Second Hand Apparel Market Global Industry Analysis and Forecast (2026-2032)

Second Hand Apparel Market size was valued at USD 67.40 Billion in 2025 and the total Second Hand Apparel Market size is expected to grow at a CAGR of 12.59% from 2026 to 2032, reaching nearly USD 154.59 Billion by 2032.

Format : PDF | Report ID : SMR_1885

Second Hand Apparel Market Overview

Second-hand apparel refers to clothing, accessories, and shoes that have been previously owned and worn by someone else before being sold or given to another person. These items come from different places like thrift stores, consignment shops, online platforms, yard sales, or personal exchanges. Second-hand apparel includes a diverse array of products, ranging from vintage and retro garments to modern fashion pieces, and vary in condition from gently worn to well-loved. The practice of buying and selling second-hand apparel supports sustainability by prolonging the life cycle of clothing, reducing waste, and lessening the environmental impact of fashion consumption.

The Report analyzes the current trends and factors influencing the market growth as well as the current market scenario that has been accelerating the second hand apparel market. For instance, the proliferation of online marketplaces and social commerce platforms has facilitated the seamless buying and selling of second-hand clothing, significantly broadening the market's global reach. The convergence of factors underscores the increasingly pivotal role of second-hand apparel in the fashion industry's landscape, reflecting a shift towards sustainability and conscious consumption. The Second Hand Apparel Market report presents a comprehensive analysis of industry-leading players' strategies, along with an in-depth examination of market segments and regional dynamics.

- India imports most of its Old used clothing from the United States, South Korea, and Canada and is the largest importer of Old used clothing in the World.

- The top 3 importers of Old used clothing are India with 19,214 shipments followed by Pakistan with 3,053 and Bangladesh with 1,745 shipments.

- 52% of consumers shopped second hand apparel in 2023.

- 60% of consumers say shopping second hand apparel gives them the most bang for their buck.

- 51% prefer to shop second-hand online vs. in a brick-and-mortar store.

- 42% of consumers believe the government should take legislative action to help promote sustainable fashion.

To get more Insights: Request Free Sample Report

Second Hand Apparel Market Dynamics

The Rise of Vintage Clothing Driving Market Growth through Sustainability and Style

Vintage clothing has escalated the market growth owing to its durability, and versatile offer by the fashion industry has propelled the market growth. An increasing number of people prefer to buy second-hand clothing as more people are embracing vintage clothing as a way to reduce their carbon footprint and make a positive impact on the environment. As vintage clothing is often durable compared to modern clothes, which are made of synthetic materials, vintage clothing is often made from natural materials. The major factors including the low level of consumers, high taste for foreign goods, high cost of locally produced textiles, and lack of patriotism have been driving the market growth. Second hand clothing shops are gradually becoming fashion heaven for more consumers especially with the advent of the Internet with several e-commerce platforms embracing technology into everyday living.

Factors Influencing Second Hand Apparel Market

Trends into Consumer Behaviour, Fashion, and Sustainability in Second Hand Apparel Market

Most of the population relies on second hand clothing because of financial constraints, and the decision to purchase second hand clothing that has been influenced by various socioeconomic, environmental, and cultural factors. Change in the dynamics of consumer preference for second hand clothing sheds light not only on emerging fashion consumption trends but also on the potential implications for the local textile and garment industry, as well as the broader sustainability and ethical considerations within the global fashion ecosystem. Consumer behavior toward choices and apparel purchases are greatly influenced by three fundamental selection criteria that are identified as product quality attributes, brand attributes, and novelty attributes which are all necessary for marketers to understand the buying decision-making of their consumers.

With 163 brands owning resale shops in 2024, retailers are already embracing the opportunities presented by resale.

Navigating Challenges and Embracing Sustainability in the Second-Hand Clothing Industry

The challenges facing the second-hand clothing industry include concerns over the quality, lack of guarantee, and lack of durability of the garments, which prevent consumers from buying more regularly. Additionally, the continuous growth in the second-hand clothing market and illegal imports pose unfair price competition to locally manufactured products, leading to the decline of the textile and clothing industry in certain regions. The fast change in fashion trends and the disposal of large amounts of new and old clothes also contribute to the environmental impact of the industry. Additionally, the negative impacts of increased cyclical effects of garment production on the environment and the scarcity of resources call for a shift towards slower consumption and the development of sustainable business models.

Second Hand Apparel Market Segment Analysis

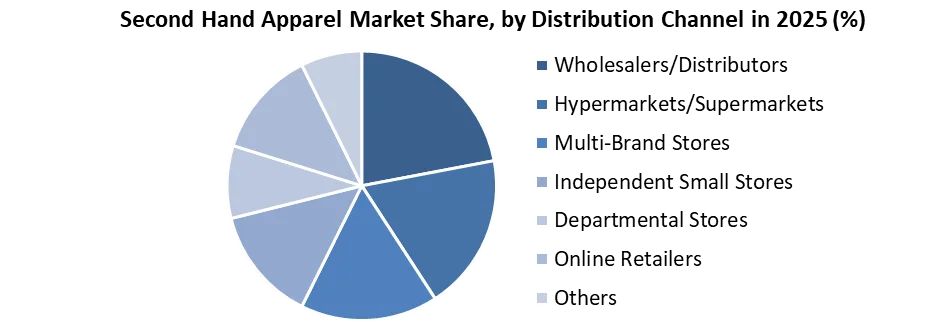

Based on the Distribution Channel, the Online Retailers segment dominates the market and is projected to rise through the forecast period with an increasing CAGR. A significant shift in consumer behaviour towards social commerce and online fashion retail solutions has propelled the market growth. The increasing penetration of mobile internet and the widespread use of social media platforms are reshaping the way people shop for clothing. The trend is expected to continue driving growth in e-commerce orders, particularly in the fashion sector. Additionally, the growing popularity of second-hand apparel is a notable trend contributing to market dynamics.

Consumers are increasingly recognizing the value proposition of second-hand clothing, including cost savings and often better quality items. Financial constraints are a significant driver for many individuals, but beyond that, there are also environmental and cultural factors influencing the decision to purchase second-hand garments. Overall, these trends point towards a dynamic market landscape where traditional retail models are being challenged by the rise of social commerce and the growing acceptance of second-hand apparel. Businesses in the fashion industry need to adapt to these shifts in consumer preferences to remain competitive and capitalize on emerging opportunities.

Based on Product Type, the Dresses & Tops segment held the highest share and is expected to dominate through the forecast period with an increasing CAGR. The increasing number of working women globally is driving the demand for formal and professional attire. Additionally, the growing influence of social media and fashion bloggers is fuelling the desire among women to stay updated with the latest trends, leading to increased demand for fashion-forward clothing.

Second Hand Apparel Market Regional Analysis

North America held the largest share and is expected to rise with an increasing CAGR through the forecast period. The growing popularity of second-hand clothing is thanks to its accessibility and low cost, changing lifestyle and fashion preferences. The rapid adoption of online shopping boards offering a varied range of second-hand clothing is one of the key aspects driving demand in the market. Online platforms like ThredUp, Poshmark, and eBay, as well as physical thrift stores, play a crucial role in facilitating the buying and selling of used clothing.

The appeal of finding unique and trendy dresses or tops at more affordable prices drives consumers to explore secondhand options. Additionally, the cyclic nature of fashion trends contributes to a continuous flow of dresses and tops into the secondhand market, thereby creating a diverse and ever-changing inventory.

Social media platforms play an important role in promoting second-hand fashion. Influencers and content creators are showcasing second-hand and second-hand apparel and encouraging followers to buy second-hand. The secondhand apparel market in the United States and Canada has seen significant growth in recent years. Factors such as environmental concerns, cost savings, and the desire for unique fashion have contributed to its growth.

Second Hand Apparel Market Competitive Landscape

- September 2023: In France, Zara expanded its services to embrace the sale, repair, and donation of used clothing. The program, which seeks to extend the life of consumers' Zara clothing and reduce waste and the need for new raw materials, is accessible through Zara's retail locations, website, and mobile app.

- In January 2024, United Kingdom-based fashion brand HERA launched an integrated platform for second hand clothing resale, promoting the quality and longevity of its products as part of its circularity journey rather than relying on pre-existing reselling sites.

- In July 2023, Journeys, a teen retail leader under Genesco and thredUP, launched 'Journeys Second hand,' an environmentally-conscious resale program allowing customers to shop secondhand apparel and resell gently-worn items for Journeys shopping credit.

- In October 2023, H&M, the Swedish apparel retailer, is set to launch a new collection called "Pre-Loved" at its flagship London store. This collection is expected to feature secondhand women's clothing. The move comes as H&M and other fast-fashion brands aim to enhance their sustainability practices.

|

Second Hand Apparel Market Scope |

|

|

Market Size in 2025 |

USD 67.40 Bn. |

|

Market Size in 2032 |

USD 154.59 Bn. |

|

CAGR (2026-2032) |

12.59 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Type

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Second Hand Apparel Market Key Players

North America

- Rendered (Clothing)

- ThredUP

- The RealReal

- Tradesy

- Buffalo Exchange

- Mercari

- 3BS Liquidators

- GLOSET LLC

Europe

- Thrift+

- Catchys

- Go Thrift

- Mania Second-Hand Clothing

- Micolet

- Vite EnVogue

- Zadaa

Asia Pacific

- LavishMark

- Technochain

- Charan

- Preloved

- Relove

- Sharewardrobe

- Vlook

- EcoStyle Exchange

Middle East and Africa

- Komodaa

- OriginalSeconds

Frequently Asked Questions

Lack of awareness has restrained the market growth.

The Market size was valued at USD 67.40 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 12.59 % from 2026 to 2032, reaching nearly USD 154.59 Billion.

The segments covered in the market report are by Product Type and Distribution Channel.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Second Hand Apparel Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Second Hand Apparel Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Second Hand Apparel Market: Dynamics

4.1. Second Hand Apparel Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Second Hand Apparel Market Drivers

4.3. Second Hand Apparel Market Restraints

4.4. Second Hand Apparel Market Opportunities

4.5. Second Hand Apparel Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Second Hand Apparel Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Dresses & Tops

5.1.2. Shirts & T-shirts

5.1.3. Sweaters

5.1.4. Coats & Jackets

5.1.5. Jeans & Pants

5.1.6. Others

5.2. Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

5.2.1. Wholesalers/Distributors

5.2.2. Hypermarkets/Supermarkets

5.2.3. Multi-Brand Stores

5.2.4. Independent Small Stores

5.2.5. Departmental Stores

5.2.6. Online Retailers

5.2.7. Others

5.3. Second Hand Apparel Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Second Hand Apparel Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Dresses & Tops

6.1.2. Shirts & T-shirts

6.1.3. Sweaters

6.1.4. Coats & Jackets

6.1.5. Jeans & Pants

6.1.6. Others

6.2. North America Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

6.2.1. Wholesalers/Distributors

6.2.2. Hypermarkets/Supermarkets

6.2.3. Multi-Brand Stores

6.2.4. Independent Small Stores

6.2.5. Departmental Stores

6.2.6. Online Retailers

6.2.7. Others

6.3. North America Second Hand Apparel Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Second Hand Apparel Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

7.2. Europe Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

7.3. Europe Second Hand Apparel Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Second Hand Apparel Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

8.2. Asia Pacific Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

8.3. Asia Pacific Second Hand Apparel Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Second Hand Apparel Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

9.2. Middle East and Africa Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

9.3. Middle East and Africa Second Hand Apparel Market Size and Forecast, by Type (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Second Hand Apparel Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Second Hand Apparel Market Size and Forecast, by Product Type (2025-2032)

10.2. South America Second Hand Apparel Market Size and Forecast, by Distribution Channel (2025-2032)

10.3. South America Second Hand Apparel Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Rendered (Clothing)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. ThredUP

11.3. The RealReal

11.4. Tradesy

11.5. Buffalo Exchange

11.6. Mercari

11.7. 3BS Liquidators

11.8. GLOSET LLC

11.9. Thrift+

11.10. Catchys

11.11. Go Thrift

11.12. Mania Second-Hand Clothing

11.13. Micolet

11.14. Vite EnVogue

11.15. Zadaa

11.16. LavishMark

11.17. Technochain

11.18. Charan

11.19. Preloved

11.20. Relove

11.21. Sharewardrobe

11.22. Vlook

11.23. EcoStyle Exchange

11.24. Komodaa

11.25. OriginalSeconds

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook