Spinning Machinery Market Global Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segmentation by Product Type, Installation and Region

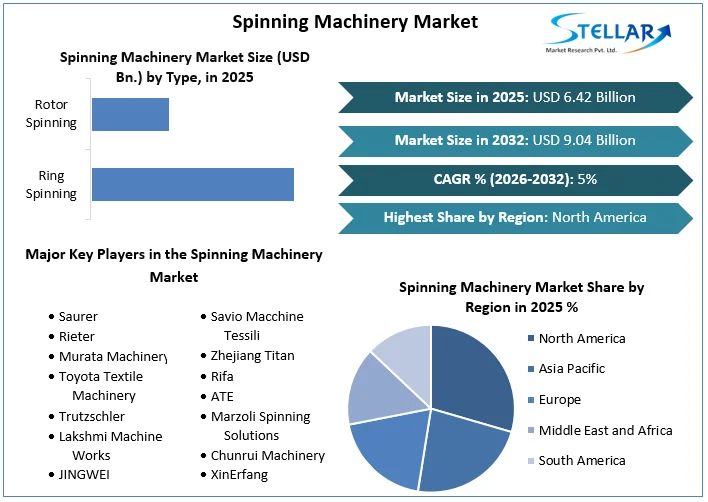

Spinning Machinery Market was valued at nearly US$ 6.42 Bn. in 2025 and market size is estimated to grow at a CAGR of 5% and is expected to reach US$ 9.04 Bn. by 2032.

Format : PDF | Report ID : SMR_201

Spinning Machinery Market Overview:

Spinning Machinery Market has fueled demand from textile fibers (natural, synthetic or blended), where it is used to produce yarn. These machines were developed during the Industrial Revolution to mass-produce cotton textile products. Currently, the spinning equipment setup entails significant financial investment and significant infrastructure, as it entails the installation of a line of machinery to perform a series of functions from the fiber stage to the yarn stage. Bale opening, conditioning of man-made fibers, mixing, carding, drawing, speed frame, ring frame, and cone winding all are spinning steps.

Cotton yarn manufacturing is concentrated in China, India, the U.S, Pakistan, Indonesia, Brazil, Turkey, South Korea, Italy, Egypt, & Japan. As a result, the leading spinning machinery vendors concentrate on these markets. The increased contribution of the fashion industry to the total GDP is a macro level driver driving the spinning machinery market. Another element boosting the technical textiles business worldwide is the demand for high-end performance from industrial yarns, including automotive textiles and geotextiles. The fact that there are so few new players in the yarn manufacturing market is a major challenge. The increase of plant capacity or the replacement of obsolete machinery results in sales revenue that accounts on an annual basis.

As a result, purchasers of spinning machinery have more negotiating leverage. However, the yarn business nevertheless demands mass manufacturing of many types of yarns, & as a result, spinning gear makers are constantly working on new developments to better serve consumers with higher productivity. The shift toward automation for each spinning machinery line is one of the most noticeable trends in the spinning machinery market. Furthermore, yarn manufacturers all over the world choose Spanish-based products for spinning machines. In addition, the textile ministry is working to establish more textiles parks in nations like India and China, where raw materials are plentiful and manpower is inexpensive.

To get more Insights: Request Free Sample Report

COVID-19 Impact on Spinning Machinery Market

COVID-19 raged & ravaged for two years, and the disease is still spreading, although the textile machines business in India, which was suffering from a lack capacity utilisation at 49 %, lost only 3% of its capacity use at 46 %. The total provisional production of textile machinery, parts, & accessories in 2020-21 decreased by 5% to Rs.5,093 crore, down from Rs.5,355 crore the previous year. Exports in 2020-21 increased from Rs. 3,307 crore, up from Rs. 2,556 crore in 2019-20.

Imports were reduced from Rs. 9,273 crore to Rs. 8096 crore, which really is positive news for the domestic industry. All of these indications show that the textile machinery business is doing well, with spinning machinery and parts doing particularly well in both nationally & abroad. Despite the COVID-19 crisis, the global market for Spinning Machines is expected to increase at a CAGR of 5.5 percent from 2020 to 2030, from an estimated At US$ 5 Bn in 2020 to a projected US$ 7.3 Bn by 2030.

In the U. S., the demand for spinning machines is expected to reach US$ 1.4 Bn by 2020. China spinning machinery market is expected to reach a market size of US$ 1.5 Bn by 2030, representing an annual growth rate of 8.4 percent from 2020 to 2030. Japan & Canada are two other noteworthy geographic markets, with projected growth rates of 3% and 5%, respectively, from 2020 to 2030. Germany is expected to expand at a CAGR of around 3.5 % in Europe.

The U.S, Canada, Japan, China, & Europe are expected to fuel the spinning machinery market's other Types segment with a 4.4% CAGR. By the end of the analysis period, these regional markets, which had a combined market value of US$ 745.2 Mn in 2020, will have grown to a predicted size of US$ 1 Bn. China will continue to be one of the fastest-growing markets in this group of regional regions. The Asia-Pacific market is expected to reach US$ 976 Mn by 2030, led by countries like Australia, India, & South Korea, while Latin America will grow at a 5.9 % CAGR during the same period.

Cotton yarn production is centered in China, India, the United States, Pakistan, Indonesia, Brazil, Turkey, South Korea, Italy, Egypt, and Japan. As a result, the leading spinning machinery vendors concentrate on these markets. The increased contribution of the fashion industry to the overall GDP is a macro-level driver driving the spinning machinery market. Another reason to boost the technical textiles industry worldwide is the demand for high-end performance from industrial yarns, such as automotive textiles and geotextiles.

There are so few new players in the yarn manufacturing market is a major challenge. The increase of plant capacity or the replacement of old machinery results in sales revenue that accounts on an annual basis. As a result, buyers of spinning machinery have had more negotiating leverage. However, the yarn business still demands mass manufacturing of any kind of yarns, and as a result, spinning gear makers are constantly working on new developments to better serve consumers with higher productivity. The shift towards automation for each spinning machinery line is a key trend in the spinning machinery market.

Furthermore, yarn manufacturers worldwide choose Spanish-based products for spinning machines. In addition, the textile ministry is working to establish more textile parks in countries like India and China, which have a plentiful supply of raw materials and low labour costs. Spinning machinery is used to make yarn out of textile fibres that are either natural, synthetic, or mixed. These machines were created during the Industrial Revolution to mass-produce cotton textile products. Currently, the spinning equipment setup entails a significant financial investment and significant infrastructure, as it entails the installation of lines of machines to perform a series of operations from the fiber stage to the yarn stage. Bale cutting, conditioning of man-made fibers, mixing, carding, drawing, speed frame, ring frame, and cone winding are all spinning steps. Spinning technology businesses continue to innovate despite the difficult business climate generated by the pandemic in 2020 and 2021. As textile manufacturers explore innovative ways to divert textile waste in landfills, the spinning sector is focusing on sustainability and circularity principles. The need to employ recycled fiber in yarns is growing, and technology to manage such fiber in a cost-effective manner while producing a high-quality product for downstream processing must be enhanced or created.

The rise of the spinning sector is being shaped by two independent factors: automation and spinning of recycled fibers, both of which are readily available today. Automation is expected to grow rapidly, especially in Western countries where labour costs and availability are limited. China's salaries have begun to climb on the east coast, igniting a desire for automation. Following this trend, several spinning machinery suppliers are reinvesting in automation, owing to the high demand and spinning machinery market for their items. Despite a drop in overall textile machinery sales, technological companies' interest in and investing in infrastructure developments has not waned. To fulfill its clients' diverse needs, Toyota Industries, for example, has created a wider spectrum of spinning machines, including high-speed ring spinning frames and roving frames. It is developing initiatives to combine the quest of excellent spinning performance to generate high-quality yarn with lower energy consumption in our product development. From April to September 2021, Toyota's net sales in the Textile Equipment Segment totaled 30.3 billion yen, a rise of 12.5 Bn yen, or 70%, owing principally to increased sales of yarn quality measuring instruments.

Italy's Marzoli is now the market leader in spinning machine supply. Europe's only comprehensive machinery line manufacturer offers cutting-edge plant, electronic control, and management systems for managing spinning processes at optimal yield. Marzoli was able to interpret the paradigms of Industry 4.0 and develop YarNet and MRM for its customers, two platforms for the informed and optimized management of the entire spinning process, thanks to synergies with the Group's digital expertise and the latest technology adopted — Cloud Computing, Smart sensors, Industrial Ethernet, Machine Learning, and so on. Marzoli is the ideal partner for achievement in the spinning world because of this added value.

Market to the stakeholders in the industry. The report provides most dominant trends in the Spinning Machinery Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Spinning Machinery Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Spinning Machinery Market report is to help understand which market segments regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key industry players and their recent developments in the global market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the global market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Spinning Machinery Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if a few players, etc dominate the market.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Spinning Machinery Market is aided by legal factors.

Spinning Machinery Market Scope:

|

Spinning Machinery Market |

|

|

Market Size in 2025 |

USD 6.42 Bn. |

|

Market Size in 2032 |

USD 9.04 Bn. |

|

CAGR (2026-2032) |

5% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By Material

|

|

|

By End-Use

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Major Players operating in the Global Spinning Machinery Market are:

- Saurer

- Rieter

- Murata Machinery

- Toyota Textile Machinery

- Trutzschler

- Lakshmi Machine Works

- JINGWEI

- Savio Macchine Tessili

- Zhejiang Titan

- Rifa

- ATE

- Marzoli Spinning Solutions

- Chunrui Machinery

- XinErfang

Frequently Asked Questions

The Global Spinning Machinery Market is growing at a CAGR of 5% during forecasting period 2026-2032.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Spinning Machinery Market: Target Audience

2.3. Global Spinning Machinery Market: Primary Research (As per Client Requirement)

2.4. Global Spinning Machinery Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2025-2032(In %)

4.1.1.1. North America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.2. Europe Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.3. Asia Pacific Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.4. South America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.5. Middle East and Africa Market Share Analysis, By Value, 2025-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.3.1.1. Global Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.3.1.1.1.Ring Spinning

4.3.1.1.2.Rotor Spinning

4.3.1.2. Global Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.3.1.2.1.Natural

4.3.1.2.2.Synthetic

4.3.1.2.3.Others

4.3.1.3. Global Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.3.1.3.1.Clothing

4.3.1.3.2.Textile

4.3.1.3.3.Other Industry

4.4. North America Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.4.1.1. North America Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.4.1.1.1.Ring Spinning

4.4.1.1.2.Rotor Spinning

4.4.1.2. North America Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.4.1.2.1.Natural

4.4.1.2.2.Synthetic

4.4.1.2.3.Others

4.4.1.3. North America Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.4.1.3.1.Clothing

4.4.1.3.2.Textile

4.4.1.3.3.Other Industry

4.4.1.4. North America Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.4.1.4.1.US

4.4.1.4.2.Canada

4.4.1.4.3.Mexico

4.5. Europe Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.5.1.1. Europe Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.5.1.2. Europe Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.5.1.3. Europe Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.5.1.4. Europe Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.5.1.4.1.UK

4.5.1.4.2.France

4.5.1.4.3.Germany

4.5.1.4.4.Italy

4.5.1.4.5.Spain

4.5.1.4.6.Sweden

4.5.1.4.7.Austria

4.5.1.4.8.Rest Of Europe

4.6. Asia Pacific Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.6.1.1. Asia Pacific Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.6.1.2. Asia Pacific Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.6.1.3. Asia Pacific Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.6.1.4. Asia Pacific Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.6.1.4.1.China

4.6.1.4.2.India

4.6.1.4.3.Japan

4.6.1.4.4.South Korea

4.6.1.4.5.Australia

4.6.1.4.6.ASEAN

4.6.1.4.7.Rest Of APAC

4.7. South America Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.7.1.1. South America Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.7.1.2. South America Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.7.1.3. South America Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.7.1.4. South America Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.7.1.4.1.Brazil

4.7.1.4.2.Argentina

4.7.1.4.3.Rest Of South America

4.8. Middle East and Africa Spinning Machinery Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.8.1.1. Middle East and Africa Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.8.1.2. Middle East and Africa Market Share Analysis, By Material, 2025-2032 (Value US$ BN)

4.8.1.3. Middle East and Africa Market Share Analysis, By End-Use Industry, 2025-2032 (Value US$ BN)

4.8.1.4. Middle East and Africa Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.8.1.4.1.South Africa

4.8.1.4.2.GCC

4.8.1.4.3.Egypt

4.8.1.4.4.Nigeria

4.8.1.4.5.Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.1. Global Competition Matrix

5.1.2. North America Competition Matrix

5.1.3. Europe Competition Matrix

5.1.4. Asia Pacific Competition Matrix

5.1.5. South America Competition Matrix

5.1.6. Middle East and Africa Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in End-Use Industry

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. Saurer.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2.Rieter

6.1.3.Murata Machinery

6.1.4.Toyota Textile Machinery

6.1.5.Trutzschler

6.1.6.Lakshmi Machine Works

6.1.7.JINGWEI

6.1.8.Savio Macchine Tessili

6.1.9.Zhejiang Taitan

6.1.10.Rifa

6.1.11.ATE

6.1.12.Marzoli Spinning Solutions

6.1.13.Chunrui Machinery

6.1.14.XinErfang

6.2. Key Findings

6.3. Recommendations