Vending Machine Market Size, Share & Forecast (2026-2032) Smart, Cashless, IoT & AI-Enabled Retail Solutions

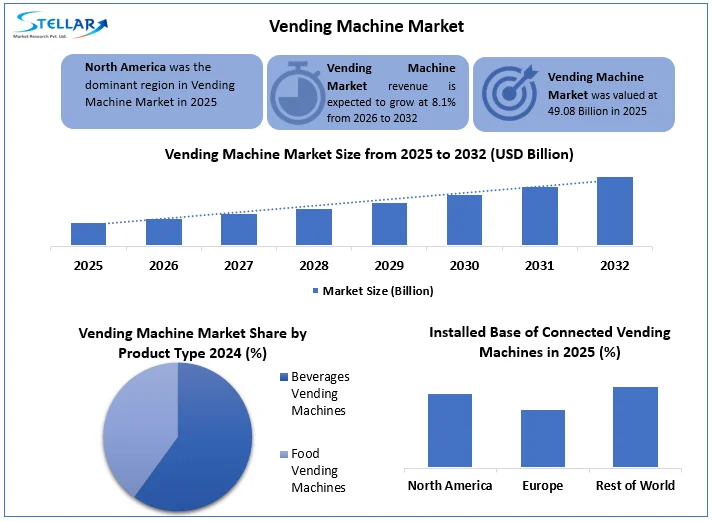

Vending Machine Market size was valued at USD 49.08 Billion in 2025 and is expected to grow at a CAGR of 8.1% during 2026 to 2032, reaching approximately USD 84.66 Billion by 2032.

Format : PDF | Report ID : SMR_1374

Vending Machine Market Overview

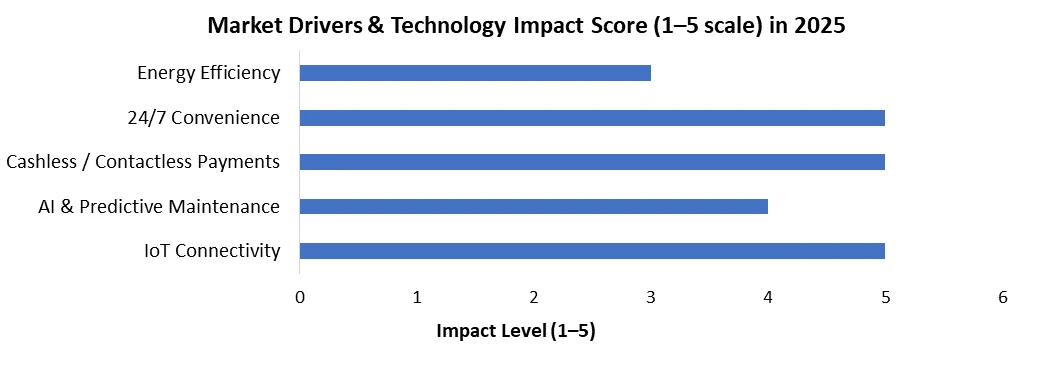

The global vending machine market is experiencing significant growth, driven by the rising adoption of smart, connected, and cashless systems that cater to the demand for 24/7 automated retail experiences. The market's expansion is further supported by strategic placement in high-traffic locations, along with the integration of IoT and AI technologies, which enable real-time monitoring and enhance operational efficiency.

While the industry faces challenges such as high capital investment and maintenance costs, increasing efforts are being made toward developing energy-efficient and sustainable solutions. Strong market growth is particularly evident in North America and Europe, where vending machines have gained widespread adoption, fostering heightened competition and a promising long-term growth outlook for the sector.

To get more Insights: Request Free Sample Report

Key Highlights (2025)

Smart & IoT-Enabled Machines: Nearly 6.5 million connected vending machines globally in 2025, leveraging AI and IoT for real-time monitoring, predictive maintenance, and enhanced consumer engagement.

High-Traffic Opportunities: Airports (412M passengers in India, 2024–2025) and U.S. office hubs (18.5M roles, May 2025) offer strategic locations for 24/7 automated retail convenience.

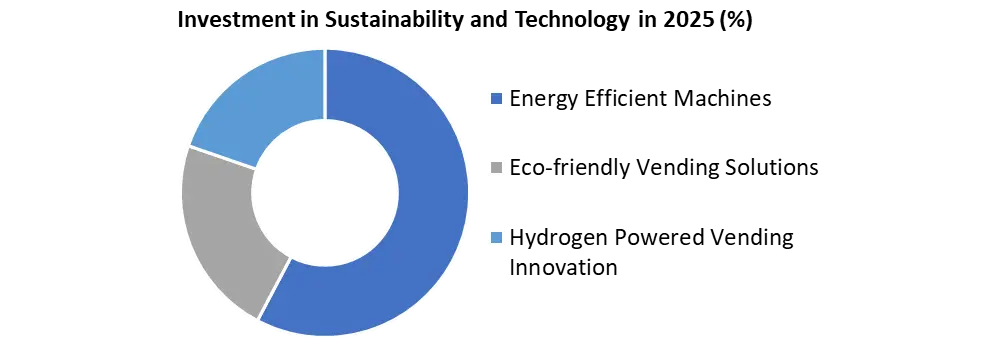

Sustainability Focus: Growth in energy-efficient and hydrogen-powered vending solutions supports eco-friendly, low-carbon operations.

Investment Considerations: High unit cost (USD 3,276–3,737) and maintenance (USD 333/year) pose challenges, offset by efficiency gains through smart vending and automation technologies.

Global Vending Machine Market Growth Driven by Smart, Cashless, 24/7 Retail

Global Vending Machine Market is evolving rapidly as smart and connected vending machines replace traditional units, supporting automated retail solutions with enhanced cashless and contactless payment capabilities. Demand for 24/7 convenience driving vending machine market growth is a core macro trend influencing placement strategy and product mix. Market expansion is intensified by urbanization, mobility patterns, and a consumer shift toward on?the?go convenience outside conventional retail hours.

Smart and Connected Vending Machines Accelerating Global Market Adoption

Installed Base: Nearly 6.5 million connected Vending Machines globally in 2025.

- Rest of World: Nearly 2.5M units

- North America: Nearly 2.3M units

- Europe: Nearly 1.8M units

Technology Enablers:

- IoT Enabled Vending Machines collect real?time data for inventory optimization and integrate with digital vending solutions.

- AI Powered Vending Machines enable predictive maintenance in smart vending machines and real?time vending machine performance monitoring.

Consumer Experience Enhancers:

- Cashless vending machines, interactive screens, and personalized offerings improve engagement and drive repeat usage.

Growth in High-Traffic Commercial Locations and Sustainable Shaping the Vending Machine Market

High Traffic Commercial Locations

- Airports: Nearly 412 million passengers handled in Indian airports in 2025, indicating robust usage potential for food and beverage vending machines.

- Transit Hubs & Workplaces: Nearly 18.5 million office & admin support roles in the U.S. in 2025 point to sustained footfall in office complexes and transit corridors.

- Strategic placements maximize transaction frequency and align with healthy and organic food vending machine demand where relevant.

Sustainability & Future Ready Deployment

- Increasing deployment of energy efficient vending machines and eco-friendly vending solutions.

- Emerging interest in hydrogen powered vending machine technology innovation highlights long term low carbon opportunities.

High Investment and Maintenance Costs Constraining Vending Machine Market Expansion

- High Initial and Maintenance Costs limit market participation:

- Typical refrigerated vending unit: Nearly USD 3,276-3,737 per machine

- Annual maintenance per machine: Nearly USD 333

- Additional expenditures include site setup, electrical/connectivity integration, and regulatory compliance for food and beverage safety.

Vending Machine Market Segmentation by Product Type and Smart Technology

By Product Type

- Beverages Vending Machines: Widely deployed for cold drinks and hot beverages.

- Food Vending Machines: Serve packaged snacks and fresh/ready?to?eat meals in high?traffic zones.

By Technology

- Semi Automatic Machines: Lower cost, partial automation; suited for small sites.

- Smart Machines: Full connectivity, real?time monitoring, inventory optimization, and enhanced consumer UX.

North America and Europe Leading the Global Vending Machine Market Adoption

North America Vending Machine Market

- High deployment density and advanced digital payments.

- Strong demand across corporate, transit, and institutional environments.

- Key growth drivers: contactless payment vending machines and connected vending machines adoption.

Europe Vending Machine Market

- Mature market with nearly 5 million vending machines serving diverse product categories.

- High urban density supports placement in transit stations, workplaces, and campuses.

- Rapid integration of cashless payments and digital transactions.

Smart, Sustainable, and 24/7 Strategies Driving Vending Machine Market Competitiveness

- Emphasis on smart vending machines with IoT and AI integration will differentiate operators in competitive environments.

- Expansion in high-traffic locations (airports, hospitals, offices) should be prioritized to capitalize on 24/7 convenience demand.

- Adoption of sustainable vending solutions and advanced automation technologies will reinforce market positioning and future proof operations.

Recent Developments

|

Company |

Year |

Recent Development |

|

EVOCA Group |

2025 |

New Netherlands sales & showroom launch; executive leadership changes; sustainability initiatives. EcoVadis Platinum rating achieved. |

|

Jofemar S.A. |

2023-2024 |

Record turnover nearly 0.070 USD Billion in 2023; Smart Energy division tripled nearly 0.021 USD Billion. Expansion of vending and automation solutions. |

|

Fuji Electric Co., Ltd. |

FY2024-FY2025 |

Increased R&D investments: nearly 0.29 USD Billion. renewable energy initiatives including 5.3?MW solar installations; expansion of vending product lines with energy-efficient machines. |

|

Cantaloupe, Inc. |

2025 |

Growthed self-service kiosks and cashless payment hardware; acquisition of Cheq Lifestyle Technology; focus on digital payment solutions and micro-market deployments. |

Global Vending Machine Market has witnessed notable developments among key players. EVOCA Group expanded its presence in the Netherlands with a new showroom launch in 2025 and enhanced sustainability practices, achieving an EcoVadis Platinum rating. Jofemar S.A. recorded a turnover of nearly USD 0.070 billion in 2023, with its Smart Energy division tripling to USD 0.021 billion, alongside broader expansion of vending and automation solutions. Fuji Electric Co., Ltd. increased R&D investments to USD 0.29 billion during FY2024-FY2025, integrating renewable energy initiatives like 5.3 MW solar installations and energy-efficient vending products. Cantaloupe, Inc. focused on digital payments, micro-market deployments, and strategic acquisitions including Cheq Lifestyle Technology in 2025.

Global Vending Machine Market Scope:

|

Global Vending Machine Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 49.08 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

8.1% |

Market Size in 2032: |

USD 84.66 Billion |

|

Global Vending Machine Market Segment Analysis |

By Type |

Beverages Vending Machine Tobacco Vending Machine Food Vending Machine Others |

|

|

By Technology |

Semi-Automatic Machine Smart Machine Automatic Machine |

||

|

By Application |

Hotels and Restaurants Corporate Offices Public Places Others |

||

Key Players -

- EVOCA Group

- Jofemar S.A.

- Fuji Electric Co., Ltd.

- Azkoyen Vending Systems

- Cantaloupe, Inc.

- Westomatic Vending Services Limited

- Royal Vendors, Inc.

- Glory Ltd

- Seaga Manufacturing Inc.

- Sellmat s.r.l.

- Wendor

- Crane Merchandising Systems Inc.

- Vending.com

- GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

- Bianchi Industry Spa

- Selecta Group B.V.

- SandenVendo America, Inc.

- N&W Global Vending S.p.A.

- FAS International S.p.A.

- Sielaff GmbH & Co. KG

- Deutsche Wurlitzer GmbH

- U-Select-It (USI)

Frequently Asked Questions

The Global Vending Machine Market was valued at USD 49.08 Billion in 2025 and is projected to reach USD 84.66 Billion by 2032, growing at a CAGR of 8.1%.

IoT-enabled connectivity, AI-powered predictive maintenance, cashless payments, and real-time monitoring are the key technologies driving smart vending machine adoption.

High-traffic commercial locations such as airports, transit hubs, offices, and hospitals provide strategic opportunities for 24/7 vending machine placement.

High initial unit costs (USD 3,276–3,737) and annual maintenance expenses (USD 333) limit market participation, despite efficiency gains from smart and automated vending solutions.

1. Vending Machine Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Vending Machine Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product

2.3.3. End-user

2.3.4. Revenue (2025)

2.3.5. Profit Margin

2.3.6. Revenue Growth

2.3.7. Geographical Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Vending Machine Market: Dynamics

3.1. Vending Machine Market Trends

3.2. Vending Machine Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

4. Operational and Environmental Impact Comparison

4.1. Energy consumption per vending machine vs. traditional retail outlets

4.2. Lifecycle environmental impact of smart vending machines vs. staffed retail stores

4.3. Carbon footprint reduction through automated retail solutions

4.4. Space utilization efficiency: vending machines vs. brick-and-mortar retail

5. Technology and Resource Utilization Comparison

5.1. Use of IoT-Enabled Vending Machines and AI-Powered Vending Machines vs. manual retail operations

5.2. Efficiency improvements through predictive maintenance and remote monitoring

5.3. Comparative operating cost per transaction: vending machines vs. traditional retail

5.4. Labor dependency reduction through automated and connected vending machines

6. Future-Ready Investment Outlook for Vending Machine Industry

6.1. Advanced Technology Investment Landscape

6.1.1. AI-driven vending machines for real-time monitoring

6.1.2. Machine learning for vending machine inventory optimization

6.1.3. Interactive touchscreen and personalized vending interfaces

6.2. Sustainability-Focused Investment Analysis

6.2.1. Sustainable Vending Machine Market growth outlook

6.2.2. Investment in energy-efficient and eco-friendly vending solutions

6.2.3. Emerging hydrogen-powered vending machine technology innovation

6.3. Long-Term Market Forecast and Capital Allocation

6.3.1. Vending Machine Market Growth outlook by region

6.3.2. Vending Machine Market Trends shaping investment decisions

6.3.3. Vending Machine Market Forecast scenarios under high smart vending adoption

6.4. Strategic Recommendations for Investors and Operators

6.4.1. Optimal deployment strategies in high-traffic commercial locations

6.4.2. Technology roadmap for scalable and connected vending networks

6.4.3. Risk-adjusted investment strategies for the Global Vending Machine Market

7. Vending Machine Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Vending Machine Market Size and Forecast, by Type (2025-2032)

7.1.1. Beverages Vending Machine

7.1.2. Tobacco Vending Machine

7.1.3. Food Vending Machine

7.1.4. Others

7.2. Vending Machine Market Size and Forecast, by Technology (2025-2032)

7.2.1. Semi-Automatic Machine

7.2.2. Smart Machine

7.2.3. Automatic Machine

7.3. Vending Machine Market Size and Forecast, by Application (2025-2032)

7.3.1. Hotels and Restaurants

7.3.2. Corporate Offices

7.3.3. Public Places

7.3.4. Others

7.4. Vending Machine Market Size and Forecast, by Region (2025-2032)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Vending Machine Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

8.1. North America Vending Machine Market Size and Forecast, by Type (2025-2032)

8.1.1. Beverages Vending Machine

8.1.2. Tobacco Vending Machine

8.1.3. Food Vending Machine

8.1.4. Others

8.2. North America Vending Machine Market Size and Forecast, by Technology (2025-2032)

8.2.1.1. Semi-Automatic Machine

8.2.1.2. Smart Machine

8.2.1.3. Automatic Machine

8.3. North America Vending Machine Market Size and Forecast, by Application (2025-2032)

8.3.1. Hotels and Restaurants

8.3.2. Corporate Offices

8.3.3. Public Places

8.3.4. Others

8.4. North America Vending Machine Market Size and Forecast, by Country (2025-2032)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. Europe Vending Machine Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. Europe Vending Machine Market Size and Forecast, by Type (2025-2032)

9.2. Europe Vending Machine Market Size and Forecast, by Technology (2025-2032)

9.3. Europe Vending Machine Market Size and Forecast, by Application (2025-2032)

9.4. Europe Vending Machine Market Size and Forecast, by Country (2025-2032)

9.4.1. United Kingdom

9.4.2. France

9.4.3. Germany

9.4.4. Italy

9.4.5. Spain

9.4.6. Sweden

9.4.7. Austria

9.4.8. Rest of Europe

10. Asia Pacific Vending Machine Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

10.1. Asia Pacific Vending Machine Market Size and Forecast, by Type (2025-2032)

10.2. Asia Pacific Vending Machine Market Size and Forecast, by Technology (2025-2032)

10.3. Asia Pacific Vending Machine Market Size and Forecast, by Application (2025-2032)

10.4. Asia Pacific Vending Machine Market Size and Forecast, by Country (2025-2032)

10.4.1. China

10.4.2. S Korea

10.4.3. Japan

10.4.4. India

10.4.5. Australia

10.4.6. Indonesia

10.4.7. Malaysia

10.4.8. Vietnam

10.4.9. Taiwan

10.4.10. Rest of Asia Pacific

11. Middle East and Africa Vending Machine Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

11.1. Middle East and Africa Vending Machine Market Size and Forecast, by Type (2025-2032)

11.2. Middle East and Africa Vending Machine Market Size and Forecast, by Technology (2025-2032)

11.3. Middle East and Africa Vending Machine Market Size and Forecast, by Application (2025-2032)

11.4. Middle East and Africa Vending Machine Market Size and Forecast, by Country (2025-2032)

11.4.1. South Africa

11.4.2. GCC

11.4.3. Egypt

11.4.4. Nigeria

11.4.5. Rest of ME&A

12. South America Vending Machine Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

12.1. South America Vending Machine Market Size and Forecast, by Type (2025-2032)

12.2. South America Vending Machine Market Size and Forecast, by Technology (2025-2032)

12.3. South America Vending Machine Market Size and Forecast, by Application (2025-2032)

12.4. South America Vending Machine Market Size and Forecast, by Country (2025-2032)

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Chile

12.4.4. Colombia

12.4.5. Rest Of South America

13. Company Profile: Key Players

13.1. EVOCA Group

13.1.1. Company Overview

13.1.2. Business Portfolio

13.1.3. Financial Overview

13.1.4. SWOT Analysis

13.1.5. Strategic Analysis

13.1.6. Recent Developments

13.2. Jofemar S.A.

13.3. Fuji Electric Co., Ltd.

13.4. Azkoyen Vending Systems

13.5. Cantaloupe, Inc.

13.6. Westomatic Vending Services Limited

13.7. Royal Vendors, Inc.

13.8. Glory Ltd

13.9. Seaga Manufacturing Inc.

13.10. Sellmat s.r.l.

13.11. Wendor

13.12. Crane Merchandising Systems Inc.

13.13. Vending.com

13.14. GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

13.15. Bianchi Industry Spa

13.16. Selecta Group B.V.

13.17. SandenVendo America, Inc.

13.18. N&W Global Vending S.p.A.

13.19. FAS International S.p.A.

13.20. Sielaff GmbH & Co. KG

13.21. Deutsche Wurlitzer GmbH

13.22. U?Select?It (USI)

13.23. Others

14. Key Findings

15. Industry Recommendations

16. Vending Machine Market: Research Methodology