Switzerland Banking Compliance Solutions Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

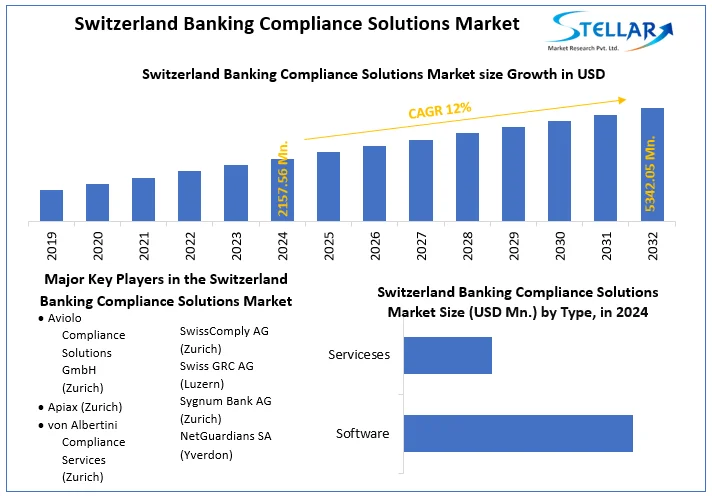

Switzerland Banking Compliance Solutions Market was valued at USD 2157.56 million in 2024. Switzerland Banking Compliance Solutions Market size is estimated to grow at a CAGR of 12% over the forecast period.

Format : PDF | Report ID : SMR_609

Switzerland Banking Compliance Solutions Market Overview:

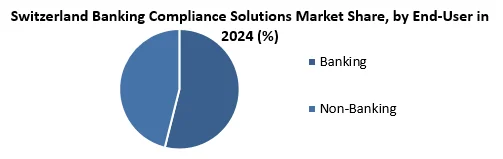

The Switzerland Banking Compliance Solutions Market analyzes and forecasts the market size, in terms of value, for the market. Further, the Switzerland Banking Compliance Solutions Market is segmented by Type, Size, and End-User. Based on Size, the market is segmented into Small, Medium, and Large. Based on Type, the Switzerland Banking Compliance Solutions Market is segmented into Service and Software. Further, the Software segment is sub-segmented into Audit Management, Compliance Management, Risk management, Policy Management, Incident Management, Enterprise Legal Management, and others. The Services segment is sub-segmented into Compliance Management service, Governance and Risk Management, Services and Data Privacy Services. Based on End Users, the Switzerland Banking Compliance Solutions Market is segmented into Banking and Non-Banking. Further, for each segment, the market sizing and forecasts have been done based on value (in USD Million).

Switzerland Banking Compliance Solutions Market Dynamics:

A compliance Solution is a set of controls and processes that allows organization to operate by contractual, statutory, and regulatory requirements regarding the use of computing and internet technologies. The banking sector requires strong and effective compliance management solutions for maintaining the pace of changing laws, regulations, standards, and internal policies. Compliance solutions are a must for the Banking industry. Banks have adopted cloud-based a governance infrastructure, as these have provided various benefits like low cost, the minimum technological infrastructure required, fast data processing, automatic and continuous up-gradation, and remote access to the cloud-based data across organizations.

To get more Insights: Request Free Sample Report

Cloud-based governance infrastructure helps the banking industry to deploy policies quickly across applications and systems. Various features are associated with the Banking compliance solutions, such as compliance and risk reporting for all the levels, automated audit tracking of all the compliance changes, and a regulatory library with links to the online sources. With the increasing number of unfair practices, the demand for the Banking Compliance Solution is also increasing.

Switzerland is considered the grandfather of the bank secrecy. But these secrecy laws have been violated by four people since 1934: Christoph Meili (1997), Bradley Birkenfeld (2007), Rudolf Elmer (2011), and Herve Falciani (2014). There is a total of 243 banking institutions present in Switzerland. Out of which there are 24 Cantonal Banks, 4 Major Banks, 59 Regional and Savings Bank, 1 Raiffeisen bank, 24 branches of foreign banks, 5 private banks, and 17 other banks. The Internet of Things and Cloud Computing have enhanced the growth of Banking Compliance Solutions for data security for the banks of Switzerland.

After using the Cloud-based compliance solutions also, the banks are facing defects in their system such as Enforcement of audit and access rights, Data storage in Switzerland, reporting cyber-attacks, Insufficient protection of CID, and insufficient liability. These are the issues related to the Banking Compliance Solution Market. However, the integration of rules and policies with the software product modules are some challenges faced by the banking compliance solution providers. The improvement is required for the growth of this market during the forecast period.

Switzerland Banking Compliance Solutions Market Segment Analysis:

By End-users, the Banking segment has dominated the market share by accounting for 71% in 2024, and it is expected to grow with a CAGR of 11.9% during the forecast period as Switzerland consists of a greater number of banking sectors, i.e., 243, which includes 24 Cantonal Banks, 4 Major Banks, 59 Regional and Savings Bank, 1 Raiffeisen bank, 24 branches of foreign banks, 5 private banks, and 17 other banks.

By Size, the medium size is dominating the market by accounting for 60% of the market share and is expected to grow with a CAGR of 14.1% during the forecast period. As there are only two large banks, that are UBS and Credit Suisse. After these two, the maximum banks are medium-sized. Hence, the medium-sized banks are dominating.

Switzerland Banking Compliance Solutions Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in Switzerland, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Switzerland Banking Compliance Solutions market to the stakeholders in the industry. The report provides trends that are most dominant in the Switzerland Banking Compliance Solutions market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Switzerland Banking Compliance Solutions Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Switzerland Banking Compliance Solutions market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key industry players and their recent developments in the Switzerland Banking Compliance Solutions market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Switzerland Banking Compliance Solutions market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Switzerland Banking Compliance Solutions market. The report also analyses if the Switzerland Banking Compliance Solutions market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Switzerland Banking Compliance Solutions market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Switzerland Banking Compliance Solutions market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Switzerland Banking Compliance Solutions market is aided by legal factors.

Switzerland Banking Compliance Solutions Market Scope:

|

Switzerland Banking Compliance Solutions Market |

|

|

Market Size in 2024 |

USD 2157.56 Mn. |

|

Market Size in 2032 |

USD 5342.05 Mn. |

|

CAGR (2025-2032) |

12% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Size

|

|

|

|

By End-User

|

Switzerland Banking Compliance Solutions MARKET KEY PLAYERS:

- Aviolo Compliance Solutions GmbH (Zurich)

- Apiax (Zurich)

- von Albertini Compliance Services (Zurich)

- SwissComply AG (Zurich)

- Swiss GRC AG (Luzern)

- Sygnum Bank AG (Zurich)

- NetGuardians SA (Yverdon)

Frequently Asked Questions

The market size of the Switzerland Banking Compliance Solutions Market by 2032 is expected to reach USD 5342.05 Million.

The forecast period for the Switzerland Banking Compliance Solutions Market is 2025-2032

The market size of the Switzerland Banking Compliance Solutions Market in 2024 was valued at USD 2157.56 Million.

- Scope of the Report

- Research Methodology

- Research Process

- Switzerland Banking Compliance Solutions Market: Target Audience

- Switzerland Banking Compliance Solutions Market: Primary Research (As per Client Requirement)

- Switzerland Banking Compliance Solutions Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Country in 2024(%)

- Switzerland

- Stellar Competition matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Extension Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Country in 2024(%)

- Switzerland Banking Compliance Solutions Market Segmentation

- Switzerland Banking Compliance Solutions Market, by Type (2024-2032)

- Software

- Services

- Switzerland Banking Compliance Solutions Market, by Size (2024-2032)

- Small

- Medium

- Large

- Switzerland Banking Compliance Solutions Market, by End-User (2024-2032)

- Banking

- Non-Banking

- Switzerland Banking Compliance Solutions Market, by Type (2024-2032)

- Company Profiles

- Key Players

- Aviolo Compliance Solutions GmbH

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Apiax

- von Albertini Compliance Services

- SwissComply AG

- Swiss GRC AG

- Concept Compliance LBA-AML

- von Albertini Compliance Services

- Sygnum Bank AG

- NetGuardians SA

- Aviolo Compliance Solutions GmbH

- Key Players

- Key Findings

- Recommendations