India Paper Packaging Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

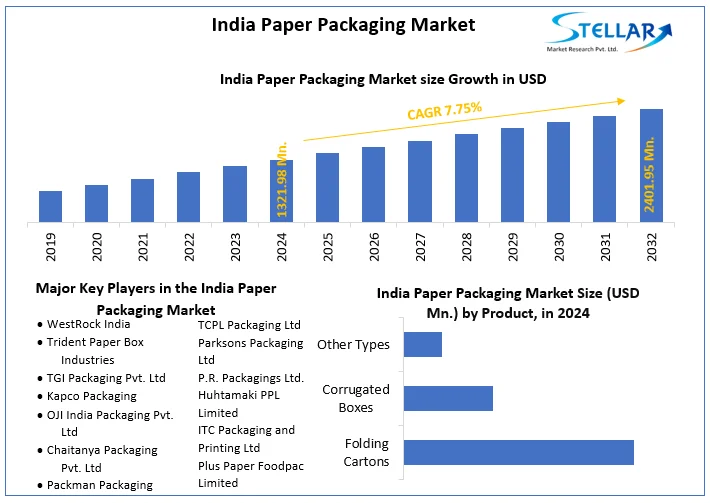

India Paper Packaging Market was valued at US$ 1321.98 Mn. in 2024. Global India Paper Packaging Market size is estimated to grow at a CAGR of 7.75 %.

Format : PDF | Report ID : SMR_184

India Paper Packaging Market Overview:

Paper packaging is a suitable solution for high protection to a wide range of products during its transporation. Moreover, it delivers more benefits like recyclability, light weight, ease of use, and biodegradability to transport firms. Packaging is the fifth largest sector and paper packaging is one of the highest growth sectors in the country.

To get more Insights: Request Free Sample Report

India Paper Packaging Market Dynamics:

In India, Government is undertaking numerous initiatives to minimize the usage of single-use plastics, that is influencing business firms to adopt sustainable and eco-friendly packaging solutions to form their presence in the india packging market growth. E-commerce is the one of the largest end-users in the country, which is driven by a young demographic profile, internet penetration, better economic performance. The , paper packaging is expected to witness a more than 5.75% rate of CAGR during the forecast period.

With a the consideration of organized retail sector in India , the demand for paper packaging is expected to increase because of rapid increase in supermarkets and modern shopping centers. Additionally, the ban of one-time-use plastic and high flactuations in plastic raw material prices are expected to drive the demand for paper packaging in the country. The paper packaging materials can be easily reused and recycled that make it one of the primary reasons behind the consideration of paper packaging as one of the most eco-friendly and economic forms of packaging.

Paper Packaging in India: Next Big Thing in The Future

Paper packaging products are playing a vital role in the overall packaging sector in India. The Indian paper packaging industry is growing at an exponential rate. The demand for better quality of paper packaging products, evolving consumer choices and shift towards eco-friendly & recyclable materials are some of the prominent factors, that drive the India paper packaging market growth. The demand for paper packaging products is going to increase in the near future because of the factors like urban population growth, disposable incomes and paper production in India. 100% FDI is permitted in Paper & Packaging industries in India, which is expected to offer key opportunity for new entry key players. Some of the states like Andhra Pradesh, Karnataka, Maharashtra, and Gujarat have a high demand for paper packaging.

India Paper Packaging Market Segment Analysis:

An increase in demand of the usage of folding cartons is one of the key drivers in the India paper packaging market. high adoption of folding carton is mainly because of certain factors such as growing FMCG and food & beverages sector. Additionally, corrugated box production has increased which is driven by the country’s logistics sector and surging exports in the country.

Food and Beverage Segment: Hold the dominant position in India Paper Packaging Market

Food and beverage industries are growing fast in India because of high consumption of food among population. The Food Safety and Standards Authority of India (FSSAI) has recently instructed food and beverage to follow new instructions at the time of packing things. In recent years, India has witnessed sustainable packaging growth because of high packaged food consumption and awareness. High consumer awareness related to packaged food, mainly packaged food deliveries are expected to drive the market growth in the future. The food and beverage industry are one of the largest end-users for paper packaging. The ban imposed on the usage of plastics in multiple states, rise in concerns regarding waste management are expected to increase the demand for paper packaging in the sector. The food delivery platforms have accelerated their contactless food delivery service, which is drive the demand for folding cartons/carton boards.

India Paper Packaging Market Regional Insights:

In India, consumers across the country are increasingly buying online groceries, food items, daily essentials through online platform. An increase in online sales is expected to boost the demand for sustainable packaging solutions. The e-commerce and retail industry are major areas that drive the demand for paper packaging solution in the country. The demand for paper packaging is increasing rapidly because of presence of end-user industries like food and beverages, cosmetics, and other industries. The government initiatives to reduce plastic wastes are expected to boost the India paper packaging market growth. The FMCG industry is one of the largest end-users in India Paper Packaging Market. According to IBEF, India is one of the largest countries of food and beverages in the world, which is expected to contribute more than 60% of global sales.

India Paper Packaging Market Competitive Landscape:

Safe Pack Solutions providers offering packaging solutions for moist or greasy food items and fresh, dried, chilled, or frozen, such as ice cream, pizza, and cakes. It offers variety of paper boards and paper packed solution for delivery at doorstep. SafePack Solutions providers are focusing on cost-effective packaging materials without compromising on quality, which drive the demand for paper packaging. Key players are gradually stepped up their investment in innovations and marketing across country. For instance, in 2021, WestRock has planned to introduce a packaging collection made using sustainably sourced wood fiber, which helps to reduce waste and build a 100 percent reusable, recyclable, and compostable product portfolio.

The objective of the report is to present a comprehensive analysis of the India Paper Packaging Market to the stakeholders in the industry. The report provides trends that are most dominant in the India Paper Packaging Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the India Paper Packaging Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the India Paper Packaging Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Paper Packaging Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the India Paper Packaging Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the India Paper Packaging Market. The report also analyses if the India Paper Packaging Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the India Paper Packaging Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the India Paper Packaging Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the India Paper Packaging Market is aided by legal factors.

India Paper Packaging Market Scope:

|

India Paper Packaging Market |

|

|

Market Size in 2024 |

USD 1321.98 Mn. |

|

Market Size in 2032 |

USD 2401.95 Mn. |

|

CAGR (2025-2032) |

7.75% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Grade

|

|

By Product

|

|

|

By End User Industry

|

|

India Paper Packaging Market Key Players

- WestRock India

- Trident Paper Box Industries

- TGI Packaging Pvt. Ltd

- Kapco Packaging

- OJI India Packaging Pvt. Ltd

- Chaitanya Packaging Pvt. Ltd

- Packman Packaging

- TCPL Packaging Ltd

- Parksons Packaging Ltd

- P.R. Packagings Ltd.

- Huhtamaki PPL Limited

- ITC Packaging and Printing Ltd

- Plus Paper Foodpac Limited

- Subam Papers Private Limited

- Jayvir Paper Industiries

Frequently Asked Questions

The India Paper Packaging Market is expected to grow at a rate of CAGR during the forecast period.

The market size of the India Paper Packaging Market by 2032 is US$ 2401.95 Mn.

The forecast period for the India Paper Packaging Market is 2025-2032.

The market size of the India Paper Packaging Market in 2024 was US$ 1321.98 Mn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. India Paper Packaging Market: Target Audience

2.3. India Paper Packaging Market: Primary Research (As per Client Requirement)

2.4. India Paper Packaging Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region,2024-2032 ( In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. India Paper Packaging Market Segmentation Analysis,2024-2032 (Value US$ MN)

4.3.1.1. India Market Share Analysis, By Grade,2024-2032 (Value US$ MN)

4.3.1.1.1. Carton board

4.3.1.1.2. Containerboard

4.3.1.1.3. Other Grade

4.3.1.2. India Market Share Analysis, By Product,2024-2032 (Value US$ MN)

4.3.1.2.1. Folding Cartons

4.3.1.2.2. Corrugated Boxes

4.3.1.2.3. Other Types)

4.3.1.3. India Market Share Analysis, By End User Industry,2024-2032 (Value US$ MN)

4.3.1.3.1. Food & Beverage

4.3.1.3.2. Healthcare

4.3.1.3.3. Personal Care

4.3.1.3.4. Household Care

4.3.1.3.5. Electrical Products

4.3.1.3.6. Other End User Industries

Chapter 5 Stellar Competition Matrix

5.1.1. India Stellar Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Grade, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in End User Industry

5.3.1.M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. WestRock India.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Trident Paper Box Industries

6.1.3. TGI Packaging Pvt. Ltd

6.1.4. Kapco Packaging

6.1.5. OJI India Packaging Pvt. Ltd

6.1.6. Chaitanya Packaging Pvt. Ltd

6.1.7. Packman Packaging

6.1.8. TCPL Packaging Ltd

6.1.9. Parksons Packaging Ltd

6.1.10. P.R. Packagings Ltd.

6.1.11. Huhtamaki PPL Limited

6.1.12. ITC Packaging and Printing Ltd

6.1.13. Plus Paper Foodpac Limited

6.1.14. Subam Papers Private Limited

6.1.15. Jayvir Paper Industiries

6.2. Key Findings

6.3. Recommendations