will continue to impact the Europe LED lighting market is the increasing adoption of energy-efficient solutions.

This has been accelerated by the European Union's ruling to phase out inefficient lighting by 2023. Regulatory impetus of this nature has accelerated the adoption of LEDs in both residential and commercial spaces. Other factors driving Europe LED Lighting Market growth include improvements in LED technology, yielding better color rendering and efficiency. For example, in 2023, Osram Licht AG launched new LED chips with 30% higher energy efficiency compared to the previous generation. Such trends increase the functionality of the products, open more applications, and thereby boost market growth.

Energy-efficient LED applications that are made by following regulatory standards will drive the Europe LED Lighting Market rapidly.

The Europe LED lighting market is driven by several key factors. Stringent Regulatory Standards are a primary driver, as EU regulations mandate the adoption of energy-efficient solutions. Germany's USD 2.71 billion funding initiative for energy-efficient lighting upgrades in public spaces underscores this driver. Growing Demand for Energy Efficiency: The segment further accelerates its growth by offering energy savings of up to 80% compared with traditional lighting. For instance, replacing the LED street lighting in Paris reduced energy consumption by 40% in 2023. These drivers play a central role in accelerating Europe LED Lighting Market growth and sustainability.

High Upfront costs will hinder Europe LED Lighting Market growth.

One of the major challenges to the market for Europe LED lighting is the high upfront cost, likely to discourage any investment despite the associated long-term savings. Besides, an initial outlay of an LED system could run as high as 50 percent more compared to traditional lighting systems, thereby hitting ultimately the adoption rate. Another challenge is the uneven consumer awareness about the advantages that LEDs offer; this affects market penetration and growth.

Infrastructure development creates new opportunities for the Europe LED Lighting Market.

The Europe LED lighting market offers significant growth opportunities. The Infrastructure Development and Renovation sector is a major opportunity, with ongoing projects like the USD 802.16 million streetlight modernization in Paris creating substantial demand for LED solutions. Furthermore, the Growing Focus on Smart City Projects presents another opportunity for Europe LED Lighting Market growth. For instance, Spain's Nou Mestalla stadium investment in 2023 has driven the adoption of advanced LED lighting technologies. These opportunities are poised to stimulate Europe LED Lighting Market growth and innovation, providing a solid foundation for future expansion.

Europe LED Lighting Market Segment Analysis:

By Product Type: Lamps dominate the Europe LED lighting market, by holding approximately XX% of the segment in 2024. Their market leadership is driven by their energy efficiency, with savings of up to 80% compared to traditional bulbs, and a long lifespan of about 25,000 hours. This widespread adoption in residential spaces and innovations by key players like Signify N.V. with their Philips Hue smart bulbs underscore the segment's strong performance. In contrast, LED luminaries account for 40% of the market, growing due to their use in commercial and industrial applications. They offer up to 70% energy savings and improved light distribution, with advancements from companies such as Eaton Corporation fueling this segment’s expansion.

By Installation Type: New installations dominate the Europe LED lighting market, comprising around XX% of the segment in 2024. This drives through increased adoption in new construction projects, mainly because of its energy efficiency and sustainability advantage. Buildings fitted with LED lighting can reduce energy consumption by up to 80%, thereby meeting some strict regulations on energy use and green building certifications. This trend is being banked on by companies such as Eaton Corporation in incorporating LED solutions into new builds. Of these, 35 % are retrofit installations; demand in this case is driven by updating existing infrastructure. Retrofit solutions enable cost-effective ways for older buildings to improve their energy efficiency and are supported by innovations from Europe LED Lighting Market leaders like Signify N.V.

By Distribution: Online stores lead the Europe LED lighting market, accounting for approximately XX% of the segment in 2024. This growth is driven by the convenience of online shopping, the ability to compare products easily, and access to a broader range of options. E-commerce platforms enable consumers to purchase LED lighting solutions with detailed product information and customer reviews, which drives market expansion. Europe LED Lighting Market Key players like Philips and Osram are expanding their online presence to capture this trend. Now, offline stores have won a market share of 45 percent, and consumers do value being able to go out and look, and test goods personally. That is what gives physical retail locations some relevance in the face of dominance from online channels: the immediacy of availability and personalized customer assistance.

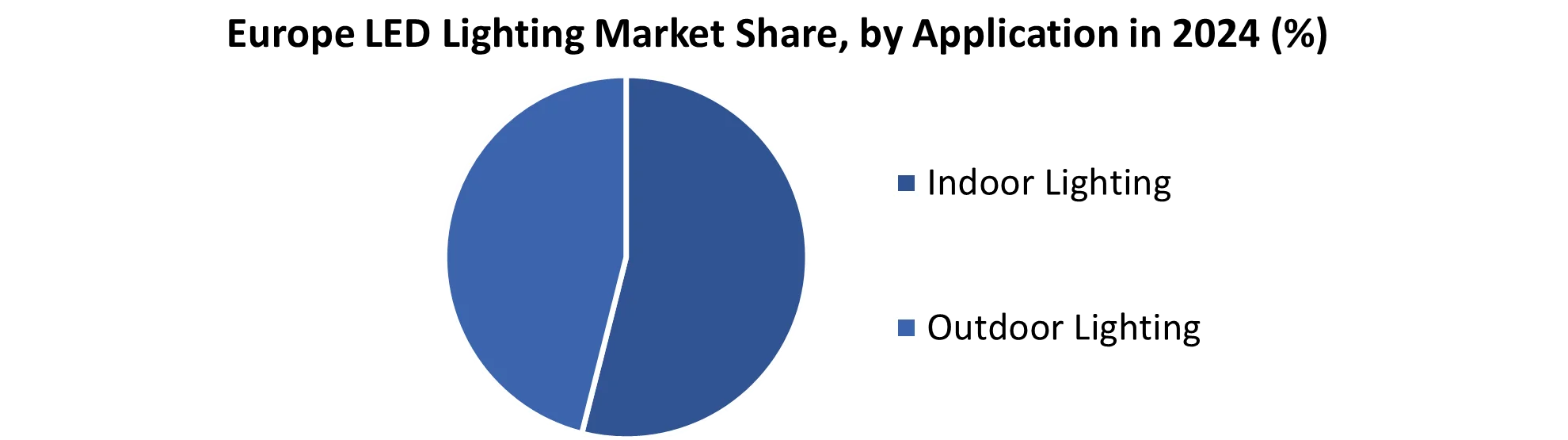

By Application: Indoor lighting dominates the Europe LED lighting market, representing approximately 70% of the segment in 2024. This dominance is driven by the growing adoption of LEDs in residential, commercial, and office spaces due to their energy efficiency, long lifespan, and versatility in various lighting designs. Innovations in indoor lighting, such as smart lighting systems and advanced dimming features, further fuel Europe LED Lighting Market growth. Outdoor lighting captures a 30% Europe LED Lighting Market share, benefiting from increasing urbanization and the need for energy-efficient solutions in public spaces, street lighting, and security applications. The emphasis on smart city projects and improved safety measures contributes to the growth of outdoor LED lighting solutions.

By End-Use: Residential applications dominate the Europe LED Lighting Market, accounting for approximately 55% of the segment in 2024. It is further fueled by the growing consumer demand for energy-efficient and cost-effective lighting solutions, and this very factor lends strong support to smart home integrations. Commercial lighting comes next, holding a 30% Europe LED Lighting Market share, with growth being majorly fostered by the rising need for energy-efficient lighting solutions in offices, retail, and hospitality sectors. The industrial segment holds a 10% share, reflecting steady demand for durable and high-performance lighting in factories and warehouses. The other category, which includes specialized applications like architectural and decorative lighting, constitutes about 5% of the Europe LED Lighting Market, influenced by niche requirements and custom lighting solutions.

Regional Analysis: Europe LED Lighting Market

In the Europe LED lighting market, Germany stands out as the dominant country, holding the largest market share due to its strong emphasis on energy efficiency and environmental sustainability. The nation's robust industrial and technological sectors drive demand for advanced LED lighting solutions. Germany's proactive climate policies and stringent regulations on energy consumption further bolster the adoption of LED technology.

In addition to Germany, the United Kingdom and France are also significant players in the market. The UK benefits from its innovative smart lighting solutions and extensive distribution networks, while France's focus on energy-efficient building standards supports the growth of LED lighting.

The Nordic countries, including Sweden and Denmark, are emerging as key regions due to their high levels of sustainability and green building initiatives.

The concentration of LED lighting manufacturers is notably high in Germany, enhancing its Europe LED Lighting Market leadership. With continued advancements and regulatory support, Germany and its neighboring countries are expected to drive substantial market growth in the coming years. Key players such as Osram Licht AG, Signify N.V., and Trilux GmbH & Co. KG contribute significantly to the region’s innovation and market dynamics.

Competitive Analysis: Europe LED Lighting Market

The European LED lighting market is competitive, with major players like Osram Licht AG, Signify N.V., and Trilux GmbH & Co. KG leading through innovation and extensive product portfolios. The supply chain spans from raw material procurement to retail, supported by efficient logistics. Europe imports LED components from Asia and exports finished products globally, reflecting a strong demand for energy-efficient solutions.

Osram Licht AG is oriented toward smart lighting and new technologies, whereas, Signify N.V. relies on its broad product portfolio and pays attention to sustainable development. Where Osram is leading in innovation, Signify does with market reach and sustainability.

Europe LED Lighting Market Scope

|

Europe LED Lighting Market |

|

|

Market Size in 2024 |

USD 19.60 Bn. |

|

Market Size in 2032 |

USD 38.57 Bn. |

|

CAGR (2025-2032) |

8.83% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Europe LED Lighting Market Segments |

By Product Type Lamps Luminaries |

|

By Installation Type New Installation Retrofit Installation |

|

|

By Distribution Channel online Store Offline Store |

|

|

By Application Indoor Lighting Outdoor Lighting |

|

|

By End-use Residential Commercial Industrial Others |

|

|

Europe LED Lighting Market Regional Analysis |

(UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) |

Europe LED Lighting Market, Key players

- Philips Lighting (Signify N.V.)

- Osram Licht AG

- Zumtobel Group AG

- Trilux GmbH & Co. KG

- Schneider Electric

- Heraeus Noblelight

- HELLA GmbH & Co. KGaA

For Global Scenario:

Frequently Asked Questions

LED lamps dominate the Europe LED lighting market, with strong growth projections driven by their energy efficiency and versatility.

The dominance of new installations over retrofits significantly boosts the growth of the LED lighting market in Europe by driving higher adoption rates in newly constructed buildings.

The primary applications for LED lighting in Europe are indoor and outdoor lighting, with increasing adoption in outdoor environments driven by smart city initiatives and energy efficiency mandates.

Indoor lighting dominates the market due to its broad application in residential, commercial, and industrial settings, while outdoor lighting is experiencing rapid growth driven by smart city developments and increased urbanization.

1. Europe LED Lighting Market: Research Methodology

2. Europe LED Lighting Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe LED Lighting Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe LED Lighting Market: Dynamics

4.1. Europe LED Lighting Market Trends

4.2. Europe LED Lighting Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape by Region

5. Europe LED Lighting Market: Market Size and Forecast by Segmentation (Value in USD Billion) (2024-2032)

5.1. Europe LED Lighting Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Lamps

5.1.2. Luminaries

5.2. Europe LED Lighting Market Size and Forecast, By Installation Type (2024-2032)

5.2.1. New Installation

5.2.2. Retrofit Installation

5.3. Europe LED Lighting Market Size and Forecast, By Distribution Type (2024-2032)

5.3.1. Online Store

5.3.2. Offline Store

5.4. Europe LED Lighting Market Size and Forecast, By Application (2024-2032)

5.4.1. Indoor Lighting

5.4.2. Outdoor Lighting

5.5. Europe LED Lighting Market Size and Forecast, By End-Use (2024-2032)

5.5.1. Residential

5.5.2. Commercial

5.5.3. Industrial

5.5.4. Others

5.6. Europe LED Lighting Market Size and Forecast, by Country (2024-2032)

5.6.1. United Kingdom

5.6.2. France

5.6.3. Germany

5.6.4. Italy

5.6.5. Spain

5.6.6. Sweden

5.6.7. Norway

5.6.8. Poland

5.6.9. Switzerland

5.6.10. Russia

5.6.11. Rest of Europe

6. Company Profile: Key Players

6.1. Philips Lighting (Signify N.V.)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Osram Licht AG

6.3. Zumtobel Group AG

6.4. Trilux GmbH & Co. KG

6.5. Schneider Electric

6.6. Heraeus Noblelight

6.7. HELLA GmbH & Co. KGaA

7. Key Findings

8. Industry Recommendations