Europe 5G technology Market- Industry Analysis and Forecast (2025-2032)

Europe 5G technology Market size was valued at USD 37.83 Bn. in 2024 and the total Europe 5G technology Market revenue is expected to grow at a CAGR of 45.7 % from 2025 to 2032, reaching nearly USD 768.43 Bn.

Format : PDF | Report ID : SMR_1796

Europe 5G Technology Market Overview

Fifth-generation wireless (5G) is the latest iteration of cellular technology. 5G was engineered to greatly increase the speed and bandwidth of wireless networks while also reducing latency when compared to previous wireless standards. Its increased speed, lower latency, and improved reliability stand to revolutionize a wide variety of industries.

The Report includes the Market dynamics such as market drivers, opportunities, restraints, and challenges that influenced market growth in Europe for 5G technology. It also includes the growth factors of adoption of 5G technology like the ease of use, perceived usefulness, attitude, anxiety, privacy risk, subjective criteria, speed, ubiquity, perceived service price, individual innovation, social impact, technical service price, environmental awareness, knowledge, openness, etc. are included in the report.

The major barrier to the 5G technology that is security and Privacy and its impact is examined in the report. The report consists of broad research on various Leading players strategies like collaboration, partnership, mergers, and acquisition which are adopted by the companies. The report analyzed the overall company’s market position with a SWOT analysis to identify strengths, weaknesses, opportunities, and threats.

- EU investment is expected to boost networks and Internet architectures in emerging areas such as machine-to-machine (M2M) communication and the Internet of Things (IoT).

- A lack of action on the 5G rollout risks Europe being left behind in 5G technology Market.

To get more Insights: Request Free Sample Report

Europe 5G Technology Market Dynamics

Driving Factors behind Europe's 5G Market Growth

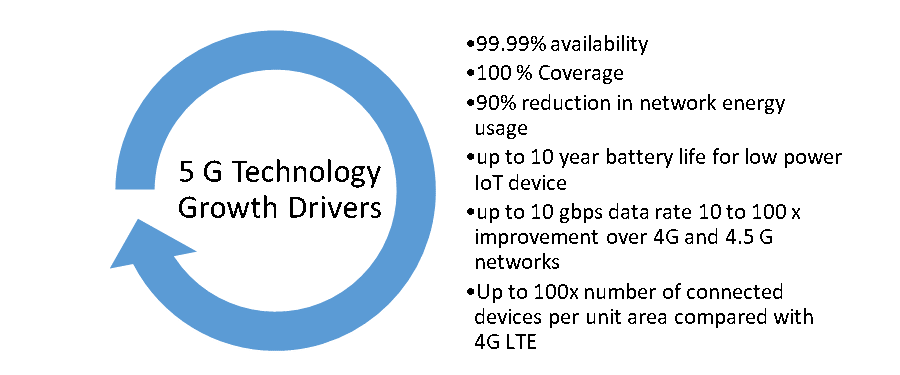

The wireless data transmission scheme for 5G, known as the adaptive modulation and coding scheme (MCS), is superior to that of 4G and 3G. The end effect is a very low Block Error Rate (BER), which is a measure of how frequently errors occur in a network that has driven the market growth in Europe. The Surge in the demand for 5G technology has been propelled owing to 5G networks utilizing a much broader range of bandwidths than previous networks. By increasing the spectrum of resources it has utilized from sub-3 GHz to 100 GHz and even higher, 5G’s range has included both lower and higher frequencies.

The improved speed efficiency has been a major factor that has influenced the market growth in Europe. For instance, 5G’s low latency (the amount of time it takes data to travel from one point to another on a network) enables the speeds that make activities like downloading a file or interacting with the cloud 10x faster than on a 4G or 3G network. As 5G technology reaches more and more customers and the number of applications that support it continues to grow, its popularity with telecommunications companies and Internet Service Providers (ISPs) is also expected to increase.

The European Commission had taken an initiative--European Innovative Partnership on Smart Cities and Communities (EIP- SCC) to connect the cities, healthcare sector, industries, banks, small businesses, and others. 5G is expected to revolutionize the healthcare industry in Europe by easing the mode of communication and operation between patients and doctors, saving up efforts and costs for patients.

Addressing Cyber security Risks and Investment Needs in Europe's 5G Market

The susceptibility of 5G networks to cyber-attacks, both from known and unidentified sources, has been a focal concern. Even with 5G's more sophisticated algorithms than its predecessors, users are still susceptible to cyber-attacks. One thing to be wary of is encryption. Although 5G networks offer encrypted apps, the 5G NR standard lacks end-to-end encryption, making it vulnerable to specific types of attacks.

Europe requires robust telecom companies with the financial capacity to invest in fiber, 5G standalone, and, eventually, 6G. Modernizing the telecom regulatory framework will require longer licenses, unified regulations among Member States, and a new approach to merger controls and spectrum allocation. The current financial situation of the EU electronic communications sector raises concerns about its capacity to find funding for the substantial investments that are needed to catch up with the technological shift as a result it has hindered the market growth. Due to a lack of innovation capacity, the majority of 5G’s critical technology in Europe is coming from companies outside the region.

Europe 5G Technology Market Segment Analysis

Based on the Component, the Services segment held the majority share in the market and is expected to rise with an increasing CAGR of 46.85 % through the forecast period. 5G connectivity is catalyzing GDP growth and is a powerful tool to help combat climate change. The mobile ecosystem is expected to focus on improving 5G coverage in rural areas and increasing investment to support the growing adoption of use cases enabled by 5G standalone (SA) and 5G-Advanced technologies. 5G connectivity and services are set to generate economic benefits of Euro 153 billion in 2032.

5G wireless technology is meant to deliver higher multi-Gbps peak data speeds, ultra-low latency, more reliability, massive network capacity, increased availability, and a more uniform user experience to more users. 5 G-enabled solutions across several industries like manufacturing, healthcare, and smart cities have boosted the market growth. 5G has been able to usher in an era where efficiency and profitability have been achieved by automobile companies by creating innovations in the processes. The key to developing autonomous vehicles is artificial intelligence, but its biggest enablers are communication and connectivity as a result 5G plays a vital role in the services.

- For instance, Thanks to 5G’s secure and real-time connectivity, the manufacturing of automobiles also gets a fillip. Ericsson recently tied up with Telefonica Germany for 5G car production through a private 5G network for Mercedes Benz.

Europe 5G Technology Market Regional Analysis

Germany dominated the market with the highest market share and is expected to grow through the forecast period. In Germany, network operators expect a significant increase in demand for 5G because 69 % of German smartphone users consider it essential that their next smartphone is 5G compatible. Germany’s largest operators have been focusing on the development of their 5G networks, with some operators already offering coverage to more than 80% of the country’s population. Germany has been one of the pioneers in the development and rollout of Private 5G networks and one of the first to offer Private 5G frequency operating licenses to enterprises.

- Germany leads the way in Europe in terms of 5G subscribers (22.6 million), followed by the United Kingdom (14.6 million).

United Kingdom is expected to witness significant growth through the forecast period and rise with a growing CAGR. The increase in demand for the smartphone has surged the market growth in the country. Private 5G is a more cost-efficient option for enterprises and large businesses. Companies build their own private 5G networks, scale end-points, and avoid the massive cost-per-device access associated with public 5G. The widespread adoption of 5G technology in the United Kingdom is facing significant obstacles, primarily owing to the limited coverage of the network and the unavailability of affordable 5G handsets.

- In 2023, Vodafone announced a standalone 5G rollout in the UK for Samsung S22 and Samsung S23 in parts of London, Manchester, Glasgow, and Cardiff.

- The UK government alone has invested nearly Euro 200m in 5G coverage.

Europe 5G Technology Market Competitive Landscape

- In February 2024, Swisscom entered into binding agreements with Vodafone Group Plc about the acquisition of 100% of Vodafone Italia for EUR 8 billion on a debt and cash-free basis to merge it with Fastweb, Swisscom's subsidiary in Italy. Mobile customers have benefited from improved connectivity and best-in-class service quality, thanks to a fully controlled and end-to-end managed wireless network. The focus on the Swiss market remains unchanged with continued high investments in innovation, top-quality service, and next-generation infrastructure

- In February 2024, BT Group’s Digital Unit announced that its modernization program to simplify and enhance BT Group’s technology architecture has achieved TM Forum’s prized ‘Running on ODA’ status. BT Group’s recognition, alongside nine other Communications Service Providers (CSPs) globally who have met the rigorous evaluation criteria, validates their success in leveraging the Open Digital Architecture (ODA) framework and building an efficient and sophisticated technology estate.

- In April 2024, Ericsson to build a next-generation smart manufacturing and technology hub in Europe. A new next-generation smart manufacturing and technology hub in Europe is estimated to serve as a collaborative space for co-developing new cellular ecosystems and production techniques. Merging all facilities in Tallinn, Estonia into one site is expected to reduce environmental impact and support Ericsson’s Net Zero journey via sustainable operations that cut carbon emissions. The 50,000-square-meter European hub is expected to be operational in early 2026

|

|

Europe 5G Technology Market Scope |

|

Market Size in 2024 |

USD 37.83 Bn. |

|

Market Size in 2032 |

USD 768.43 Bn. |

|

CAGR (2025-2032) |

45.7 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Component

|

|

By Technology

|

|

|

By Spectrum

|

|

|

By Application

|

|

|

Country Scope |

|

Europe 5G technology Market Key Players

- Telenor

- Telecom Italia

- Swisscom

- BT Group

- Orange

- Telefonica

- Vadafone

- Deutsche Telekom

- Nokia

- Ericsson

Country Breakdown:

Germany 5G Technology Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

Cyber security are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 37.83 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 45.7 % from 2025 to 2032, reaching nearly USD 768.43 Billion.

The segments covered in the market report are By Component, technology, Application and spectrum.

1. Europe 5G Technology Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe 5G Technology Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Europe 5G Technology Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Europe 5G Technology Market: Dynamics

4.1. Europe 5G Technology Market Trends

4.2. Europe 5G Technology Market Drivers

4.3. Europe 5G Technology Market Restraints

4.4. Europe 5G Technology Market Opportunities

4.5. Europe 5G Technology Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Europe 5G Technology Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Europe 5G Technology Market Size and Forecast, by Component (2024-2032)

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Europe 5G Technology Market Size and Forecast, by Technology (2024-2032)

5.2.1. Enhanced Mobile Broadband [eMBB]

5.2.2. Ultra-Reliable Low Latency Communication [URLLC]

5.2.3. Massive Machine Type Communication [mMTC]

5.3. Europe 5G Technology Market Size and Forecast, by Spectrum (2024-2032)

5.3.1. 5G NR Sub-6GHz

5.3.2. 5G NR mmWave

5.4. Europe 5G Technology Market Size and Forecast, by Application (2024-2032)

5.4.1. Consumer

5.4.2. Enterprises

5.5. Europe 5G Technology Market Size and Forecast, by Country (2024-2032)

5.5.1. Germany

5.5.2. United Kingdom

5.5.3. Spain

5.5.4. France

5.5.5. Italy

5.5.6. Belgium

5.5.7. Sweden

5.5.8. Poland

5.5.9. Russia

6. Company Profile: Key Players

6.1. Telenor

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Telecom Italia

6.3. Swisscom

6.4. BT Group

6.5. Orange

6.6. Telefonica

6.7. Vadafone

6.8. Deutsche Telekom

6.9. Nokia

6.10. Ericsson

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook