Global Wood Pulp Market Size, Share & Forecast 2026–2032 | Packaging Demand, Market Growth & Chemical Pulp Shift.

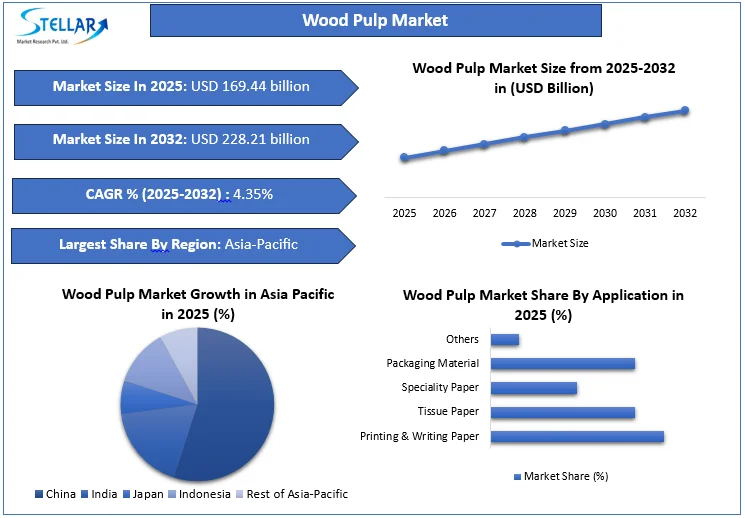

The Global Wood Pulp Market is expected to grow at a 4.35% CAGR from 2026 to 2032, increasing from USD 169.44 billion in 2025 to USD 228.21 billion by 2032, driven by rising packaging demand, expanding tissue consumption, and sustainable pulp production initiatives.

Format : PDF | Report ID : SMR_1810

Wood Pulp Market Overview

Wood pulp forms the backbone of the global paper, packaging, and tissue industries, serving as the essential fiber input for high-strength packaging, hygiene products, and specialty paper applications. Global Wood Pulp Market size was USD 169.44 billion in 2025 and is forecast to reach USD 228.21 billion by 2032, with a CAGR of 4.35%. Accelerating demand for sustainable packaging, consistent growth in tissue and hygiene consumption, and a structural shift toward chemical wood pulp with superior strength and performance characteristics. Market momentum is reinforced by low-carbon pulp production, certified fiber sourcing, and energy-efficient manufacturing, while raw material and energy price volatility remains a key constraint.

Key Highlights:

- Over 1,250 chemical pulp mills operate globally, reflecting the accelerating shift toward chemical wood pulp across packaging, tissue, and specialty paper applications.

- Packaging and tissue demand is supported by more than 1,150 pulp mills and 4,200 paper facilities, highlighting strong industrial dependence on consistent wood pulp supply.

- Sustainable production is advancing, with over 50% of industry energy sourced from biomass and biofuels, enabling nearly 50% reduction in CO? emissions intensity.

- Asia-Pacific Wood Pulp Market dominated global consumption growth, while North America and South America remain key supply hubs, supported by 423 million cubic meters in 2024 of global pulpwood production.

To get more Insights: Request Free Sample Report

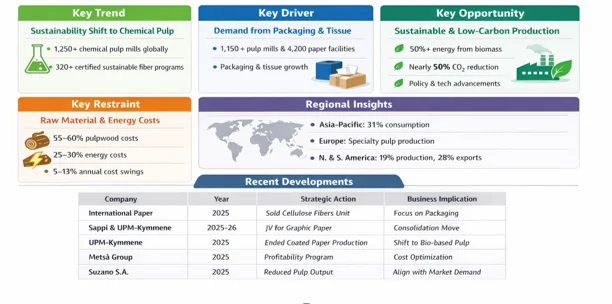

Wood Pulp Market Key Trend: Sustainability-Driven Shift Toward Chemical Wood Pulp Production

The wood Pulp Market is undergoing a structural transition toward chemical wood pulp, including kraft, sulfite, and dissolving pulp grades. These products are formally classified within government-monitored production frameworks due to their fiber purity, strength consistency, and process efficiency.

- As of 2025, rising adoption of kraft, sulfite, and dissolving pulp processes is evident across more than 1,250 chemical pulp mills worldwide, delivering higher fiber purity and strength than mechanical pulp for printing, packaging, and specialty paper applications.

- In 2024, chemical pulp is officially recognized within national and international production classification systems across over 75 countries, with more than 320 certified sustainable fiber programs implemented globally, supporting environmental compliance and low-carbon pulp production initiatives.

Wood Pulp Market Key Driver – Rising Demand for Packaging and Tissue Applications

Structural expansion of packaging and tissue segments in wood pulp Industry. Chemical wood pulp underpins the durability and strength requirements of corrugated board and containerboard, while simultaneously delivering the softness and absorbency essential for tissue and hygiene products. In 2024, industrial alignment across over 1,150 pulp mills and more than 4,200 paper and paperboard facilities underscores the strategic dependence of these end-use segments on consistent pulp fiber supply. Packaging remains the dominant application, and tissue products provide stable, recurring consumption, reinforcing long-term market growth trajectories.

Wood Pulp Market Key Opportunity – Expansion of Sustainable and Low-Carbon Wood Pulp Production

The expansion of sustainable and low-carbon pulp production presents a significant opportunity for industry participants. In 2025, more than 50% of energy used in pulp and paper manufacturing originated from biomass and biofuels, improving energy self-sufficiency. Environmental performance has strengthened, with direct CO? emissions per unit of output declining by nearly 50% over recent decades, supported by energy efficiency investments, renewable integration, and process modernization initiatives promoted through 2023–2025 policy frameworks.

• Over 50% of industry energy derived from biomass and biofuels in 2025

• Nearly 50% reduction in direct CO? emissions per unit of output

• Increased deployment of energy-efficient and low-carbon technologies

• Policy-driven support for renewable energy and circular-economy practices

Wood Pulp Market Key Restraint – Volatility in Raw Material and Energy Costs

Volatility in raw material and energy costs remains a key structural restraint for the Global Wood Pulp Market, affecting production economics, operating margins, and supply chain stability.

Raw Material Costs:

- In 2024, pulpwood and fiber feedstocks accounted for 55–60% of total production costs, with global pulpwood production near 423 million cubic meters, while prices fluctuated by around 13% due to seasonality, logistics constraints, and regional supply limitations across the pulp and paper supply chain.

Energy Costs:

- In 2024, energy accounted for 25–30% of total production costs in pulp and paper manufacturing, with industrial energy consumption near 4,150 petajoules, while price volatility caused 5–10% annual operational cost swings, affecting overall cost stability.

Global Wood Pulp Market Segmentation Analysis

Segmentation of the wood pulp market aligns with forestry and industrial classifications, enabling standardized reporting across regions.

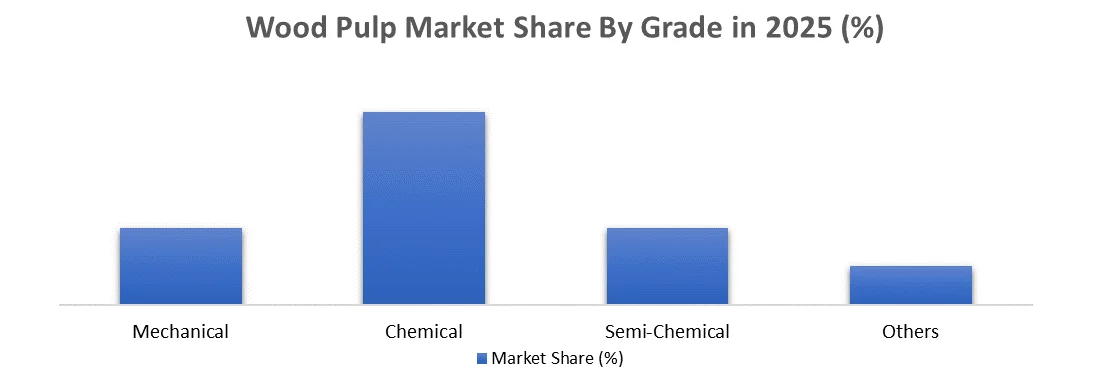

By Grade, the wood pulp market size is categorized into mechanical pulp, chemical pulp, semi-chemical pulp, and specialty pulp grades. Chemical pulp dominates due to superior fiber properties, while mechanical pulp is used in lower-grade paper applications. Semi-chemical pulp offers a balance between yield and strength, and other categories include dissolving and specialty pulps tracked separately.

By application, wood pulp demand has primarily driven by paper and paperboard manufacturing. Packaging materials form the largest application due to strength requirements in corrugated and containerboard products. Tissue paper provides stable demand linked to hygiene use. Printing and writing papers rely on pulp quality, while specialty and other applications include functional papers and technical absorbents.

Global Wood Pulp Market Regional Insights

Analysis highlights concentration in production, consumption, and exports. Asia Pacific dominates consumption, while North America and South America remain critical production and export hubs. Europe maintains a strong position in specialty pulp production under strict sustainability standards.

- Asia Pacific dominated global wood pulp market (31% in 2024), supported by expanding industrial capabilities and growing paper and packaging sectors, while Europe maintains strength in specialty pulp production with certified fiber sourcing, high-value grades, and strict sustainability compliance.

- North America and South America remain critical production and export hubs, contributed nearly 19% of global pulp production and 28% of global pulp exports in 2024, respectively, supplying both regional and international markets.

Global Wood Pulp Market Competitive Landscape

- Competition is driven by scale, regional strengths, sustainable fiber access, and technology adoption, with the United States, China, and Brazil contributing 24%, 15%, and 12% of global output in 2023.

- global integrated leaders like International Paper, WestRock, Suzano S.A., Stora Enso, and UPM-Kymmene, as well as regional champions and niche operators focusing on technology efficiency, sustainability compliance, and supply chain control.

- Key regional drivers include Asia-Pacific’s cost-efficient chemical pulp, North America’s integrated mills, and Europe’s specialty pulp with sustainability focus, while industry priorities include energy efficiency, certified sourcing, infrastructure investment, and risk management.

Recent Development in Wood Pulp Market:

|

Company |

Year |

Recent Development / Strategic Action |

Impact / Business Implication |

|

International Paper Company |

2025 |

Sold Global Cellulose Fibers business to focus on core packaging solutions |

Repositioning toward packaging; operational optimization; capacity consolidation |

|

Sappi Limited |

2025-2026 |

Signed non-binding LOI for 50/50 JV with UPM-Kymmene to combine European graphic paper businesses |

Consolidation to optimize production in declining paper grades; shift to high-value pulp and specialty products |

|

UPM-Kymmene Corporation |

2025 |

Permanently ended coated mechanical paper production at Kaukas mill |

Transition to sustainable pulp and bio-based production; rationalization of legacy assets |

|

Metsä Group |

2025 |

Launched program to improve profitability and cash flow, including personnel adjustments |

Cost optimization; structural adjustments amid raw material and energy price pressures |

|

Suzano S.A. |

2025 |

Reduced annual market pulp production by Nearly 3.5% relative to nominal capacity of 13.4 million tonnes/year |

Reflects cyclical market adjustments; aligns supply with demand |

Wood Pulp Market Scope:

|

Global Wood Pulp Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 169.44 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

4.35% |

Market Size in 2032: |

USD 228.21 billion |

|

Wood Pulp Market Segment Analysis |

By Type |

Hardwood Softwood |

|

|

By Grade |

Mechanical Chemical Semi-Chemical Others |

||

|

By Application |

Printing & Writing Paper Tissue Paper Speciality Paper Packaging Material Others |

||

|

By Distribution Channel |

Offline Online |

||

|

By End Use |

Packaging Healthcare Food & Beverages Personal Care Other Printing Commercial Printing Packaging Printing Publication Printing Building and Construction Residential Commercial Industrial Infrastructural Others |

||

|

By Region |

North America Europe Asia Pacific (APAC) Middle East & Africa (MEA) South America |

||

Wood Pulp Market Key Players:

- International Paper Company (North America)

- Domtar Corporation / Paper Excellence (North America)

- WestRock Company (North America)

- Canfor Corporation (North America)

- Resolute Forest Products (North America)

- Rayonier Advanced Materials (North America)

- Stora Enso Oyj (Europe)

- UPM-Kymmene Corporation (Europe)

- Sappi Limited (Europe)

- Metsä Group (Europe)

- Södra (Europe)

- Smurfit Kappa Group (Europe)

- Suzano S.A. (Asia Pacific / South America)

- Oji Holdings Corporation (Asia Pacific)

- Asia Pulp & Paper (APP) (Asia Pacific)

- Nippon Paper Industries Co., Ltd. (Asia Pacific)

- Nine Dragons Paper Holdings (Asia Pacific)

- West Fraser Timber Co. Ltd. (Middle East & Africa / North America)

- Central National-Gottesman (Middle East & Africa)

- Celulosa Arauco y Constitución S.A. (South America)

- Empresas CMPC S.A. (South America)

- APRIL – Asia Pacific Resources International Limited (South America / Asia Pacific)

- Canfor (South America / North America)

- Södra Cell (Europe)

- Mondi Group (Europe & Asia)

- Tembec Inc. (North America)

- Smurfit Kappa – Regional Expansions (Europe)

- Arctic Paper (Europe)

- Billerud (Europe)

- Emami Paper Mills (Asia)

Frequently Asked Questions

Asia-Pacific dominates global wood pulp consumption, supported by expanding paper, packaging, and industrial production capabilities.

A major trend is the shift toward chemical pulp grades such as kraft, sulfite, and dissolving pulp due to higher fiber purity, strength, and process efficiency.

Volatility in raw material costs (pulpwood/fiber) and energy prices are primary restraints, impacting production economics, operating margins, and supply chain stability.

Top players include International Paper, Suzano S.A., UPM-Kymmene, WestRock, Stora Enso, and Sappi Limited, driving innovation, sustainability, and regional supply.

1. Wood Pulp Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Wood Pulp Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Type Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Wood Pulp Market: Dynamics

3.1. Wood Pulp Market Trends

3.2. Wood Pulp Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Technological Advancements & Product Innovation in the Wood Pulp Market

4.1. Innovations in Chemical Pulping Technologies (Kraft, Sulfite, and Modified Processes)

4.2. Advancements in Mechanical & Chemi-Mechanical Pulping Efficiency

4.3. Sustainable Pulp Manufacturing Technologies and Low-Emission Processes

4.4. Automation, AI, and Industry 4.0 Applications in Wood Pulp Production

4.5. Technological Developments in High-Yield, Specialty, and Dissolving Wood Pulp

5. Global Wood Pulp Pricing Analysis (2020–2025)

5.1. Global Wood Pulp Price Trends by Pulp Type (Hardwood, Softwood, Dissolving)

5.2. Raw Material Cost Structure: Wood Fiber, Energy, and Chemical Inputs

5.3. Regional Price Variations and Demand–Supply Impact

5.4. Price Sensitivity Across Developed and Emerging Economies

5.5. Pricing Dynamics for Certified, Sustainable, and Specialty Wood Pulp

6. Wood Pulp Supply Chain & Manufacturing Insights

6.1. Key Raw Material Sources (Hardwood, Softwood, Plantation Wood, Forest Residues)

6.2. Global Wood Pulp Manufacturing Clusters and Industrial Corridors

6.3. Pulp Production Processes, Yield Optimization, and Quality Control Practices

6.4. Import Dependency, Trade Routes, and Global Pulp Flow Analysis

6.5. Supply Chain Risk Assessment, Forestry Constraints, and Mitigation Strategies

7. Distribution & Procurement Channels in the Wood Pulp Market

7.1. Global Procurement Practices of Paper Mills, Packaging Producers, and Textile Manufacturers

7.2. Role of Traders, Distributors, and Long-Term Supply Contracts

7.3. Digital B2B Platforms and E-Procurement Trends in Pulp Trading

7.4. Spot Market, Contract Pricing, and Regional Supply Chain Dynamics

8. Policy & Regulatory Environment for Wood Pulp Production

8.1. Global Wood Pulp Manufacturing Standards, Certifications, and Compliance Frameworks

8.2. Environmental Regulations Governing Forestry, Emissions, and Effluents

8.3. Sustainable Forestry Policies, Chain-of-Custody, and Deforestation Regulations

8.4. Trade Policies, Tariffs, and Non-Tariff Barriers Affecting Wood Pulp

9. Role of the Wood Pulp Industry in the Circular Economy

9.1. Circular Economy Principles Applied to Wood Fiber and Pulp Production

9.2. Integration of Recycled Fiber and Circular Pulp Manufacturing Models

9.3. Environmental and Economic Benefits of Circular Wood Pulp Systems

9.4. Global Circular Economy Initiatives Relevant to the Pulp Industry

9.5. Role of Government, Forestry Bodies, and Industry Partnerships

10. Impact of Digitalization on Wood Pulp Demand

10.1. Declining Graphic Paper Demand and Implications for Pulp Consumption

10.2. Growth of Packaging, Tissue, and Specialty Grades Supporting Pulp Demand

10.3. Digital Transformation in Pulp Mill Operations and Supply Chain Management

10.4. Strategic Role of Wood Pulp in a Digital yet Sustainability-Driven Economy

10.5. Long-Term Demand Outlook for Wood Pulp by End-Use Sector

11. Socioeconomic Impact of the Wood Pulp Industry

11.1. Employment Generation Across Forestry, Pulp Mills, and Logistics

11.2. Rural Development and Economic Impact of Plantation Forestry

11.3. Corporate Social Responsibility (CSR) in Forestry and Pulp Manufacturing

11.4. Development of Local and Regional Wood Fiber Supply Chains

12. Challenges in Scaling Wood Pulp Production

12.1. Capital Investment Requirements and Technology Upgrade Costs

12.2. Raw Material Availability, Forestry Constraints, and Climate Risks

12.3. Global Competition, Cost Pressures, and Market Volatility

12.4. Environmental Compliance, Carbon Emissions, and Water Usage Challenges

12.5. Workforce Availability, Skills Gap, and Operational Efficiency Issues

13. Consumer and Industry Attitudes Toward Wood Pulp-Based Products

13.1. Preference for Wood-Based Fibers Over Plastic and Synthetic Alternatives

13.2. Sustainability Awareness and Demand for Certified Wood Pulp

13.3. Influence of Textile, Packaging, and Hygiene Sectors on Pulp Consumption

13.4. Role of ESG Commitments and Sustainability Communication

14. Investment Landscape & Funding Trends in the Wood Pulp Market

14.1. Global Investment Opportunities in Wood Pulp Capacity Expansion

14.2. Foreign Direct Investment (FDI) Trends in Forestry and Pulp Projects

14.3. Private Equity, Infrastructure Funds, and Strategic Investments

14.4. Government Incentives for Sustainable Forestry and Pulp Manufacturing

14.5. Mergers, Acquisitions, and Capacity Consolidation Trends

15. Water Usage & Resource Management in Wood Pulp Manufacturing

15.1. Water Consumption Patterns in Chemical and Mechanical Pulping

15.2. Water Recycling, Closed-Loop Systems, and Process Optimization

15.3. Wastewater Treatment Technologies and Regulatory Compliance

15.4. Innovations in Water-Efficient and Low-Discharge Pulp Mills

15.5. Environmental and Cost Implications of Water Management

16. Growth of the Global Recycled Fiber & Pulp Industry

16.1. Global Recycled Fiber and Secondary Pulp Market Overview

16.2. Role of Recycling in Reducing Dependence on Virgin Wood Pulp

16.3. Key Recycling Markets and Integration with Virgin Pulp Supply

16.4. Waste Paper Regulations and Recycling Policy Frameworks

16.5. Future Growth Outlook and Impact on Wood Pulp Demand

17. Global Trade & Export Dynamics of the Wood Pulp Market

17.1. Global Wood Pulp Trade Flows and Volume Movements

17.2. Key Exporting and Importing Regions

17.3. Demand Trends in North America, Europe, and Asia

17.4. Competitive Positioning of Major Pulp-Producing Regions

17.5. Trade Barriers, Logistics Constraints, and Export Challenges

18. Wood Pulp Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

18.1. Wood Pulp Market Size and Forecast, By Type (2025-2032)

18.1.1. Hardwood

18.1.2. Softwood

18.2. Wood Pulp Market Size and Forecast, By Grade (2025-2032)

18.2.1. Mechanical

18.2.2. Chemical

18.2.3. Semi-Chemical

18.2.4. Others

18.3. Wood Pulp Market Size and Forecast, By Application (2025-2032)

18.3.1. Printing & Writing Paper

18.3.2. Tissue Paper

18.3.3. Speciality Paper

18.3.4. Packaging Material

18.3.5. Others

18.4. Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

18.4.1. Offline

18.4.2. Online

18.5. Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

18.5.1. Packaging

18.5.1.1. Healthcare

18.5.1.2. Food & Beverages

18.5.1.3. Personal Care

18.5.1.4. Other

18.5.2. Printing

18.5.2.1. Commercial Printing

18.5.2.2. Packaging Printing

18.5.2.3. Publication Printing

18.5.3. Building and Construction

18.5.3.1. Residential

18.5.3.2. Commercial

18.5.3.3. Industrial

18.5.3.4. Infrastructural

18.5.3.5. Others

18.6. Wood Pulp Market Size and Forecast, By Region (2025-2032)

18.6.1. North America

18.6.2. Europe

18.6.3. Asia Pacific

18.6.4. Middle East and Africa

18.6.5. South America

19. North America Wood Pulp Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

19.1. North America Wood Pulp Market Size and Forecast, By Type (2025-2032)

19.1.1. Hardwood

19.1.2. Softwood

19.2. North America Wood Pulp Market Size and Forecast, By Grade (2025-2032)

19.2.1. Mechanical

19.2.2. Chemical

19.2.3. Semi-Chemical

19.2.4. Others

19.3. North America Wood Pulp Market Size and Forecast, By Application (2025-2032)

19.3.1. Printing & Writing Paper

19.3.2. Tissue Paper

19.3.3. Speciality Paper

19.3.4. Packaging Material

19.3.5. Others

19.4. North America Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

19.4.1. Offline

19.4.2. Online

19.5. North America Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

19.5.1. Packaging

19.5.1.1. Healthcare

19.5.1.2. Food & Beverages

19.5.1.3. Personal Care

19.5.1.4. Other

19.5.2. Printing

19.5.2.1. Commercial Printing

19.5.2.2. Packaging Printing

19.5.2.3. Publication Printing

19.5.3. Building and Construction

19.5.3.1. Residential

19.5.3.2. Commercial

19.5.3.3. Industrial

19.5.3.4. Infrastructural

19.5.3.5. Others

19.6. North America Wood Pulp Market Size and Forecast, by Country (2025-2032)

19.6.1. United States

19.6.2. Canada

19.6.3. Mexico

20. Europe Wood Pulp Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

20.1. Europe Wood Pulp Market Size and Forecast, By Type (2025-2032)

20.2. Europe Wood Pulp Market Size and Forecast, By Grade (2025-2032)

20.3. Europe Wood Pulp Market Size and Forecast, By Application (2025-2032)

20.4. Europe Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

20.5. Europe Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

20.6. Europe Wood Pulp Market Size and Forecast, by Country (2025-2032)

20.6.1. United Kingdom

20.6.1.1. United Kingdom Wood Pulp Market Size and Forecast, By Type (2025-2032)

20.6.1.2. United Kingdom Wood Pulp Market Size and Forecast, By Grade (2025-2032)

20.6.1.3. United Kingdom Wood Pulp Market Size and Forecast, By Application (2025-2032)

20.6.1.4. United Kingdom Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

20.6.1.5. United Kingdom Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

20.6.2. France

20.6.3. Germany

20.6.4. Italy

20.6.5. Spain

20.6.6. Sweden

20.6.7. Russia

20.6.8. Rest of Europe

21. Asia Pacific Wood Pulp Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

21.1. Asia Pacific Wood Pulp Market Size and Forecast, By Type (2025-2032)

21.2. Asia Pacific Wood Pulp Market Size and Forecast, By Grade (2025-2032)

21.3. Asia Pacific Wood Pulp Market Size and Forecast, By Application (2025-2032)

21.4. Asia Pacific Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

21.5. Asia Pacific Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

21.6. Asia Pacific Wood Pulp Market Size and Forecast, by Country (2025-2032)

21.6.1. China

21.6.2. S Korea

21.6.3. Japan

21.6.4. India

21.6.5. Australia

21.6.6. Indonesia

21.6.7. Malaysia

21.6.8. Philippines

21.6.9. Thailand

21.6.10. Vietnam

21.6.11. Rest of Asia Pacific

22. Middle East and Africa Wood Pulp Market Size and Forecast (by Value in USD Million and Volume in Units) (2025-2032)

22.1. Middle East and Africa Wood Pulp Market Size and Forecast, By Type (2025-2032)

22.2. Middle East and Africa Wood Pulp Market Size and Forecast, By Grade (2025-2032)

22.3. Middle East and Africa Wood Pulp Market Size and Forecast, By Application (2025-2032)

22.4. Middle East and Africa Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

22.5. Middle East and Africa Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

22.6. Middle East and Africa Wood Pulp Market Size and Forecast, by Country (2025-2032)

22.6.1. South Africa

22.6.2. GCC

22.6.3. Egypt

22.6.4. Nigeria

22.6.5. Rest of ME&A

23. South America Wood Pulp Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

23.1. South America Wood Pulp Market Size and Forecast, By Type (2025-2032)

23.2. South America Wood Pulp Market Size and Forecast, By Grade (2025-2032)

23.3. South America Wood Pulp Market Size and Forecast, By Application (2025-2032)

23.4. South America Wood Pulp Market Size and Forecast, By Distribution Channel (2025-2032)

23.5. South America Wood Pulp Market Size and Forecast, By End Use Industry (2025-2032)

23.6. South America Wood Pulp Market Size and Forecast, by Country (2025-2032)

23.6.1. Brazil

23.6.2. Argentina

23.6.3. Colombia

23.6.4. Chile

23.6.5. Rest Of South America

24. Company Profile: Key Players

24.1.1. International Paper Company

24.1.2. Company Overview

24.1.3. Business Portfolio

24.1.4. Financial Overview

24.1.5. SWOT Analysis

24.1.6. Strategic Analysis

24.1.7. Recent Developments

24.2. Domtar Corporation / Paper Excellence (North America)

24.3. WestRock Company (North America)

24.4. Canfor Corporation (North America)

24.5. Resolute Forest Products (North America)

24.6. Rayonier Advanced Materials (North America)

24.7. Stora Enso Oyj (Europe)

24.8. UPM-Kymmene Corporation (Europe)

24.9. Sappi Limited (Europe)

24.10. Metsä Group (Europe)

24.11. Södra (Europe)

24.12. Smurfit Kappa Group (Europe)

24.13. Suzano S.A. (Asia Pacific / South America)

24.14. Oji Holdings Corporation (Asia Pacific)

24.15. Asia Pulp & Paper (APP) (Asia Pacific)

24.16. Nippon Paper Industries Co., Ltd. (Asia Pacific)

24.17. Nine Dragons Paper Holdings (Asia Pacific)

24.18. West Fraser Timber Co. Ltd. (Middle East & Africa / North America)

24.19. Central National-Gottesman (Middle East & Africa)

24.20. Celulosa Arauco y Constitución S.A. (South America)

24.21. Empresas CMPC S.A. (South America)

24.22. APRIL – Asia Pacific Resources International Limited (South America / Asia Pacific)

24.23. Canfor (South America / North America)

24.24. Södra Cell (Europe)

24.25. Mondi Group (Europe & Asia)

24.26. Tembec Inc. (North America)

24.27. Smurfit Kappa – Regional Expansions (Europe)

24.28. Arctic Paper (Europe)

24.29. Billerud (Europe)

24.30. Emami Paper Mills (Asia)

24.31. Others.

25. Key Findings

26. Analyst Recommendations

27. Wood Pulp Market: Research Methodology