France Esports Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

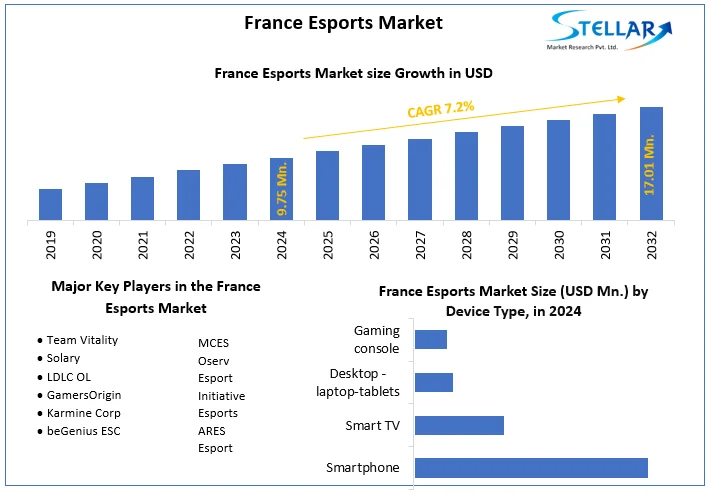

The France Esports Market size was valued at USD 9.75 Mn. in 2024 and the total France Esports Size is expected to grow at a CAGR of 7.20 % from 2025 to 2032, reaching nearly USD 17.01 Mn. in 2032.

Format : PDF | Report ID : SMR_1708

France Esports Market Overview

E-Sports, a short form of Electronic Sports, essentially refers to all the sports played through digital platforms or in the form of video games. Digital simulation of real-life situations would also fall within the purview of E-Sports. It is quite different from all conventional sports because these games are played virtually between the players who might be in different parts of the world. These games do not require physical meetings of the players nor much of a physical effort; the players’ effort is more on the mental side.

The Report has covered current market trends influencing market growth and future prospects are presented in the report under France Esports Market. The report includes both qualitative and quantitative research with a focus on interpreting data, identifying patterns and gaining actionable insights from the France Esports market. The analysis of key players strategies include in the France Esports Market has been covered in the report.

France has a thriving esports community with well-structured leagues and tournaments featuring popular games such as League of Legends, FIFA, and Counter-Strike. France’s government has recognized the potential of esports and invested in developing a national strategy to cater specifically to the burgeoning market. The initiative paves the way for future investment opportunities while encouraging growth within France's Esports Market.

- In January 2023, the French government revealed plans for a National Esports Strategy, which would include support for esports visas for players and talent, grassroots esports support, and a better-structured esports ecosystem.

- In January 2024, the French government updated the VAT tax rate from 20% to 5.5% for esports event ticket sales.

- Roughly 55% of French individuals aged 16 to 65 know about the term esports, with around 35% accurately characterizing the term.

To get more Insights: Request Free Sample Report

France Esports Market Dynamics

France Emerges as a Key Player in the Esports Market

The growing emphasis on fan engagement is likely to fuel demand for live sports events. France stands out among these markets when it comes to audience monetization. Around 24% of French consumers have already purchased esports-related items, putting France ahead of France (around 13%) and catching up with Spain (around 26%), Poland (around 26%), and Italy (around 25%), which are Europe's esports powerhouses in terms of consumer awareness and penetration. The legal and regulatory framework surrounding esports is well–established in France resulting in a boost in the market growth.

Numerous factors influencing the market growth in France, such as increased video game awareness and the popularity of Esports, are driving the country's growth in the Esports market. Surged in the Education of Esports Market has propelled the market Growth. For Instance, In 2023 tournament organizer ArmaTeam, the Versaille education authority Académie de Versailles, and the Institute of Sports-Health Sciences of Paris won an award for innovation in school for their ‘Educ Esports’ project. The five-year project, which received a €2m (~£1.72m) grant, explores various opportunities for leveraging esports in an educational capacity.

Navigating Regulatory Hurdles and Monetization Challenges in France Esports Market

France Esports faces Challenges such as Regulation and legal framework, talent development, monetization, etc. Lack of Rules and regulations in France Esports impacted the market growth in the country owing to issues such as player contracts, taxation, and visa regulations for international players. Lack of investment in talent development programs, and coaching academies in France for Epsorts has hindered the market growth. Monetization remains a significant challenge in the Esports market, while there are multiple revenue streams like sponsorships, tournament winnings, and merchandise, the market has yet to find a sustainable and scalable model for revenue generation. The Challenge lies in converting the massive viewership and fan engagement into a stable income in the French esports Market.

France Esports Market Segment Analysis

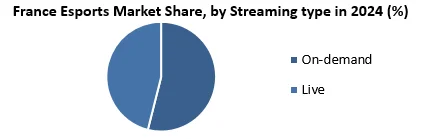

Based on Streaming type, the Live Streaming segment held the highest number of shares and is expected to grow during the forecast period. Live Streaming has become the driving force of the market growth in 2024. The user-friendly interfaces and interactive features of these platforms have turned gaming into a communal experience, blurring the lines between players and viewers. The rising number of esports enthusiasts, especially among the younger demographic, is fueling the demand for live streams.

Additionally, the increased accessibility to high-speed internet and the proliferation of smartphones have made it easier for viewers to watch live gaming events on the go. The esports industry has witnessed significant investment and support from major companies, leading to higher production values for live streams. In Live Streaming, sponsorship is expected to grow rapidly, followed by advertising during the forecast period.

|

|

France Esports Market Scope |

|

Market Size in 2024 |

USD 9.75 Mn. |

|

Market Size in 2032 |

USD 17.01 Mn. |

|

CAGR (2025-2032) |

7.20 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Game genre

|

|

By Revenue Model

|

|

|

By Streaming type

|

|

|

By Device Type

|

France Esports Market Key Players

- Team Vitality

- Solary

- LDLC OL

- GamersOrigin

- Karmine Corp

- beGenius ESC

- MCES

- Oserv Esport

- Initiative Esports

- ARES Esport

Frequently Asked Questions

Regulatory hurdles are expected to be the major restraining factors for the France Esports market growth.

The France Esports Market size was valued at USD 9.75 Million in 2024 and the total France Esports revenue is expected to grow at a CAGR of 7.20 % from 2025 to 2032, reaching nearly USD 17.01 Million By 2032.

1. France Esports Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. France Esports Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. France Esports Market: Dynamics

3.1.1. Market Drivers

3.1.2. Market Restraints

3.1.3. Market Opportunities

3.1.4. Market Challenges

3.2. PORTER’s Five Forces Analysis

3.3. PESTLE Analysis

3.4. Regulatory Landscape

3.5. Analysis of Government Schemes and Initiatives for the European Esports Industry

4. France Esports Market Size and Forecast by Segments (by Value USD)

4.1. France Esports Market Size and Forecast, by Game Genre (2024-2032)

4.1.1. FPS

4.1.2. MOBA

4.1.3. RTS

4.1.4. Sport simulation

4.2. France Esports Market Size and Forecast, by Revenue Model (2024-2032)

4.2.1. Sponsorship

4.2.2. Media Rights

4.2.3. Advertising

4.2.4. Publisher Fees

4.2.5. Merchandise & Tickets

4.3. France Esports Market Size and Forecast, by Streaming Type (2024-2032)

4.3.1. On-demand

4.3.2. Live

4.4. France Esports Market Size and Forecast, by Device Type (2024-2032)

4.4.1. Smartphone

4.4.2. Smart TV

4.4.3. Desktop -laptop-tablets

4.4.4. Gaming console

5. France Esports Market: Competitive Landscape

5.1. STELLAR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Service Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Leading France Esports Market Companies, by market capitalization

5.5. Market Structure

5.5.1. Market Leaders

5.5.2. Market Followers

5.5.3. Emerging Players

5.6. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Team Vitality

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Scale of Operation (small, medium, and large)

6.1.7. Details on Partnership

6.1.8. Regulatory Accreditations and Certifications Received by Them

6.1.9. Awards Received by the Firm

6.1.10. Recent Developments

6.2. Solary

6.3. LDLC OL

6.4. GamersOrigin

6.5. Karmine Corp

6.6. beGenius ESC

6.7. MCES

6.8. Oserv Esport

6.9. Initiative Esports

6.10. ARES Esport

7. Key Findings

8. Industry Recommendations