Sports Medicine Market - Industry Analysis and Forecast (2025-2032) Trends, Drivers, Statistics, Dynamics, Segmentation by of End User Segment, Application and Product type

Global Sports Medicine Market size was valued at USD 6.21 Bn. in 2024 and is expected to reach USD 9.75 Bn. by 2032, at a CAGR of 5.8%.

Format : PDF | Report ID : SMR_1594

Sports Medicine Market Overview

Sports medicine is a subspecialty of healthcare that addresses injuries sustained during physical exercise and sports, including prevention, diagnosis, treatment, and rehabilitation. It merges exercise science with medical expertise to maximize athletes' performance while avoiding and treating injuries. Sports medicine physicians are specially trained to assist wounded patients in returning to their pre-injury state as quickly as possible. They are specialists in keeping physically active individuals healthy and injury-free, which includes kids and teenagers playing sports, adults working out for personal fitness, and people with physically demanding occupations. Doctors in sports medicine have received specific training to aid patients in their recovery from injuries and to avert further issues. To offer complete care to athletes of all levels, they collaborate with a group of medical specialists that includes licensed sports trainers, nutritionists, and physical therapists.

Healthcare professionals that specialize in sports medicine treat a wide range of injuries, such as fractures, eating disorders, concussions, knee and shoulder injuries, and tendonitis, asthma brought on by exercise, heat illness, and cartilage damage. Following the treatment of an injury, they assist patients in avoiding further issues and optimizing their performance through healthy diet. The COVID-19 pandemic has had an impact on the sports medicine industry, which has led to financial hardships for people and healthcare systems and reduced access to non-essential medical care. Nevertheless, a steady recovery of the business is expected, with telemedicine adoption and home-based exercise being prioritized.

The Global Sports Medicine Market is prominently dominated by North American Region because of the growing millennial obsession with fitness and exercise and the resulting need for sports medicine. The growing need for new healthcare facilities is predicted to drive the greatest growth in the Asia Pacific market. The growth of the Sports Medicine market is also attributed to several trends such as rising popularity of sports and physical activity, increasing awareness regarding the prevention and treatment of sports injuries, growing investments in sports medicine, and shift from proactive care to preventive care concerning sports injuries. Similarly, many key driving factors such as consistent innovation of new products, the increasing adoption of arthroscopy devices in minimally invasive surgeries, the growing usage of fracture and ligament repair devices are fuelling the rise of the Sports Medicine Market. The Sports Medicine Market is segregated on the basis of End User Segment, Application and Product type.

To get more Insights: Request Free Sample Report

Sports Medicine Market Dynamics

Trends attributing to the expansion of Sports Medicine Market,

Rising popularity of sports and physical activity is catering to establish an ideal environment for the rise of the Sports Medicine Market globally. With having over 53.12% of American children aged 6 to 17 were actively involved in sports and an alarming annual record of almost 3.5 million injuries among individuals aged 14 and under in the United States which ultimately helped the Sports medicine market. Also due to the increase of media coverage and awareness campaigns, the understanding regarding sports injuries has gained immense importance for seeking proper medical care. For treatment and preventive care, athletes and those who engage in physical activity are more likely to see sports medicine specialists for their treatments.

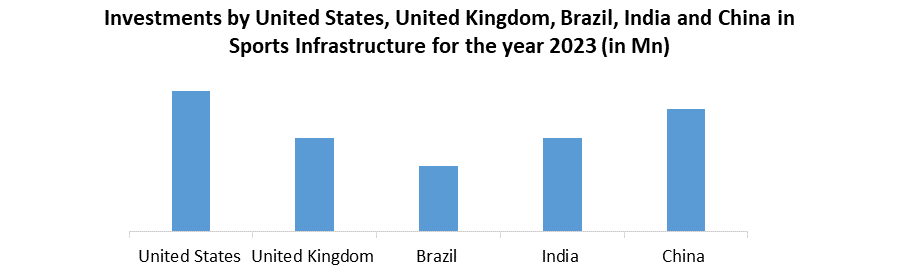

Growing Investments in Sports Medicine, as the sports injuries have spurred and the participation in sports and fitness activities is on the rise many key players are increasing their investments in order to gain dominant position in the market. For instance, in August 2021 Bioventus, US based company, invested in Trice Medical. As the part of the investment the Company receive exclusive sales and distribution rights to Trice’s products outside of the US. Governments and other concerned entities are investing heavily to improve their sporting facilities, which only accelerate the expansion of the sports medicine industry. , the Champion Hudson Power Expresss power line in New York, a $2.2 billion project and the New Fortress Energy Louisiana LNG terminal in Grand Isle, worth 1.2$ billion by US government proves the Rising Market Sports Medicine Market.

Key Driving Factors of the Sports Medicine Market

Consistent innovation of new products, due to ongoing advancements in Medical Technology which created advanced surgical methods, imaging devices, and diagnostic tools, helped the Sports Medicine specialists to identify and treat injuries with greater accuracy and efficiency thanks to research developments. Technologies such as Body Reconstruction & Repair, Body Support and Recovery Products were the most widely used technologies in the year 2024. Also with the introduction of specialized sports medicine education programs which includes programs like kinesiology, anatomy, physiology, nutrition, and biology, enables students to gained specialized knowledge about the human body and its response to physical conditions which helps the Sports Medicine Market reach a larger audience driving its way towards a mass expansion.

The increasing adoption of arthroscopy devices in minimally invasive surgeries has proven to be most imperative driving factor for the Sports Medicine Market. As it was the most widely used technology in the year 2024. Orthopaedics has been transformed by the minimally invasive surgical procedure, Arthroscopy, making it possible for doctors to diagnose and treat a wide range of joint-related disorders with amazing accuracy. The rise in the usage of fracture and ligament operation devices and the growing adoption of arthroscopy devices in minimally invasive surgeries have impacted significantly to the Sports Medicine Market towards its continuous expansion.

The Arthroscopy devices market size globally was valued at USD 11 billion in 2024 and was projected to grow at 6.5% CAGR. Conmed Corporation, Henke Sass Wolf GmbH, Medtronic plc, Smith & Nephew plc, Richard Wolf GmbH, Arthrex, Inc., Karl storz GmbH & Co. KG, Stryker Corporation, Johnson & Johnson, Zimmer Biomet Holdings, Inc. are some of the key players who are currently dominating in the Arthroscopy technique.

Focus on home-based fitness and telemedicine, has proved to be another key driving factor for the Sports Medicine Market due to the rise in the adoption of Telemedicine and increasing focus on home-based fitness becoming the trend in the Sports Medicine Market. The Covid19 pandemic has contributed severely for the rising adoption of Telemedicine and focus on home-based fitness. The epidemic has also resulted in new developments in the sports medicine industry, such as the increasing use of telemedicine and an emphasis on at-home exercise. Lockdowns' increased focus on physical health fuelled demand for products like wearable fitness trackers and at-home gym equipment that encourage wellbeing.

The trend toward telemedicine and home-based fitness has made it feasible to offer remote monitoring, consultations, and rehabilitation guidance—a benefit that especially helpful in the case of a pandemic. Patients and athletes have easy access to professional advice and follow-up care, which ensures continuous support without requiring in-person visits.

Restraints faced By the Sports Medicine Market

High cost of orthopaedic implants and other devices, affect the Sports Medicine Market due to several factors- Healthcare Budgets, this occur because Expensive orthopaedic implants put a strain on healthcare finances, making it more difficult for hospitals and other healthcare facilities to make investments in cutting-edge sports medical technology. Consequently, there is fewer cutting-edge therapies for sports-related injuries available. Limiting access to Specialized Care- Access to specialized sports medical care restricted due to the expensive expense of orthopaedic implants, especially for those without full insurance coverage. This result in unequal access to healthcare, which limit the effectiveness and reach of Sports Medicine Market as a whole.

Geographic Disparities, There is an unequal distribution of sports medicine doctors and facilities due to geographic differences. Specialized sports medicine services be easier to access in urban places, whereas access is limited or non-existent in rural or isolated areas. This disparity make it more difficult for people in some places to get timely, specialist care for injuries sustained during sports. Also, when there are no local sports medical facilities or specialists available, emergency situations like on-field injuries during sporting events, cannot receive the attention they need right at that time. Lower levels of public knowledge and education regarding the value of preventative care, injury treatment, and the advantages of sports medicine also be observed in areas with restricted access to sports medical services. This ignorance is a factor in delayed or insufficient healthcare seeking.

Market Segmentation of Sports Medicine Market

By Application, the sports medicine market, majorly refers to the application which includes Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries, Back and Spine Injuries, Hip and Groin Injuries. Knee injuries is a significant segment within the sports medicine industry. The knee injuries segment held the largest share of the sports medicine market in 2024 and is expected to continue during the forecast period, knee injuries are reported a market share of about 39% of all sports injuries, and approximately 36% of all injuries in sports are related to knee injuries. Also, the significance of shoulder injuries is evident, particularly in the treatment and management of rotator cuff injuries.

In sports such as baseball, handball, tennis, and volleyball frequently experience acute incidents of trauma, leading to shoulder injuries, including rotator cuff contusions, tears, and tendinopathies. The global rotator cuff injury treatment market was estimated to be worth USD 989.3 million in 2023 and is expected to reach USD 1244.2 million during the forecast period.

By Product Type, The market is divided into a number of product categories, including as prosthetic, arthroscopy equipment, implants, orthobiologics, and other uses. When it comes to treating musculoskeletal problems, implants are essential since they provide options like joint replacements and stabilization devices that aid in the healing process. With the use of arthroscopy instruments, surgeons can see, diagnose, and treat joint-related problems with less invasiveness and quicker recovery times during minimally intrusive surgeries. Enhancing mobility and tissue regeneration, prosthetics and orthobiologics provide sportsmen recovering from injuries with cutting-edge options.

Improvements in surgical instruments and the general rise in minimally invasive procedures have an impact on the global arthroscopy business, with, the prosthetics market is impacted by both the rise in limb impairments and technology developments. Also, as medical technology has advanced, orthobiologics which include biologics for orthopaedic applications and regenerative therapies have grown.

By End-user, the segment of the global sports medicine market refers to the various categories of end-users which primarily includes Hospitals, Orthopaedic Clinics, Ambulatory Surgical Centres (ASCs), Rehabilitation Centres. It is imperative for the sports medicine market to comprehend the varied requirements of different end customers, as this facilitates the customization of products and services to certain healthcare environments. Among these hospitals holds the largest market share with over 50%, making it the most dominant player in the group. With the rise and popularity of different kinds of sports in the masses the Orthopaedic clinics have also surged, proving to be the most trusted emerging player in this segment. Orthopaedic Clinics concentrate on musculoskeletal health.

They usually offer specialist care for ailments connected to sports injuries. Ambulatory Surgical Centres (ASCs) are crucial endpoints for sports medicine interventions who don't have lengthy hospital stays because they offer outpatient surgical procedures. United Surgical Partners International (USPI), Dignity Health, St. Joseph's Outpatient Surgery Center are some of the prominent players globally which specializes in the Ambulatory Surgical Centres (ASCs).

Competitive Landscape for Sports Medicine Market

The competitive landscape of the Sports Medicine Market is characterized by several key players including Arthrex, Smith & Nephew plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Medtronic plc, Conmed Corporation, Mueller Sports Medicine, Inc. To improve their market position, these businesses are concentrating on ongoing R&D, innovative product development, and international expansion. The market is seeing a rise in demand for eco-friendly and sustainably produced goods, and technical developments are fuelling the sports medicine industry's expansion.

Breg, Inc. a leading orthopaedic bracing and billing Services Company, partnered with Correal International to offer orthopaedic products to physicians and patients in China. Agili-C creator CartiHeal was recently bought by Smith & Nephew in an effort to increase the variety of sports medicine products it offers. This action is a component of the business's investment in cutting-edge sports medical technologies.

The industry is not only seeing strategic investments from the already established players in the Sports Medicine Market but also from UHNIs who sees a greater potential in the Sports Medicine Market for instance, Dee and Jimmy Haslam American businesswoman and the owner of the Cleveland Browns, a professional football team in the National Football League (NFL), donated $20 million to establish the Haslam Sports Innovation Centre at the University Hospitals. This centre aims to identify, support, and invest in the best innovations in sports medicine to reduce injury risk, promote healing, and improve performance for athletes.

|

Sports Medicine Market Scope |

|

|

Market Size in 2024 |

USD 6.21 Bn. |

|

Market Size in 2032 |

USD 9.75 Bn. |

|

CAGR (2025-2032) |

5.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Application

|

|

By Product Type

|

|

|

By Industry Vertical

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Sports Medicine Market

- Smith and Nephew

- Stryker Corporation

- Zimmer Biomet

- Arthrex GmbH

- Enovis

- Mueller Sports Inc.

- Breg Inc

- BioTek

- RTI Surgical

- Cramer Products

- GE Healthcare

- KARL STORZ

- Johnson and Johnson Services Inc.

Frequently Asked Questions

The Sports Medicine Market is expected to grow at a CAGR of 5.8% during forecasting period 2025-2032.

Sports Medicine Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The important key players in the Sports Medicine Market are – Smith and nephew, Stryker Corporation, Zimmer Bionet, Arthrex GmbH, Enovis, Mueller Sports Inc, Breg Inc., RTI Surgical.

The Global Market is studied from 2024 to 2032.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Sports Medicine Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Sports Medicine Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Total Production (2024)

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2023)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Sports Medicine Market: Dynamics

4.1. Sports Medicine Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Sports Medicine Market Drivers

4.3. Sports Medicine Market Restraints

4.4. Sports Medicine Market Opportunities

4.5. Sports Medicine Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Global Sports Medicine Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Global Sports Medicine Market Size and Forecast, by Application (2024-2032)

5.1.1. Knee Injuries

5.1.2. Foot and Ankle Injuries

5.1.3. Back and Spine Injuries

5.1.4. Hip and Groin Injuries

5.1.5. Shoulder Injuries

5.2. Global Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

5.2.1. Prosthetic

5.2.2. Arthroscopy Equipment

5.2.3. Implants

5.2.4. Orthobiologics

5.2.5. Others

5.3. Global Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

5.3.1. Hospitals

5.3.2. Orthopedic Clinics

5.3.3. Ambulatory Surgical Centers

5.3.4. Rehabilitation Centers

5.4. Global Sports Medicine Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Sports Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Sports Medicine Market Size and Forecast, by Application (2024-2032)

6.1.1. Knee Injuries

6.1.2. Foot and Ankle Injuries

6.1.3. Back and Spine Injuries

6.1.4. Hip and Groin Injuries

6.1.5. Shoulder Injuries

6.2. North America Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

6.2.1. Prosthetic

6.2.2. Arthroscopy Equipment

6.2.3. Implants

6.2.4. Orthobiologics

6.2.5. Others

6.3. North America Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

6.3.1. Hospitals

6.3.2. Orthopedic Clinics

6.3.3. Ambulatory Surgical Centers

6.3.4. Rehabilitation Centers

6.4. North America Sports Medicine Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Sports Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Sports Medicine Market Size and Forecast, by Application (2024-2032)

7.2. Europe Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

7.3. Europe Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

7.4. Europe Sports Medicine Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Sports Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Sports Medicine Market Size and Forecast, by Application (2024-2032)

8.2. Asia Pacific Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

8.3. Asia Pacific Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

8.4. Asia Pacific Sports Medicine Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Sports Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Sports Medicine Market Size and Forecast, by Application (2024-2032)

9.2. Middle East and Africa Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

9.3. Middle East and Africa Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

9.4. Middle East and Africa Sports Medicine Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Sports Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Sports Medicine Market Size and Forecast, by Application (2024-2032)

10.2. South America Sports Medicine Market Size and Forecast, by Product Type (2024-2032)

10.3. South America Sports Medicine Market Size and Forecast, by Industry Vertical (2024-2032)

10.4. South America Sports Medicine Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Smith and Nephew

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Stryker Corporation

11.3. Zimmer Biomet

11.4. Arthrex GmbH

11.5. Enovis

11.6. Mueller Sports Inc.

11.7. Breg Inc

11.8. BioTek

11.9. RTI Surgical

11.10. Cramer Products

11.11. GE Healthcare

11.12. KARL STORZ

11.13. Johnson and Johnson Services Inc.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook