Venezuela Coffee Market : Industry Analysis and Forecast (2024-2030) by Source, Type, Process, and Region.

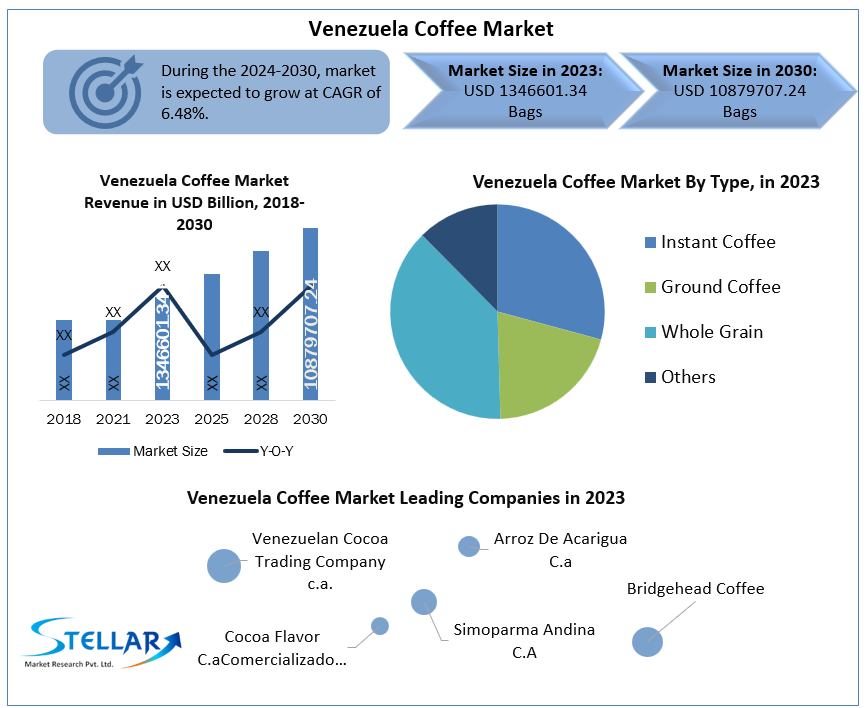

Venezuela Coffee Market size is volume at 1346601.34 bags in 2023. Coffee will encourage a great deal of transformation in Beverage Sector in Venezuela.

Format : PDF | Report ID : SMR_80

Venezuela Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product

To get more Insights: Request Free Sample Report

Venezuela Coffee Market Dynamics:

The Venezuela Coffee Market is currently facing massive shortages of agricultural inputs including, fungicides, herbicides, fertilizers, machinery, and fuel. Acute fuel shortages in 2020 has a negative impact for Venezuelan coffee production. Industry associations declared that they no longer have access to enough fuel to efficiently harvest and transport crops to market. This has become a common complaint across all sectors of Venezuelan agriculture. Shortages are expected to continue, as the Maduro regime's fiscal shortfall limits its ability to import refined petroleum products. The area planted is expected to decrease by ten percent to 180,000 hectares in 2021. Manufacturers expect that some young non-bearing trees will die without inputs, as coffee rust goes untreated and competing plants are not pushed back with herbicides.

Venezuela once produced a majority of its agricultural inputs. Currently, the Maduro regime finds itself without the necessary capital to import agro-inputs, some of which are now subject to international sanctions. Coffee production specifically suffers from a lack of fertilizers to boost flowering, herbicides to limit competing plants, and fungicides to protect trees from coffee rust. A shortage of fuel and replacement parts for equipment for tractors are not operating and the trucks that would have brought coffee to market are either not operating or focused instead on transporting staple food products.

Once the richest country in Latin America, and known to have the largest oil reserves in the world, Venezuela is now in the midst of an economic crisis. Hit by a case of hyperinflation that's estimated at 42,000 %. Prices are at an all-time high, the bolivar has lost 98% of its value, and the currency has become next to worthless. Payment for everyday goods requires unimaginable piles of banknotes. Coffee prices in 2020 are out of reach for most Venezuelan consumers. Currently, one kilogram of coffee retails for around $8.00, while the Venezuelan monthly minimum wage is $2.50 on average. Only the wealthiest few percent of Venezuelans can purchase coffee. Lower quality products, often a mix of roasted coffee and corn, are replacing coffee for many consumers.

Venezuelans typically drink coffee. As purchasing power has eroded, consumers have been forced to use their limited resources on food products. Similarly, the Maduro regime’s deteriorating financial situation has forced it too to focus on imports of staple food products. Until Venezuelan coffee producers ramp up production or imports resume, domestic coffee consumption is expected to stay well below historic levels.

Venezuela produces less than one percent of the world's coffee, and most of it is drunk by the Venezuelans themselves. Some interesting Venezuela coffees are again entering the North American specialty market. Venezuela's finest coffees are a class of coffees known as Maracaibos, named after the port through which they are shipped, which are grown in the western part of the country near the border with Colombia. Venezuelan coffee qualities include a sweet and slightly rich flavor with balanced acidity.

The majority of Venezuelan coffees will be from local coffee roasters who have managed to get their hands on some green coffee beans, which will offer a more authentic taste than pre-roasted and imported coffees. Even the omnipresent Starbucks currently lacks a Venezuelan coffee offering.

Venezuela Coffee Market Segment Analysis:

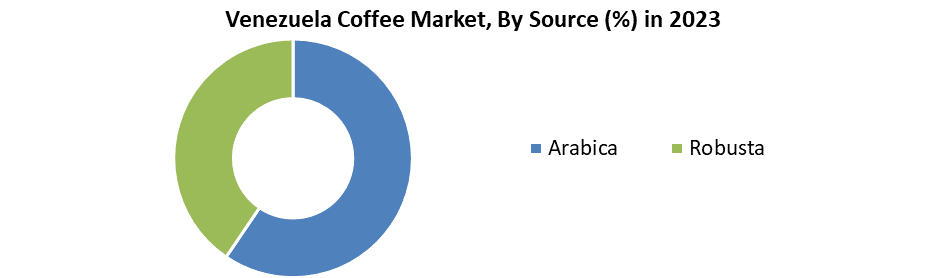

By Source, Robusta dominated the market with a 53 % share in 2023. Robusta coffee beans have a high caffeine content, which makes them less sour and much stronger. These beans are strong and tasty, with a pleasant chocolate aroma in the mouth. These factors are driving the growth of the segment in the market.

The objective of the report is to present a comprehensive analysis of the Venezuela Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Venezuela Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Venezuela Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Venezuela Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Venezuela Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Venezuela Coffee market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Venezuela Coffee market. The report also analyses if the Venezuela Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Venezuela Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Venezuela Coffee market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Venezuela Coffee market is aided by legal factors.

Venezuela Coffee Market Scope:

|

Venezuela Coffee Market |

|

|

Market Size in 2023 |

USD 1346601.34 Bags. |

|

Market Size in 2030 |

USD 10879707.24 Bags. |

|

CAGR (2024-2030) |

34.78% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

KEY PLAYERS:

- Venezuelan Cocoa Trading Company c.a.

- Arroz De Acarigua C.a

- Cocoa Flavor C.aComercializadora Rey Castilla INC

- Simoparma Andina C.A

Frequently Asked Questions

1. Venezuela Coffee Market: Research Methodology

2. Venezuela Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Venezuela Coffee Market: Dynamics

3.1. Venezuela Coffee Market Trends

3.2. Venezuela Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Venezuela Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2030)

4.1. Venezuela Coffee Market Size and Forecast, by Source (2024-2030)

4.1.1. Arabica

4.1.2. Robusta

4.2. Venezuela Coffee Market Size and Forecast, by Type (2024-2030)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Venezuela Coffee Market Size and Forecast, by Process (2024-2030)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Venezuela Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Venezuelan Cocoa Trading Company c.a.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Arroz De Acarigua C.a

6.3. Cocoa Flavor C.aComercializadora Rey Castilla INC

6.4. Simoparma Andina C.A

7. Key Findings

8. Industry Recommendations