Asia Pacific ISO Container Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

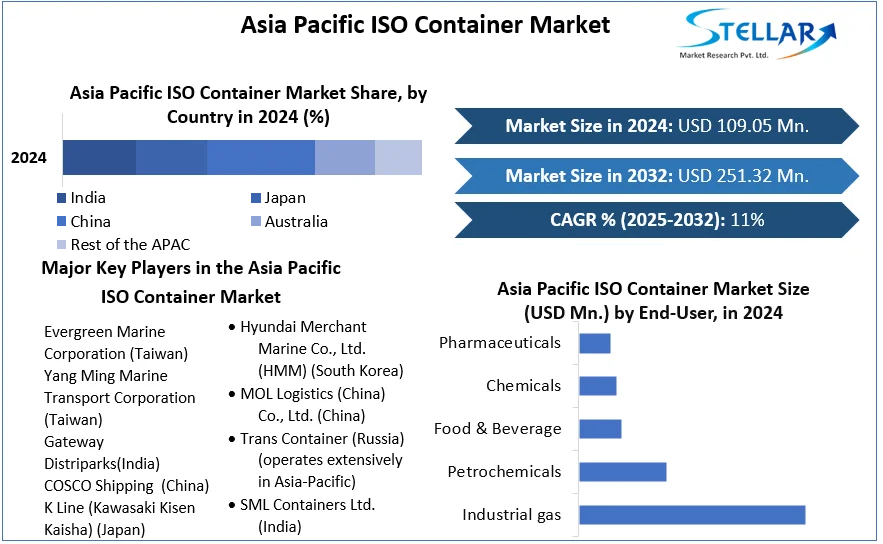

Asia Pacific ISO Container Market size was valued at USD 109.05 Million in 2024 and the total Asia Pacific ISO Container Market size is expected to grow at a CAGR of 11% from 2025 to 2032, reaching nearly USD 251.32 Million by 2032.

Format : PDF | Report ID : SMR_2493

Asia Pacific ISO Container Market Overview

ISO containers, also known as intermodal containers, are standardized shipping containers designed for transportation of goods across multiple modes of transport, such as ships, trains, and trucks, without the need to unload and reload the cargo. These containers are built according to the specifications set by the International Organization for Standardization (ISO), ensuring they meet the stringent requirements for size, strength, and durability. ISO containers come in various types, including dry cargo containers, refrigerated containers, and tank containers, making them versatile for transporting a wide range of goods, from raw materials to finished products.

The Asia-Pacific ISO container market has been a vital component of the region's logistics and supply chain infrastructure, driven by robust trade activities and the rapid expansion of e-commerce. The market benefits from the region's strategic geographical location, extensive port networks, and well-established trade routes, making it a hub for global trade. The availability of ISO containers in the Asia-Pacific region is supported by leading manufacturers and logistics companies, ensuring a steady supply to meet the growing demand. Consumer needs in this market are primarily focused on efficient, cost-effective, and secure transportation solutions, which ISO containers fulfill owed to their standardization and versatility.

Asia-Pacific ISO container sector has been strong, with consistent growth in containerized trade volumes driven by rising exports and imports across key economies such as China, India, and Japan. On the consumption side, regional revenue has seen significant contributions from China, which remains the largest consumer of ISO containers, followed by Japan and South Korea. The most commonly used products in this market include dry cargo containers and refrigerated containers, essential for transporting consumer goods, perishables, and industrial products.

In conclusion, the Asia-Pacific ISO container market is poised for continued growth, supported by increasing trade activities, the expansion of e-commerce, and the ongoing development of regional infrastructure. The market's ability to meet the diverse needs of consumers, coupled with its strong geographical reach and robust supply chain, ensures its critical role in facilitating global trade and economic development in the region.

- World imports most of its Iso container, China from China, United States and Turkey

- The top 3 importers of Iso container, China are Costa Rica with 2,797,206 shipments followed by United States with 1,258,189 and India at the 3rd spot with 787,759 shipments.

To get more Insights: Request Free Sample Report

Asia Pacific ISO Container Market Dynamics

Growing Demand for ISO Containers in Asia-Pacific Amid Expanding Trade and Industrialization

The Asia-Pacific ISO container market has been witnessing robust growth, driven by the region's expanding trade activities and rapid industrialization. As global trade routes increasingly pass through Asia, particularly China, Japan, South Korea, and India, the demand for ISO containers has surged to support the efficient transportation of goods. Additionally, the region's booming e-commerce sector and the rise of manufacturing hubs in Southeast Asia have further bolstered the need for reliable and standardized shipping solutions. For example, companies like China International Marine Containers (CIMC) are capitalizing on this trend by ramping up production and innovation to meet the growing market needs.

Expanding Trade Routes Fuel Demand for ISO Containers in Asia Pacific

The burgeoning trade routes across the Asia Pacific region are significantly driving the demand for ISO containers. As economic powerhouses like China, India, and Southeast Asian nations continue to ramp up their export activities and infrastructure developments, the need for standardized and efficient cargo solutions has never been greater. For instance, China's Belt and Road Initiative, which aims to enhance global trade connectivity, has spurred a rise in both port infrastructure and intermodal transport, consequently increasing the demand for ISO containers to facilitate smooth and scalable logistics operations. This growth trajectory is further supported by the region's ongoing industrialization and urbanization efforts, solidifying the role of ISO containers as a critical component in the seamless movement of goods across diverse markets

Navigating Regulatory and Environmental Hurdles in the Asia Pacific ISO Container Market

The Asia Pacific ISO container market faces a range of challenges stemming from regulatory and environmental concerns. Diverse national regulations and standards across the region complicate the uniformity and compliance of ISO containers, creating hurdles for manufacturers and logistics providers. For example, stringent emission regulations in countries like Japan and South Korea demand costly modifications to container handling equipment and transport methods. Additionally, environmental pressures are prompting stricter waste management and recycling requirements, forcing companies to invest in sustainable practices and technologies. These regulatory complexities and environmental demands can increase operational costs and disrupt supply chains, presenting significant obstacles for market players striving to maintain efficiency and competitiveness in the evolving landscape of the Asia Pacific region.

Asia Pacific ISO Container Market Segment Analysis

By Transport Modes, Marine transport remains the dominant segment, reflecting its critical role in international trade. With an extensive network of ports and a robust fleet of container ships, marine transport commands approximately 65% of the market share in 2024.

- For instance, China's extensive coastline and its major ports like Shanghai and Shenzhen facilitate a substantial volume of containerized goods, driving this segment's prominence.

- CIMC is a major manufacturer of ISO containers and has a substantial influence on the marine transport sector through its production of containers used in shipping.

Rail transport, while less dominant than marine, plays a significant role, especially in facilitating inland movement within the region's vast and interconnected rail networks. It represents around XX% of the market share in 2024. The expansion of rail infrastructure, such as China's Belt and Road Initiative, enhances connectivity between ports and inland regions, contributing to rail's growth. The China-Europe rail routes, for example, underscore the increasing importance of rail in linking key economic zones across Asia and Europe.

- While primarily known for shipbuilding, KSOE is involved in projects that enhance rail transport infrastructure, particularly in integrating rail and marine logistics.

Road transport, though crucial for last-mile delivery and short-distance movements, holds a smaller share of the market, accounting for approximately XX% in 2024. This segment is driven by the need for flexible and accessible transportation solutions within and between countries. In countries like India and Thailand, where road networks are continually improving, road transport ensures efficient distribution of containerized cargo from ports to inland destinations.

- SML Containers focuses on the production and distribution of containers, which are frequently transported by road for last-mile delivery and regional distribution.

- In addition to rail, Chengdu Jinxin also utilizes road transport for the distribution of containers within inland China.

Asia Pacific ISO Container Market Regional Analysis

The Asia-Pacific ISO container market exhibits dynamic growth across its diverse countries, reflecting the region's pivotal role in global trade and logistics. China remains the dominant force in the market, held a substantial share of approximately 45% in 2024. China's robust economic expansion, massive export-import activities, and extensive port infrastructure, including major hubs like Shanghai and Shenzhen, contribute to its leading position. The country’s strategic initiatives, such as the Belt and Road Initiative, further bolster its dominance by enhancing connectivity and boosting trade volumes.

India accounts for about XX% of the market share in 2024. India's rapid industrialization, burgeoning manufacturing sector, and expanding port facilities, such as the Mumbai and Chennai ports, drive its significant share in the container market. The country’s emphasis on improving logistics infrastructure, including new highways and inland container depots, supports its growing role in the regional market.

Japan held around XX% of the market share in 2024. The country’s advanced technology, strong manufacturing base, and major ports like Tokyo and Yokohama underpin its substantial presence in the ISO container market. Japan’s focus on technological innovation and efficient logistics systems enhances its competitive edge in the region.

South Korea represents approximately XX% of the market share in 2024. With its strategic port cities such as Busan and Incheon, and a well-developed shipping industry, South Korea maintains a significant position. The country's advanced container manufacturing capabilities and strong logistics network contribute to its market presence.

Singapore, with its world-renowned port facilities and strategic location along major shipping routes, held about XX% of the market share. The Port of Singapore is one of the busiest in the world, facilitating a high volume of container traffic and enhancing Singapore’s role as a global logistics hub.

Australia, which commands roughly XX% of the market, benefits from its established port infrastructure, including Sydney and Melbourne ports, and its strategic position in the Asia-Pacific region. The country’s stable economic environment and trade agreements support its container market participation.

Other countries in the Asia-Pacific region, including Thailand, Malaysia, and Vietnam, collectively account for the remaining XX%. These nations are experiencing growth in their container markets due to increasing industrial activities, port expansions, and improvements in logistics infrastructure.

- For instance, Thailand’s expansion of its Laem Chabang port and Malaysia’s development of Port Klang enhance their positions in the market.

Asia Pacific ISO Container Market Competitive Landscape

The Asia-Pacific ISO container market is characterized by intense competition, driven by a mix of established industry giants and emerging players. Key companies operating in this market include Evergreen Marine Corporation (Taiwan), COSCO Shipping (China), and China International Marine Containers (CIMC) (China), among others. These companies dominate the market with extensive fleets, advanced manufacturing capabilities, and expansive global networks. The competitive dynamics are influenced by factors such as technological innovation, fleet expansion, strategic partnerships, and regional market penetration. Established players often leverage their vast resources and experience to maintain market leadership, while emerging companies focus on niche markets, cost-effective solutions, and localized services to carve out a significant share. The ongoing shifts in trade patterns, coupled with the increasing demand for efficient and sustainable container solutions, continue to reshape the competitive landscape of the Asia-Pacific ISO container market.

COSCO Shipping (China), a top player in the Asia-Pacific ISO container market, stands out with its extensive service offerings, massive fleet size, and robust financial performance. COSCO’s service portfolio includes comprehensive container shipping, logistics services, and terminal operations, supported by a global network that spans across major trade routes. The company’s strong financials, driven by consistent growth in revenues and profitability, enable it to invest heavily in technology and fleet expansion, reinforcing its competitive edge in the market.

Gateway Distriparks (India), an emerging player, focuses primarily on providing integrated logistics and container handling services within the Indian subcontinent. Although smaller in scale compared to COSCO, Gateway Distriparks has shown impressive growth in recent years by capitalizing on India’s burgeoning trade activities and infrastructural developments. The company’s strategic investments in rail-linked inland container depots and cold chain logistics have allowed it to differentiate its offerings in a competitive market. While COSCO Shipping dominates with its global reach and financial might, Gateway Distriparks is gaining traction by targeting specific regional markets and offering specialized services that meet local demand efficiently.

|

Asia Pacific ISO Container Market |

|

|

Market Size in 2024 |

USD 109.05 Mn. |

|

Market Size in 2032 |

USD 251.32 Mn. |

|

CAGR (2025-2032) |

11% |

|

Historic Data |

2019-2024 |

|

Base Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Transport Modes Marine Rail Road |

|

By Container Type Lined Tanks Reefer Tanks Cryogenic Tanks Gas Tanks Swap Body Tanks Multi-Compartment Tanks Others |

|

|

By End-User Industrial gas Petrochemicals Food & Beverage Chemicals Pharmaceuticals Others |

|

|

Countries Scope: |

China, S Korea, Japan, India, Australia, ASEAN, New Zealand, Taiwan, and Rest of Asia Pacific |

Asia Pacific ISO Container Market Key Players

- Evergreen Marine Corporation (Taiwan)

- Yang Ming Marine Transport Corporation (Taiwan)

- Gateway Distriparks(India)

- COSCO Shipping (China)

- K Line (Kawasaki Kisen Kaisha) (Japan)

- Concor (Container Corporation)(India)

- CXIC Group Containers Company Limited (China)

- China International Marine Containers (Group) Ltd. (CIMC) (China)

- Dong Fang International Container (Group) Co., Ltd. (China)

- Wan Hai Lines Ltd. (Taiwan)

- Korea Shipbuilding & Offshore Engineering Co., Ltd. (KSOE) (South Korea)

- Hyundai Merchant Marine Co., Ltd. (HMM) (South Korea)

- MOL Logistics (China) Co., Ltd. (China)

- TransContainer (Russia) (operates extensively in Asia-Pacific)

- SML Containers Ltd. (India)

- Chengdu Jinxin Shipping Co., Ltd. (China)

- Sinotrans Limited (China)

- Zhonglu International Logistics Co., Ltd. (China)

- PIL (Pacific International Lines) Ltd. (Singapore)

- Other Players

Frequently Asked Questions

Ans: Key challenges for the Asia-Pacific ISO container market include fluctuating raw material prices, stringent environmental regulations, and logistical complexities in handling diverse container types.

Ans. The Market size was valued at USD 109.05 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 11% from 2025 to 2032, reaching nearly USD 251.32 Million.

Ans. The segments covered are Transport Modes, Container Type, and End-User.

Asia Pacific region held the highest share in 2024.

1. Asia Pacific ISO Container Market: Research Methodology

2. Asia Pacific ISO Container Market: Executive Summary

3. Asia Pacific ISO Container Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Asia Pacific ISO Container Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Opportunities

4.4. Market Challenges

4.5. PORTER’s Five Forces Analysis

4.6. PESTLE Analysis

4.7. Strategies for New Entrants to Penetrate the Market

4.8. Regulatory Landscape

5. Asia Pacific ISO Container Market Size and Forecast by Segments (by Value USD Billion)

5.1. Asia Pacific ISO Container Market Size and Forecast, by Transport Modes (2024-2032)

5.1.1. Marine

5.1.2. Rail

5.1.3. Road

5.2. Asia Pacific ISO Container Market Size and Forecast, by Container Type (2024-2032)

5.2.1. Lined Tanks

5.2.2. Reefer Tanks

5.2.3. Cryogenic Tanks

5.2.4. Gas Tanks

5.2.5. Swap Body Tanks

5.2.6. Multi-Compartment Tanks

5.2.7. Others

5.3. Asia Pacific ISO Container Market Size and Forecast, by End-User (2024-2032)

5.3.1. Industrial gas

5.3.2. Petrochemicals

5.3.3. Food & Beverage

5.3.4. Chemicals

5.3.5. Pharmaceuticals

5.3.6. Others

5.4. Asia Pacific ISO Container Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia.

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key players

6.1. Evergreen Marine Corporation (Taiwan)

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Portfolio

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. COSCO Shipping (China)

6.3. Yang Ming Marine Transport Corporation (Taiwan)

6.4. Gateway Distriparks(India)

6.5. K Line (Kawasaki Kisen Kaisha) (Japan)

6.6. Concor (Container Corporation)(India)

6.7. CXIC Group Containers Company Limited (China)

6.8. China International Marine Containers (Group) Ltd. (CIMC) (China)

6.9. Dong Fang International Container (Group) Co., Ltd. (China)

6.10. Wan Hai Lines Ltd. (Taiwan)

6.11. Korea Shipbuilding & Offshore Engineering Co., Ltd. (KSOE) (South Korea)

6.12. Hyundai Merchant Marine Co., Ltd. (HMM) (South Korea)

6.13. MOL Logistics (China) Co., Ltd. (China)

6.14. TransContainer (Russia) (operates extensively in Asia-Pacific)

6.15. SML Containers Ltd. (India)

6.16. Chengdu Jinxin Shipping Co., Ltd. (China)

6.17. Sinotrans Limited (China)

6.18. Zhonglu International Logistics Co., Ltd. (China)

6.19. PIL (Pacific International Lines) Ltd. (Singapore)

6.20. Others Players

7. Key Findings

8. Industry Recommendation