Pet Services Market Global Industry Overview and Forecast (2026-2032) Size, Share, Report Analysis, Growth Trends, Dynamics

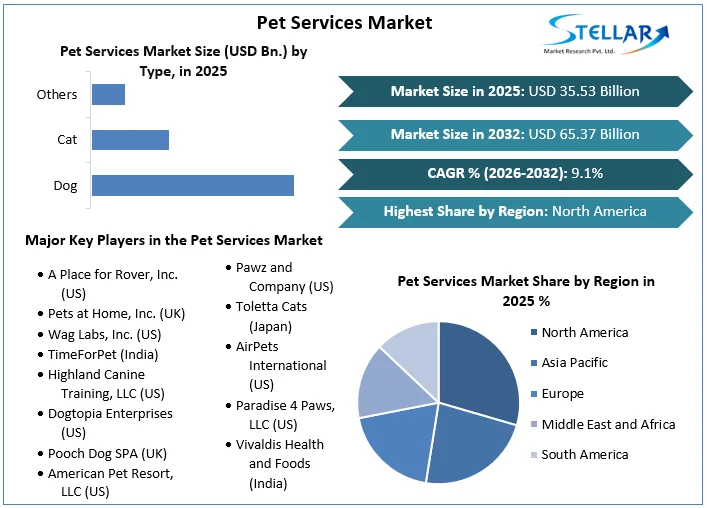

Pet Services Market size was valued at US$ 35.53 Bn. in 2025 and the total revenue is expected to grow at 9.1% through 2026 to 2032, reaching nearly US$ 65.37 Bn. by 2032.

Format : PDF | Report ID : SMR_1144

Pet Services Market Overview:

An increasing number of pet pets, pet breeding, strategies used by important companies, and rising pet costs are some of the key factors in this market. For example, February 2022, Petco Health and Wellness Company, Inc. has partnered with Rover- an online pet market online pet services industry, to provide Petco customers with access to pet accommodation, accommodation, and dog-walking services. This has enabled Rover to reach nearly 130,000 pet owners who have registered for Petco's Vital Care.

Pet Services Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2019-2024), statistics, infographics, and presentations are used. The report examines the Pet Services markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes Pet Services investor recommendations based on a detailed analysis of the current competitive landscape of the Pet Services market

To get more Insights: Request Free Sample Report

Pet Services Market Dynamics:

The COVID-19 epidemic has led to a slowdown in the market, particularly by 2020. This negative impact is mainly due to the closure and restriction of access to pets' services due to social isolation and closure practices. For example, 85% of Pet Sitters International members experienced a more than 50% decline in business during the outbreak of violence. Pets at Home, Inc., a U.S. company, temporarily closed its rehabilitation facilities and reported approximately 29 declines. % of repairs received. in 2020. In another study conducted by a Japanese pet insurance company - Anicom, the cost of hotel and pet accommodation was found to be significantly lower for both dogs and cats. Wag Labs, Inc. based in the U.S., has also reported a nearly 63% decline in total bookings by 2020.

However, demand returned in 2021 as business activities resumed slowly. Pets at Home, Inc. bridesmaids were able to provide social brides during the 2nd and 3rd closures. The company has reduced the price of its social partners by 7 pounds sterling (~ USD 9) depending on dog size and breed. Rover - the leading pet service provider, reported a 75% increase in bookings by 2023. The company registered 4.2 million for more than 80% of which included repeated bookings. The company reported that it continued to recover from bookings before returning to travel, without the effects of the COVID-19 variety. The company aims to expand globally to expand its regional presence in Europe, and has traveled to Australia, New Zealand, and parts of Asia.

Some of the key factors affecting the market include increased penetration of paid and subscription services, inclusion of data science in market mechanics, efficiency, return to post-epidemic normalization, and an increase in the number of pets and services offered. For example, premium services drive sales of other types of service, thereby accelerating revenue growth. Premium subscribers also often choose long-term plans that can increase customer loyalty and use of services. For example, 25% of premium Wag Labs subscribers opt for annual plans. The growing adoption of online marketing channels and service delivery is expected to further market growth. PetSmart LLC, for example, offers practical dog training services.

Pet Services Market Segment Analysis:

On the basis of types, half of the dogs dominated the global market by 2025 with a budget of more than 80.0%. Half of the cats are estimated to grow by a good rate of 10.8% during the forecast period. Key factors contributing to this growth include an increase in pet ownership, the cost of pets, the personalization of pets, and the payment of products and services. Other factors include an increase in nuclear populations, declining birth rates in key markets, and an increase in the adoption of pet insurance.

In March 2022, Pet Sitters International (PSI) reported that its affiliate and pet pets offer a wide range of dog and cat shelter services. 75% of PSI members also provide services to small animals, while 73% provide bird services, 70% freshwater fish, and 59% provide reptiles and aquatic animals. The business portfolio of most businesses includes basic pet care visits (approximately 94%), while other services include dog visits, night visits, and pet transport.

The pet riding segment had a larger revenue share of more than 25.0% by 2025. A key factor that is expected to promote partial growth includes the practice of returning to post-COVID work that leads pet parents to opt for pet care during the day, pet housing, and pet housing. night riding services. Wiggles is an Indian pet service provider that provides pet accommodation, dog training, pet products and essentials, grooming products, and pet food, among others. In June 2021, the launch introduced a shelter for dogs whose owners were affected during the Covid-19.

The pet care share is expected to expand to the fastest CAGR of 9.9% over the forecast period due to increased demand for pet services and key corporate programs. Pets at Home, Inc. is a leading company in the U.S. pet care market. thanks to its 254 facilities that offer a one-room bridal salon, a grocery store, and a veterinarian's practice. The company's grooming room salons are the largest series of branded salons in the country.

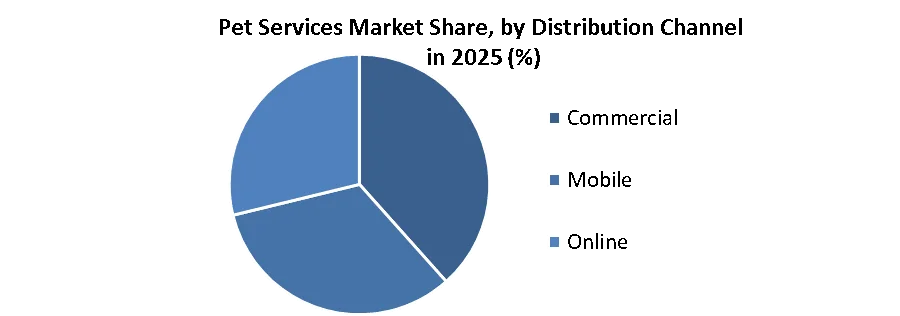

On the basis of distribution channels, commercial centres have a higher revenue share of more than 55.0% by 2025. Highlights of this significant assignment include a large number of retail outlets that provide pet services, a wide range of service portfolios, and the acceptance of sales for all channels and marketing strategies. Dogtopia Enterprises, for example, provides pet care during the day, rides, and spa services. Their centres are between 6,000 and 8,000 square feet, and some centres also have an outdoor space. Developed economies recognize the growing presence of these institutions, thus providing a platform for growth in the near future.

The other component, which includes domestic and internet delivery, is expected to register a rapid growth rate of 10.3% from 2026 to 2032. This is due to the increase in investment, market players providing service delivery in all areas, and increasing growth. the number of online markets that help access pets service providers. In October 2020, Brazil's largest online retailer of pet products acquired DogHero - a leading pet company that provides pet services including a pet keeper, nursery, accommodation, tours, and a veterinarian. This helped the company expand its portfolio and strengthen its position in the market.

Pet Services Market Regional Insights:

North America region holds the largest revenue share of more than 35.0% by 2025. The growth of the North American region is due to the presence of key service providers, the adoption of various strategies to increase market access, and the increase in the cost of pets. According to the U.S. Census Bureau, a total of 20,413 institutions providing pet care services in 2019. In addition, according to the APPA, American pet parents have spent about $ 103 billion on their livestock by 2020.

Asia Pacific is projected to grow at a rapid CAGR of 10.7% over the forecast period. This is due to the increase in pets, the availability of pet service providers, and the increase in revenue from key markets that present lucrative opportunities in the forecast period. Petsfolio, for example, is a pet service company that provides training, grooming, walking, and dog riding services in India. The Australian Pet Care Association INC was established in 1992 to represent and support business owners working in the Doggy Day Care industry, Pet Resort / Kennel, and the Dog Training sector.

The objective of this report is to present an in-depth analysis of the Pet Services Market to industry stakeholders. The report provides the recent trends in the Pet Services Market and how these factors will impact on new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the Pet Services Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the Pet Services Market report assist the readers to understand which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the Pet Services Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the Pet Services Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Pet Services Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors that help in analyzing how much a government can impact the Market. Economic variables assist in the calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the Pet Services Market is aided by legal factors.

Pet Services Market Scope:

|

Pet Services Market |

|

|

Market Size in 2025 |

USD 35.53 Bn. |

|

Market Size in 2032 |

USD 65.37 Bn. |

|

CAGR (2026-2032) |

9.1% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By Services

|

|

|

|

By Distribution Channel

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Pet Services Market Key Players

- A Place for Rover, Inc. (US)

- Pets at Home, Inc. (UK)

- Wag Labs, Inc. (US)

- TimeForPet (India)

- Highland Canine Training, LLC (US)

- Dogtopia Enterprises (US)

- Pooch Dog SPA (UK)

- American Pet Resort, LLC (US)

- Pawz and Company (US)

- Toletta Cats (Japan)

- AirPets International (US)

- Paradise 4 Paws, LLC (US)

- Vivaldis Health and Foods (India)

- PetDom (India)

- PETOKOTO (Japan)

Frequently Asked Questions

Dog is the leading Type segment of Pet Services market.

The market size of the Pet Services is expected to reach by USD 65.37 Bn. in Pet Services Market.

The forecast period of Pet Services market is 2026-2032.

Commercial facility is the leading Distribution Channel segment of Pet Services market.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Pet Services Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Pet Services Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Pet Services Market: Dynamics

4.1. Pet Services Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Pet Services Market Drivers

4.3. Pet Services Market Restraints

4.4. Pet Services Market Opportunities

4.5. Pet Services Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Pet Services Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Pet Services Market Size and Forecast, by Type (2025-2032)

5.1.1. Dog

5.1.2. Cat

5.1.3. Others

5.2. Pet Services Market Size and Forecast, by Services (2025-2032)

5.2.1. Pet Boarding

5.2.2. Pet Grooming

5.2.3. Pet Walking

5.2.4. Pet Transportation

5.2.5. Others

5.3. Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

5.3.1. Commercial

5.3.2. Mobile

5.3.3. Online

5.4. Pet Services Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Pet Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Pet Services Market Size and Forecast, by Type (2025-2032)

6.1.1. Dog

6.1.2. Cat

6.1.3. Others

6.2. North America Pet Services Market Size and Forecast, by Services (2025-2032)

6.2.1. Pet Boarding

6.2.2. Pet Grooming

6.2.3. Pet Walking

6.2.4. Pet Transportation

6.2.5. Others

6.3. North America Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

6.3.1. Commercial

6.3.2. Mobile

6.3.3. Online

6.4. North America Pet Services Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Pet Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Pet Services Market Size and Forecast, by Type (2025-2032)

7.2. Europe Pet Services Market Size and Forecast, by Services (2025-2032)

7.3. Europe Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

7.4. Europe Pet Services Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Pet Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Pet Services Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Pet Services Market Size and Forecast, by Services (2025-2032)

8.3. Asia Pacific Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

8.4. Asia Pacific Pet Services Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Pet Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Pet Services Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Pet Services Market Size and Forecast, by Services (2025-2032)

9.3. Middle East and Africa Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

9.4. Middle East and Africa Pet Services Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Pet Services Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Pet Services Market Size and Forecast, by Type (2025-2032)

10.2. South America Pet Services Market Size and Forecast, by Services (2025-2032)

10.3. South America Pet Services Market Size and Forecast, by Distribution Channel (2025-2032)

10.4. South America Pet Services Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. A Place for Rover, Inc. (US)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Pets at Home, Inc. (UK)

11.3. Wag Labs, Inc. (US)

11.4. TimeForPet (India)

11.5. Highland Canine Training, LLC (US)

11.6. Dogtopia Enterprises (US)

11.7. Pooch Dog SPA (UK)

11.8. American Pet Resort, LLC (US)

11.9. Pawz and Company (US)

11.10. Toletta Cats (Japan)

11.11. AirPets International (US)

11.12. Paradise 4 Paws, LLC (US)

11.13. Vivaldis Health and Foods (India)

11.14. PetDom (India)

11.15. PETOKOTO (Japan)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook