Sensitive Skin Care Products Market - Global Industry Analysis and Forecast (2025-2032)

The Sensitive Skin Care Products Market size was valued at USD 146.94 Billion in 2024 and the total Global Sensitive Skin Care Products revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 282.21 Billion by 2032.

Format : PDF | Report ID : SMR_1727

Sensitive Skin Care Products Market Overview

The sensitive skin care market is experiencing several factors such as heightened consumer awareness of skin sensitivities, shifting lifestyles with urbanization, and rising demand for natural, organic ingredients due to concerns over chemical additives. The report covers the profit margins of key players across regions and segments of the sensitive skin care products market, critical for assessing financial health and competitiveness. Trends shape the sensitive skin care market, with a focus on eco-friendly, sustainable, natural, and innovative products to address diverse skin concerns. The report provides a comprehensive Analysis of revenue and sales figures, evaluating growth trajectories, market size, and growth opportunities across regions and product segments. Investment opportunities abound in the growing sensitive skin care market. As the sector continues its significant growth trajectory, investors explore avenues such as product development, marketing, and distribution channel growth. Technological innovation presents a lucrative option, with potential returns from investing in research and development of personalized formulations and technologies for sensitive skin. Also, strategic investments in branding, focusing on product efficacy, safety, and natural ingredients, offer companies a chance to stand out in the competitive market landscape. These investment opportunities promise substantial potential for growth and differentiation in the dynamic sensitive skin care market.

- In 2022, France led beauty product exports with $10.8 billion, followed by South Korea ($7.09B), the United States ($6.02B), Japan ($4.57B), and Germany ($4.13B). Conversely, China emerged as the top importer, spending $11.1 billion, with the United States ($5.77B), Hong Kong ($3.78B), Germany ($2.85B), and Singapore ($2.58B) following suit. The data underlines France's dominance in exports and China's significant role in imports, reflecting global trade patterns in the Skincare industry.

Global Market Scope: Inquiry Before Buying

Sensitive Skin Care Products Market Dynamics

Growing Urbanization and Pollution

Urbanization and escalating pollution levels exacerbate skin sensitivity and dermatological concerns, particularly impacting residents of urban areas. The heightened exposure to environmental pollutants and irritants increases the susceptibility of urban dwellers to skin irritations and allergies, creating a greater demand for mild skincare remedies. Moreover, the pervasive stress prevalent in urban settings compromises skin resilience, compounded by adverse weather conditions and potential exposure to irritants in densely populated environments. Consequently, city inhabitants confront elevated risks of developing sensitive skin conditions like eczema and dermatitis, stimulating the need for specialized skincare solutions tailored to urban lifestyles.

The heightened awareness of the correlation between urban lifestyles and sensitive skin is driving consumer demand for tailored skincare solutions. Individuals actively pursue fragrance-free products designed for sensitive skin, driving the market growth. Opportunities abound for innovation, including the development of anti-pollution skincare lines featuring ingredients that shield against pollutants. Additionally, there's a focus on products aimed at calming and soothing skin, reducing irritation, and supporting the skin barrier. Targeted marketing strategies are key, with campaigns specifically targeting urban consumers, focusing on the advantages of sensitive skincare solutions personalized to their needs.

- Personal care and sensitive skin care beauty products rank as the second most purchased category on US social media in 2021, indicating a significant shift to online buying. To stay competitive, companies must align with evolving consumer habits by enhancing their online presence. It includes developing user-friendly websites to streamline the consumer journey. Particularly, Gen Z emerges as the most influenced generation by social media, with 63% making purchases based on platform content. It underscores the importance for Skin care companies to capitalize on social media influence to drive sales and engage with their target audience effectively.

- In 2022, the US cosmetics market experienced rapid growth at 21.9%, contrasting with Europe's 1.8% increase. However, their growth rates are converging, with both regions projected to achieve 3.8% growth in 2030. The global luxury skincare market is forecasted to reach $31.56 billion by 2027. Significantly, the US predominantly derives revenue from non-luxury cosmetics, accounting for 70%, whereas Europe has a more balanced split, with 54% of revenue coming from non-luxury products. These trends indicate evolving market dynamics and consumer preferences in both regions.

Environmental Sustainability

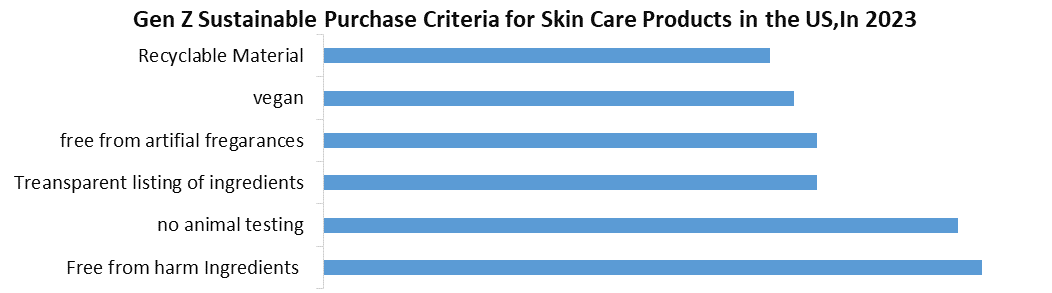

The Sensitive Skin Care Products market faces a dual challenge such as meeting consumer demand for eco-friendly solutions while ensuring efficacy and safety. Urban consumers increasingly prioritize sustainability, prompting a need for sustainable skincare options for sensitive skin. Traditional preservatives, though effective, are expected to irritate sensitive skin, necessitating gentler alternatives. Also, transitioning from plastic packaging raises logistical concerns, requiring innovative, sustainable alternatives that uphold product quality and hygiene standards. Achieving this delicate balance is crucial for industry players navigating the evolving demands of eco-conscious consumers.

- The revenue growth of natural skin care products globally has surged, averaging a remarkable 6.94% growth rate. Starting from a negative growth of -2.90% in 2015, this sector has experienced consistent expansion and is projected to continue flourishing in the foreseeable future. Significantly, the growth rate of natural and organic personal care products between 2018 and 2030 is even more rapid in North America at 9.12% compared to the global average of 8.32%.

- In the US, women displayed a strong inclination towards purchasing all-natural products for skin care (57%) and hair care (51%) in 2016. Conversely, the sustainable personal care market share among UK Millennials is expected to decline by 2% by 2025. Additionally, in the US, 50% of Gen Z consumers expressed unwillingness to purchase skincare products from brands not certified as cruelty-free, underscoring the growing importance of ethical considerations among younger demographics.

Sensitive Skin Care Products Market Segment Analysis

By Products, Face care products dominate the largest share of the sensitive skin care products market, representing a significant portion of total revenue, with reports indicating a revenue of over $8.9 billion in 2024 alone. The dominance is attributed to heightened consumer demand for facial care solutions, driven by growing awareness of sensitive skin conditions and the need for specialized products. Face care claims higher profit margins, owing to the utilization of premium ingredients and targeted benefits tailored to address specific skincare concerns. However, this segment also witnesses intense competition among leading players and brands vying for market share. The competitive landscape necessitates continuous innovation and differentiation strategies to maintain a competitive edge and capitalize on evolving consumer preferences. Face care products play an essential role in driving overall market growth, driven by consumer demand for effective and specialized skincare solutions, leading to both lucrative opportunities and fierce competition within the segment.

Sensitive Skin Care Products Market Regional Analysis

The North American Sensitive Skin Care Products market shows robust growth prospects and is expected to reach a CAGR of XX% in 2024. The demand is driven by heightened consumer awareness of sensitive skin issues and a preference for gentle, fragrance-free formulations. Recent developments include ingredient innovations such as probiotics and ceramides, aiming to strengthen the skin barrier. Dermatologist-endorsed brands are gaining popularity, addressing consumer demand for expert-recommended solutions. Additionally, the Direct-to-Consumer (D2C) model is flourishing, enabling brands to offer personalized recommendations and cater to niche segments within the sensitive skincare market.

In the United States, companies operating in the sensitive skincare sector encounter significant cost considerations across various aspects of their business operations. Expenses related to research and development, marketing, and distribution be substantial, impacting overall service costs. Nevertheless, premium brands with distinctive formulations and strong brand recognition often enjoy favorable profit margins. Additionally, sourcing sustainable and ethically produced raw materials is expected to result in higher expenses, thereby contributing to production costs. While the regulatory framework overseen by the Food and Drug Administration (FDA) ensures product safety and labeling accuracy, the absence of specific regulations for "sensitive skin" products permits some marketing flexibility within the broader safety and labeling guidelines applicable in North America.

Sensitive Skin Care Products Market Competitive Landscape

New product launches have a profound impact on the sensitive skincare market. Innovation plays a pivotal role in driving growth, as novel ingredients and formulations attract new customers and spark market excitement. Brands are increasingly focusing on addressing specific sensitive skin concerns such as eczema, rosacea, and dryness, catering to diverse consumer needs. Additionally, competition intensifies with new entrants and niche brands offering competitive pricing, while established players depend on brand recognition to maintain their market presence and differentiate themselves in the increasingly crowded market landscape.

- Johnson & Johnson and Sequential Skin, a US-based testing company, partnered in March of 2023. To assist it expand its growing database of skin samples, this collaboration would be centered on the step-by-step development of the newest techniques for non-invasive genetic skin testing.

- Sep-2022: To expand its skin health business, L'Oréal teamed up with Verily, an Alphabet precision health company. Through this partnership, L'Oréal's beauty tech initiatives will be merged with Verily's potent solutions for dermatologists and consumers, hence facilitating L'Oréal's product creation. Additionally, the alliance would broaden L'Oréal's market penetration in the North American beauty industry.

|

Sensitive Skin Care Products Market Scope |

|

|

Market Size in 2024 |

USD 146.94 Bn. |

|

Market Size in 2032 |

USD 282.21 Bn. |

|

CAGR (2025-2032) |

8.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Products Face Care Body Care Lip Care |

|

By Distribution Channel Supermarkets & Hypermarkets Specialty Stores Pharmacy & Drugstores Online Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Sensitive Skin Care Products Market

- L'Oréal S.A.

- Unilever PLC

- The Estée Lauder Companies Inc.

- maxingvest AG (Beiersdorf AG)

- Amorepacific Corporation

- Pevonia International Inc

- Johnson & Johnson Services Inc.

- Kao Corporation

- Sebapharma GmbH & Co. KG

- Sunday Riley

- Mario Badescu

- The Honest Company, Inc.

- e.l.f. Beauty, Inc. (NYSE:ELF)

- Revlon

- Mary Kay Inc.

- Coty Inc.

- Bath & Body Works, Inc.

- LVMH Moët Hennessy Louis Vuitton.

- Unilever

- Kao Brands

Frequently Asked Questions

Sensitive skin care products help manage common skin conditions such as eczema, rosacea, and dermatitis by providing gentle cleansing, hydration, and soothing ingredients. However, it's essential to consult a dermatologist for personalized treatment recommendations.

Yes, sensitive skin care products typically be used in conjunction with other skincare products, such as cleansers, moisturizers, and serums. However, it's essential to patch-test new products and introduce them gradually into your skincare routine to avoid potential irritation or adverse reactions.

The Market size was valued at USD 146.94 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 8.5 % from 2025 to 2032, reaching nearly USD 282.21 Billion.

The segments covered in the market report are by Products and Distribution Channels.

1. Sensitive Skin Care Products Market: Research Methodology

2. Sensitive Skin Care Products Market: Executive Summary

3. Sensitive Skin Care Products Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Sensitive Skin Care Products Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Sensitive Skin Care Products Market Size and Forecast by Segments (by Value Units)

6.1. Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

6.1.1. Face Care

6.1.2. Body Care

6.1.3. Lip Care

6.2. Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

6.2.1. Supermarkets & Hypermarkets

6.2.2. Specialty Stores

6.2.3. Pharmacy & Drugstores

6.2.4. Online

6.2.5. Others

6.3. Sensitive Skin Care Products Market Size and Forecast, by Region (2024-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Sensitive Skin Care Products Market Size and Forecast (by Value Units)

7.1. North America Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

7.1.1. Face Care

7.1.2. Body Care

7.1.3. Lip Care

7.2. North America Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

7.2.1. Supermarkets & Hypermarkets

7.2.2. Specialty Stores

7.2.3. Pharmacy & Drugstores

7.2.4. Online

7.2.5. Others

7.3. North America Sensitive Skin Care Products Market Size and Forecast, by Country (2024-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Sensitive Skin Care Products Market Size and Forecast (by Value Units)

8.1. Europe Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

8.1.1. Face Care

8.1.2. Body Care

8.1.3. Lip Care

8.2. Europe Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

8.2.1. Supermarkets & Hypermarkets

8.2.2. Specialty Stores

8.2.3. Pharmacy & Drugstores

8.2.4. Online

8.2.5. Others

8.3. Europe Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

8.3.1. Supermarkets & Hypermarkets

8.3.2. Specialty Stores

8.3.3. Pharmacy & Drug Stores

8.3.4. Online

8.4. Europe Sensitive Skin Care Products Market Size and Forecast, by Country (2024-2032)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Sensitive Skin Care Products Market Size and Forecast (by Value Units)

9.1. Asia Pacific Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

9.1.1. Face Care

9.1.2. Body Care

9.1.3. Lip Care

9.2. Asia Pacific Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

9.2.1. Supermarkets & Hypermarkets

9.2.2. Specialty Stores

9.2.3. Pharmacy & Drugstores

9.2.4. Online

9.2.5. Others

9.3. Asia Pacific Sensitive Skin Care Products Market Size and Forecast, by Country (2024-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Sensitive Skin Care Products Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

10.1.1. Face Care

10.1.2. Body Care

10.1.3. Lip Care

10.2. Middle East and Africa Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

10.2.1. Supermarkets & Hypermarkets

10.2.2. Specialty Stores

10.2.3. Pharmacy & Drugstores

10.2.4. Online

10.2.5. Others

10.3. Middle East and Africa Sensitive Skin Care Products Market Size and Forecast, by Country (2024-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

11.1. South America Sensitive Skin Care Products Market Size and Forecast, by Products (2024-2032)

11.1.1. Face Care

11.1.2. Body Care

11.1.3. Lip Care

11.2. South America Sensitive Skin Care Products Market Size and Forecast, by Distribution Channel (2024-2032)

11.2.1. Supermarkets & Hypermarkets

11.2.2. Specialty Stores

11.2.3. Pharmacy & Drugstores

11.2.4. Online

11.2.5. Others

11.3. South America Sensitive Skin Care Products Market Size and Forecast, by Country (2024-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. L'Oréal S.A.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Unilever PLC

12.3. The Estée Lauder Companies Inc.

12.4. maxingvest AG (Beiersdorf AG)

12.5. Amorepacific Corporation

12.6. Pevonia International Inc

12.7. Johnson & Johnson Services Inc.

12.8. Kao Corporation

12.9. Sebapharma GmbH & Co. KG

12.10. Sunday Riley

12.11. Mario Badescu

12.12. The Honest Company, Inc.

12.13. e.l.f. Beauty, Inc. (NYSE:ELF)

12.14. Revlon

12.15. Mary Kay Inc.

12.16. Coty Inc.

12.17. Bath & Body Works, Inc.

12.18. LVMH Moët Hennessy Louis Vuitton.

12.19. Unilever

12.20. Kao Brands

13. Key Findings

14. Industry Recommendation